We’re Reiterating Our $200 Fair Value Estimate for PayPal

We continue to be big fans of PayPal. The company has a pristine balance sheet, high quality cash flow profile, impressive growth outlook, and is trading well below its fair value estimate as of this writing. Though investors initially sold off shares of PYPL following its third-quarter report November 2 due to its expected growth trajectory slowing down in the near term, we're reiterating our fair value estimate of $200 per share as PayPal continues to deliver impressive fundamental performance. PayPal’s medium- and long-term growth outlooks remain stellar. Venmo could be a source of significant upside in the medium-term, and we are monitoring events closely.

By Callum Turcan

On November 2, PayPal Holdings Inc (PYPL) reported third quarter 2020 earnings (period ended September 30, 2020) that beat both top- and bottom-line consensus estimates. However, management guided for PayPal’s near-term growth trajectory to slow down before rebounding in the medium-term for reasons we will cover in this note. The expected slowdown in its near-term growth rate saw shares of PayPal shift lower after posting its latest earnings report. However, we are taking a longer term view. We continue to be huge fans of PayPal and include shares of PYPL as a top-weighted holding in the Best Ideas Newsletter portfolio. We're reiterating our fair value estimate of $200 per share of PayPal.

Quarterly Update

During the first nine months of 2020, PayPal remained a free cash flow cow, generating $4.0 billion in free cash flow (up from $2.8 billion in the same period last year). The firm’s GAAP revenues grew by 24% year-over-year in the third quarter and 20% year-over-year during the first nine months of 2020, highlighting its ability to capitalize on secular growth tailwinds (such as the proliferation of e-commerce). PayPal’s GAAP operating income grew by 40% year-over-year in the third quarter and 21% year-over-year during the first three quarters of 2020 due primarily to revenue growth and greater economies of scale. Its operating expenses increased significantly during both periods in 2020 versus 2019 levels, though not at a rate that would lead to margin erosion (its GAAP operating margin grew significantly last quarter versus the same quarter a year-ago).

At the end of September 2020, PayPal had $14.2 billion in cash, cash equivalents, and short-term investments on hand along with $3.4 billion in long-term investments. Stacked up against no short-term debt and $8.9 billion in long-term debt on the books, PayPal retained its nice net cash position at the end of the third quarter. We are big fans of companies with pristine balance sheets. PayPal used its stellar financial position to repurchase $1.4 billion of its stock during the first nine months of 2020, and we view share repurchases as a good use of capital given that shares of PYPL are trading below their fair value estimate as of this writing (and during most of 2020).

On an operational basis, PayPal reported that its total payment volumes (‘TPV’) grew by 38% year-over-year (36% when excluding foreign currency movements) in the third quarter of 2020. The number of payment transactions rose to ~4.0 billion last quarter, up 30% on a year-over-year basis. PayPal’s active user base also rose significantly last quarter, rising by 22% year-over-year, hitting 361 million active accounts. During the initial phases of the ongoing coronavirus (‘COVID-19’) pandemic, PayPal was adeptly able to navigate the storm.

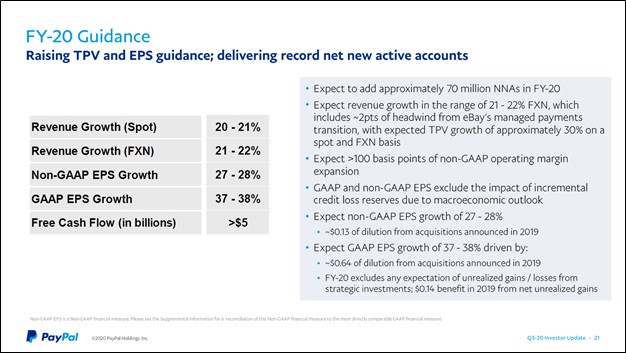

Management raised PayPal’s TPV guidance (its TPV is now expected to grow by 30% year-over-year in 2020 versus a high 20s% growth rate previously) and earnings guidance (its diluted GAAP EPS is now expected to grow by 37%-38% year-over-year in 2020 versus ~25% previously) during the company’s latest earnings report. In the upcoming graphic down below, PayPal lays out its full year guidance for 2020. We appreciate that PayPal expects to generate over $5.0 billion in free cash flow this year.

Image Shown: PayPal expects to post significant TPV, revenue, and GAAP EPS growth in 2020. Additionally, the company expects to generate north of $5.0 billion in free cash flow this year. Image Source: PayPal – Third Quarter of 2020 IR Earnings Presentation

Pivoting Away from eBay

PayPal noted in its latest earnings report that its ‘Merchant Services’ business has performed well of late. During PayPal’s latest earnings call, management noted that PayPal “added over 1.5 million new merchants in the quarter, over two times our pre-COVID rate and we now have 28 million merchants on our platform” which we appreciate.

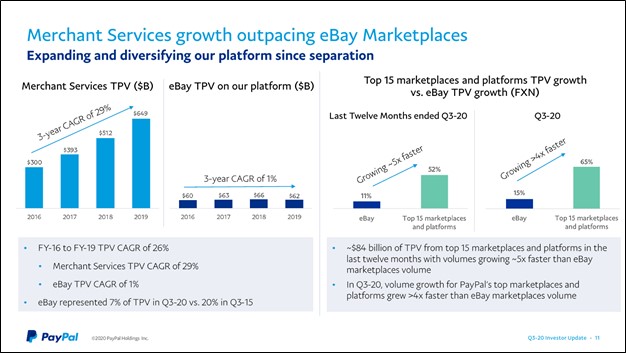

Please note that PayPal’s five-year agreement with eBay Inc (EBAY) ended in July 2020, meaning the TPV PayPal generates from eBay will likely shift significantly lower in the near term. However, PayPal has been steadily moving away from eBay over the past several years, with eBay representing just 7% of PayPal’s total TPVs in the third quarter of 2020, down from 20% in the third quarter of 2015. Though this separation will create near-term headwinds, PayPal’s long-term growth trajectory on this front remains intact.

Image Shown: PayPal is steadily transitioning away from eBay now that their five-year arrangement has come to an end. Image Source: PayPal – Third Quarter of 2020 IR Earnings Presentation

Here is what PayPal’s management team had to say regarding the firm’s relationship with eBay and PayPal’s impressive TPV performance overall during PayPal’s latest earnings call (emphasis added):

“The digitization of the global economy can bind with the rise of digital wallets will drive our growth over the next decade. Our scale, two-sided network, trusted brand, our strong relationships with the regulators around the world, and our AI and data modeling capabilities can all be leveraged to ensure our PayPal and Venmo apps are essential parts of our customers’ daily lives.

We still have a lot to do to achieve that vision, but let me be clear. We are investing to create one of the most compelling and expensive digital wallets in the world. And you can see this beginning to play out in our strong Q3 results. In Q3, our total payment volume grew by a record 36% on an FX neutral basis to $247 billion in annual run rate, just shy of $1 trillion. Even more impressive is the growth of our volumes, excluding eBay, which grew 38% eclipsing any previous record.

And in early October, we hit our all-time highest TPV day outperforming any previous day in our history. These record results are happening even as eBay moves their base to their managed payments platform. eBay is now just 7% of our total volumes and will likely be between 5% to 6% by the end of the year. Our transactions in the quarter were just over 4 billion growing 30% year-over-year. This is the first time we have processed over 4 billion transactions in a quarter and it’s worth noting that our core PayPal daily active accounts increased 32% versus a year ago consistent with last quarter.” --- Dan Schulman, President and CEO of PayPal

Additionally, we are intrigued by PayPal’s strategy as it concerns its mobile peer-to-peer payment transaction app Venmo. The app has experienced tremendous TPV growth of late, and PayPal wants to build on that momentum. In October, Venmo launched the Venmo Credit Card which is issued by Synchrony Financial (SYF) and powered by the Visa Inc (V) network. Management expects Venmo could generate $900 million in revenue by 2021 according to commentary given during PayPal’s latest earnings call.

We are intrigued by the revenue-generating opportunities this offering could yield, and please note the card is integrated digitally into Venmo’s mobile app (customers are also issued a physical card as well). PayPal also offers a Mastercard Inc-branded (MA) debit card. PayPal’s management team had this to say regarding Venmo during PayPal’s latest earnings call (emphasis added):

“Venmo had a very strong Q3 with 65 million users driving $44.3 billion in TPV up 61% year-over-year. Venmo’s growth continues to exceed our expectations and we are forecasting revenue for Venmo to approach $900 million in 2021 driven by investments in new capabilities. As the Venmo’s revenue base diversifies and scales its transaction margin continues to improve and we now expect Venmo to also make a positive contribution to our transaction margin dollars in 2021.

By Q1, the Venmo checkout experience will mirror the ease and simplicity of a PayPal branded transaction. We anticipate a meaningful increase in merchant transactions with some of the world’s largest retailers and marketplaces incorporating Venmo as a payment option at checkout, both online and offline as our QR codes are integrated into physical retail. The Venmo credit card will be fully rolled out in Q1.” --- CEO of PayPal

Looking ahead, management noted during PayPal’s latest earnings call the firm was “clearly on a trajectory to deliver stronger long-term growth than our previously guided medium-term outlook of 17% to 18% currency neutral revenue growth, and approximately 20% earnings growth on average annually.” However, due to PayPal’s stellar performance in 2020 and the expected headwinds created by the end of its agreement with eBay, PayPal’s 2021 comps will be tough in the eyes of management (additionally, PayPal’s fourth quarter performance will face headwinds from the end of the eBay agreement).

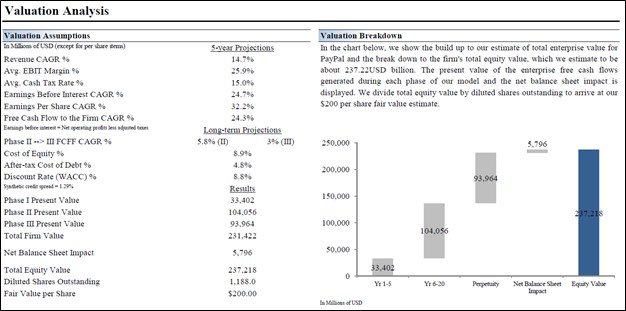

With that in mind, given that the vast majority of a company’s intrinsic value is derived from the mid-cycle (Years 6-20) and perpetuity part of the business cycle (Years 21+), we are encouraged by management’s optimistic view on PayPal’s medium- and long-term growth outlook. This is why, in our view, PayPal’s latest earnings report reinforced our fair value estimate of $200 per share of PYPL. Please see Value Trap for an in-depth look at our thoughts as it concerns discounted free cash flow analysis.

Image Shown: Short-term headwinds aside, PayPal’s latest earnings report reinforced our optimistic view on its long-term growth outlook which in turn is why we are maintaining our fair value estimate of $200 per share.

Concluding Thoughts

We continue to be big fans of PayPal. The company has a pristine balance sheet, high quality cash flow profile, impressive growth outlook, and is trading well below its fair value estimate as of this writing. Though investors initially sold off shares of PYPL due to its expected growth trajectory slowing down in the near-term, we're reiterating our fair value estimate of $200 per share as PayPal continues to deliver impressive fundamental performance. PayPal’s medium- and long-term growth outlooks remain stellar. Venmo could be a source of significant upside in the medium-term, and we are monitoring events closely.

-----

Banks & Money Centers Industry – AXP BAC BBT BK C DFS FITB GS HSBC JPM KEY MS NTRS PNC RF STI TCF USB WFC

Dollar Store and Department Store Industries – KSS M JWN BIG DG DLTR PSMT

Financial Tech Services Industry – MA MELI PYPL VRSK V

Food Retailing Industry – CASY COST CVS KR SYY TGT WBA WMT

Related: SQ, IYG, IPAY, IYF, XLF, SYF, COF, LC, FISV, BTC, GBTC, JPM

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Dollar General Corporation (DG), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Vanguard Consumer Staples ETF (VDC) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment