Steel Dynamics Bets Big on North America’s Industrial Economy

Image Source: Steel Dynamics Inc – June 2020 IR Presentation

By Callum Turcan

Investor sentiment towards the steel industry is rebounding as the medium- and long-term outlook for global industrial activity has improved markedly since March 2020. The ongoing coronavirus (‘COVID-19’) pandemic has significantly hampered near-term industrial activity, though major fiscal stimulus packages (made feasible through major monetary stimulus programs) launched in various developed nations could provide some relief.

Shares of Steel Dynamics Inc (STLD) have recovered meaningfully since their March 2020 lows and are trading a tad below our fair value estimate as of this writing. Shares of STLD yield ~3.6% on an annualized forward-looking basis as of this writing and we give the steel maker a Dividend Cushion ratio of 1.3x providing for a “GOOD” Dividend Safety rating. The company has made great strides in improving its financial position over the past several years. We will first provide some background on the fiscal stimulus measures that have either been approved and or proposed in key economies across the world, before digging deeper into Steel Dynamics.

Fiscal Stimulus Efforts

The European Union is moving forward with an approximately USD$0.8 trillion fiscal stimulus package that if approved, would significantly improve the outlook for Southern European economies which have been decimated by COVID-19 (due largely to the region’s reliance on tourism). Germany enacted an approximately USD$0.8 trillion fiscal stimulus package in March 2020 which was followed up by another fiscal stimulus measure worth roughly USD$0.15 trillion in early-2020. China pushed forward a meaningful fiscal stimulus package worth approximately USD$0.5 trillion which includes utilizing local government funding to invest in new infrastructure projects. Japan has embarked on an approximately USD$1.1 trillion fiscal stimulus program to shore up its economy.

In the US, several major fiscal stimulus packages have been approved this year including the ~$2.2 trillion Coronavirus Aid, Relief, and Economic Security Act (‘CARES Act’) in March which was followed up by an additional ~$0.5 trillion in emergency funding, namely for the Payroll Protection Program (‘PPP’) and to bolster the healthcare industry (additional money for hospitals and COVID-19 testing). Multiple healthcare-oriented packages were passed into law before the CARES Act, bringing total fiscal relief and stimulus spending relating to the pandemic in the US up to almost $3.0 trillion. There has also been talk about a potential US infrastructure stimulus program that could be worth $1.0 trillion - $1.5 trillion, though when that funding is spent and whether a bipartisan agreement could be reached is far from certain (as is the ultimate size of the potential program).

Federal governments around the world are leaning heavily on both fiscal and monetary stimulus programs to offset the devasting impact COVID-19 has had (and continues to have) on global economies. We caution that the risk of a second wave of COVID-19 infections remains very real for all nations.

With all of that in mind, the medium-term economic outlook for the global economy is much brighter than it was just a few months ago. There are an enormous amount of potential COVID-19 treatments and vaccines currently under development and undergoing human clinical trials. Should any of those prove successful (especially a vaccine), the positive benefits from households all over the world being able to safety go back to “normal activities” combined with major fiscal stimulus measures should provide a powerful uplift to global economic growth.

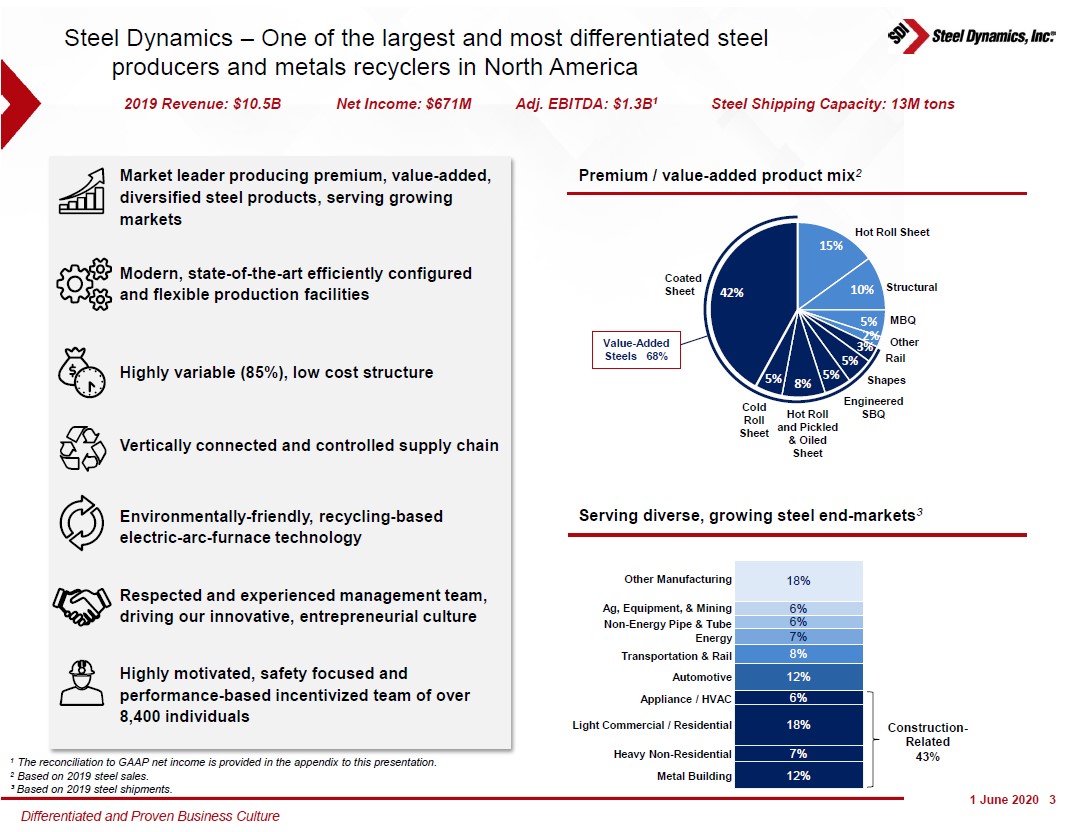

Steel Dynamics

Based in Fort Wayne, Indiana, Steel Dynamics operates several steel mills in the US and a large scrap metals recycling and processing business after acquiring OmniSource in 2007. The company bills itself as “one of the largest domestic steel producers and metal recyclers in the United States, based on current estimated steelmaking and coating capacity of approximately 13 million tons and actual metals recycling volumes, with one of the most diversified, high-margin steel product portfolios.” Over two-fifths of Steel Dynamics’ 2019 revenues came from customers in constructed-related end markets, as you can see in the upcoming graphic down below.

Image Shown: For a steel maker, we like Steel Dynamics’ operational flexibility which we will cover in just a moment, though the company remains heavily dependent on the strength of its key end-markets. The slowdown in the global industrial economy is something Steel Dynamics cannot readily mitigate. Image Source: Steel Dynamics – June 2020 IR Presentation

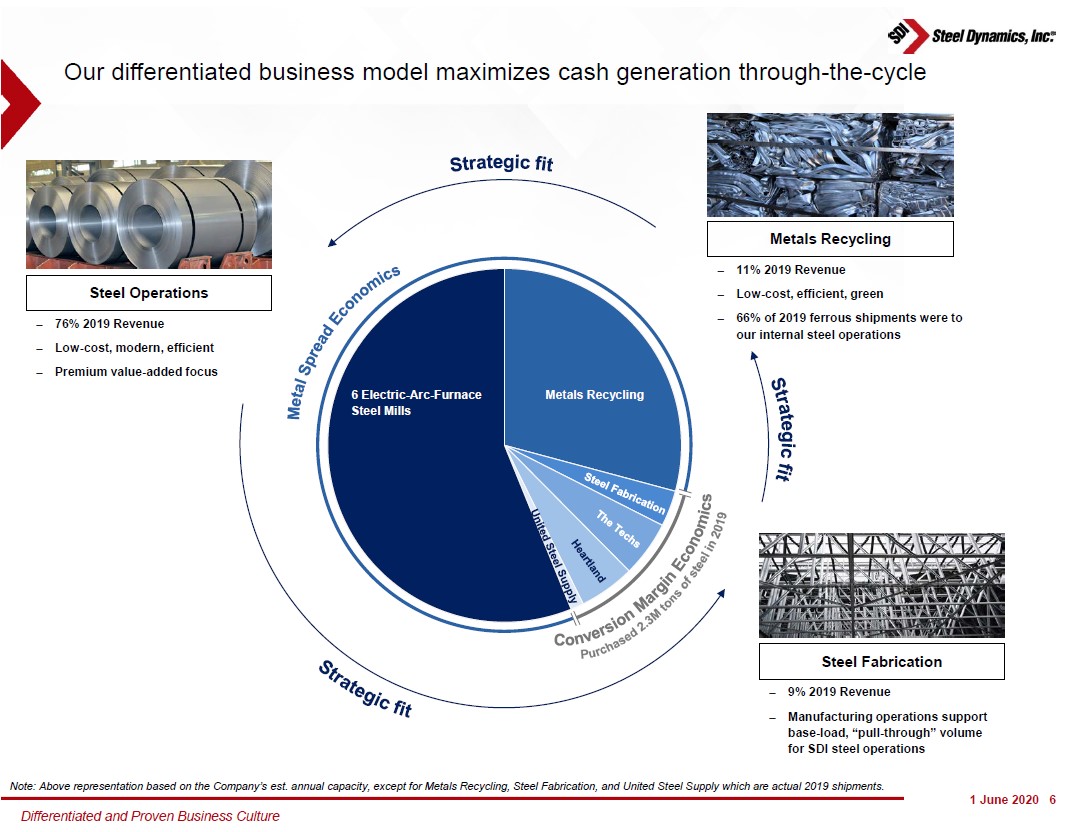

In 2019, about three-quarters of Steel Dynamics’ revenue came from its ‘Steel Operations’ as you can see in the upcoming graphic down below. Electric arc furnaces (‘EAFs’) can produce steel from scrap metal and pig iron is often used as well during this process. As compared to blast furnaces, EAFs are considered far more flexible on an operational level and less energy intensive, allowing for a better cost structure compared to steel makers that operate blast furnaces. While blast furnaces need to be run near-constantly, EAFs can ramp up or down to meet fluctuating demand for steel products, which is especially useful during volatile times such as these. Steel Dynamics operates several steel producing EAFs, providing it greater operational flexibility compared to some of its peers than run several blast furnaces, like United States Steel Corporation (X).

Image Shown: Steel Dynamics is a major steel producer in the US and operates six EAFs. Image Source: Steel Dynamics – June 2020 IR Presentation

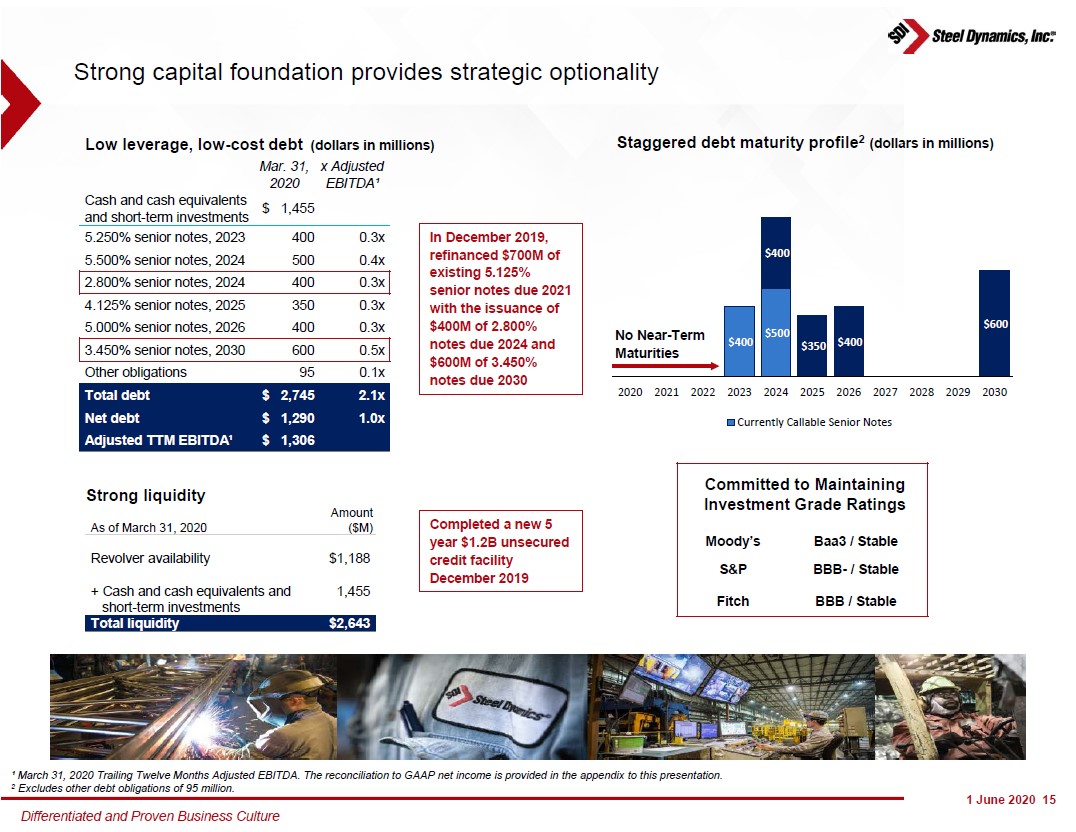

Steel Dynamics exited March 2020 with $1.5 billion in cash, cash equivalents, and short-term investments stacked up against $0.1 billion in short-term debt and $2.6 billion in long-term debt. Given the staggered nature of Steel Dynamics’ debt maturity schedule after the firm completed key refinancing activities in December 2019, as you can see in the upcoming graphic down below, we see the firm being well-positioned to ride out the storm created by the pandemic. Steel Dynamics continued to optimize its debt burden through refinancing activities completed in June 2020 by redeeming $0.4 billion in senior notes due 2024 and $0.5 billion in senior notes due 2024 with senior notes due in 2025 and 2031. The coupon on the newly issued debt was significantly lower than the coupon on the debt that was retired.

Image Shown: Steel Dynamics is supported by its strong liquidity position and investment grade credit ratings (BBB-/Baa3/BBB-). Image Source: Steel Dynamics – June 2020 IR Presentation

From 2017 to 2019, Steel Dynamics generated $0.9 billion in free cash flow on average per year while spending $0.2 billion per year covering its dividend obligations and another $0.4 billion per year covering its share repurchases on average. During the pandemic, the company has so far continued to declare its $0.25 per share quarterly dividend (which was raised in the first quarter of 2020 by a penny per share versus the fourth quarter of 2019 payout).

Steel Dynamics’ board of directors authorized an additional $0.5 billion in share repurchase authority in February 2020. However, management indicated during the firm’s latest quarterly conference call that the company was waiting for additional clarity on the trajectory of the global economy before making any big decisions on that front:

“The reason the Board authorized an additional $500 million in February of this year is simply because we think share repurchases during periods of excess cash flow is an important tool to have and so we wanted to have that tool, because we actually only had I think about $40 million to $50 million left on a previous program.” --- Theresa Wagler, CFO of Steel Dynamics

Management provided some guidance regarding Steel Dynamics’ capital expenditure expectations (most of which are going towards building a new steel plant, which we will cover in just a moment) over the next two years during the firm’s latest quarterly conference call:

“For the remainder of the year, we currently are planning the capital investments to be roughly $1.2 billion of which the new Sinton, Texas Steel Mill represents $1 billion. This spending percent is heavily weighted to the second half of 2020 over $700 million of that $1 billion spend is actually meant to be in the second half of this year.

As we gain more visibility and see extent of the disruption in 2020 related to the Corona virus, we could shift some of the 2020 investment into 2021 if we believed it was necessary. Based on current timeline, we estimate capital investments for 2021 to be in the range of $700 million to $750 million of which Sinton represents $600 million.

We entered the [COVID-19] crisis in a position of strength with a strong cash position and liquidity profile. Entering 2020 we had over $1.6 billion of cash in short-term investments. At the end of the first quarter, we have almost $1.5 billion. Combined with a $1.2 billion undrawn unsecured revolving credit facility. We have available liquidity of over $2.6 billion.” --- CFO of Steel Dynamics

Please note Steel Dynamics’ $1.2 billion revolving credit line matures in December 2024 and there were no outstanding borrowings against the facility as of the end of the first quarter of this year (a marginal amount of letters of credit had been posted against the facility as of the end of this period).

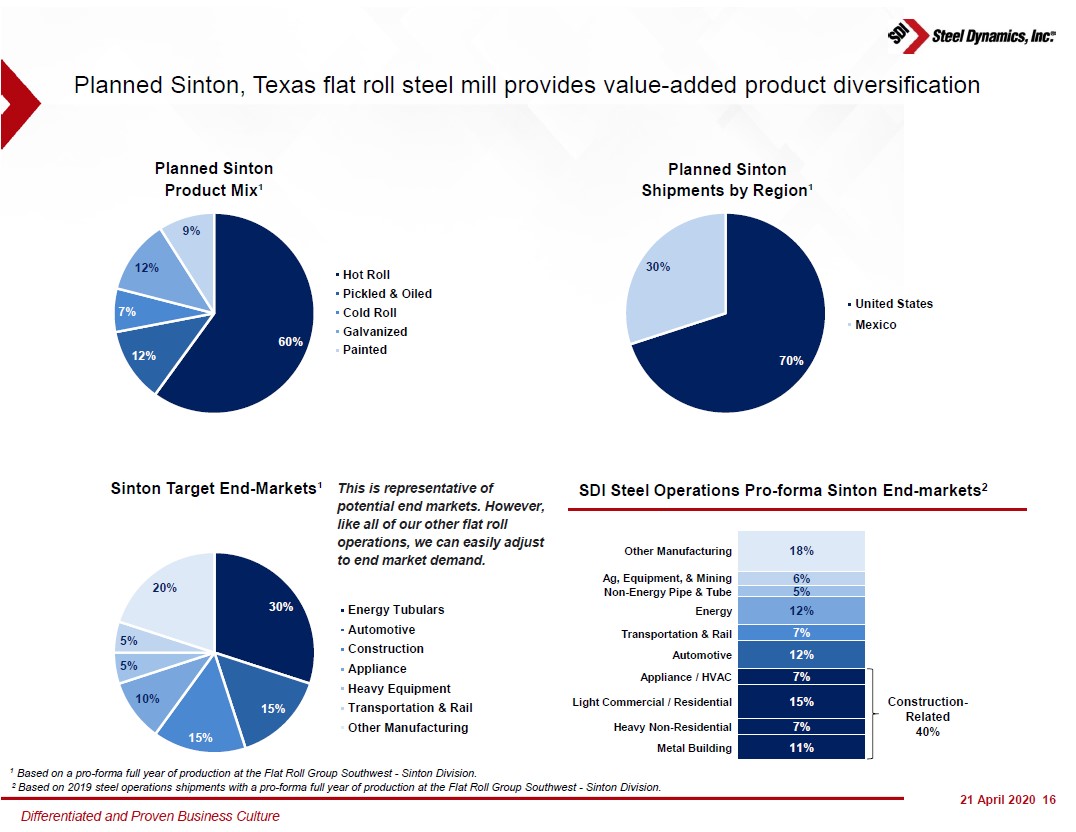

Building a New Steel Mill

Steel Dynamics is building a new ~$1.9 billion electronic arc furnace flat roll steel mill in Sinton, Texas, which is located near the port of Corpus Christi along the US Gulf Coast. By mid-2021, the flat roll steel mill is expected to be operational, and development activities are already underway after the project was announced back in 2019. While the pandemic likely caused minor delays, it appears the project is still on-track to start commercial operations next year. Steel Dynamics plans on constructing a galvanizing line at the steel mill with 550,000 short tons per year in production capacity, along with a paint line that has a coating capacity of 250,000 short tons per year to produce high-strength steel grades (a short ton means the US measure of a ton, as compared to a metric ton or tonnes).

Please note that part of the reasoning behind the facility is to meet demands of the domestic energy sector (with an eye towards the oil & gas extraction and refining industry), as a lot of energy-specific steel products used in the US are imported from overseas manufacturers. Being able to produce high-strength steel grades will enable Steel Dynamics to provide tubular steel products that meet industry requirements.

While low raw energy resource prices are putting a lot of pressure on the energy sector right now, the new steel mill won’t be operational until at least the middle of 2021 (as currently envisioned) or later (if the pandemic or other factors delay construction activities). A combination of a recovering energy sector and the advantages of being located domestically could see Steel Dynamics take market share from overseas competitors, including shipments to Houston (which was brought up by management during the firm’s latest quarterly conference call).

Tariffs are a key factor here, especially after President Trump and his administration imposed meaningful tariffs on steel imports back in 2018 (as an aside, please note many administrations in the past have imposed tariffs on steel and steel product imports). The current administration’s protectionist trade policy recently secured a legal victory when the US Supreme Court decided not to hear a case brought forth by steel importers which argued the tariffs were unconstitutional. For reference, the recent tariffs were enacted under powers provided to the president through the 1962 Trade Expansion Act (specifically Section 232 that allows for the chief executive to limit/prevent imports of goods into the US for national security reasons).

Steel Dynamics’ management team sees the proximity of the future steel mill to key customers resulting in material costs saving versus its competitors by reducing freight expenses. The proposed steel mill will have on-site access to two Class I railroads and transloading options provides access to a third Class I railroad network. Additionally, the future steel mill will have access to the deepwater port of Corpus Christi and major highway systems. Pig iron supplies can be sourced from overseas producers (made possible through the deepwater port) or from suppliers with nearby operations. The Austrian firm Voestalpine AG (VLPNY) operates a high-quality hot briquetted iron plant in Corpus Christi.

The Sinton site has additional space that could allow for customers to set up their own facilities on-site. During Steel Dynamics’ latest quarterly conference call, the company noted that one customer had committed to locate on-site and another was close to making a commitment. If both customers were to locate on-site, that could represent 800,000 tons in annual steel consumption capacity which would provide a steady source of demand for the future steel mill.

To support operations at the new steel mill, Steel Dynamics intends on acquiring “100% of the equity interest of Zimmer, S.A. de C.V.” which is a scrap metal company headquartered in Monterrey, Mexico, through an all-cash deal. Zimmer’s operations include six scrap processing facilities that source supplies from Northern and Central Mexico. Additionally, Zimmer also operates third-party scrap metal processing facilities. Combined, these facilities have the processing capacity to handle up to 2,000,000 gross tons annually. Financial terms of the deal were not disclosed in the press release.

Steel Dynamics was still waiting for regulatory approval from the Mexican government back in April 2020 and noted it would take at least a couple of months before the deal would close. Management had this to say on the potential deal during Steel Dynamics’ latest quarterly conference call:

“From a raw material perspective, our metals recycling operations already control significant and growing scrap volume in Mexico through scrap management agreements, much of which is prime. As I mentioned in March, we are also planning to acquire a Mexican scrap company as part of our raw material strategy for Sinton.

Their primary operations are strategically located near high volume industrial scrap sources through Central and Northern Mexico. The company currently ships approximately 500,000 gross tons of scrap annually, but as an estimated annual processing capability of about two million tons. After closing, we plan to ramp up volume fairly quickly. We are currently waiting for Mexican regulatory approval, as well as other closing requirements that are expected to close in the coming months.” --- Mark Millett, CEO of Steel Dynamics

After scanning through Steel Dynamics’ latest SEC filings and press releases, it appears the deal has not closed yet given the apparent lack of new publicly available information on the subject. It is possible the pandemic will lead to the closing of the deal getting delayed, but that should not negatively impact Steel Dynamics’ growth ambitions in a meaningful way.

Looking Towards Domestic and Foreign Markets

Steel Dynamics has identified three major regional markets it intends on targeting with the new steel mill including the US West Coast and Southern US regions along with Mexico. Combined, those three markets are expected to have ~27 million tons in annual flat rolled steel demand according to third-party data cited by Steel Dynamics (though that data was apparently from around 2017). The company is targeting customers in the automotive and construction industries along with the energy sector, among others. As you can see in the upcoming graphic down below, ~70% of the steel mill’s production is expected to go to domestic customers and the remainder is expected to be exported to markets in Mexico.

Image Shown: Steel Dynamics intends to export a portion of the production from the Sinton steel mill under development in Texas to Mexican markets. Domestically, the firm is targeting a wide range of customers with an eye towards the energy sector and the automobile and construction industries. Image Source: Steel Dynamics – First Quarter 2020 Earnings IR Presentation

Mexico’s demand for flat rolled steel has grown significantly over the past decade, though the slowdown in the global economy due to the pandemic has significantly altered the landscape for the world’s industrial sector. That being said, Mexico’s economy should bounce back on the strength of the US economy and a potential recovery in the energy sector.

Concluding Thoughts

Having a lot of cash on hand better positioned Steel Dynamics to ride out the storm while keeping its dividend policy and growth ambition strategy intact. Steel Dynamics possess the financial strength to complete its new steel mill in Sinton, Texas, though we caution that the firm will likely need to scale back its share repurchase program to maintain its strong liquidity position going forward given the headwinds created by the ongoing pandemic. Though the steel industry will face very significant hurdles in the short-term, Steel Dynamics’ operational flexibility (a product of the steel maker operating electric arc furnaces instead of blast furnaces) gives it a leg up over its less flexible peers. Steel Dynamics’ guidance for the second quarter of 2020 indicates that the firm expects to remain profitable in the short-term.

-----

Auto Making Industry – F GM HMC HOG TM TSLA

Auto Parts Supplier Industry – ALSN APTV JCI LEA MGA

Building Materials Industry – CSL LPX MLM MAS MHK OSB OC VMC

Distributors Industry – AXE AIT FAST MSM GWW WCC

Diversified Mining Industry – BHP FCX NEM RIO SCCO VALE WPM

Energy Equipment & Services (Large) Industry – BKR HAL NBR NOV SLB FTI SI

Independent Oil & Gas Industry – APA COG CLR DVN EOG MRO OXY PXD

Industrial Minerals - ARLP, CCJ, CNX, HCR, NRP

Oil & Gas (Majors Industry) – BP CVX COP XOM RDS.A RDS.B TOT

Oil & Gas Pipeline Industry – ENB ET EPD KMI MMP

Refining Industry – HES HFC MPC PSX VLO

Steel Industry – [AKS was acquired by CLF] MT GGB NUE PKX STLD X

Related – CLF, IYM, JJU, FOIL, SLX, XME, CNHI, MZDAY, NKLA, NSANY, SPCE, VLKAF, VLKPF, VWAGY, RS, CMC, AAUKF, FSUMF

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Kinder Morgan Inc (KMI) and Newmont Corporation (NEM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. BP plc (BP), Enterprise Products Partners L.P. (EPD), Magellan Midstream Partners L.P. (MMP), and the ProShares Short High Yield ETF (SJB) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Both the simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios include a SPDR S&P 500 ETF Trust (SPY) put option holding with a $295 per share strike price that expire on August 21, 2020. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment