Reiterating Our $229 Fair Value Estimate for Berkshire Hathaway

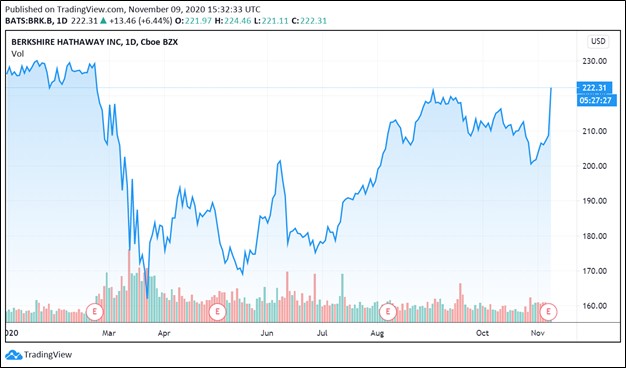

Image Shown: Shares of Berkshire Hathaway Inc Class B are moving on upwards.

Berkshire Hathaway Inc reported third quarter 2020 earnings this past Saturday, November 7. The insurance and industrial conglomerate reported that its GAAP income almost doubled year-over-year as its investment portfolio reported large gains. However, that masked pressures at some of Berkshire Hathaway’s myriad businesses as the company navigated the storm created by the ongoing coronavirus (‘COVID-19’) pandemic. Berkshire Hathaway continued to generate significant free cash flows during the first nine months of 2020, and we are reiterating our fair value estimate of $229 per share of Berkshire Hathaway Class B shares.

By Callum Turcan

On November 7, Berkshire Hathaway Inc (BRK.A) (BRK.B) reported third quarter earnings for 2020. Its GAAP diluted EPS came in at $12.66, up from $6.75 in the same period last year. Berkshire Hathaway has been steadily repurchasing its common stock, with its ‘average equivalent Class B shares outstanding’ falling by ~3% year-over-year in the third quarter. We appreciate that Berkshire Hathaway continued to be very free cash flow positive during the first nine months of 2020, and we continue to include shares of Berkshire Hathaway Class B in our Best Ideas Newsletter portfolio at a modest weighting.

Back on August 20, we reduced the weighting of Berkshire Hathaway Class B shares in our Best Ideas Newsletter portfolio (link here). Though we continue to be huge fans of Warren Buffett and his investing prowess, large-cap tech companies with pristine balance sheets, stellar cash flow profiles (low capital expenditure requirements to maintain a certain level of revenues), and promising growth outlooks underpinned by secular growth tailwinds are likely to continue outperforming going forward. We increased the weighting shares of Apple Inc (AAPL) and Microsoft Corporation (MSFT) have in our Best Ideas Newsletter portfolio on August 20 with the “proceeds” from the reduction in Berkshire Hathaway. Please note Berkshire Hathaway has an enormous equity stake in Apple, which was worth approximately $111.7 billion at the end of September 2020.

Quarterly Update

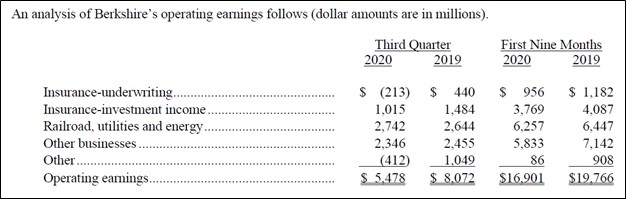

Due to its relatively large investment portfolio, Berkshire Hathaway’s ‘investment and derivate gains/losses’ line-item can have an outsized impact on its GAAP financials. For reference, this line-item was equal to about half of Berkshire Hathaway’s GAAP revenues during the third quarter of 2020 (keeping in mind that this line-item was not included in the firm’s ‘total revenues’ line-item). For that reason, Berkshire Hathaway also provides a breakdown of its operating incomes by business segment which can be viewed in the upcoming graphic down below. Natural disasters (wildfires in the West Coast region, hurricanes in the US Gulf Coast and Atlantic Coast regions) likely weighed on Berkshire Hathaway’s insurance business last quarter. However, its industrial businesses performed relatively well as its ‘railroad, utilities and energy’ segment reported year-over-year operating income growth last quarter.

Image Shown: Berkshire Hathaway’s insurance businesses faced significant headwinds last quarter, though its industrial businesses performed quite well as its ‘railroad, utilities, and energy’ segment reported year-over-year operating income growth. Image Source: Berkshire Hathaway – Third Quarter of 2020 Earnings Press Release

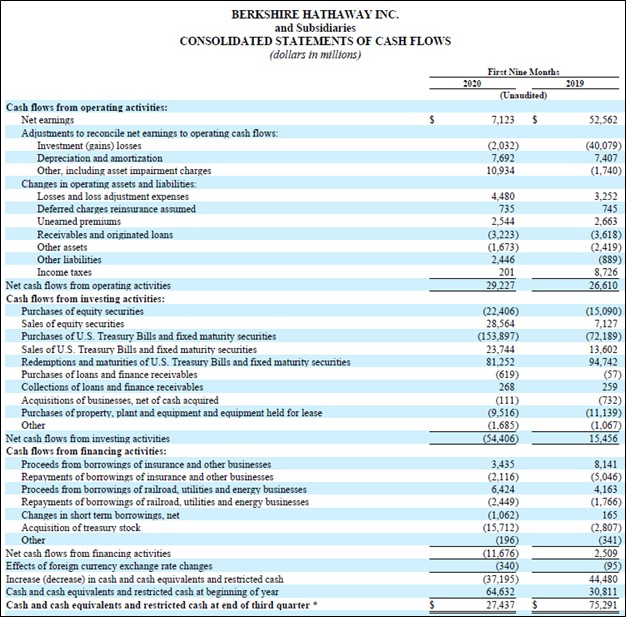

Looking at Berkshire Hathaway’s cash flow statement, the firm generated $19.7 billion in free cash flow during the first three quarters of 2020, up from $15.5 billion in the same period back in 2019. The company’s ability to generate significant free cash flows in any environment highlights one of the reasons why we like Berkshire Hathaway. During the first three quarters of 2020, Berkshire Hathaway spent $15.7 billion buying back its stock and we view these repurchases as a good use of capital given that shares of BRK.B have traded well below their intrinsic value for most of 2020, in our view.

Image Shown: Berkshire Hathaway’s free cash flow during the first nine months of 2020 grew meaningfully on a year-over-year basis. Image Source: Berkshire Hathaway – 10-Q SEC filing covering the third quarter of 2020

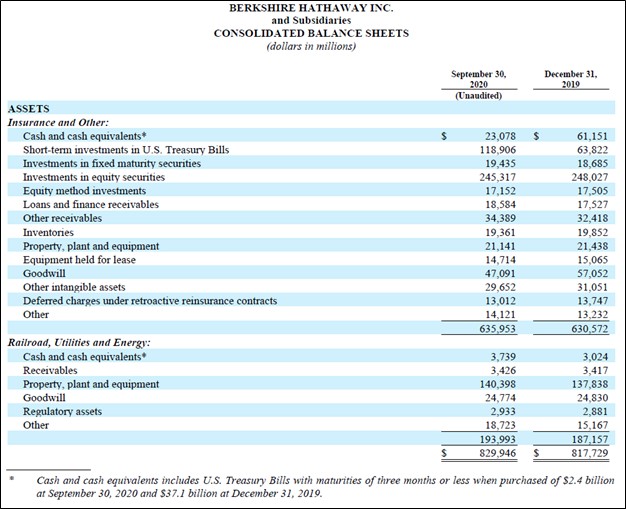

Pivoting now to Berkshire Hathaway’s balance sheet, the company continued to have a large portion of its investment portfolio effectively in cash seen through its large total cash, cash equivalents (includes US Treasuries with maturities of three months or less), and short-term US Treasuries holdings which can be viewed in the upcoming graphic down below. However, please note that after the third quarter ended, Berkshire Hathaway completed a large part of its acquisition of Dominion Energy Inc’s (D) natural gas transmission and storage assets (we covered that deal in detail here), though the agreement covering some pipeline assets will not be completed until early-2021 according to Berkshire Hathaway’s latest 10-Q SEC filing.

Image Shown: Berkshire Hathaway has recently put some of its enormous cash pile to use, though many investors are wondering when or if Mr. Buffett will make another large deal. Image Source: Berkshire Hathaway – 10-Q SEC filing covering the third quarter of 2020

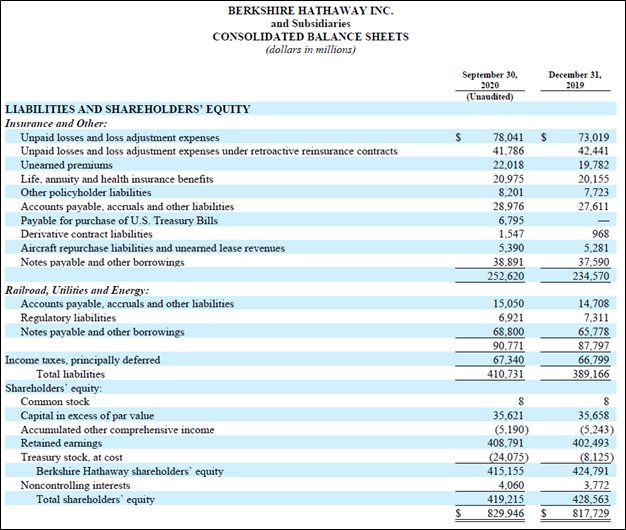

With that in mind, please note Berkshire Hathaway also has significant long-term liabilities relating to its insurance business, and on top of that, a sizable total debt load as you can see in the upcoming graphic down below. Berkshire Hathaway will still retain ample financial firepower after the deal with Dominion Energy closes, which in total had an enterprise value of ~$9.7 billion (including debt assumed). No material information on Berkshire Hathaway’s recent bet on several Japanese trading houses (we covered that deal in detail here) was made readily available, though those stakes were acquired before the end of the third quarter.

Image Shown: Berkshire Hathaway has meaningful long-term liabilities that investors should be aware of. Image Source: Berkshire Hathaway – 10-Q SEC filing covering the third quarter of 2020

Concluding Thoughts

As of this writing, Berkshire Hathaway is converging towards its fair value estimate. Please note that the top end of our fair value estimate range sits at $275 per share of BRK.B, indicating there could be room for significant capital appreciation upside. On a final note, markets rallied on November 9 after Pfizer Inc (PFE) and BioNTech SE (BNTX) reported that the interim results from their Phase 3 clinical trial had shown that their “[COVID-19] vaccine candidate was found to be more than 90% effective in preventing COVID-19 in participants without evidence of prior SARS-CoV-2 infection in the first interim efficacy analysis.” We are intrigued and encouraged by this news.

-----

Oil & Gas Pipeline Industry – ENB ET EPD KMI MMP

Utilities (Large) Industry - AEP, D, DUK, ED, EIK, ETR, EXC, FE, NEE, NGG, OKE, PCG, PPL, SO, XEL

Utilities (Mid/Small) Industry - AEE, ALE, BIP, CNP, CMS, DTE, ES, LNT, MGEE, NFG, NI, PEG, PNW, SCG, SJI, SR, SRE, WEC

Data Sheet on Stocks in the Insurance Industry

Related: AAPL, AMLP, AMZA, ITOCF, JETS, MARUF, MITSF, MSBHF, MSFT, SPY, SSUMY, VDC, XLF, XLU, EWJ, EWJV, EWJE, DXJ, PFE, BNTX, XLV

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Berkshire Hathaway Inc (BRK.A) (BRK.B) Class B shares are included in Valuentum’s simulated Best Ideas Newsletter portfolio. Apple Inc (AAPL), Microsoft Corporation (MSFT), and Health Care Select Sector SPDR Fund (XLV) are all included in Valuentum’s simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Enterprise Products Partners L.P. (EPD), Magellan Midstream Partners L.P. (MMP), Utilities Select Sector SPDR (XLU), and Vanguard Consumer Staples ETF (VDC) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment