Shares of Newsletter Portfolio Idea Johnson & Johnson Off to the Races!

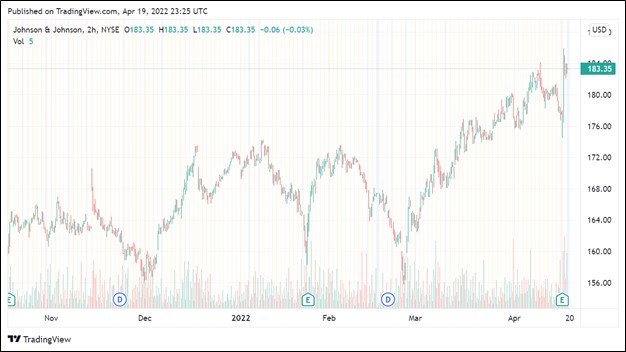

Image Shown: Shares of Johnson & Johnson, an idea in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios, are shifting higher.

By Callum Turcan

On April 19, Johnson & Johnson (JNJ) reported first-quarter earnings for 2022 that missed consensus top-line estimates but beat consensus bottom-line estimates. The company lowered its guidance for 2022, but shares of JNJ rallied during regular trading hours that day as its underlying performance remains strong. J&J suspended guidance for its coronavirus ('COVID-19') vaccine sales, though we want to stress that these sales were not needle-moving as it concerns our estimate of the company’s fair value. The firm was selling the vaccines on a not-for-profit basis and didn’t intend to change that until the end of this year or until 2023 (or potentially never).

J&J also pushed through a 7% sequential increase in its dividend on April 19, with 2022 marking its 60th consecutive year of payout increases, earning the firm the coveted Dividend Aristocrat status. We include shares of JNJ in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Shares of JNJ yield ~2.5% as of this writing.

Johnson & Johnson’s business model is in the process of getting fundamentally altered due to the planned separation of its consumer health business from its pharmaceutical and medical devices operations, which is expected to occur within less than two years. As we have noted in the past, J&J is also steadily working on putting its various legal issues behind it, though its planned business separation along with its legal issues fundamentally altered its proposition as a straightforward dividend growth opportunity.

We continue to like J&J in our newsletter portfolios, though we are keeping a close eye on how its business separation strategy will ultimately pan out.

Earnings Update

In the first quarter of 2022, J&J generated $23.4 billion in GAAP revenues (up 5% year-over-year) due to strength at its ‘Pharmaceutical’ and ‘MedTech’ (previously referred to as ‘Medical Devices’) business segments offsetting weakness at its ‘Consumer Health’ segment. On a non-GAAP adjusted operational sales basis, each segment reported year-over-year revenue growth as foreign currency headwinds were quite material last quarter across all of its business segments (which its adjusted operational sales metric strips out).

Last quarter, its Consumer Health unit benefited from strong sales of its over-the-counter (‘OTC’) products such as TYLENOL and MORTIN analgesics, IMODIUM digestive health products, and upper respiratory products. However, sales of this segment’s health and beauty products were negatively impacted by supply constraints.

At its Pharmaceutical unit, sales growth last quarter was driven by DARZALEX (oncology therapeutic), STELARA (treats plaque psoriasis and psoriatic arthritis), TREMFYA (treats plaque psoriasis), ERLEADA (oncology therapeutic), INVEGA SUSTENNA/XEPLION (treats schizophrenia), and INVEGA TRINZA/TREVICTA (treats schizophrenia and schizoaffective disorders) offerings. Sales of its COVID-19 vaccine also supported its revenue performance last quarter.

Pivoting to its MedTech unit, sales growth was supported by the recovery in elective surgeries after these activities were subdued during the worst of the COVID-19 pandemic. J&J noted that its electrophysiology products, contact lenses and surgical vision products, wound closure products, biosurgery products, and hips, trauma, and knees products sold well last quarter. Going forward, the ongoing recovery in elective surgeries and bigger picture, the eventual normalization of health care activities should continue supporting the financial performance of this unit.

The company’s GAAP gross margin shifted lower by ~80 basis points year-over-year to 67.6% in the first quarter of 2022 as supply chain hurdles and inflationary pressures took their toll. J&J stepped up its marketing spend and recorded a sizable ‘in-process research and development’ expense item that weighed on its bottom-line, with its GAAP diluted EPS declining by 17% year-over-year to reach $1.93 last quarter. With that in mind, J&J still was able to outperform expectations as it concerns its bottom-line performance. Its non-GAAP adjusted diluted EPS rose by 3% year-over-year last quarter to reach $2.67.

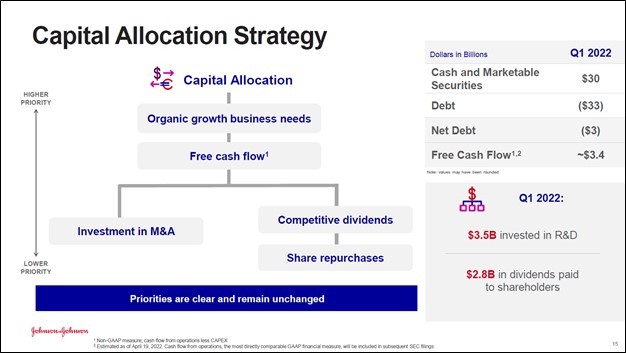

While J&J did not provide a balance sheet or cash flow statement alongside its latest earnings report (and has yet to file the relevant 10-Q SEC filing as of this writing), the company did provide a snapshot of its free cash flow and balance sheet health within its latest earnings presentation. The firm noted that its free cash flows fully covered its dividend obligations last quarter with room to spare, and that its net debt load was relatively modest for a company of its size as one can see in the upcoming graphic down below.

Image Shown: J&J is a solid free cash flow generator with ample liquidity on hand and a relatively low net debt load for a firm of its size. Image Source: J&J – First Quarter of 2022 IR Earnings Presentation

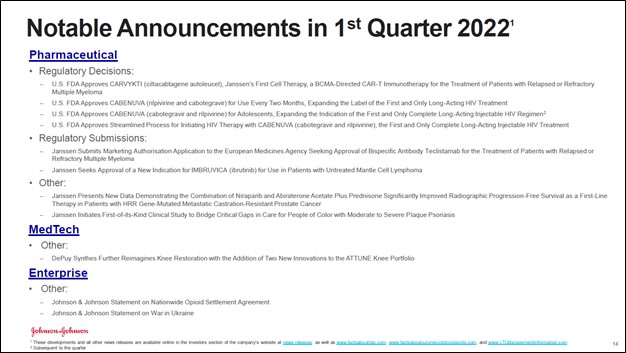

J&J continues to invest in innovation as it spent heavily on R&D activities last quarter, which we are supportive of given the successes its pharmaceutical and medical devices operations have had. For instance, its MedTech unit recently launched new orthopedics products in the realm of trauma, knees, sports, spine, and digital solutions. At its Pharmaceutical unit, J&J recently launched its INVEGA HAFYERA therapeutic that treats schizophrenia that further strengthened its portfolio in the realm of neuroscience.

To accomplish these victories and others, J&J needs to invest in R&D. Last quarter, R&D expenses represented ~15% of its revenues and its in-process research and development expenses represent an additional ~3% of its revenues during this period. In the upcoming graphic down below, J&J highlights its other achievements in the first quarter of 2022.

Image Shown: We appreciate J&J’s focus on innovation and how that is supporting its efforts to launch new products and services, which underpins its bright growth outlook. Image Source: J&J – First Quarter of 2022 IR Earnings Presentation

Overall, we were impressed with J&J’s performance last quarter as the company is adeptly navigating the volatile macro environment. During the firm’s latest earnings call, management noted that J&J was turning to “cost improvement initiatives, strategic price increases and contract negotiations with external supply partners” to offset inflationary pressures as labor, energy, and transportation costs are all on the rise and that dynamic is not expected to abate anytime soon.

Guidance Update

As noted previously, J&J lowered its guidance for 2022 in conjunction with its latest earnings update and withdrew guidance related to its COVID-19 vaccine sales. Here is what management had to say on that issue during J&J’s latest earnings call (emphasis added):

“Moving to full year 2022 guidance and key considerations. I'll start with comments on our COVID-19 vaccine and foreign exchange impacts, essentially the only items with updates from our January guidance. As market demand for all COVID-19 vaccines is currently challenged by global supply surplus and vaccine hesitancy in developing markets, we have made the decision to suspend guidance for sales of our COVID-19 vaccine.

This will enable investors to focus on the performance of our core businesses, which drive the current and future value for investors. We are maintaining the total adjusted operational earnings per share guidance we provided in January, absorbing, if need be, the modest income impact from the COVID-19 vaccine.” --- Joe Wolk, EVP and CFO of J&J

We appreciate J&J’s efforts to develop a COVID-19 vaccine and want to stress that the company was not attempting to make a meaningful amount of profit from the development. Even when the vaccine shifts from a not-for-profit to a for-profit model, if that is the case, it will still not be needle-moving for J&J in the long haul.

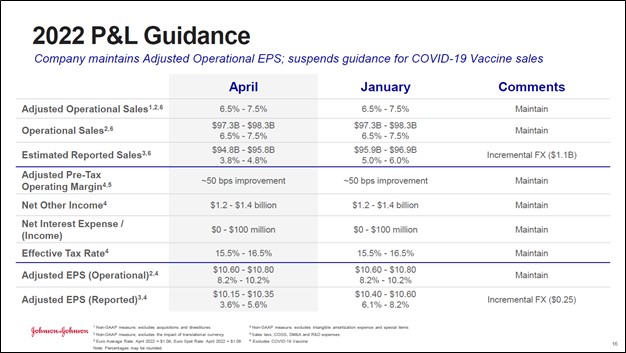

In the upcoming graphic down below, J&J highlights its updated forecasts for 2022, and we want to stress that its adjusted operational sales, adjusted pre-tax operating margin, and adjusted operational EPS (all non-GAAP figures according to the footnotes) guidance for 2022 remains the same as the forecast put out in January 2022. What changed was its estimated reported sales and adjusted reported EPS (also non-GAAP figures according to the footnotes) due to foreign currency headwinds. Underlying demand for J&J’s offerings remains strong, and its business is expected to continue rebounding nicely in 2022.

Image Shown: Underlying demand for J&J’s offerings remains strong though foreign currency headwinds are creating some “noise” around its financial performance. Image Source: J&J – First Quarter of 2022 IR Earnings Presentation

The company expects supply chain constraints facing its Consumer Health segment will remain throughout 2022; however, those pressures should ease up starting in the second half of this year particularly for its skin health and beauty products according to J&J. Additionally, this segment should post stronger second-half performance as compared to its expected first half performance.

Recent launches of new products and services along with the continuation of the recovery in the medical devices industry is expected to support the future performance of its MedTech segment, though J&J is monitoring the pandemic closely and will adjust as needed. Pivoting to its Pharmaceutical segment, J&J expects it will post above-market growth (on an adjusted operational sales basis) this year with consistent performance throughout 2022. We appreciate J&J’s bright outlook.

Concluding Thoughts

J&J runs a solid business that continues to put up strong results in the face of major exogenous shocks. When investors realized that its latest guidance update was not nearly as poor as some initial headwinds suggested and that J&J has a plan in place to keep growing the business, shares of JNJ shot up during regular trading hours on April 19. The company remains incredibly committed to its income-seeking shareholders and its new CEO, Joaquin Duato, is doing a wonderful job so far.

Our fair value estimate for J&J sits at $160 per share and the top end of our fair value estimate range sits at $192 per share. In light of its strong performance and the planned separation of its consumer health business from its pharmaceutical and medical devices operations, readers should expect myriad changes to our valuation model covering J&J in the coming quarters. The stock remains a key idea in the simulated Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio.

Johnson & Johnson's 16-page Stock Report (pdf) >>

Johnson & Johnson's Dividend Report (pdf) >>

-----

Health Care Bellwethers Industry – JNJ, WBA, CVS, ISRG, MDT, ZBH, BAX, BDX, BSX, MTD, SYK, BIIB, GILD, ABT, ABBV, LLY, AMGN, BMY, MRK, PFE, VRTX, ZTS, REGN, UNH

Related: VDC, XLV

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares in DIS, FB, GOOG, VRTX, and XLE and is long call options on DIS and FB. Johnson & Johnson (JNJ) and Health Care Select Sector SDPR Fund (XLV) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Vertex Pharmaceuticals Inc (VRTX) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. UnitedHealth Group Inc (UNH) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Vanguard Consumer Staples ETF (VDC) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

1 Comments Posted Leave a comment