PPL Corp Updates Investors, Launches Share Buyback Program

Image Source: PPL Corporation – Second Quarter of 2021 IR Earnings Presentation

By Callum Turcan

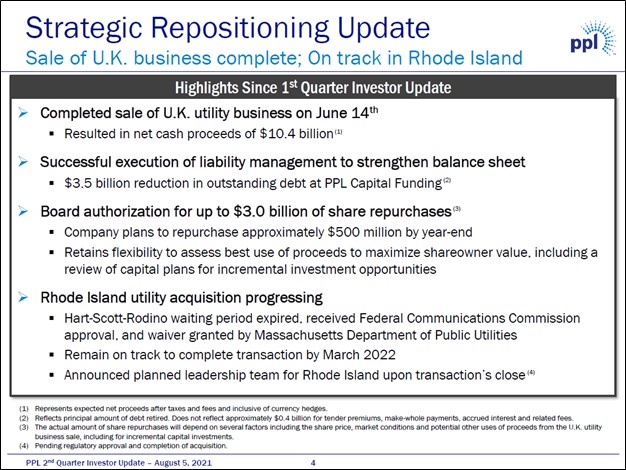

On August 5, PPL Corporation (PPL) posted second quarter 2021 earnings, and shares of PPL initially moved higher after the report. Though the gas and electric utility, which has a major regulated utility presence in Kentucky and Pennsylvania, missed both top- and bottom-line estimates, what investors were likely focused on most was the announcement that PPL Corp had approved a $3.0 billion share buyback program. The firm expects to spend $0.5 billion buying back its shares in 2021, and we view this as a solid use of PPL Corp’s capital given our fair value estimate sits at $45 per share of PPL, well above where the utility is trading at as of this writing.

Here, we must highlight that this buyback program is being funded from the approximately $10.4 billion in net cash proceeds (after taxes and fees) PPL Corp received when it exited the UK utility space, something we covered extensively in our May 2021 article Utility PPL Is Pursuing a Major Transformation and Has a VBI Rating of 9 (link here).

General Update and Debt Reduction

PPL Corp is also using some of the net cash proceeds to acquire Rhode Island’s main utility, The Narragansett Electric Company, through a deal with an equity value of $3.8 billion. During PPL Corp’s latest earnings update, management reiterated that the transaction was on track to close in March 2022. Currently, PPL Corp is waiting for approval from the US Federal Energy Regulatory Commission (‘FERC’) and the Rhode Island Division of Public Utilities and Carriers. The firm filed the relevant paperwork at both entities in May 2021.

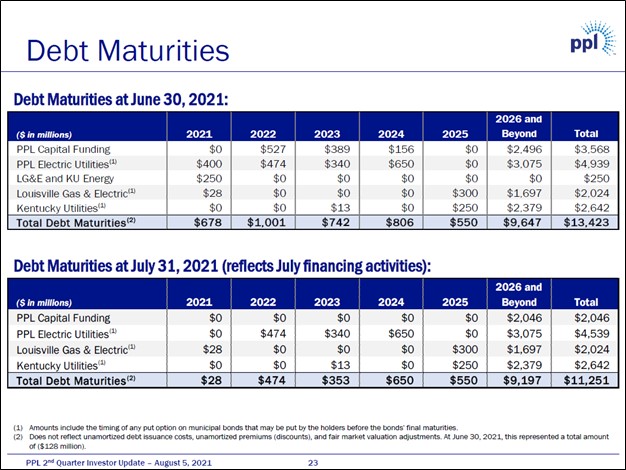

Recently, PPL Corp paid down $3.5 billion of its debt through various tender offerings that were concluded in July 2021 (some of these activities were completed in the second quarter and some in the third quarter of this year). We are pleased to see PPL Corp putting its net cash infusion to good use. In the upcoming graphic down below, PPL Corp highlights the well-staggered nature of its debt maturity schedule.

Image Shown: PPL Corp, on a pro forma basis when taking its recent debt tender offerings into account, has a relatively modest amount of debt coming due on an annual basis through 2025. We appreciate the well-staggered nature of its debt maturity schedule as that should go a long way in supporting its future refinancing activities. Image Source: PPL Corp – Second Quarter of 2021 IR Earnings Presentation

Green Energy Push, In Moderation

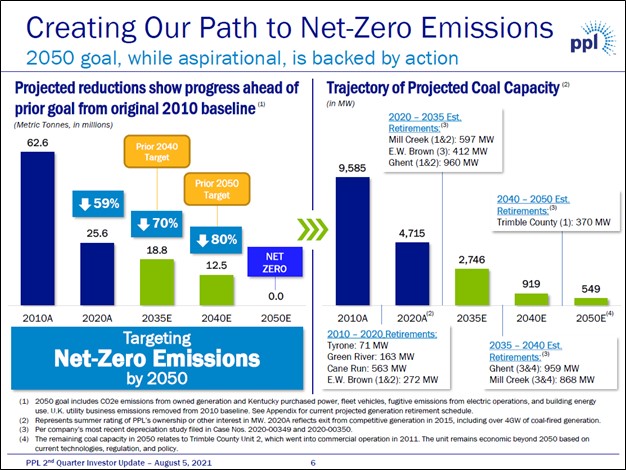

PPL Corp committed to achieving net-zero emissions by 2050 in conjunction with its latest earnings update, with a 70% reduction targeted by 2035 and an 80% reduction targeted by 2040 using 2010 levels as a baseline (excluding its former UK operations). This is important from an investing perspective in the sense that if PPL Corp gets the relevant regulatory bodies to sign off on its plan, the company’s growth runway will become much longer as it spends billions upon billions revamping its transmission, distribution, and power generation operations. During the utility’s latest earnings call, management noted that PPL Corp had withdrawn its rate base growth projections over the coming years due to its ongoing transformation, and that the firm would provide an update on that trajectory down the road.

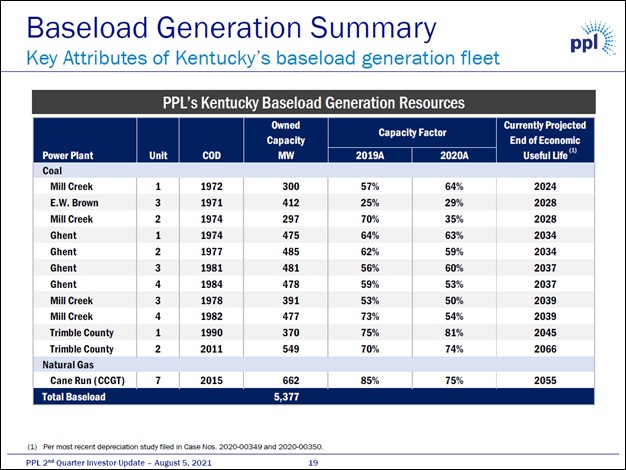

The company has a sizable coal-fired power generation fleet in Kentucky that is now quite old (save for its newer Trimble County Unit 2 operation), and older power plants are far less economical than newer operations all else being equal. PPL Corp plans to grow its natural gas-fired power generation capacity and renewable energy power generation capacity in the state going forward, aided by its major cash infusion and ability to tap capital markets at attractive rates. Please note growing regulatory headwinds, both realized and expected, are a key factor here.

Image Shown: Many of PPL Corp’s coal-fired power plants in Kentucky are quite old and have been operating at subdued capacity factors in recent years due primarily to rising competition from modern natural gas-fired power plants. Image Source: PPL Corp – Second Quarter of 2021 IR Earnings Presentation

Modern natural gas power plants (specifically, combined-cycle operations) are incredibly economical in the current environment as “fracking” activities have aggressively reduced domestic natural gas prices. Furthermore, these facilities are baseload generators, otherwise referred to as dispatchable energy sources (meaning power grid operators can request for additional power supply as needed).

Renewable energy operations, such as solar and wind, have become significantly more economical over the past decade though the intermittent nature of these power sources requires dispatchable energy sources to ensure the lights stay on around the clock. Battery storage aims to solve this problem, though these offerings are prohibitively expensive now, which could change over the coming years.

The upcoming graphic down below highlights how PPL Corp intends to change its power generation mix over the coming decades, though this only focuses on the power plant retirement side of the equation.

Image Shown: PPL Corp plans to steadily retire most of its coal-fired power plant fleet over the coming decades. Image Source: PPL Corp – Second Quarter of 2021 IR Earnings Presentation

Management had this to say on the issue during the company’s latest earnings call (lightly edited, emphasis added):

“We've outlined our updated path to net-zero carbon emissions on [the slide depicted in the above graphic on this article], along with our current expectations on coal fire generation capacity in Kentucky, which is consistent with the generation planning and analysis study included in our recently approved rate case filings. We'll need to advance technology to achieve net-zero emissions by 2050 as we balance the need for affordable, reliable, and sustainable energy for our customers.

Based on these current factors and consistent with our most recent rate case filings in Kentucky, we currently expect to achieve a reduction in our coal-fired capacity of 70% by 2035, 90% by 2040, and 95% by 2050 from our baseline in 2010.

We anticipate having about 550 megawatts of remaining coal-fired generation in 2050 due to our highly efficient and relatively new Trimble County Unit 2 that started commercial operation in 2011. Therefore, our objective is to continue to explore innovative ways through our R&D efforts to economically drive these reductions further, while supporting our customers and local communities. We have also assessed the implications of advancing these goals even further.

Our internal view of what it could take to achieve 100% carbon-free generation by 2035, as proposed by the Biden administration, using current technologies would create significant affordability issues for our customers.” --- Vincent Sorgi, President and CEO of PPL Corp

The company is attempting to find a middle ground between affordability and the environment. At the end of the day, the trajectory of subsidies and regulatory hurdles (or lack thereof) geared towards the power grid and power generation operations from the federal government are likely to play an outsized role here. We are keeping an eye on the situation.

In Pennsylvania, the firm owns the regulated PPL Electric utility which provides electric distribution and transmission services. Modernizing the power grid represents how PPL Corp can capitalize on green energy investments and potential subsidies in that market. PPL Corp’s pending acquisition of Rhode Island’s major regulated utility will create new growth opportunities in the realm of green energy investments as well.

Financial Firepower

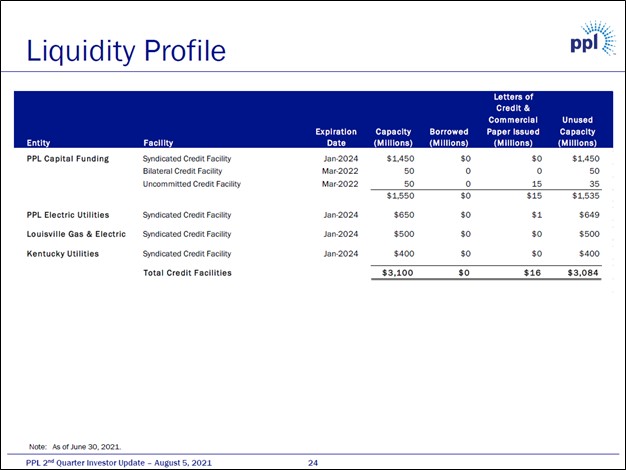

At the end of June 2021, PPL Corp had $7.6 billion in cash and cash equivalents on hand versus $2.2 billion in short-term debt and $11.1 billion in long-term debt, though please note this does not take all of its latest debt tendering activities into account (its total debt load dropped by $2.6 billion from the end of December 2020 to the end of June 2021). PPL Corp also had $3.1 billion in remaining borrowing capacity across its revolving credit lines at the end of June 2021 as you can see in the upcoming graphic down below, most of which do not mature until 2024. The utility has ample liquidity and access to liquidity on hand to fund its pending purchase of The Narragansett Electric Company and its planned share repurchases while still being able to invest in the business.

Image Shown: PPL Corp has ample access to liquidity via its numerous revolving credit lines. Image Source: PPL Corp – Second Quarter of 2021 IR Earnings Presentation

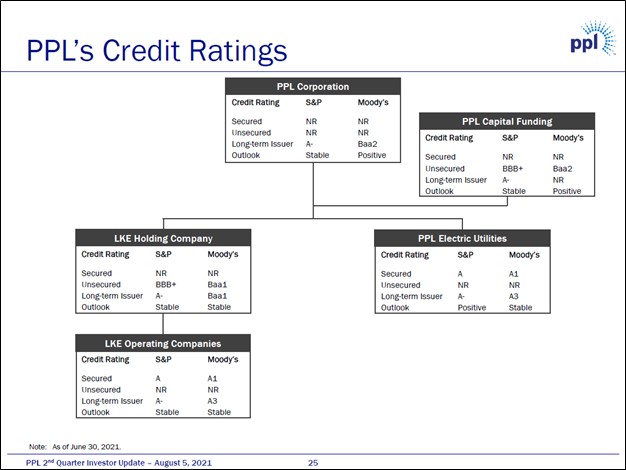

As it concerns access to capital markets, PPL Corp’s various financing entities and subsidiaries retained rock-solid investment grade credit ratings as you can see in the upcoming graphic down below. We expect PPL Corp to retain solid access to capital markets at attractive rates going forward.

Image Shown: PPL Corp and its affiliated entities had strong investment grade credit ratings as of the end of June 2021. Image Source: PPL Corp – Second Quarter of 2021 IR Earnings Presentation

PPL Corp is targeting a CFO to debt ratio of 16%-18%, a holding company to total debt ratio below 25%, and a debt-to-total capitalization ratio of 45%-55% going forward. During PPL Corp’s latest earnings call management noted that while the firm intended to wait until its pending Rhode Island utility acquisition closes before announcing its dividend adjustment, the firm would likely target a payout ratio in the 60%-65% range. Its dividend is expected to grow alongside its earnings once that adjustment takes place.

In our view, PPL Corp is communicating to investors that a right-sizing of the payout is likely due to the reduction in cash flows from its UK divestment combined with its growth ambitions and recent share buyback strategy. We expect PPL Corp’s dividend will remain competitive going forward. A payout ratio in the 60s% range is on the lower end of things compared to its peers, probably due to PPL Corp wanting to retain capital to aggressively grow its rate base and buy back its stock going forward.

Rate Base Increase

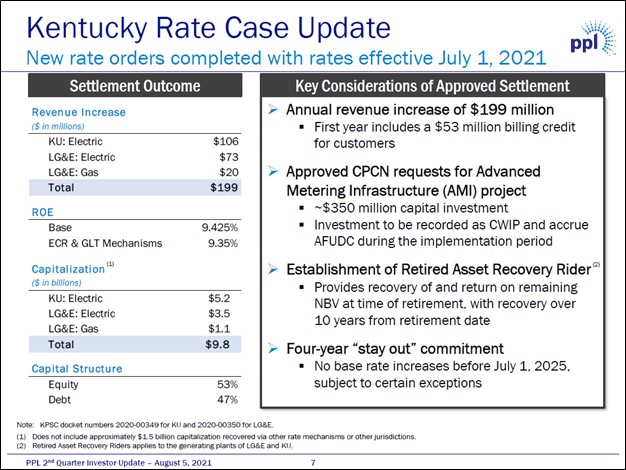

In April 2021, the Kentucky Public Service Commission (‘KPSC’) approved rate increases at PPL Corp’s two regulated utilities in Kentucky, Louisville Gas and Electric Company (‘LG&E’) and Kentucky Utilities Company (‘KU’), which went into effect July 1, 2021. Here is an overview of the rate increases from a related 8-K SEC filing:

The KPSC orders provide for increases in annual electricity revenues of $73 million and $106 million at LG&E and KU, respectively, and an increase in annual gas revenues of $20 million at LG&E. The orders include an authorized 9.425% return on equity in such base rate calculations and an authorized 9.35% return on equity for environmental compliance recovery and gas line tracker mechanisms. The orders approved annual revenue amounts that represent increases of approximately 6.4%, 6.5% and 5.7%, respectively, from LG&E and KU annual electricity revenues and LG&E annual gas revenues.

Additionally, this order involved a $53 million billing credit for customers of LG&E and KU (termed as “one-year billing adjustments”) to help its customers adjust to the new rates. This will be reflected in PPL Corp’s financial performance going forward. Beyond rate increases, this agreement will help PPL Corp roll out advanced metering infrastructure at KG&E and KU. During PPL Corp’s latest earnings call, management noted these advanced meters should result in meaningful operating and maintenance (‘O&M’) expense reductions and ultimately cost savings for its customers over the long haul.

Image Shown: An overview of PPL Corp’s recent rate increases at its regulated Kentucky utilities. Image Source: PPL Corp – Second Quarter of 2021 IR Earnings Presentation

Concluding Thoughts

PPL Corp earns a VBI rating of 9 and its outlook is quite bright. The company is trading well below its intrinsic value as of this writing, and in light of its share buyback program and technical strength of late, shares of PPL Corp may start to gain some real traction here.

Investors are waiting for its major Rhode Island utility acquisition to close, and everything is progressing in the right direction on that front. PPL Corp should benefit from a simplification of its business model now that it is a pure play on the US utility space. The company was able to further streamline its corporate structure by recently retiring the remaining debt at an intermediate holding company and subsequently deregistering that entity according to recent management commentary, offering incremental upside on this front which we appreciate.

PPL Corp appears to be positioning itself to take advantage of the potential for greater green energy subsidies from the US federal government while also attempting to get out of the way of growing regulatory hurdles as it concerns the domestic electric and gas utility space, in our view. That strategy makes perfect sense in the current environment. Shares of PPL yield ~5.8% as of this writing.

-----

Utilities (Mid/Small) Industry - AEE, ALE, CNP, CMS, DTE, ES, LNT, MGEE, NI, PEG, PNW, SCG, SJI, SR, SRE, WEC

Utilities (Large) Industry - AEP, D, DUK, ED, EIK, ETR, EXC, FE, NEE, NGG, PCG, PPL, SO, XEL

Related: XLU

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Utilities Select Sector SPDR ETF (XLU) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment