Economic Commentary: Marks, Dalio, and the Discount Rate

Image Source: Mike Cohen

We sat down with the Valuentum team to discuss their latest thoughts on recent economic developments. To kick off the conversation, let’s start with the team’s views on the latest memo from Oaktree’s Howard Marks: Mysterious. For those that don’t know Howard, he is the Director and Co-Chairman of Oaktree, which managed about $122 billion in AUM, as of September 2019. The memo goes into depth on the reasons for negative interest rates, the impact of negative interest rates, and opines on whether the US will ever see negative interest rates. Then, we’ll go from there!

Brian Nelson: The concept of negative interest rates is not merely academic, but they have far-reaching implications across the global financial system. As it relates to equity prices, for example, negative interest rates have material implications on estimates of intrinsic values, particularly as the cash flows of longer-duration “growthy” equities are worth more as the present-value damage from discounting isn’t as punitive.

Many that continue the conversation of “growth versus value” may be overlooking the very possibility that the talk is meaningless/spurious, however, in that many “growth” stocks are actually the ones that are undervalued because of depressed rates across the yield curve. Said another way, “growthy” equities with asset-light business models that generate substantial free cash flows are very sensitive to discount rates, and the market may not be giving these types of stocks full credit for their long-duration free cash flows. The market, instead, likes to focus on snapshot-in-time multiples and overlooks longer-duration dynamics.

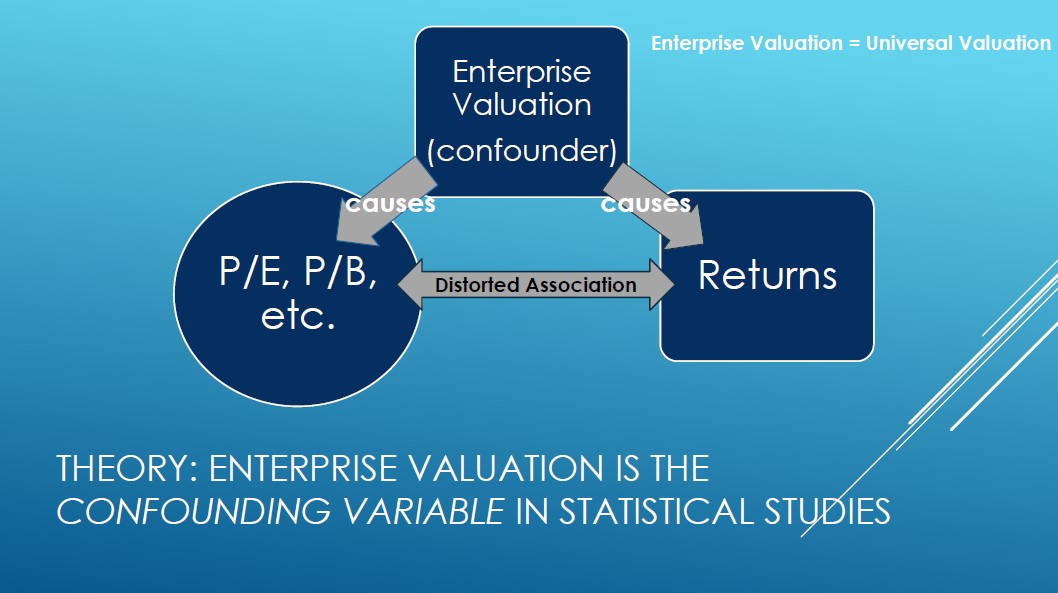

For example, growth stocks with fantastic financials and free-cash-flow generating prowess, like Facebook (FB) are more “value” than “growth” because of the firm’s longer-duration and undervalued free cash flow stream, but many may only consider Facebook a growth stock, given that top-line expectations are elevated and the company may have a comparatively high P/E ratio. Perhaps now more than ever as a result of low rates, the conversation between “growth and value” has become even more turned on its head, and we’ve been cautioning investors about betting on a reversion to the mean of any ambiguously-defined value metric (trailing P/E, EV/EBITDA, P/B). Be careful out there—even the smartest of researchers aren’t measuring what they think they are measuring, and most of the conclusions from quantitative statistical research are spurious due to the presence of confounding variables within enterprise valuation.

[For more information on why you should be concerned about the trend in investment management toward realized, ambiguous backward-looking factors/multiples, please watch Nelson’s presentation to the Los Angeles chapter of the American Association of Individual Investors here.]

Marks indirectly hits on a couple of these dynamics in his memo, noting how important interest rates are in the discounting mechanism of present values, as well as how historical relationships, as it relates to quantitative finance and algorithmic trading:

Negative rates can warp the calculation of discounted present values. In particular, when the discount rate is negative, the present value of future pension obligations can exceed their future value. The combination of high discounted obligations and low yields on investments can be disastrous for the funded status of pension funds.

Financial models and algorithms – which essentially are a matter of looking for and profiting from deviations from historic relationships – may not work as well as they did in the past, since history (all of which has been based on positive interest rates) may be out the window.

Nobel prizes have been awarded to economists that developed concepts such as the efficient frontier, the Capital Asset Pricing Model and the Black-Scholes option pricing model. But when a negative value is assumed for the risk-free rate in these types of models, fair value results shoot off toward infinity. With trillions of securities and derivatives dependent on these models, valuation is critical. (Jim Bianco, op. cit.)

With all this talk about negative interest rates, however, the 10-year Treasury (TLT, TBT) has now bounced back closer to 2%, hovering just shy of that mark.

Matthew Warren: Marks’ memo is brilliant. I wish I wrote the piece, but then I wouldn't have been able to nail it quite like he did...

My gut is that the US will see negative rates and substantial disinflation or deflation at some point in the not-very-distant future. If that is true, sussing out bond-proxies with good risk/reward will be of paramount importance to investors. The really tricky part is determining what odds to put on slow growth in the US and the world, as compared to slow US growth and negative growth in parts of the world like Europe (VGK, IEV, IEUR) and Japan (EWJ), as compared to slow persistent negative growth in the US and the world, as compared to a depression-like scenario.

It's not just the rates that matter (positive, zero, or negative), but which discrete scenario we end up in? For example, a particular REIT (VNQ) with moaty characteristics might look pretty good in all scenarios but the depression-like scenario in which case the share price plummets along with substantial property price deflation in the US. In this (hopefully tail risk) scenario of a depression-like scenario, you actually may want to consider owning long US bonds and/or hard cash.

The recent collapse in long bonds actually flags the probability of the last two scenarios rising in meaningful fashion, in my opinion. Underpinning this, I am still of the opinion that the price of the long bond is still set by marginal buyers and sellers that are acting on their opinion as opposed to those that are forced to hold long bonds.

Callum Turcan: To Matt's final point, I agree as it relates to setting US long bond prices, but less so in Europe given negative interest rates set by the ECB combined with onerous rules in some Eurozone nations that compel financial and insurance institutions (some state-run) to buy negative yielding government bonds in a "zombie-like" fashion.

A week ago or so, expectations were increasing that the US and China (FXI, MCHI) will complete a Phase One deal, as it has been dubbed, with reports coming out that both sides may simultaneously cut tariffs on each other's exports by a certain amount (and possibly by an equal amount, meaning if the US reduces tariffs on $100 billion worth of imports from China, China would cut tariffs on $100 billion worth of imports from the US). However, that conflicts with reports that the US-China accord in the works won't get done in November (as previously reported), as trade negotiators are now targeting a December signing. The location of the signing ceremony remains a point of contention, as President Trump would like to do so in Iowa but the Chinese ruled that suggestion out (given how that could be viewed as a win for the US over China if the deal is signed on US soil), so now locations in Europe are being scoped out (including Switzerland, the "neutral" country).

That is feeding into expectations that global economic growth may bottom out in 2019 or 2020 and start rebounding in 2020 or 2021 --the IMF expects global economic activity to pick up pace in 2020 from 2019 levels, but I doubt that could be the case while growth in the EU and Japan remains anemic, unless growth in China, America, India (INDA, PIN), Brazil (EWZ), and elsewhere really picks up the slack. Thus, the 10-year Treasury is perking up to levels last seen several months ago when the current interest rate cut cycle started kicking into gear. Market participants don't seem to think there will be another rate cut in the US in December 2019, as was previously expected just a few weeks ago.

For utilities (XLU) and REITs, quasi-bond like investments, the ongoing paradigm shift stings. However, keep in mind the fickle nature of US-China trade negotiations. Should talks break down again, as they have repeatedly in the past, this picture reverts to where we were just a couple of months ago (meaning lower 10-year Treasury yields and ongoing pessimism regarding global economic growth going forward). Adding on to that, while current market optimism is arguably justified under a US-China trade deal scenario, what do you guys think would happen should a deal not materialize in December 2019?

Brian: I think that Trump will do all that he can to “declare victory” with any trade deal with China before the 2020 election, so I do think that we will get some sort of accord before he starts hitting the campaign trail hard. Whether it will be a meaningful agreement is questionable, and I continue to believe that China’s best move is to wait out Trump until after the 2020 election to determine long-term trade policy.

As for interest rates, it was encouraging to see the 10-year rally a bit as an indication of perhaps a more stable financial system, but if it continues to advance, the conversation will start to shift to the negative implications on equity values, the narrative that many were concerned about when the Fed began tightening. In some ways, the 10-year at about 2% may be the best scenario at the moment.

Matthew: I think the 10-year yield popping up just after three rate cuts to be an undeniable improvement from where we were when the long bond rates collapsed. It is incrementally bullish for all stocks but bond proxies. That said, only time will tell if offshore weakness mends itself and whether we can avoid a significant worsening of the trade war. Those are two key things to watch. The banks (XLF, KBE, KRE) are healthy in the US, with the exception of being late in this cycle and some clear excesses in levered loans. Commercial real estate looks late cycle to me, but we will see.

The reason I say this is a material fundamental improvement is that I think the long bond markets are reflexive and actually drive real expectations among market participants. When the long bond rates collapsed, it was a large, liquid global market shouting at you that the odds of deflation are/were uncomfortably high. I think that is still true today, but to a lesser extent, and therefore the incremental bullishness. If we see the rates collapse again, go right back on deflation watch.

With respect to another topic, what do you think about Bridgewater’s Ray Dalio’s views on the upcoming paradigm shift – Ray Dalio: National Debt And Liabilities Will Cause Higher Taxes.

Callum: On the issue of pensions and retirement healthcare plans, the assumed rate of return a lot of these systems are using are simply absurd. In a low interest rate environment, late in the business cycle, with a portfolio that is highly concentrated in bonds and bond-like investments, how is the "average" pension fund in the US going to generate 7% annual returns into perpetuity? That doesn't seem feasible to me, and we know the reason why expected rates of return aren't being seriously lowered to adjust to the realities of the new paradigm (in place since QE was launched around the world). Should the assumed rate of return on these plans get cut to reasonable levels, say 5% or so per year, then the governments managing these programs would have to admit to both their constituents and to the retirement program beneficiaries that those obligations are not well funded.

Brian: Dalio’s point that the national debt, pension liabilities, and healthcare debt may result in higher taxes makes a lot of sense. One of the risks that I continue to point to is a potential reversion to prior corporate tax rates under a Democratic president, particularly in the event that tax receipts dry up during any impending recession. The US, for example, is already overflowing with trillions in sovereign debt, and it is running a deficit in the midst of one of the strongest domestic economies in history. When things slow, or even show signs of slowing, we could see the equity market get whipsawed quite a bit. A reversion to prior corporate tax rates, or even more punitive policy, under a new administration is a very real possibility, perhaps even a probable one.

Callum: Switching gears a bit, it looks like the "almost done" US-China trade deal is still far from being so, with Chinese agricultural purchases from the US representing the current roadblock according to Bloomberg. I suspect that China won't commit to material agricultural purchases unless the US significantly reduces existing tariffs and doesn't move forward with the planned tariff increases on December 15. That's a proposition that will largely depend on who President Trump decides to listen to within his cabinet (Kudlow, Mnuchin, and Ross versus Navarro and Lightizer).

If the US opts not to reduce tariffs and instead holds out, there won't be a narrow trade deal in my view, at least not for the foreseeable future. China likely enjoys the proposition that committing to US agricultural purchases in return for tariff relief offers when it comes to ongoing negotiations and leverage, considering that if the US decides to levy additional tariffs on China, China can quickly respond by reducing agricultural buys assuming China purposely buys US agricultural on a spot market basis (meaning that Beijing publicly commits to buying US agricultural products, under certain conditions, but doesn't commit to long-term buys from the US under binding contracts).

More broadly, in terms of America's large deficit and debt load, that seems more manageable than the pension problems facing American cities and states given the ability for the US federal government to more easily raise revenue without certain adverse effects (i.e. corporations and wealthier individuals leaving higher tax states for lower tax states).

According to the WSJ (cited by CNBC piece here), China doesn't want to commit to a predetermined level of agricultural purchases from the US, and the US continues to push for structural changes in China's economy that aren't likely to be approved by Beijing (save for modest adjustments in areas like financial services, changes that were already in the process of being implemented long before the US-China trade war).

Brian: As we wrap up the conversation, I wanted to address a member question:

You use an extremely high 10-year US Treasury rate. Even if the 10-year rate you use is historically accurate, it strikes me that a near doubling of interest rates in any small time frame would portend calamities that would have made the entire construct irrelevant. In short, if the US 10-year rises that fast, we've had a paradigm shift that makes ALL equities a problem.

In other words, can you explain why you use the risk-free rate you use in your valuation model? Why do you use a risk-free rate assumption of 4.25% when the current spot rate of the 10-year Treasury is about 2%?

In our discounted cash-flow models that we use to value every non-financial operating company in our coverage universe, we match the duration of future free cash flows (from year 1 to perpetuity) with expectations of the average discount rate over this forecast horizon (from year 1 to perpetuity). We think the best way to achieve expectations of the long-term future average rate of the 10-year Treasury (risk free rate) is to use the weighted average of the historical 10-year Treasury and the current spot rate. The goal of using a weighted average risk-free rate in our DCF process is to achieve balance with respect to the duration of future cash flows.

For example, discounting a cash flow in Year 20 at the current spot rate doesn’t make much sense to us. Other methods consider the yield curve in discounting future free cash flows, or use a long-term average of the risk free rate without considering near-term changes in the 10-year Treasury rate. We think the use of the spot rate on the 10-year Treasury as the risk free rate in any valuation model would not only cause significant fair-value volatility but also result in a systematic overvaluation of companies relative to their true long-term intrinsic worth. Read more about our discussion of the discount rate in Value Trap: Theory of Universal Valuation.

Though a negative 10-year Treasury rate is a real possibility in the future, it is notoriously difficult to forecast interest rates, as even the past few months have shown. The pitfalls of using the spot rate, as it relates to ultra-volatile fair value estimates is well-understood, and the forward-looking nature of discounted cash-flow valuation means using something representative of a very long-duration assessment. Paying attention to the overall weighted average cost of capital (WACC) assumption in the context of fundamental risk, both in absolute and relative terms (comparing discount rates between companies as an assessment of relative risk), however, is most important, even moreso than the risk-free rate assumption, itself.

The presence of risk premiums (added to the risk-free rate) within the application of the discount rate (WACC) means that the discounted cash-flow model will always be a relevant tool to forecast intrinsic worth of equities. Investors, however, need to pay close attention to equities where the overall WACC approaches 0. This is, in part, what happened as to how a bubble in Kinder Morgan (KMI) was formed years ago. We talk about this dynamic extensively in Value Trap, too.

Valuentum's Weighted Average Cost of Capital Distribution >>

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

0 Comments Posted Leave a comment