PayPal, Facebook Post Strong Second-Quarter Results

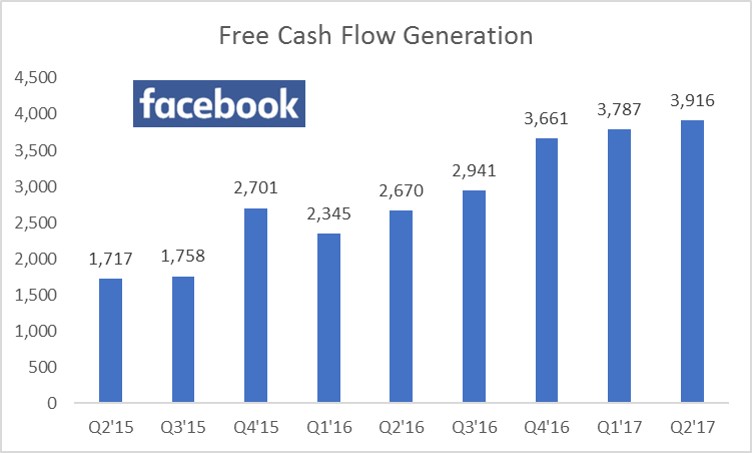

Image shown: Facebook's traditional free cash flow (CFO less capital expenditures), in millions.

Two of our favorite holdings in the Best Ideas Newsletter portfolio put up strong second-quarter results. We continue to like their respective shares.

By Brian Nelson, CFA

Online payments processor PayPal (PYPL) and social media advertising giant Facebook (FB) are two of our favorite holdings in the portfolio of the Best Ideas Newsletter. Both forward-leaning, mobile-oriented companies reported second-quarter results after the market closed July 26, and both have traded higher following the release.

PayPal’s revenue advanced 20% in the second quarter, after excluding effects from currency exchange, and the company leveraged that growth into an impressive 27% jump in GAAP and non-GAAP earnings per share, the latter to $0.46, coming in ahead of expectations. PayPal added 6.5 million active customer accounts during the period, with net new additions up 80%, and its $106 billion in total payment volume was 26% higher than the mark in the year-ago period on a foreign currency neutral basis. The online payments innovator’s newly-landed partnership with Baidu (BIDU) July 26 broadens its opportunity with Chinese consumers, and news of the extension of its existing partnership with Visa (V) into Europe is equally exciting.

PayPal's cash-flow generating capacity and balance-sheet health are top notch. The company generated operating cash flow of $921 million and free cash flow of $747 million during the second quarter of the year, both solid marks, and it ended the second quarter with more than $4 billion in cash and no short- or long-term debt. PayPal raised its full-year guidance, too, now calling for non-GAAP earnings per share in the range of $1.80-$1.84 (was $1.74-$1.79) on expectations of a 19%-20% increase in revenue (was 17%-19%), adjusting for impacts from currency exchange. This is the second time PayPal has raised guidance in as many quarters.

Facebook’s second-quarter results may have been even better. Total revenue in its quarter advanced 45%, and the social media platform leveraged that expansion into a 61% increase in operating earnings as the company’s operating margin leapt 5 percentage points, the latter surprising the Street to the upside given consensus views that greater investments in the business will start to eat away at levels of profitability. Facebook’s net income advanced 71% in the quarter, and diluted earnings per share increased 69%, to $1.32, well ahead of the consensus view. Mobile advertising revenue now accounts for 87% of total advertising revenue, and both daily active users and monthly active users advanced 17% on a year-over-year basis in the quarter.

The financials get even better at Facebook. Net cash from continuing operations leapt to $10.42 billion during the first-half of 2017 from $7.14 billion over the same period last year. Capital expenditures came in at $2.72 billion and $2.13 billion over the respective periods, revealing corresponding free cash flow generation of $7.7 billion and $5 billion, implying 50%+ year-over-year growth. Facebook’s balance sheet health is simply amazing. At the end of the second quarter, cash and marketable securities stood at $35.45 billion, and the company holds no debt on the books. We’ve never been more excited to include Facebook’s shares in the Best Ideas Newsletter portfolio, and we think its second quarter will reset Street expectations much higher.

Related: TWTR, SOCL