Santander Working Its Way Through the Pandemic

The underlying first-half results from Banco Santander are quite reasonable. We are impressed by how well the South American, Corporate & Investment Banking, and Wealth Management & Insurance segments are holding up in such a tough environment. In its large European operations, pressures that come from the whole continent being overbanked were evident, however.

By Matthew Warren

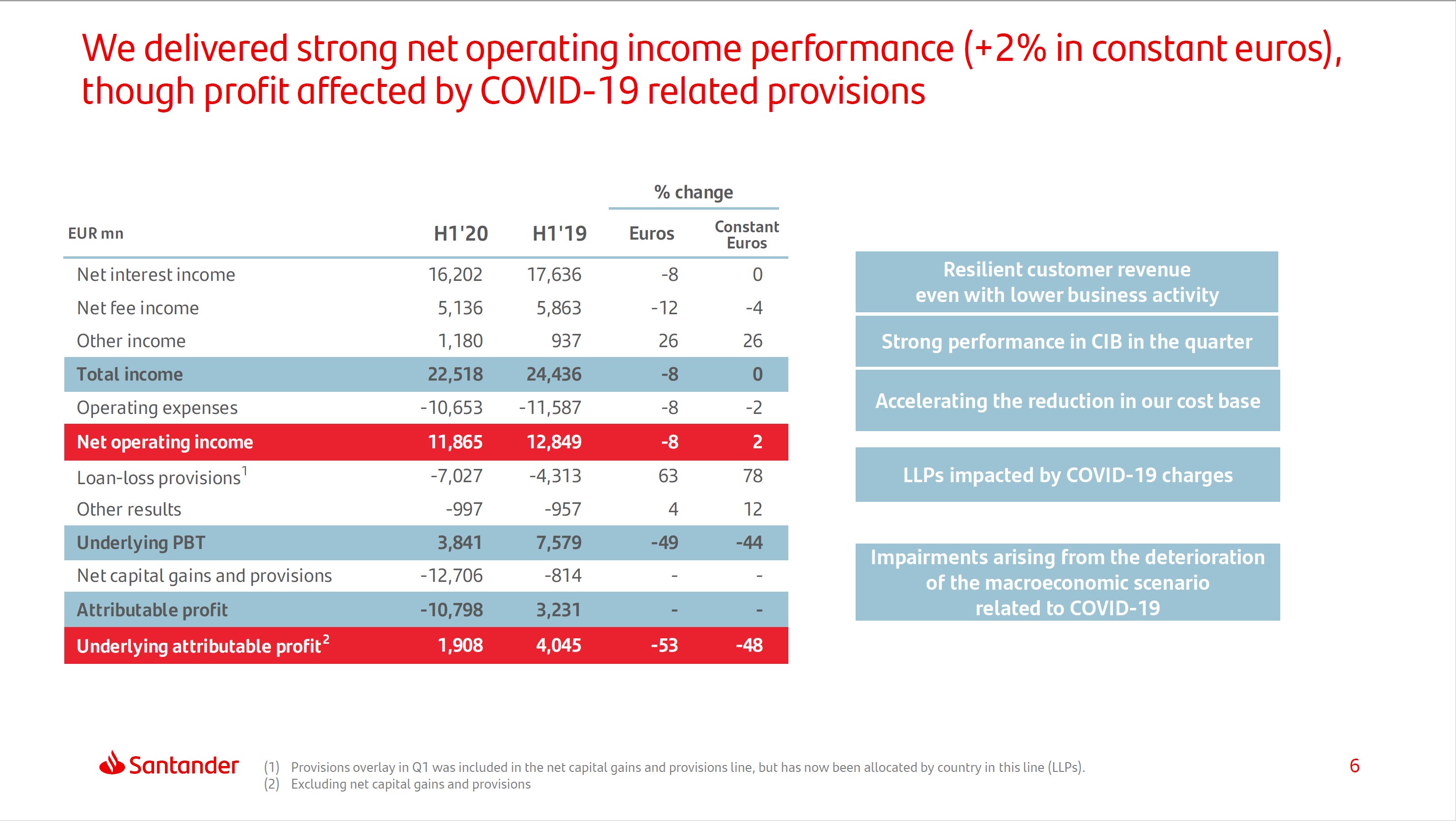

On July 29, Banco Santander (SAN) reported first-half 2020 results. The bank is working its way through the pandemic, with total income down 8% in the first half and underlying attributable profit down 53%. While it took massive goodwill write downs in the quarter, these do not affect its capital levels, which are healthy and growing since last quarter end. As one can see in the upcoming graphic down below, loan loss provisions are the foremost cause of decline in underlying profits.

Image Shown: Santander’s underlying attributable profit is down 53% in the first half of this year compared to last year. Image Source: Santander 2Q2020 Earnings Presentation

While loan loss provisions are up substantially, non-performing assets are more "flattish," as a significant amount of loans are facing moratoria at the moment. While the bank is trying to make prudent assumptions regarding the ultimate loss content in these loans, it will ultimately depend on how the macro economy shakes out--which of course depends on how the pandemic plays out in coming months and years.

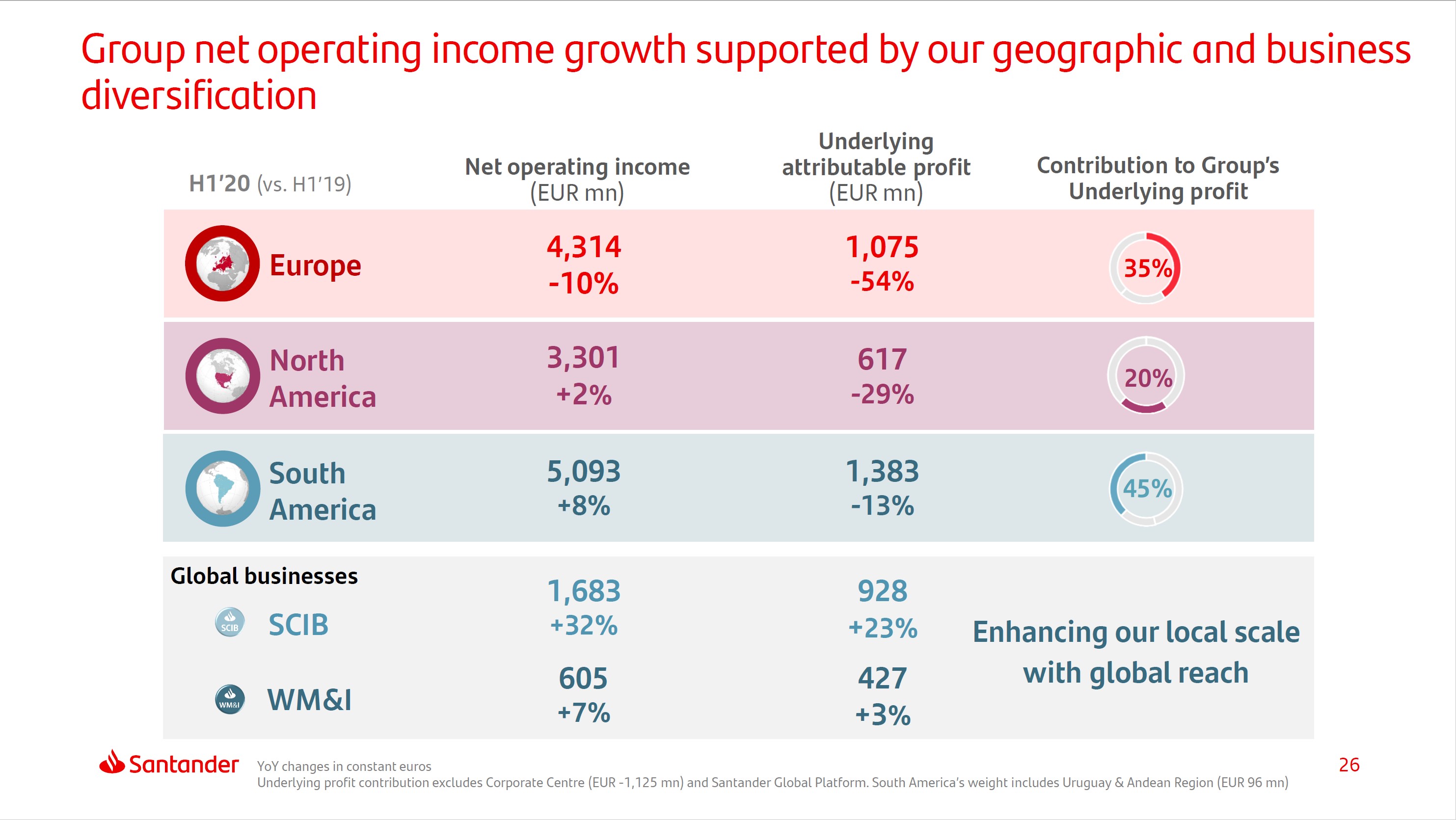

As we saw last quarter and again this quarter as one can see in the upcoming graphic down below, the bank’s South American operations continue to hold up better than many other geographies around the world. Santander’s position in Brazil is quite impressive indeed. Even though it is facing more stringent regulations regarding overdraft-type loans, the bank is still able to put up a 17% return on tangible common equity in the country.

Image Shown: Santander’s results were buoyed by South America, the Corporate & Investment Bank, and Wealth Management and Insurance units. Image Source: Santander 2Q2020 Earnings Presentation

All told, if one looks past the more than $10 Billion EUR goodwill write down in the quarter, the underlying results at Santander are quite reasonable indeed. We are impressed by how well the South American, Corporate & Investment Banking, and Wealth Management & Insurance segments are holding up in such a tough environment. In its large European operations, however, you can see the pressures that come from the whole continent being overbanked.

View our latest video on how banks/financials performed during the COVID-19 crisis here.

---

Related: BNPQF, IITOF, DB, ING, CRARF, SCGLF, BBVA, UNCFF, CRZBF, BCS, BKZHY, EUFN

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Matthew Warren does not own any of the securities mentioned. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment