Yahoo! Should Still Buy eBay’s “Free Cash Flow”

Image Source: eBay

According to the latest from CNBC, there are five bidders left for Yahoo’s (YHOO) core business, and it’s very likely the company will make the sale to one of them soon. Many are saying that Verizon (VZ) is the front-runner, but we can’t rule out the buying power of the group led by Quicken Loans’ Dan Gilbert, who has the backing of the Oracle of Omaha himself, Warren Buffett, or a high-ball bid from private equity, perhaps TPG Capital. AT&T (T), Time (TIME), and other private equity giants KKR and Bain Capital might still be in the game as well.

We think breaking apart Yahoo! or selling it outright, instead of merging it with eBay (EBAY) isn’t the optimal long-term solution. In any case, however, a breakup will offer some consolation to Yahoo! shareholders, which have been on a wild ride the past few years with the volatile Alibaba (BABA) stake. We’ve heard that Frank Quattrone, who orchestrated the overpriced sale of LinkedIn (LNKD) to Microsoft (MSFT) is advising Yahoo! CEO Marissa Mayer. This is a good thing for Yahoo! shareholders. Maybe he’ll put together another overpriced sale to an unsuspecting bidder looking to “take advantage” of the low interest rate environment, or so they’ll say.

The recent quarterly results from eBay speak to what we’ve been getting at, with our proposed YHOO-EBAY combination, which is looking less and less likely to come to fruition, partly due to a culture in Silicon Valley that may not put much emphasis on free-cash-flow generation relative to the sexiness of top-line growth. Silicon Valley will not be told what to do – the entrepreneurial spirit will always be to prove the naysayers wrong. But cash will always be king – the dot-com bubble and bust taught them that, even if the current generation may not remember it as well as the previous. If you haven’t yet read our open letter to the board of Yahoo, it can be accessed here.

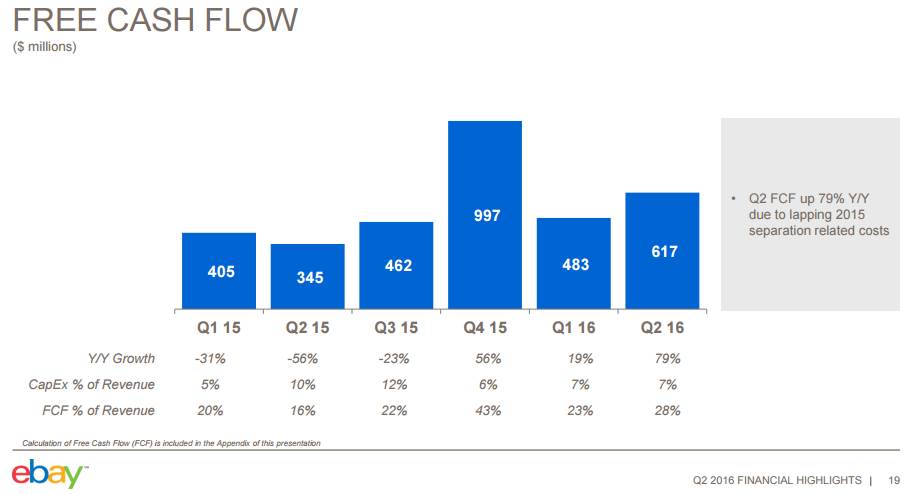

As for former Best Ideas Newsletter holding, eBay, things are progressing well. Our basic thesis for a YHOO-EBAY transaction rests on a leveraged buyout of eBay to harvest eBay’s robust free cash flow generation to pay down new outstanding debt, utilizing both talented teams to drive innovation across all platforms from legacy eBay to Tumblr to Flickr. Get this – eBay registered a near-6% increase in revenue during its second-quarter results, released July 21, generating non-GAAP earnings per share of $0.43, in excess of consensus numbers. It also raised its full-year top-line and bottom-line numbers, and drove free cash flow of $617 million during the period (up ~80% on a year-over-year basis). Through the first six months of the year, eBay has hauled in $1.1 billion of free cash flow, far greater than the $750 million generated during the same period a year-ago.

During the past three years, eBay has generated in excess of $2.2 billion of free cash flow, and we think it will exceed that mark in 2016 as well, as it remains on pace to do so with the holiday season still ahead of us for the year (it generated almost a $1 billion of free cash flow in the fourth quarter of 2015 alone). Management has been guiding free cash flow in the range of $2.2-$2.4 billion for 2016, but that may very well be conservative. The company only holds a modest net debt position of ~$1 billion on the balance sheet, with cash and short-term investments standing at ~$8.1 billion at the end of the quarter. A leveraged buyout of eBay at market, or with an enterprise value of ~$35 billion, still makes a lot of sense, in our opinion. eBay still sports a conservative free cash flow yield of ~7%, and its business is growing! Even if eBay doesn’t get bought out though, can you imagine the pop in the stock if it establishes a run-rate dividend near its free cash flow generation capacity?

Shares of eBay might very well soar. We could add the company back to the Best Ideas Newsletter portfolio. It has been a huge winner for us in the past.