Schlumberger and Liberty Oilfield Services Make a Deal

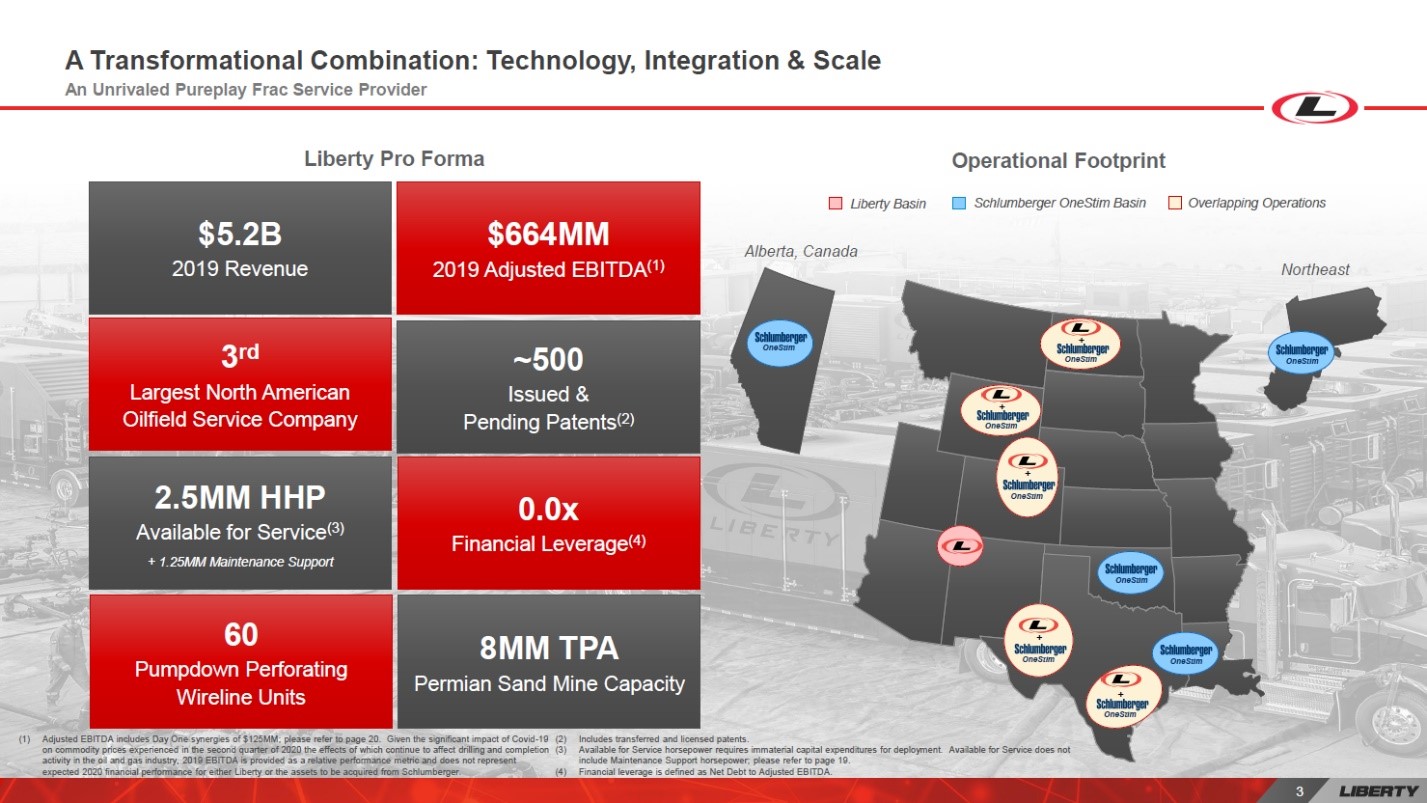

Image Shown: Schlumberger NV is combining its OneStim business with Liberty Oilfield Services Inc. The picture above is an overview of the combined company on a pro forma basis. Image Source: Liberty Oilfield Services Inc – Schlumberger to Contribute OneStim to Liberty IR Presentation

By Callum Turcan

On September 1, Schlumberger NV (SLB) and Liberty Oilfield Services Inc (LBRT) announced that Schlumberger would combine its onshore hydraulic fracturing business in the US and Canada, OneStim, with Liberty Oilfield Services. That includes Schlumberger’s pressure pumping and pumpdown perforating businesses in the relevant regions, and its frac sand business in the Permian Basin (West Texas and Southeastern New Mexico).

In return, Schlumberger is getting a 37% equity stake in Liberty Oilfield Services (on a pro forma basis) which primarily offers pressure pumping and other oilfield services to upstream companies operating in onshore US markets. The day the news broke, shares of LBRT were up 36% during normal trading hours while shares of SLB were down 1%, as investors clearly saw Liberty Oilfield Services as the big winner from this industry consolidation.

Overview

For reference, these are businesses in the oilfield services industry that support completion activities (the “fracking” of horizontal wells) in the unconventional raw energy resources extraction space in North America. Companies that extract raw energy resources are operating in what is known as the upstream industry, which includes both conventional and unconventional operations (unconventional refers to fracking operations and conventional refers to non-fracking operations, generally speaking).

As raw energy resources prices tumbled this year due to the ongoing coronavirus (‘COVID-19’) pandemic, upstream-related drilling and completion activity declined precipitously, especially in the US and Canada. The pain the oilfield services industry is facing can trace its roots back to 2015, when the upstream industry started to aggressively press for lower rates from oilfield services providers while scaling back development activity as the upstream industry responded to the collapse in oil prices that started in late-2014. Natural gas prices in the US and Canada had already crashed due to the rise of fracking earlier on in the 2010s decade and remain very subdued to this day.

To win over business from the upstream industry (which was contending with low raw energy resources prices across the board), the oilfield services industry had to offer reduced rates just to stay afloat. We want to emphasize here that oilfield services companies have been contending with reduced pricing and lower utilization rates at the same time over the past several years (and to this day).

In our view, Schlumberger wants out of the pressure pumping space. Though Schlumberger will retain a sizable equity stake in Liberty Oilfield Services, we would not be surprised to see the firm sell that down over time. Schlumberger is conducting a massive restructuring of its business and has cut ~21,000 jobs as part of this process. International and offshore upstream activities are now Schlumberger’s main focus, though the firm is also seeking upside by expanding its digital offerings. Longer term, Schlumberger wants to shift towards an asset-light business model, one built on licensing out its technology and patents.

Schlumberger purchased Weatherford International Plc’s (WFTLF) US pressure pumping business back in late-2017 for $430 million in cash to combine it with its own. Schlumberger appears to be taking a hefty loss on that acquisition as the deal did not pan out as expected. At the time, Schlumberger aimed to build up a pressure pumping business with enough scale to compete with Halliburton Company (HAL) in North America. As an aside, Weatherford International filed for Chapter 11 in 2019 as the pressures facing the oilfield services industry combined with its large debt load proved to be untenable.

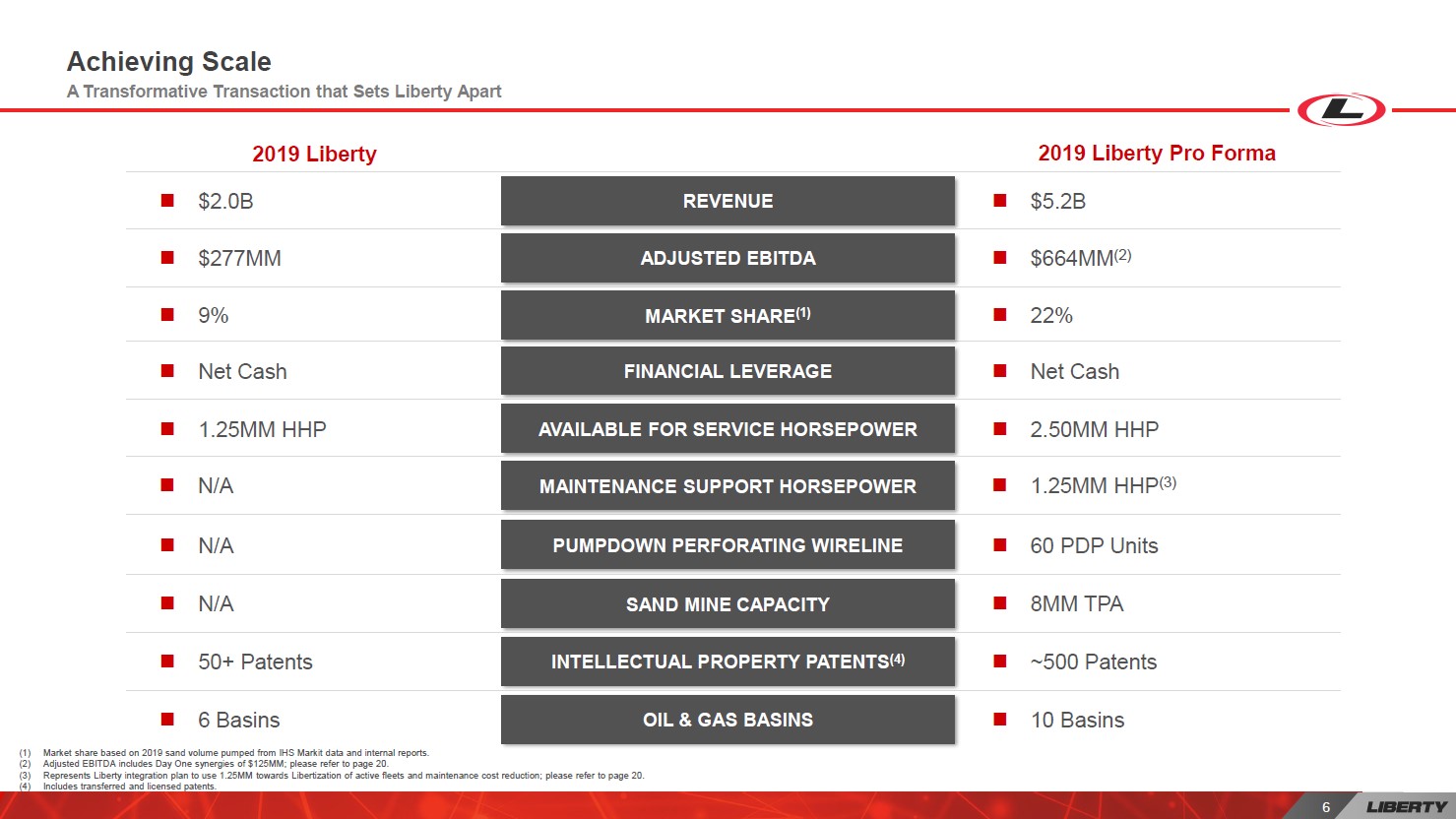

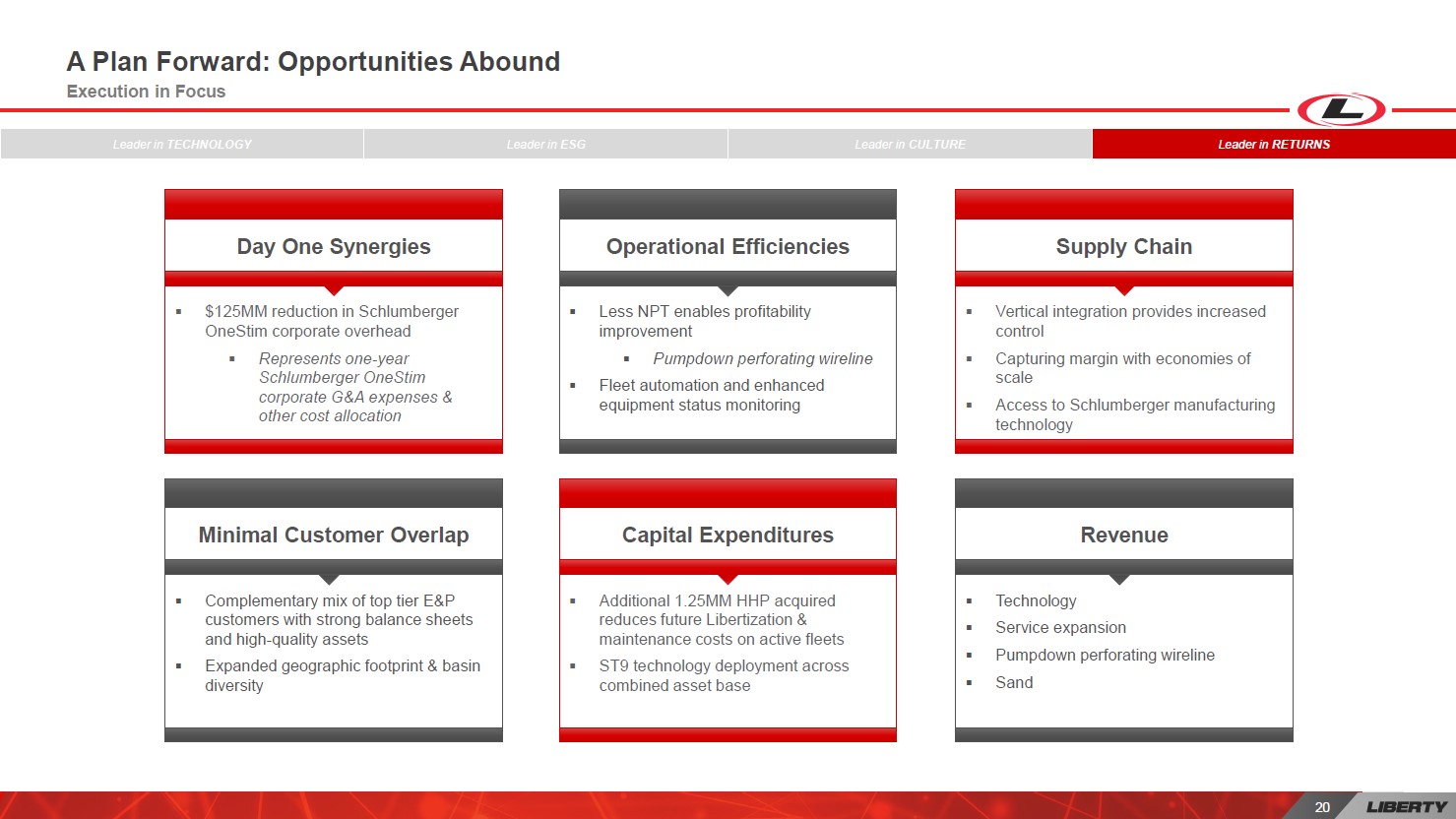

The deal with Liberty Oilfield Services is expected to close by the fourth quarter of 2020 and is forecasted to generate $125 million in synergies right off the bat. However, we caution that those synergies are based off of “one year [of Schlumberger’s] OneStim corporate G&A expenses & other cost allocation[s]” meaning it is not clear if those costs will simply stay with Schlumberger, though it is likely the firm will continue cutting costs going forward. On the plus side, the pro forma company is expected to have a net cash position and significantly more market share as you can see in the upcoming graphic down below.

Image Shown: We appreciate that the new Liberty Oilfield Services will have a net cash position and greater economies of scale. Image Source: Liberty Oilfield Services – Schlumberger to Contribute OneStim to Liberty IR Presentation

The duo sees the combination reducing the capital intensity of the pro forma company by allowing it to spend less on maintenance as you can see in the upcoming graphic down below.

Image Shown: An overview of the various synergies the combined company is forecasted to generate and how Liberty Oilfield Services plans to proceed going forward when the deal closes. Image Source: Liberty Oilfield Services – Schlumberger to Contribute OneStim to Liberty IR Presentation

Concluding Thoughts

Previous downturns in raw energy resources prices (particularly the downturn from late-2014 to 2017) and the negative effect that had on upstream development activity devasted the financial position of companies operating in the oilfield services industry heading into the pandemic. Lower pricing (to retain business) and lackluster utilization rates (as the total addressable market shrank faster than industry-wide reductions in capacity) are nearly impossible to circumnavigate. Schlumberger wanted out of the pressure pumping space in the US and Canada, and though this is an all-equity deal, it sets the stage for an eventual exit.

-----

Oil & Gas (Majors Industry) – BP CVX COP XOM RDS.A RDS.B TOT

Independent Oil & Gas Industry – APA COG CLR DVN EOG MRO OXY PXD

Industrial Minerals - ARLP, CCJ, CNX, HCR, NRP

Refining Industry – HES HFC MPC PSX VLO

Oil & Gas Pipeline Industry – ENB ET EPD KMI MMP

Energy Equipment & Services (Large) Industry – BKR HAL NBR NOV SLB FTI SI

Related: LBRT, XLE, XOP, BNO, USO, UNG, WTFLF

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Enterprise Products Partners L.P. (EPD) and Magellan Midstream Partners L.P. (MMP) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment