Stocks Surge: Strong S&P 500 Earnings Growth Expected, Headline Scares With Inflation Tamed, Interest Rates Still Low

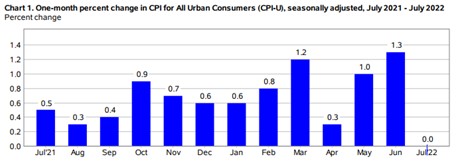

Image Source: BLS. The pace of inflation looks like it may slow down considerably in 2023 as sequential monthly increases pause their advance.

The Consumer Price Index (CPI-U), seasonally adjusted, paused its advance during the month of July, and the markets have generally reacted positively to the news. We’re reiterating our view that inflation is not necessarily bad for the markets over the long haul, and while it may take some time for companies to sort out higher prices across their input bases, inflation is not a new challenge for the markets at all, and the best way for investors to combat inflationary tendencies, by and large, is via stocks, which generate nominal earnings, whose equity prices are quoted nominally, and whose values are based on nominal future expected free cash flows.

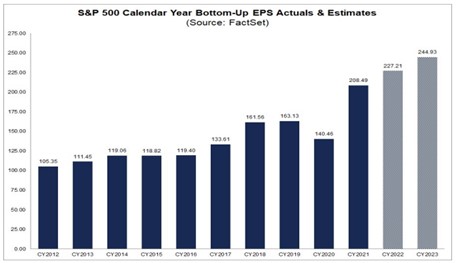

When this year started, we pointed to the strong net-cash-rich balance sheets of the largest companies, their tremendous future expected free cash flow capacity, and a benign 10-year Treasury rate, which at the time was trading in the mid-1% range, as reasons to be bullish (and we viewed companies seeking to raise their prices as another bullish sign). We had thought pricing power would flow straight to the bottom line (earnings) at some of the largest companies, but we’ve seen modest demand destruction and some earnings pressure, but our optimism endures. S&P 500 calendar year bottom-up EPS is targeted to advance nicely in the coming years, and while there are many skeptics to the pace of future earnings expansion, we think consensus earnings growth or thereabouts is largely achievable.

Image Source: FactSet. S&P 500 earnings are set to advance considerably in the next couple years.

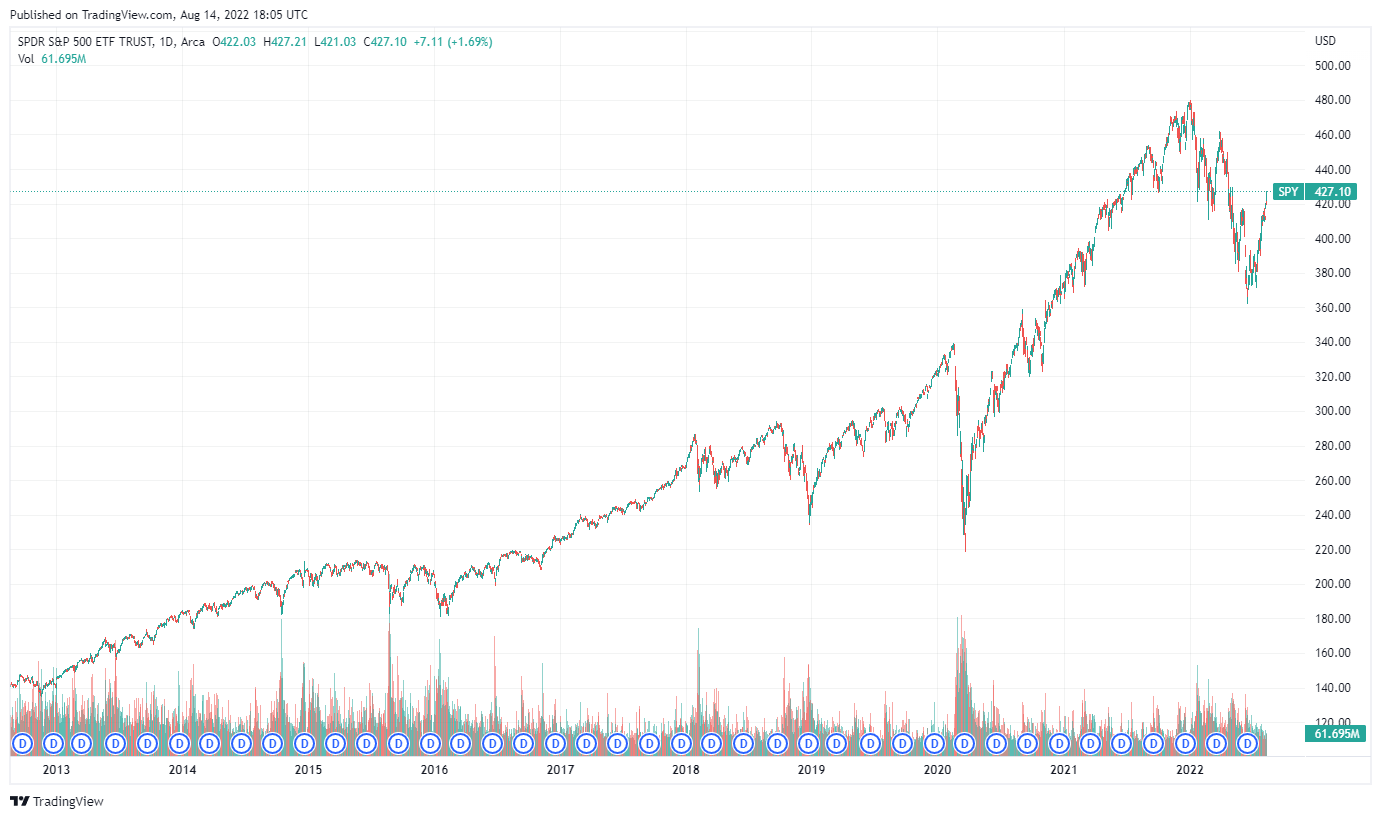

The S&P 500 (SPY), as measured by the SPY, is down just 10% year-to-date and less than 4% during the past 52 weeks, both measures on a price-only basis. The volatility that the markets have experienced through the course of 2022, from our perspective, should have largely been expected given that the index has advanced more than 70% during the past five years -- a huge rally. We think it's fair to say that based on the proliferation of price-agnostic trading (e.g. meme stocks, quant and index trading, and the like), investors should brace for even more volatility in the coming years; we’ve done our best to get our members ahead of this trend (read Value Trap). That said, however, we maintain our positive take on stocks for the long haul.

Some members may say that we missed this pullback in the markets so far in 2022, but we think it’s fair to set some expectations. For starters, this is not the Great Financial Crisis (GFC) or the COVID-19 meltdown. In situations when we’re asking the question whether the financial system will sustain itself as in the GFC or whether humanity may face a global killer as in the coronavirus, it’s certainly reasonable to consider laying on lots of (put) protection and seek to raise some cash. In the case of 2022, however, it was just different. 2021 had been a fantastic year, almost across the board, and the modest rise in the 10-year Treasury and temporarily elevated levels of inflation (which actually started in early 2021) weren’t going to let us cause panic across our followers and membership base.

What we’re saying is that we didn’t miss this pullback. We continue to view it as a run-of-the-mill market sell-off -- and one that would have (and has had) a rebound that many would have missed almost entirely had we sounded a big alarm near the top. As investors can see, since the mid-June bottom, the markets have already rallied more than 20% off the lows. There is still a way to go for the markets to reclaim all-time highs on the indices, but what we’re trying to say is that there are some things to take action on -- the GFC or COVID-19, in particular -- and then there are normal goings-on in the market, where relative outperformance can be had rather than swing trading and scaring people out of long-term investing. My guess is that there are a lot of people that sold out 20% ago due to inflation concerns that are now thinking about getting back in just shy of all-time highs.

The NASDAQ has reclaimed 13,000, and this index, along with large cap growth, has revealed to be as levered to a recovering stock market as any. Many disruptive innovation stocks have been punished over the past 18 months and investors might still steer clear of these stocks, but this group has never been our favorite. We’ve become a broken record when we say that our favorite ideas are always in the diversified newsletter portfolios -- emphasis on diversified. We like anywhere between 15-20 securities in a portfolio, and that should be viewed as concentrated. Anything less than that is taking on far too much risk for our taste. We’re as disappointed and surprised by the stock price and fundamental performance of Meta (META) and PayPal (PYPL) as any investor, but these are peculiar times, and when we see the next resurgence in economic activity, we think the leaders heading into this pull back will be the leaders once again. In the next bull market: Yes, to big cap tech and large cap growth, and no to energy, financials and small cap "value."

You may agree that some of the research we see out there almost looks like it is written by investors that sold out or rather were wiped out at the bottom of the Great Financial Crisis and will never ever be bullish again. They seem scarred. Other research seems to be written by doomsayers that may have sold at the top before the COVID-19 meltdown, but never returned and are just sitting on the sidelines hoping to get another chance to get back in. It remains to be seen whether stocks will ever re-visit those generational lows again, but we highly, highly doubt it. Government officials have shown time and time again that they will step in when the going gets tough, and yes, we still think the Fed has your back.

Now, that doesn’t mean stocks will go up on every tick or the Fed won’t raise rates or shrink its balance sheet, but it does mean that we think the Fed (and Treasury and sometimes the White House) will continue to act as a key player leading to the success of long-term investors. Today, the Fed has already created some wiggle room for further stimulus by raising rates more aggressively than expected this year as it builds up optionality for the next crisis, the timing of which is truly the only uncertainty. The markets will eventually have another crisis, but we think we’ll be looking back to today thanking our lucky stars that the Fed is doing what it is doing now by raising rates to build a safety net for the next downturn--all the while the SPY is only down ~10% year-to-date.

Image Source: TradingView. With all the panic research out there, you’d think the market has been cut in half. The SPY is down just ~10% so far in 2022.

Everybody seems to be looking to compare this stock market to another market sometime in the past, but regardless of which market analog you read about, there is one thing that every market pullback, crises, or calamity has had in common: The markets eventually returned to all-time highs. That’s what we’re betting on. Some say we could see new highs in the markets by the end of the year, but for us, we’re okay if it takes some time longer than that. The higher nominal input prices that everyone is talking about today will eventually act as a launchpad for nominal earnings and nominal equity prices in the future, pushing stocks ever higher, in our view. What more can we say, we continue to like stocks for the long haul!

----------

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

0 Comments Posted Leave a comment