The Mortgage REIT Business Doesn't Work...

Key Takeaways:

· The good times are over for mortgage REITs.

o Mortgage market dynamics are inherently difficult to predict.

o A flatter yield curve has negatively impacted net interest rate spread income across the entire mortgage REIT universe. We’re already seeing deteriorating gross ROE’s from some of the largest industry constituents.

o The Fed has only caused a marginal tightening in mortgage spreads, and in our view, a marginal widening due to reduced Fed activity (if/when it happens) is perhaps the best-case scenario as it relates to spread income for the group. A continuation of spread tightening is likely the base-case scenario, which is negative for the group.

o Net interest rate spread income and gross ROE’s will only be materially enhanced in the future through more risky dealings and increased leverage. Adding leverage is like "pulling the wool over investors' eyes." It's a very, very low-quality way of bolstering returns relative to core net interest margin expansion.

o The book value of some mortgage REITs will be punished regardless of what happens to interest rates. However, a rising interest rate environment can be devastating by causing other comprehensive losses (unrealized losses on investments marked to market) that will completely wipe out period spread income, causing rapid and uncomfortable declines in book value.

o Dividend payments may not be sustainable under these conditions.

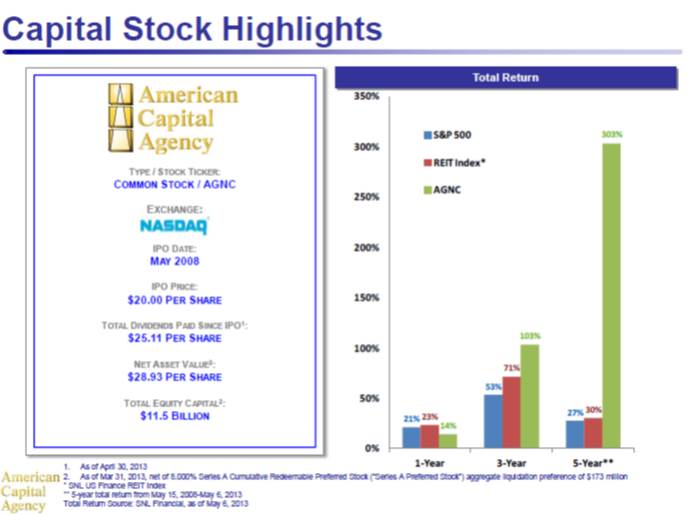

We sometimes wonder if investors are paying attention to the risks of the mortgage REIT industry, or if they just stare in paralyzed awe at the potential of future dividend payments from constituents (which may or may not be realized). After all, a look at industry bellweather American Capital Agency's (AGNC) total returns can really catch the eye of the investor. The REIT, which manages a levered portfolio of residential mortgage securities, went public in May 2008 at $20 per share, and it has paid in dividends an amount greater than an investor's initial investment at IPO ($25.11 per share)—in just 5 years! Plus, shares recently closed at a touch below book value (net asset value) of $28.93 per share (up meaningfully since the IPO price). Unarguably, the returns at American Capital Agency have been fantastic.

Image Source: American Capital Agency

Cutting Through the Propaganda

But let's cut through the public relations propaganda. On industry bellweather American Capital Agency's most recent conference call (click here for the presentation slide deck), President and CIO of American Capital Agency Gary Kain acknowledged the “very real” bear argument with respect to the mortgage REIT industry (click here for a full description of the risks related to this group):

"I really want to take a step back and look at one of the things that we hear from investors often...(we)...had a near zero funding cost for a number of years and the yield curve has been really pretty steep. So, mortgage REIT’s had a great run, but this business doesn’t work if (#1) interest rates go up and (#2) if the yield curve is flatter and there is a lot of people with that view on mortgage rates."

The investment community has it right, in our view.

Modest Spread Widening Is A Best-Case Scenario

Let's address (#2) the "flatter" yield curve first. As the cost of funds (borrowing) and asset yields converge, a flatter yield curve negatively impacts net interest rate spread income generated across the entire mortgage REIT universe. American Capital Agency, American Capital Mortgage (MTGE), CYS Investments (CYS), Annaly Capital (NLY), Hatteras Financial (HTS), Capstead Mortgage (CMO), Anworth Mortgage (ANH), Armour Residential (ARR), and Western Asset Mortgage (WMC) are a few participants that come to mind.

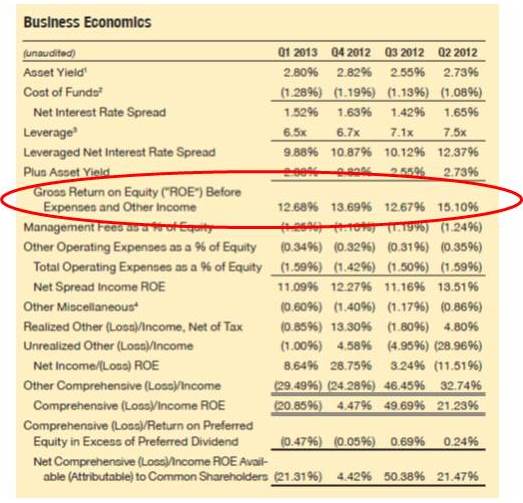

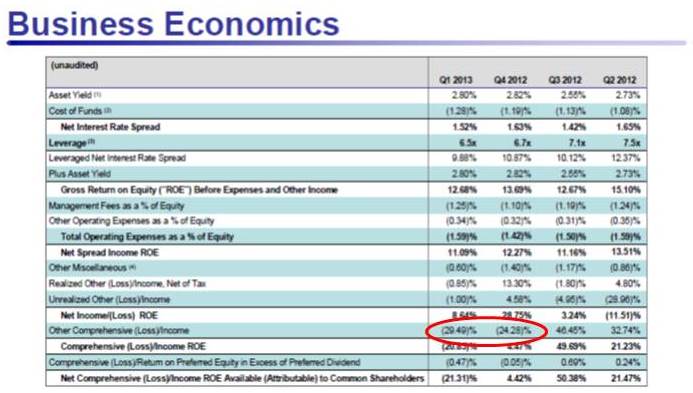

We’re already seeing tighter net interest rate spreads hurt gross ROE’s at industry bellweather American Capital Agency, as the REIT’s recent disclosure (fact sheet) highlights--encircled in red below. Though we admit a portion of American Capital Agency's declining gross ROE’s can be attributed to reduced 'adjusted' leverage, the firm’s net interest spread has declined to 1.52% (Q1 2013) from 1.65% (Q2 2012) as the cost of funds has increased faster than asset yields--the year-over-year comparison is even worse (was 2.31% in Q1 2012).

Image Source: American Capital Agency

Such a trend is systemic across the mortgage REIT industry, and we don't think it will reverse anytime soon, even if the Fed takes its foot off the gas. In Gary Kain's words on American Capital Agency's most recent conference call (quote below), the Fed has only caused a marginal tightening in mortgage spreads, and in our view, a marginal widening due to reduced Fed activity (if/when it happens) is perhaps the best-case scenario (as it relates to improving spread income for the group). A continuation of spread tightening is likely the base-case scenario for the industry, a marked negative.

“the Fed was involved in QE1 in 2009...the expectation was that the Fed was going to tighten up mortgages to the point where agency mortgages...where they were unattractive. The reality has been that mortgages are only marginally tighter than they were when Fed started the program which is confusing to me personally, I mean we didn’t expect them to perform the way they did.”

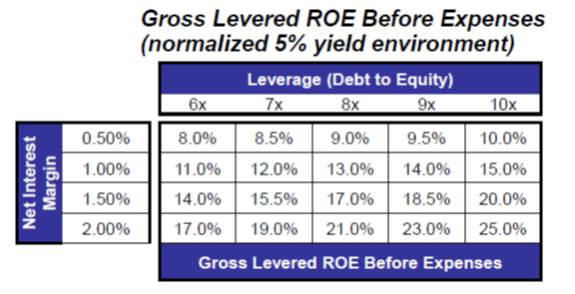

So how does the mortgage REIT industry expect to turn things around as it relates to net interest rate spread income? The answer: by adding more leverage (risk). Simply put, if the firm's net interest margin continues to get squeezed by either higher funding costs or lower yields, American Capital Agency (and other constituents) seem content in simply adding additional leverage (risk) to keep investors happy. American Capital Agency's disclosure, shown below, reveals this uncomfortable relationship between leverage (debt to equity) and gross ROE's.

Image Source: American Capital Agency

Though 10x leverage (the right column of this table) is far from the days of the GSEs (government sponsored entities), Fannie and Freddie, which took a 50 basis point spread and leveraged it 40x to generate a 20% ROE, we just can't get comfortable with a business model that will rely solely on increasing leverage in the future to improve returns to shareholders. Savvy investors know that the true measure of a company's economic value creation rests on the return on its operating assets, not its capital structure (leverage). Adding additional leverage is like "pulling the wool over investors' eyes." It's a very, very low-quality way of bolstering returns relative to, let's say, net interest margin expansion, in a mortgage REIT's case.

Why Even Parallel Interest Rate Shifts Could Hurt Net Asset Value

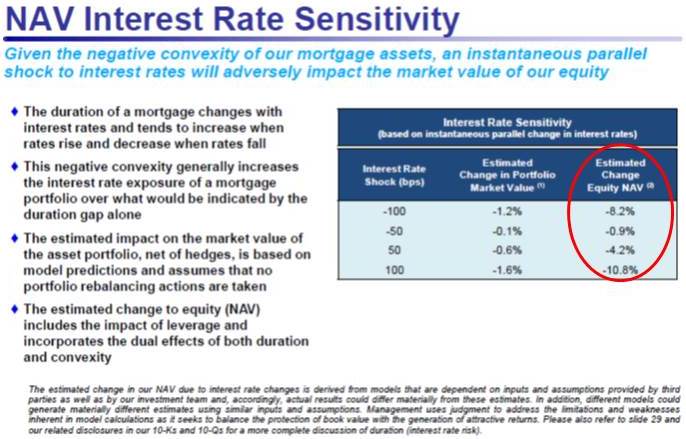

Interestingly, we came across the following disclosure that was buried on page 42 of industry bellweather American Capital Agency's recent slide deck. Essentially, under almost any move (shock) in interest rates, the change in the firm's book value (NAV) is negative (encircled in red below)--not good. Duration and convexity are working against investors in American Capital Agency's shares (at least at this point in time). We think such a present dynamic is not well-known across the mortgage REIT industry.

Image Source: American Capital Agency

What does this mean? In our view, it means that there's not much reward, if at all, for the added risk of American Capital Agency's business model (due to balance sheet risk). Said differently, under a situation where interest rates increase or decrease (and spreads remain constant), American Capital Agency's net asset value could fall (due to the negative impact from other comprehensive losses). Simply put, we think the odds are stacked against an investor in American Capital Agency's shares (at least for now).

Unrealized Losses on Investments Will Accelerate Net Asset Value Deterioration

This brings us to (#1): interest rates go up.

Source: US Department of the Treasury

The most important driver behind changes in a mortgage REIT's net asset value is other comprehensive income/(loss), or OCI. Basically, changes in OCI include net unrealized losses on investments marked to market. As shown below, higher interest rates drove asset declines in American Capital Agency's investment portfolio that hurt ROE's by 29.49 percentage points and 24.28 percentage points in its first quarter of 2013 and fourth quarter of 2012, respectively. This is a big deal.

Image Source: American Capital Agency

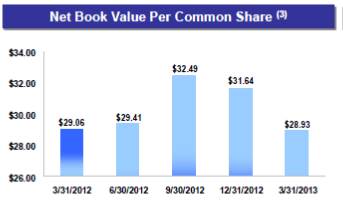

Though we fall short of explicitly forecasting higher interest rates in the future, a continuation of existing trends, which seems most likely for the group, could be devastating for many constituents (as book values continue to erode). Below, we show what has happened to American Capital Agency's net book value in recent periods as a result of higher interest rates.

Image Source: American Capital Agency

Valuentum's Take

Though we admit mortgage market dynamics are inherently difficult to predict, we think the odds are stacked against many constituents in the mortgage REIT industry. Participants must deal with tightening interest rate spreads and deteriorating investment portfolios (book values) in the event of a rising interest rate environment. By extension, declining net asset values will pressure the capital decisions of industry constituents, and we would not be surprised if additional dividend cuts are around the corner. We continue to steer clear of the group.