Update on Dell Technologies and VMware

Image Source: VMware Inc – First Quarter Fiscal 2021 IR Earnings Presentation

By Callum Turcan

Dell Technologies Inc (DELL) and VMware Inc (VMW) are back in the news as the WSJ recently reported the former is considering spinning off its enormous equity stake in the latter. Back in September 2016, Dell completed its ~$67 billion cash-and-stock acquisition of EMC which gave Dell a controlling equity stake in VMware (and a mountain of net debt in the process). As of January 31, 2020, Dell owned approximately 80.9% of VMware’s outstanding equity. Dell can spin off its equity stake in VMware tax-free after a five-year waiting period, though Dell would need to wait until September 2021 before that could occur (given when the EMC deal closed).

Background

Please note that Dell consolidates the financial performance of VMware and SecureWorks Corp’s (SCWX) with its own. As of January 31, 2020, Dell owned an 86.8% equity stake in SecureWorks. Here is some additional information from Dell’s fiscal 2020 Annual Report:

Principles of Consolidation — These Consolidated Financial Statements include the accounts of Dell Technologies and its wholly-owned subsidiaries, as well as the accounts of VMware, Inc., Pivotal, and SecureWorks Corp. (“Secureworks”), each of which is majority-owned by Dell Technologies, except for Pivotal, which is a wholly-owned subsidiary of VMware, Inc. as of December 30, 2019 upon completion of the acquisition of Pivotal’s non-controlling interest. All intercompany transactions have been eliminated.

Additionally, here is some background on each company’s operational focus. Dell primarily sells servers and networking hardware, software, and services to data centers (with an eye towards cloud computing and storage infrastructure), along with desktops and laptops for consumers and enterprises. VMware provides cloud computing, cybersecurity, and digital workspace offerings. SecureWorks offers network cybersecurity and online threat monitoring services.

Update on Our Arbitrage Play Commentary

We covered the situation of whether there might be an arbitrage opportunity with Dell and VMware back in December 2019 (link here), and here was our conclusion at the time:

In fiscal 2019 (period ended February 1, 2019), VMware generated $3.4 billion in free cash flow. During this period, Dell generated ~$2.4 billion in free cash flow when removing VMware’s performance from its operations [for simplification purposes we only removed VMware’s financial performance from Dell’s consolidated financials given SecureWorks’ relatively immaterial size as it relates to this exercise].

When using a discount rate of 10% and a perpetual growth rate of 2-3%, the value of Dell (i.e. if it were debt free) would be roughly $30-$34.5 billion. However, in arriving at Dell’s equity value, one must subtract Dell’s net debt position. In doing so, we find that Dell’s value, excluding its stake in VMware, is actually negative--to the tune of about $10-$15 billion ($30-$34.5 billion less $7.7 billion in short term debt less $44.7 billion in long-term debt plus $8.6 billion in cash). This tally (negative ~$10-$15 billion) when combined with Dell’s stake in VMware (~$50 billion) brings the estimated value close to Dell’s current market capitalization of ~$37 billion…

Effectively, in the enterprise valuation context, it appears that the market is already pricing in both the value of Dell’s stake in VMware [back in December 2019], its future free cash flows, and its large net debt position into the value of Dell’s equity. The key takeaway from this exercise is multi-fold. One, enterprise valuation is critical in estimating intrinsic value and its ties to market capitalization. Two, don’t forget about the importance of net debt in the enterprise valuation construct, and three, while limits to arbitrage can exist, it doesn’t look like an arbitrage opportunity is evident with DELL/VMW [as of December 2019], at least from our perspective.

As Dell and VMware have both published their fiscal 2020 Annual Reports, we can provide an update on the potential arbitrage opportunity. Please note the share price of DELL and VMW, after recovering from the pandemic induced sell off, were largely flat from December 2019 late-June 2020 as of this writing.

On a consolidated basis, Dell generated $7.0 billion in free cash flow in fiscal 2020 (period ended January 31, 2020). VMware generated $3.6 billion in free cash flow in fiscal 2020 (period ended January 31, 2020), indicating Dell generated ~$3.4 billion in free cash flow last fiscal year when excluding VMware’s performance. Using a discount rate of 10% and a perpetual growth rate of 2% - 3%, the value of Dell (i.e. if it were debt free) would be roughly $42.5 billion - $48.6 billion. However, Dell’s balance sheet must also be taken into consideration.

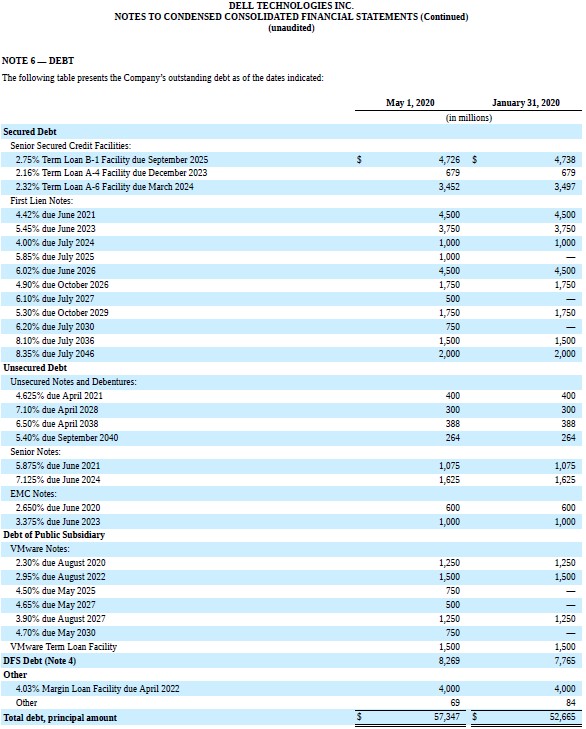

Dell is heavily burdened by its large net debt load and please note most of Dell’s debt on a consolidated basis is on its own books (Dell also has a wholly-owned financing subsidiary that we will cover later on). As of the end of Dell’s first quarter fiscal 2021 (period ended May 1, 2020), the company had $12.2 billion in cash and cash equivalents on hand on a consolidated basis which was stacked up against $8.4 billion in short-term debt and $48.4 billion in long-term on a consolidated basis. At the end of VMware’s latest fiscal quarter (period ended May 1, 2020), the company’s net debt load stood at approximately $1.8 billion (cash and cash equivalents less VMware’s combined short-term debt, notes payable to Dell, and long-term debt balance).

Given that SecureWorks is a relatively small company, we are looking at just Dell and VMware in this exercise. As an aside, Dell’s equity stake in SecureWorks is worth approximately $0.8 billion as of this writing and at the end of SecureWorks’ latest fiscal quarter (period ended May 1, 2020), the firm had a net cash position of just under $0.2 billion

With a net debt position of approximately $42.7 billion (removing VMware’s cash-like and debt-like items from this picture), an estimated value of roughly $42.5 billion - $48.6 billion for Dell before taking balance sheet considerations into account (and after removing VMware’s fiscal 2020 free cash flows from this calculation), and an equity stake in VMware worth around $50.3 billion as of this writing, Dell’s market capitalization of $38.2 billion as of this writing appears to be a reflection of the market heavily discounting the value of Dell’s data center-oriented businesses.

Other considerations include the possibility that the market could be factoring in the inability for Dell to underload its VMware equity stake in a tax-efficient manner or at current market prices (given what might happen if the float of VMW were to increase immensely in a short period of time, particularly as it relates to potential downward pressure on the share price of VMW).

It is possible that an DELL/VMW arbitrage opportunity may have arisen; however, it is also possible that market participants are expecting Dell’s free cash flows to deteriorate materially over the coming years and that our perpetuity calculation for Dell’s valuation (before balance sheet considerations) is overly generous, especially when considering how the ongoing coronavirus (‘COVID-19’) pandemic might impact its operations and financials going forward.

How Dell Might Proceed

In the event Dell converted its VMware stake into cash at VMware’s current share price, Dell’s net debt load would flip to a net cash position (before taking tax and other considerations in mind). In the event Dell spun off its equity stake in VMware to its shareholders, Dell would continue to carry a massive net debt load. Given that Dell would be hard pressed to manage its debt load without its large equity stake in VMware, in our view we think Dell’s management team would rather raise cash at or near VMware’s current valuation than put Dell in a financially precarious position. Here’s what Dell’s management team had to say during the firm’s latest quarterly conference call (emphasis added):

“The latest data is pointing to a challenging environment, with global GDP expected to decline between 3% to 5% in 2020; and IT spending, excluding telecom, to be down 5% to 10%. While it's difficult to predict the shape of the slowdown and the recovery and the resultant impact on IT spending, our job is to prudently manage our business so that we are in a strong position on the other side of this crisis. We remain committed to delevering and achieving investment-grade ratings. Our intent remains to reduce core debt by approximately $5.5 billion in fiscal 2021, in addition to the debt repayment associated with the Q1 issuance, though this may be influenced by the macro and related business performance.

So to close, these are unprecedented times but Dell Technologies is well positioned. are moving forward, winning the consolidation, integrating and innovating across Dell Technologies to create the future of technology infrastructure and creating long-term value for all stakeholders. This is our strategy and focus. And in a world that is increasingly looking for resiliency, reliability and innovation, we are uniquely positioned to emerge from this time as the essential technology company for the data era.” --- Tom Sweet, CFO of Dell

Dell wants to rein in its debt load, which we appreciate, though the ongoing COVID-19 pandemic and the growing threat of a second wave of COVID-19 infections (in countries all around the world) represent major hurdles to that strategy.

Managing Debt Maturities

In the upcoming graphic down below, Dell provides an overview of its debt maturity schedule on a consolidated basis. Please note that the “DFS Debt” refers to debt relating to Dell Financial Services (‘DFS’), Dell’s financing wing. DFS offers revolving loans, fixed-term leases and loans, and financial services for “customers in North America, Europe, Australia, and New Zealand” and DFS is a wholly-owned subsidiary of Dell. According to management commentary during Dell’s latest quarterly conference call, the “majority” of the financing subsidiary’s debt “is nonrecourse to the company and is backed by high-quality receivables.”

Image Shown: Dell has a lot of debt coming due in the 2020s. Image Source: Dell – 10-Q SEC filing cover the first quarter fiscal 2021

Dell’s management team has been actively managing the firm’s maturity schedule and had this to say regarding Dell’s liquidity position and near-term financing outlook during the company’s latest quarterly conference call:

“Our [Dell’s] liquidity position is strong with excess cash on the balance sheet and $5.5 billion of undrawn revolver capacity after repaying a partial draw in [fiscal] Q1. We are comfortable with our capital structure, including our ability to support DFS growth. We have worked to smooth out our debt maturity towers with only $600 million due this June [in calendar year 2020], plus approximately $200 million of debt amortization for the year. As I reflect on current results and future opportunities, I'm reminded that we are a different company than we were just three years ago and most certainly different than we were in any of the prior economic slowdowns.” --- CFO of Dell

Concluding Thoughts

We think it is unlikely that Dell would want to spin off its large equity stake in VMware without raising a meaningful amount of cash in the process. Dell’s total debt load is enormous, even when factoring out debt that is non-recourse to the company (specifically DFS-related debt). Having to deal with that burden without the benefit of VMware would likely put Dell in a financially precarious position.

As it relates to a potential arbitrage opportunity, Dell’s near- and medium-term financial trajectory may get hampered by COVID-19 and using the firm’s fiscal 2020 free cash flows in a perpetuity calculation may be overly generous. Dell’s consolidated GAAP revenues in the first quarter of fiscal 2021 were flat on a year-over-year basis, though its ‘Products’ segment’s net revenues were down 3% during this period. We need greater clarity on how Dell might proceed with its VMware equity stake it terms of its broader strategic goals.

-----

Broad Line Semiconductor Industry – AMD AVGO FSLR INTC TXN

Computer Hardware Industry – AAPL BB HPQ IBM TDC

Communications Equipment Industry – CSCO JNPR KN NOK SMCI

Integrated Circuits Industry – ADI MCHP MRVL NVDA SWKS TSM XLNX

Semiconductor Equipment Industry – AMAT CREE IPGP KLAC LRCX MKSI SNPS TER

Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM

Related: DELL, SCWX, SPY, VMW

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO), Intel Corporation (INTC), and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Oracle Corporation is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Both the simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios include a SPDR S&P 500 ETF Trust (SPY) put option holding with a $295 per share strike price that expire on August 21, 2020. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment