October Dividend Growth Newsletter Introduction

Dear Member,

The month of September represented some tough sledding for the markets, and we think things will get worse before they get better. If you missed our write up on the seven reasons why we think we’re due for a fall, please be sure to catch up on the piece here. We made a number of changes to the Dividend Growth portfolio since the release of the previous edition of the newsletter. Let’s make sure you didn’t miss anything.

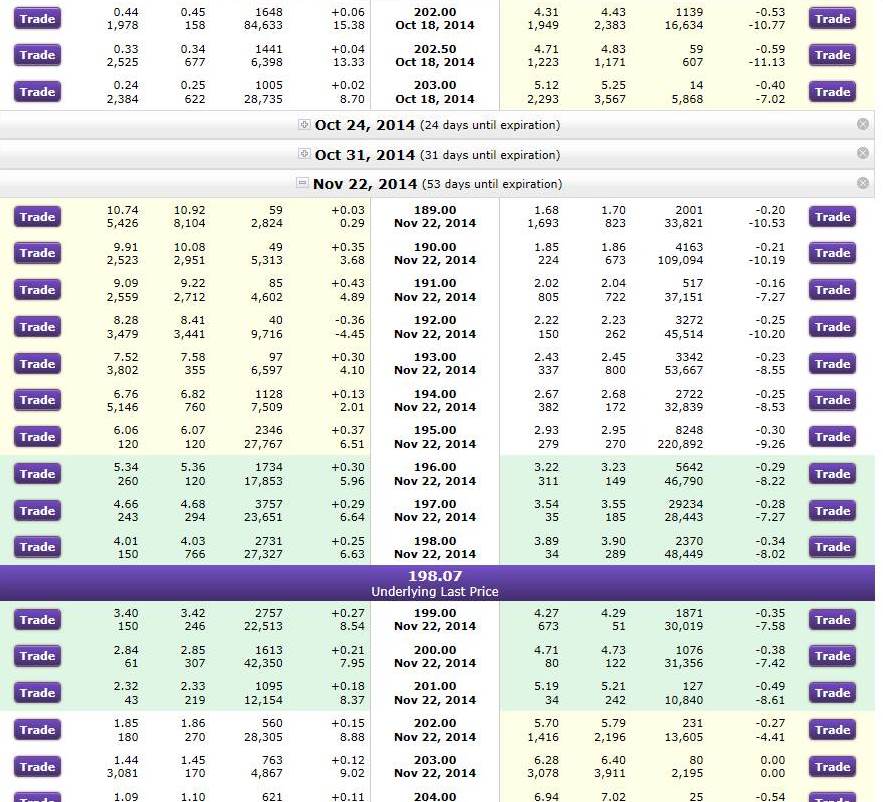

For one, yesterday, we added S&P 500 SPDR put option contracts to the portfolio to protect the large gains. Specifically, we added protection in the form of 5 put option contracts on the S&P 500 (SPY), with November 22 expiration at $195.00 strike ($295 each). We noted in the transaction alert email that the options positions are hedges to the portfolio and may expire worthless. There was a question about pricing on the contracts at the time of the transaction alert, and I have pasted the image of the option chain below (calls on the right, puts on the left). The price of the options contracts have moved since then, and now bear a cost of ~$375-$400 each at last check (slightly less attractive than yesterday’s pricing shown below).

Image Source: Scottrade

We also made a couple additions and a couple removals to the Dividend Growth portfolio since the last edition. On September 19, we opened a 2% position in Coach (COH). Though this idea is not without material risks, we think the firm's ~4% dividend yield will act as nice pricing support. We still think downside is rather limited, though we note that shares are already underwater since the purchase price, but that’s why we added protection. We can’t forget that both the market and industry can influence equity prices thanks in part to the indexing industry. The market is headed lower, in our view. Transaction details: 80 shares at $37.55 each.

Also on September 19, we opened up a 2% position in HCP (HCP). The firm is the first healthcare REIT selected to the S&P 500 and the only REIT included in the S&P 500 Dividend Aristocrats Index. Shares yield 5%+. Omega (OHI), a firm we talked about quite a bit in the past, remains on the watch list. Here’s HCP’s transaction details: 75 shares at $40.11 each. Importantly, we received a question about why we added HCP to the Dividend Growth portfolio despite its Valuentum Buying Index only being a 6, and I wanted to address it. The answer comes down to not being too picky with respect to dividend growth selections. Let me explain.

Unlike the Best Ideas portfolio, where capital appreciation is the key consideration (a greater focus on the Valuentum Buying Index), the Dividend Growth portfolio has a smaller subset of companies to choose from—first, those that pay dividends, and material ones at that. Second, we demand a Dividend Cushion ratio above 1 on holdings, meaning that we demand sufficient cash flow coverage of the dividend. This narrows the universe down even further, as most high yielders are figuratively ‘mortgaging the president’s desk’ to keep paying a hefty and unsustainable dividend yield. I’m thinking of those yielding 10% or above. You might get a few dividend coupons from these 10%+ yielders, but don’t count on the yield staying at that level for long. The dividend will either be cut or the market will have to re-price shares to more appropriate levels, with the former much more likely than the latter. It scares me how many people like to click on articles promising stocks with 15% dividend yields and higher.

But back to the point, in the Dividend Growth portfolio, we’re likely not going to find the perfect stock to add every single time (i.e. a 10-VBI-rated Dividend Aristocrat that is yielding north of 6% and has a Dividend Cushion ratio well above 1). This is probably one of the most difficult things new investors have to understand (all companies have good and bad characteristics). In the case of HCP, the REIT is one of the best dividend growth healthcare REITs on the market, pays a nice 5%+ dividend yield, has a solid Dividend Cushion, and boasts a respective 6 on the Valuentum Buying Index. This is good enough for me and quite nice within the context of a portfolio setting. HCP also helps replace the lost income from the removal of Kinder Morgan Energy Partners (KMP). On a side note, I can’t believe how many people are interested in Kinder Morgan (KMI). It makes me a bit nervous, with energy prices sliding.

That said, we continue to evaluate where we'd like to add energy exposure to the Dividend Growth portfolio after removing Kinder Morgan Energy Partners. Read more about the reasons for its removal here (Aug 2014). We continue to exercise patience in this regard, and as many readers know, we're not huge fans of the master limited partnership (MLP) business model. Please read more on that topic here (Feb 2014), if you haven’t already. But while we stated we’d be patient in putting new capital to work in the energy MLP space, KMI is not an MLP. We’re warming up to its shares. If you haven’t checked out our updated report on the firm on our website, please have a look. Still, we’re in no hurry to be adding KMI shares just yet, however--our expectations are for a market correction and the headache regarding the re-consolidation of the firm’s financials is a big one.

Regarding removals to the Dividend Growth portfolio, we let Emerson Electric (EMR) and Phillips 66 (PSX) go yesterday. Bye and thank you. Both have been fantastic performers, especially Phillips 66, the spin-off of Conoco Phillips (COP). We think both firms are fundamentally sound, but both are leveraged to the economic cycle. At the top of this piece in the seven reasons (the link at the top of the article), we stated that we’re working to limit our exposure to cyclicals at this point. We could see 5%-10% move lower in the broader markets (maybe more), and we wouldn’t think anything was abnormal. Cyclicals will likely see the steepest drops. We made a few cyclical removals in the Best Ideas portfolio as well, but this is the Dividend Growth Newsletter, and we’ll leave a discussion of that to the more relevant audience. The exit prices were $63.02 per share for Emerson and $81.43 per share for Phillips.

All in, we’re pretty pleased with the ideas that we’ve delivered in the Dividend Growth portfolio thus far, and we continue to expect continued outperformance relative to the goals set forth in the Dividend Growth portfolio. From Altria (MO) to Apple (AAPL) to Microsoft (MSFT) to Hasbro (HAS) and beyond, we trust you’ve found success. The protection added to the Dividend Growth portfolio as recently as yesterday is already paying “dividends”, and we’re doing the best to outline and emphasize the challenges we’re up against in coming quarters.

Best wishes and please stay tuned. Thank you for your continued membership.

Humbly yours,

Brian Nelson, CFA

President, Equity Research

brian@valuentum.com

*NOTE: Our Dividend Growth portfolio’s goal is to generate a mid-to-high single digit annual return (about 7.5%) over rolling 3-5 year periods. As of today October 1, 2014, the portfolio is significantly exceeding this goal.

Dividend Growth portfolio holdings: MO, AAPL, CVX, COH, ETP, GE, HAS, HCP, INTC, JNJ, MDT, MSFT, PG, PPL, SPY (put options), O.