Zillow Continues to Disrupt Real Estate Market

Image Source: Zillow Group Inc – May 2020 IR Presentation

By Callum Turcan

Record low interest rates for mortgages in the US, largely a product of the Fed’s monetary stimulus measures (quantitative easing and near-zero interest rates), has gone a long way in stimulating demand for homes. According to the US Census Bureau, the national homeownership rate stood at 67.4% in the second quarter of 2020, up ~260 basis points from the same period the prior year. For reference, the domestic homeownership rate has been steadily climbing higher since 2015-2016 (when homeownership rates were in the low-60s% range) according to data provided by the US Census Bureau. Homeownership rates peaked in 2005-2006 at the high-60s% level before sliding significantly lower over the next decade due in part due to the ramifications of the Great Financial Crisis (‘GFC’) and the tightening of mortgage lending standards (in large part due to Dodd–Frank Wall Street Reform and Consumer Protection Act that was passed in 2010).

Zillow Group Background

For Zillow Group Inc (Z) (ZG), this trend reversal (i.e. rising US homeownership rates) has been a boon to its financial performance. From 2017 to 2019, its annual GAAP revenues surged from under $1.1 billion to over $2.7 billion. Zillow Group offers a variety of services catering to the real estate market in the US including an online real estate marketplace, digital-advertising services, and ‘Zillow Offers’ which involves offering prospective home sellers a cash offer based on its home value calculation operations. Zillow Offers was available in 22 markets at the end of 2019, though the goal is to continue expanding this operation’s geographical presence and currently is available in ~25 markets.

Zillow also originates home loans through ‘Zillow Home Loans’ and please note the firm sells these loans on the secondary market (at the end of 2019, its Zillow Home Loans offering was available in 44 US states). Back in November 2018, Zillow completed its acquisition of Mortgage Lenders of America (for ~$67 million in cash) to support its Zillow Offers business and its mortgage marketplace business.

In 2014, Zillow announced it would acquire Trulia for ~$3.5 billion in stock. The deal closed in February 2015. At the time, both companies were largely advertising companies working with real estate professionals, though Zillow has since changed its business model considerably.

Disrupting the Real Estate Space

Though the digital advertising space has faced significant headwinds due to the ongoing coronavirus (‘COVID-19’) pandemic, Zillow’s financial performance continued to impress this year. During the first nine months of 2020, Zillow grew its GAAP revenues by about 42% year-over-year. Greater economies of scale helped shrink its GAAP operating loss, though Zillow’s operating expenses have grown materially in recent years as the firm scaled up and launched adjacent business ventures (for instance, Zillow Offers was launched in April 2018).

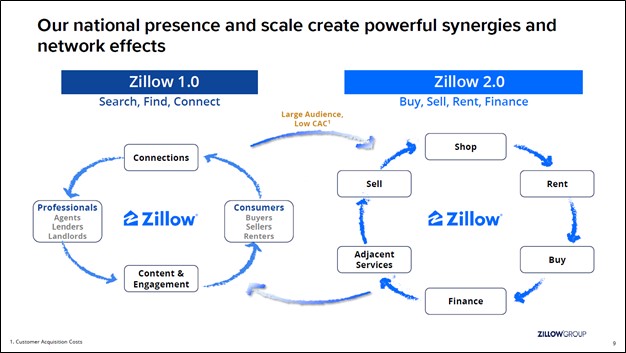

As an aside, roughly two-thirds of the company’s Zillow Offers “are closed digitally with a remote notary” according to recent management commentary, highlighting the impact Zillow’s past technology investments have had on its ability to continue operating during the pandemic. We appreciate Zillow’s focus on technology and innovation. Expanding into new markets and launching new services underpins what could be a very impressive long-term growth story. The upcoming graphic down below highlights Zillow’s ongoing transformation.

Image Shown: Zillow is moving into adjacent markets in the real estate space in the US to extend its growth runway and solidify its competitive position in this enormous industry. Image Source: Zillow Group – May 2020 IR Presentation

Shares of Z (Zillow Class C shares) and ZG (Zillow Class A shares) have surged higher this year, in part because many US households have sought to leave large urban areas by buying a home in suburban areas where those households can afford more living space. The working from home (‘WFH’) dynamic has been key here, as households (generally speaking) realized they would appreciate more space once forced to stay indoors for long periods of time due to the COVID-19 pandemic. More broadly, urban areas have become quite expensive in several parts of the country, which makes suburban areas more appealing from an economic point of view. Here is what Zillow’s management team had to say on these issues during the firm’s latest earnings call (emphasis added):

“First, let's talk about the residential real estate tailwind. Simply put, people want to move, and we see additional pent-up demand on the horizon, low mortgage rates are helping. And of course, there's been a major shift in the way we think about work, life and home. We have taken our usual calculus about where and how we live, and we've turned it on its head instead of stretching and wrapping our lives to fit around where we work, we've been forced to find a way to stretch and wrap our work to fit around our lives. Not for all, but for many, this has been a healthy and liberating inversion, one that prioritizes life above work. And now obvious byproduct of this inversion is that many are rethinking where they live. This is part of the great reshuffling I've been talking about.

In September, we saw the pace of existing home sales climbed to the highest level since 2006, exceeding 6.5 million annualized units. Many are debating and doubting the longevity of this reshuffling trend. My intuition, everything I see in here externally and what is happening right here at Zillow with its 5,000-plus employees, is that a new distributed workforce culture has already been born. I sense this is happening across knowledge work at Corporate America broadly, though different companies are waking up at different paces. This doesn't feel temporal. It feels like it will take years to play out and could end up being the defining cultural trend of the decade.” --- Rich Barton, CEO of Zillow

Furthermore, Zillow sees demographic trends working in its favor, namely that Millennials (broadly speaking, those in their 20s and 30s) are entering the stage where home ownership becomes more prevalent. The trends towards greater homeownership rates in the US appears to have long legs, assisted by record low mortgage rates, though we caution that severe economic downturns have historically pressured national homeownership rates (with those headwinds historically lasting for several years).

Though Zillow is clearly a leading innovator in the US real estate space, the company is still very exposed to exogenous forces (even if Zillow is better positioned than many of its peers to ride out whatever storm arises). Management noted that “the audience we built over the past 15 years is nearly double the size of our closest competitor and grew more than 30% in Q3” during Zillow’s latest earnings call, highlighting the firm’s impressive competitive position in this enormous market.

Rock-Solid Financial Position

At the end of September 2020, Zillow had $3.8 billion in cash, cash equivalents, and short-term investments on the books combined. Stacked up against $0.2 billion in short-term debt (‘borrowings under credit facilities’ and ‘convertible senior notes, current portion’) and $1.8 billion in long-term debt (‘convertible senior notes, net of current portion), Zillow retained a nice net cash balance. Having a pristine balance sheet allows Zillow to make the large investments in technology required to remain competitive and put the firm in a better position to ride out the storm caused by the COVID-19 pandemic.

We caution that Zillow does have short- and long-term lease liabilities (over $0.2 billion in total at the end of September 2020) to be aware of, though those liabilities are still relatively modest compared to its large cash-like position. Zillow generated almost $0.7 billion in free cash flow during the first nine months of 2020, though we caution that historically, its cash flow performance has been quite volatile due to significant working capital movements (changes in its ‘inventory’ line-item in particular). Here is what management had to say regarding Zillow’s near-term outlook during the firm’s latest earnings call (emphasis added):

“Turning to our outlook for the fourth quarter. Many of our businesses historically have seen seasonally slower activity levels in Q4, but 2020 has been anything but typical. While we are seeing some seasonality as we enter the quarter, we are seeing stronger inputs than would normally be expected in many of our businesses. Across the entire company, we are seeing strong inputs on our growth drivers, coupled with continued focus on profitability, which is resulting in guidance that reflects growth with leverage. We expect consolidated EBITDA at the midpoint of our outlook to be $119 million, up from a loss of $3 million last year.” --- Allen Parker, CFO of Zillow

Zillow’s near- and long-term outlook appears quite bright as things stand today.

Concluding Thoughts

We are not interested in adding shares of Zillow to our newsletter portfolios at this time, though we are keeping an eye on the company as it continues to disrupt the real estate market in the US. Going forward, we would like to see Zillow’s cash flow performance stabilize on an annual basis, as that would provide greater clarity on its future expected financial performance. On a final note here, management commented that “Zillow Offers makes up only a tiny fraction of all residential real estate transactions just 0.2%” during the firm’s latest earnings call, highlighting Zillow’s long growth runway on this front in the event it continues to gain market share. As more “digitally-savvy” generations start thinking about home ownership, Zillow is well-positioned to capitalize on that upside.

-----

Related: Z, ZG, WFM, MILN, RDFN, NWHM, RMAX, RLGY, NRZ, PMT, NLY, AGNC, CMO

Also tickerized for holdings in the iShares U.S. Home Construction ETF (ITB).

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL) and Microsoft Corporation (MSFT) are both included in both Valuentum’s simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Alphabet Inc (GOOG) Class C shares and Facebook Inc (FB) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment