Theft Becoming a Huge Problem for Retailers

Image Source: Ben Schuman

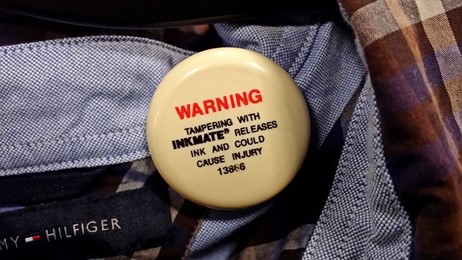

Theft has always been a problem for retailers, but it has never been as big of a problem as it has been in recent quarters. Emboldened by the lack of police response and employees sometimes getting fired for confronting shoplifters, retail organized crime is on the rise. We’re not talking theft in the millions, or billions, but likely in the tens of billions per year or more across the U.S. Some attribute the rise of organized retail crime to the pandemic, which paved the way for shoplifters to post their loot online in order to make a quick buck. Some retailers are especially feeling the pinch, and recent commentary reveals just how bad retail theft (shrink) has become to their respective businesses.

Video: A mob robs a store in Los Angeles, California. Source

Target (TGT): “…our team continues to face an unacceptable amount of retail theft and organized retail crime…Shrink in the second quarter remained consistent with our expectations, but well above the sustainable level where we expect to operate over time. And unfortunately, safety incidents associated with that are moving in the wrong direction…During the first five months of this year, our stores saw a 120% increase in theft incidents involving violence or threats of violence. As a result, we're continuing to work tirelessly with retail industry groups and community partners to find solutions to promote safety for our store teams and our guests.”

Walmart (WMT): “Shrink is comprised of more than one thing. That's part of it. And we do think that in some jurisdictions here in the U.S., there needs to be action taken to help protect people from crime, including theft. The other part of shrink is more controllable, and we stay focused on that as a priority.”

Dick’s Sporting Goods (DKS): "We are pleased with our strong sales performance for the second quarter led by robust transaction growth and continued market share gains. Within the quarter, sales accelerated significantly in July, and we remain confident in delivering positive comp sales for 2023. While we posted another double-digit EBT margin, our Q2 profitability was short of our expectations due in large part to the impact of elevated inventory shrink, an increasingly serious issue impacting many retailers. Despite moderating our 2023 EPS outlook, the enthusiasm we have for our business and the confidence we have in our long-term growth opportunities have never been stronger."

Home Depot (HD): …we are certainly in the battle in retail as we kind of think about shrink. But we have always continued to lean into initiatives that we have seen that can have impact to mitigate overall. And I know it’s early as we think about the Inform Act, but the Inform Act is one of the key components as we think about organized retail crime that I think will help give us a little bit more visibility in some of the things that are happening out there. But certainly, it’s been largely in line with what we have seen in the last several quarters. We certainly have key initiatives to help mitigate that. And we need our kind of government partners to help on their end as well to help us in retail to really mitigate what we have seen out there.

Macy’s (M): “We continue to be focused on protecting gross margin. We will navigate the year with the intent to stimulate increased conversion and margin dollar expansion. Our annual gross margin rate outlook also includes an estimate for increased shrink, which we call shortage relative to our initial expectations.”

NOW READ: A Market Pullback Should Be Expected; Focusing on Generating Alpha

NOW READ -- Questions for Valuentum’s Brian Nelson

NOW READ -- ALERT: Big Yield Additions to Dividend Growth Newsletter Portfolio and High Yield Dividend Newsletter Portfolio

NOW READ -- ALERT: Going to “Fully Invested” in the Best Ideas Newsletter Portfolio

NOW READ -- Expect Huge Equity Returns This Decade, Much More Volatility However

NOW READ -- There Are No Free 'Income' Lunches

----------

Tickerized for holdings in the XRT.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

0 Comments Posted Leave a comment