Safeway Misses But Will Sell Unprofitable Chicago Business

Thursday afternoon, grocery retailer Safeway (click ticker for report: SWY) posted lackluster third quarter results that were overshadowed by the firm’s decision to sell its unprofitable Chicago-area Dominick’s stores. Revenue increased just 1.1% year-over-year to $8.6 billion during the period, a touch better than consensus estimates. Operating earnings per share, net of Dominick’s, were $0.10, down 38% year-over-year and well short of consensus expectations. Still, free cash flow has nearly doubled year-to-date to $382 million, equal to 1.5% of total revenue.

Goodbye Chicago

Perhaps the most encouraging news from the third quarter came from the announcement that Safeway will exit its Chicagoland Dominick’s business by early 2014. The firm bought Dominick’s for $1.2 billion in 1998, but the acquisition hasn’t been anything but a disaster. Over the past 15 years, Dominick’s has lost market share to competitors such as Whole Foods (click ticker for report: WFM), Mariano’s (click ticker for report: RNDY), Trader Joe’s, and Wal-Mart (click ticker for report: WMT), forcing Safeway to close several stores. In fact, Safeway noted that Dominick’s lost nearly $50 million in fiscal year 2012. Since Safeway will take a substantial write-down on the company, the firm will have $400-$450 million in cash tax savings against the sale of its Canadian supermarket business.

As for Dominick’s, it seems the brand is finished. Private equity-owned competitor Jewel purchased four stores, but Safeway indicated that it would have to sell stores to multiple buyers. In our view, any cash generated from sales is icing on the cake. Considering Dominick’s wasn’t able to post a profit on nearly $1.5 billion in sales, we think the brand is doomed to irrelevance over the long run. Nevertheless, the demise of Dominick’s will be a net-positive for almost all operators in the Chicago area, and we think Roundy’s could look to acquire some of Dominick’s real estate to expand its Mariano’s footprint.

The Operating Business

Image Source: Valuentum, Company Filings

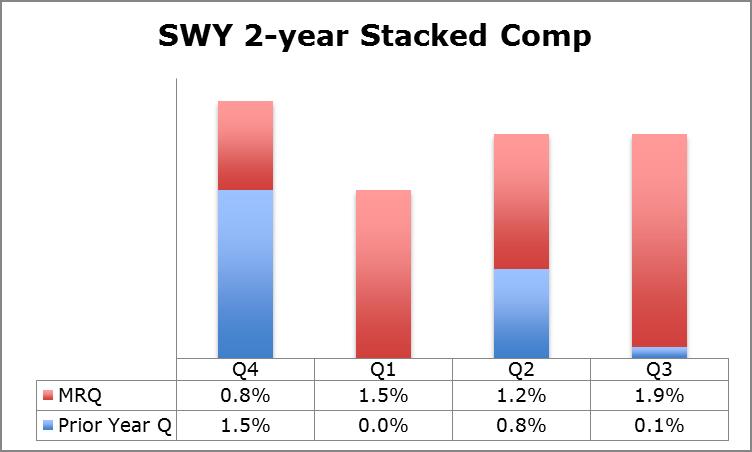

Safeway’s operating results were relatively poor during the third quarter. Excluding fuel sales, same-store sales increased 1.9% year-over-year. However, the sales gain clearly came at the expense of gross margins, which declined 36 basis points (53 basis points excluding fuel) year-over-year to 25.8% of sales. SG&A increased 7 basis points year-over-year to 24.87% of sales as management did a relatively strong job of controlling fixed costs. Consequently, the firm’s operating margin fell 43 basis points year-over-year to an anemic 0.94% of sales.

Though recent comparable sales trends aren’t great by any stretch of the imagination, 2013 has clearly revealed acceleration compared to 2012. Still, we do not believe 2013 sales gains are strong enough to compensate for likely share losses stemming from an incredibly competitive grocery environment.

Guidance

Looking ahead, Safeway narrowed its full-year same-store sales growth guidance to 1.6%-1.9% (excluding fuel) driving earnings per share of $1.05-$1.12. Safeway also narrowed its free cash flow guidance to $600-$650 million compared to its prior expectation of $600-$700 million.

Valuentum’s Take

2013 is shaping up to be another tough year for Safeway, but we do appreciate the firm’s focus on asset rationalization and debt repayment. Unfortunately, we find it very difficult to get excited about a grocer with operating margins below 1% competing in a cutthroat market. We think there are much more favorable risk/reward situations than Safeway at this time.