Philip Morris International Posts Solid Guidance, Cuts Costs

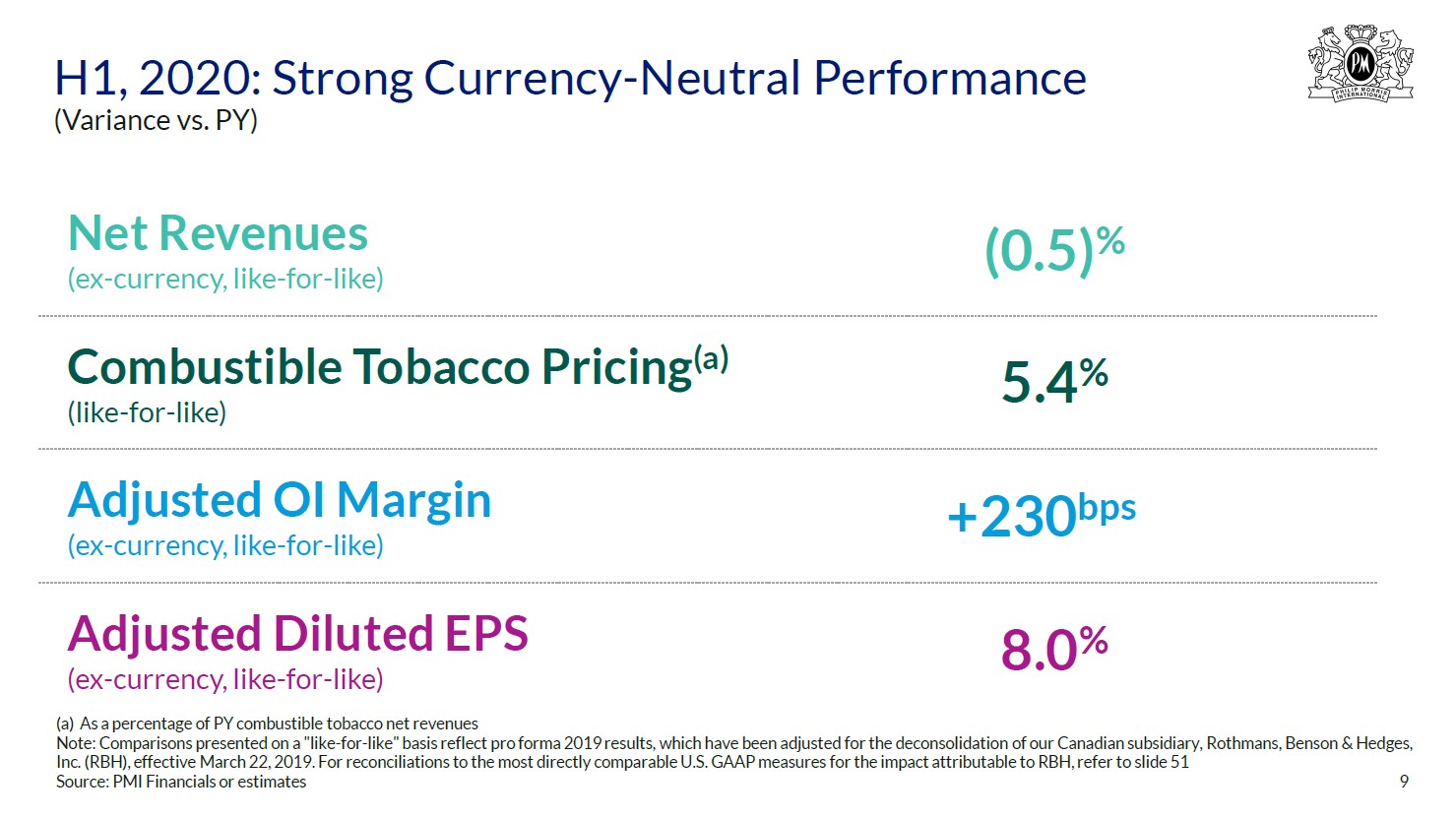

Image Shown: Excluding foreign currency headwinds, Philip Morris International Inc’s financials held up relatively well during the first half of 2020, all things considered with an eye towards the pandemic. Image Source: Philip Morris International Inc – Second Quarter of 2020 IR Earnings Presentation

By Callum Turcan

The ongoing coronavirus (‘COVID-19’) pandemic has severely stressed consumer spending in countries all over the globe, and that includes spending on cigarettes and other tobacco products. For a major tobacco company like Philip Morris International Inc (PM), this dynamic weighs negatively on its near-term outlook, though the company is well-positioned to ride out the storm for several reasons. We continue to like Philip Morris International as a holding in the High Yield Dividend Newsletter portfolio, and shares of PM yield ~6.0% as of this writing.

Philip Morris International’s dividend coverage on a forward-looking basis is decent and supported by its optimistic guidance (a rebound is expected during the second half of 2020), growing demand for its heated tobacco offerings (such as IQOS, which is not an acronym), high quality cash flow profile, ongoing access to capital markets at attractive rates (particularly debt markets), pricing power at its traditional cigarette brands (such as Marlboro), and its ample liquidity position at the end of June 2020.

However, we caution that Philip Morris International’s large net debt load, while manageable, weighs negatively against its dividend coverage strength. We give Philip Morris International a “GOOD” Dividend Safety rating which factors in modest per share payout growth and expected future free cash flows over the next five full fiscal years, along with its large net debt load.

Strong Guidance with Caveats

Management expects Philip Morris International’s financial performance will rebound in the second half of 2020 after taking a hit during the first half of the year (highlighted in the upcoming graphic down below), as communicated during the firm’s second quarter 2020 earnings report published July 21.

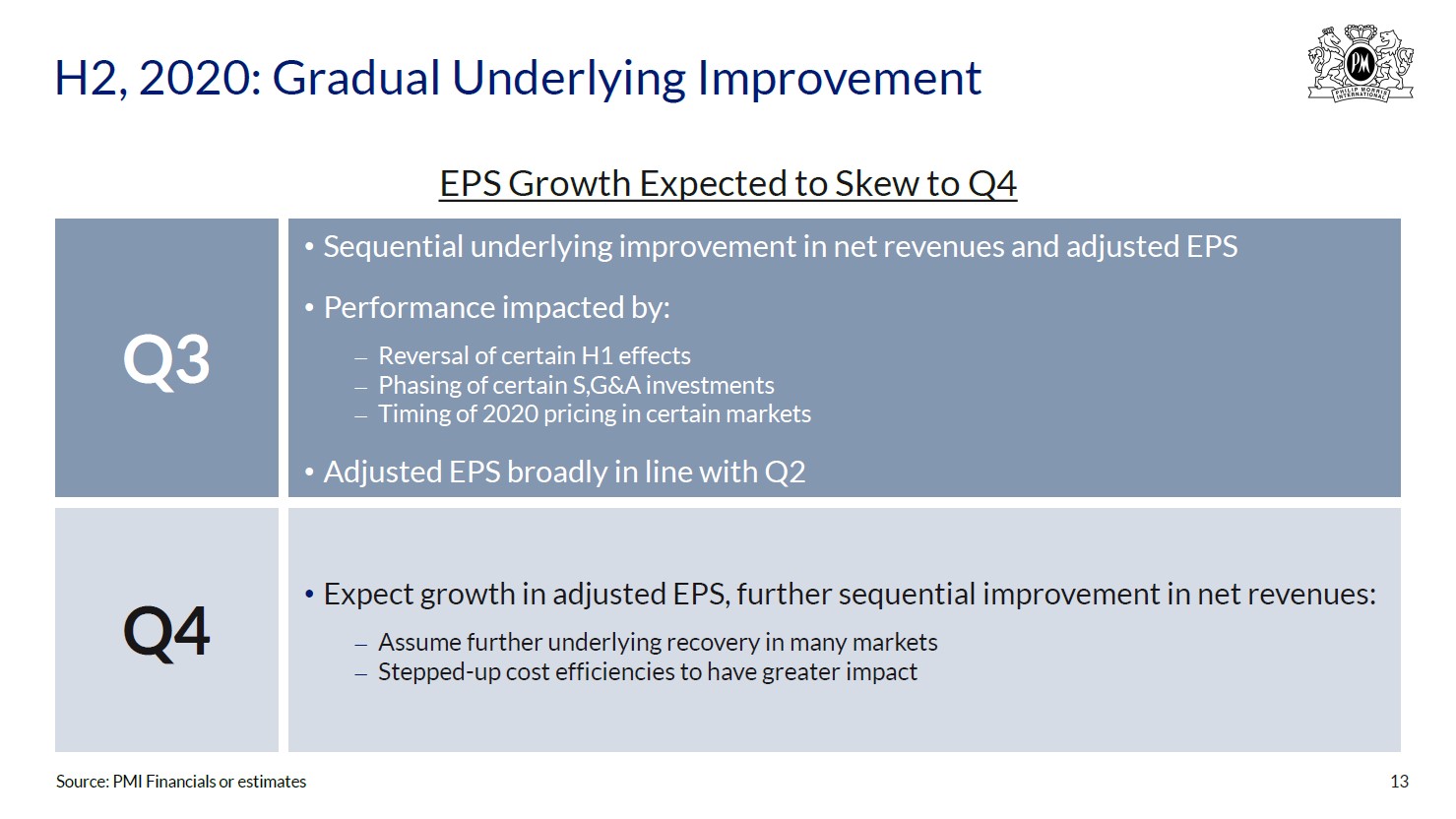

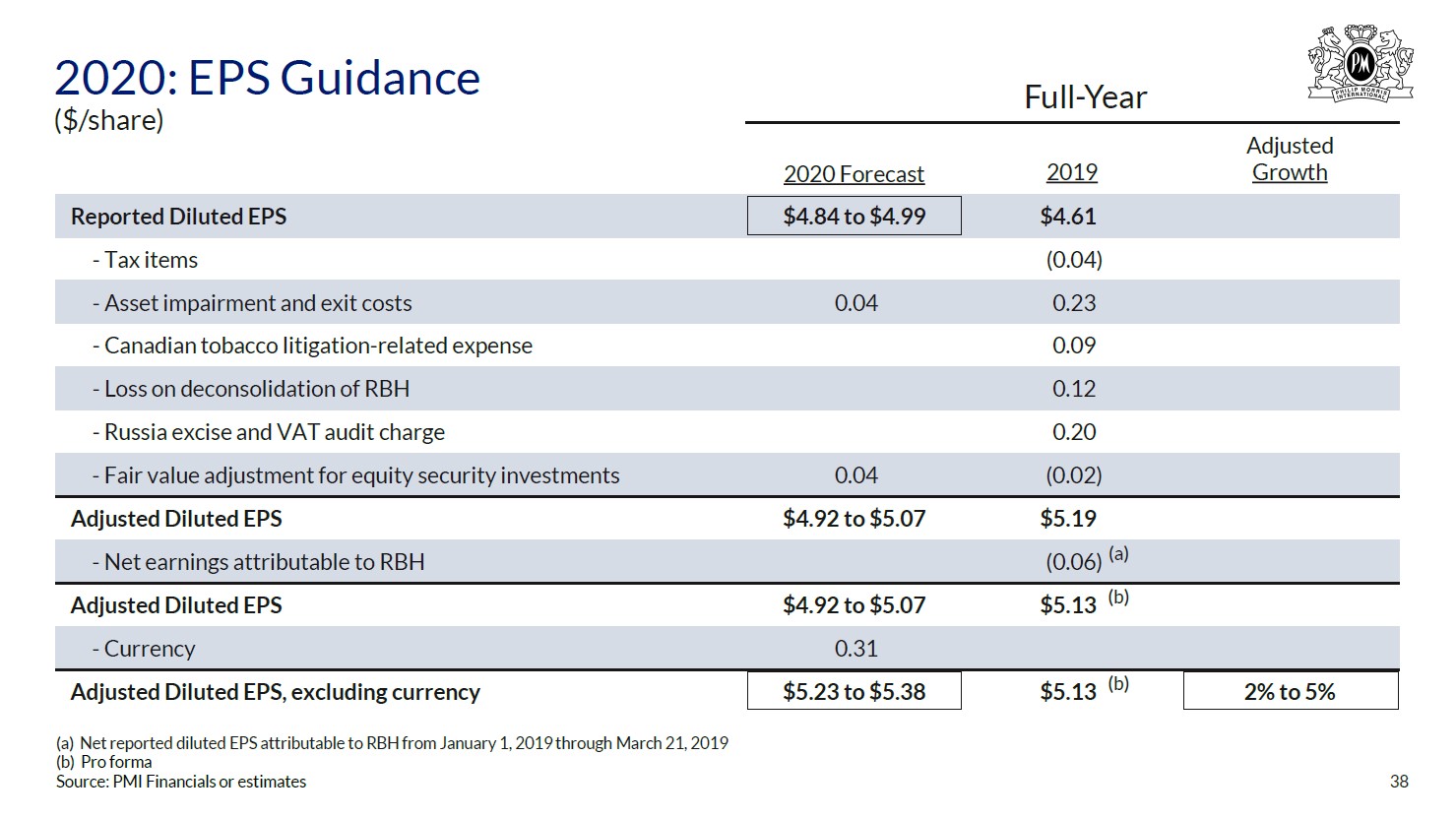

Image Shown: Philip Morris International expects to generate modest adjusted non-GAAP EPS growth this year on a currency neutral basis. Image Source: Philip Morris International – Second Quarter of 2020 IR Earnings Presentation

First, some background. Please note Philip Morris International sells Marlboro-branded cigarettes outside the US (after getting spun out of Altria Group Inc [MO] back in March 2008) along with other tobacco products (such as the heated tobacco IQOS offering and other cigarette brands). Excluding the US and China, Philip Morris International expects the global tobacco market will shrink by approximately 7%-9% this year.

In particular, Philip Morris International expects duty free sales will be weak this year due to a decline in international travel, and weak in Indonesia as well due to a new pricing mechanism getting rolled out (minimum retail selling price requirements are expected to go into full effect by September 2020 at the earliest). These dynamics along with a general reduction in tobacco sales worldwide due to the pandemic are expected to play a leading role in pushing Philip Morris International’s total shipment volumes down by 8%-10% this year, according to the company’s forecasts.

Even with these headwinds in mind, Philip Morris International still expects to grow its non-GAAP adjusted diluted EPS this year versus 2019 levels when excluding foreign currency headwinds. Please note that foreign currency headwinds are expected to be very material this year, which is why we always take adjusted guidance with a grain of salt. Excluding foreign currency headwinds and other factors, Philip Morris International expects to grow its non-GAAP diluted EPS by 2%-5% this year as you can see in the upcoming graphic down below. This growth is expected to be made possible by a sharp rebound in its financial performance by the fourth quarter of 2020.

Image Shown: Philip Morris International expects to generate modest adjusted non-GAAP EPS growth this year on a currency neutral basis. Image Source: Philip Morris International – Second Quarter of 2020 IR Earnings Presentation

On a currency neutral basis, Philip Morris International expects its revenues will decline modestly this year, though when excluding its duty free and Indonesian operations the firm sees its revenues growing modestly this year. Breaking this down, what the company appears to be communicating to investors is that outside of its duty free and Indonesian operations, and foreign currency headwinds, Philip Morris International’s performance is holding up quite well in the face of the pandemic. Please note that those headwinds are material and cannot simply be swept under the rug, though we appreciate what management is attempting to communicate to investors.

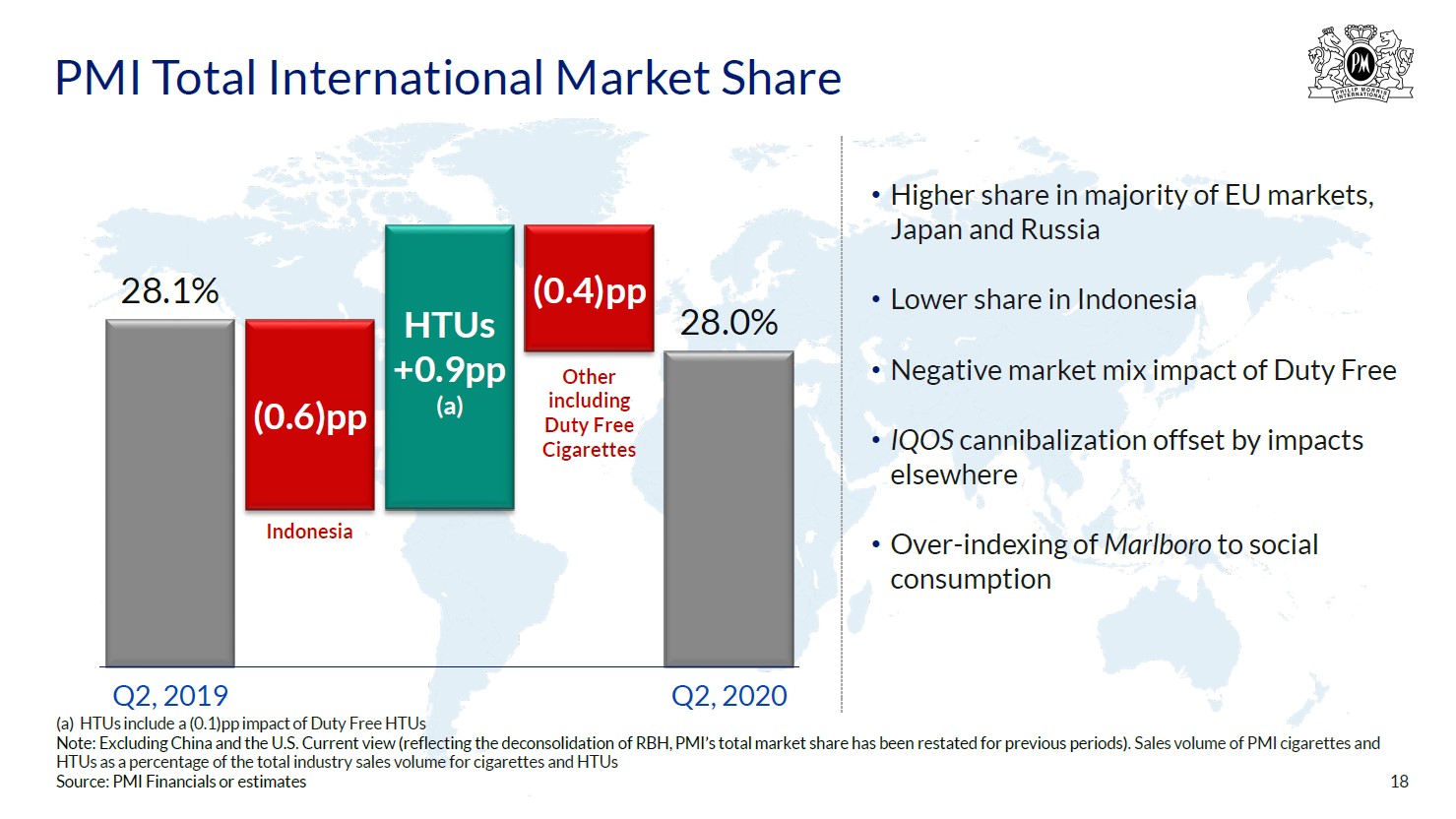

Philip Morris International’s outlook is supported by a few things including its dominant market position (the firm controls ~28% of the global tobacco market outside of the US and China), ability to push through price increases due to the inelastic nature of tobacco demand, and ongoing cost control measures. Management is targeting $1.0 billion in annualized savings by 2021 through manufacturing cost reductions via productivity improvements and SG&A expense reductions. Philip Morris International noted it was on track to achieving those cost savings during its latest earnings call.

During the first half of 2020, Philip Morris International’s ‘marketing, administration, and research costs’ dropped by over 9% year-over-year. Meaningful expense reductions allowed for the company’s GAAP operating income to climb higher by over 5% though its GAAP revenues tumbled by a bit under 5% during this period. We see a lot of potential for Philip Morris International to significantly improve its cash flow profile by keeping a lid on operating costs. The firm’s GAAP net income rose by just under 3% during the first half of 2020 on a year-over-year basis, which we appreciate given the headwinds created by the pandemic.

Innovating in an Old Market

Where Philip Morris International is having the most success in terms of volume growth is at its heated tobacco segment. In particular, Philip Morris International’s IQOS offering has been selling very well and winning over new users (generally users who previously smoked traditional cigarettes). During the second quarter of 2020, while Philip Morris International’s cigarette shipment volumes were down 17.6% year-over-year, its heated tobacco unit (‘HTU’) shipment volumes were up 24.3% year-over-year. In total, the company’s cigarette and HTU shipment volumes were down 14.5% year-over-year last quarter.

IQOS was designed and is marketed towards smokers of traditional cigarettes looking for a different way to consume tobacco and nicotine. This offering should not be conflated with other non-traditional tobacco products that were allegedly targeted towards teens. On July 7, the US Food and Drug Administration (‘FDA’) gave Philip Morris Products permission to market IQOS as a “reduced exposure” product. Here is what management had to say on the issue during Philip Morris International’s latest earnings call (emphasis added):

“We reached a truly historic milestone for IQOS, our mission and our future growth prospect on July 7 with the FDA's authorization of IQOS as a modified risk tobacco product. IQOS is the first electronic nicotine product to receive an MRTP [modified risk tobacco product] order. Following a review of our extensive scientific evidence package, the agency found that an exposure modification order for IQOS is appropriate to promote the public health in the United States, demonstrating that IQOS is fundamentally different product from combustible cigarette and a better choice for adults who would otherwise continue to smoke. The agency concluded that issuing the order for IQOS is expected to benefit the health of the population as a whole taking into account both user of tobacco product and person who do not currently use tobacco product.

A critical enabler for the future growth of RRPs [reduced risk products] is the implementation of differentiated regulatory framework that can help encourage adults who would otherwise continue to smoke to instead switch to better alternatives, in line with the harm reduction principle. The authorization allows a version of IQOS to be marketed with information confirming the validity of our scientific studies with regard to the significant reduction of exposure to the harmful and potentially harmful chemicals contained in cigarette smoke. The FDA decision and subsequent comprehensive post-market controls and monitoring, focusing on use prevention provide an important example of how government and public health organization around the world can implement an inclusive, science-based approach to help rapidly shift adult smokers who would otherwise continue smoking to better options while simultaneously guarding against unintended consequences.”

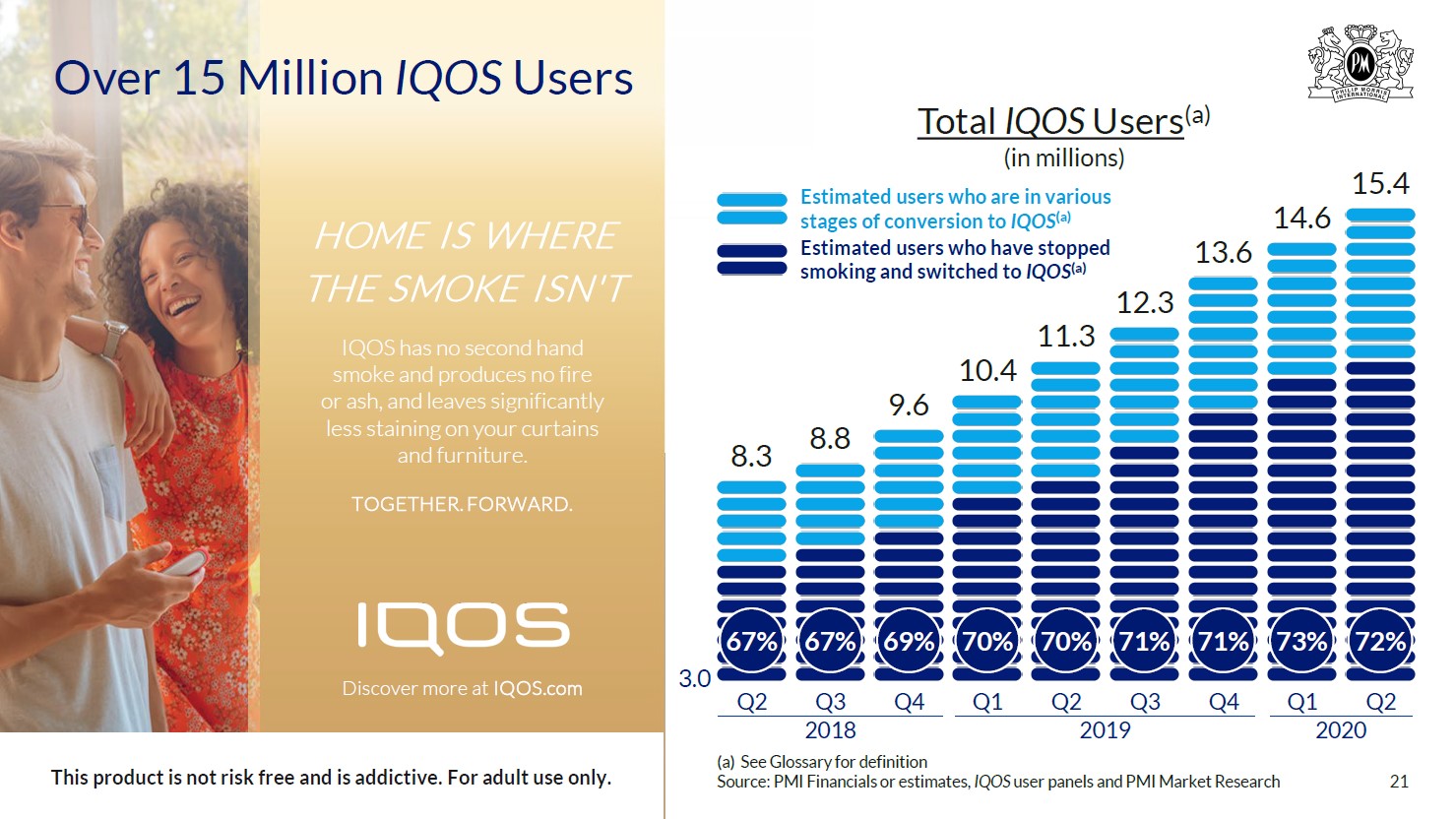

Philip Morris International has a licensing agreement with Altria to market IQOS in the US, which has been slowly rolled out in the country. In the upcoming graphic down below, Philip Morris International provides an overview of its IQOS product’s growth trajectory in terms of its user base. Please note the growing percentage of the IQOS user base that were previously smokers of traditional cigarettes before transitioning to the heated tobacco offering.

Image Shown: IQOS continues to post steady user base growth which lends a tremendous amount of support to Philip Morris International’s financial outlook, given the ongoing secular decline of traditional cigarette volumes in many markets. Image Source: Philip Morris International – Second Quarter of 2020 IR Earnings Presentation

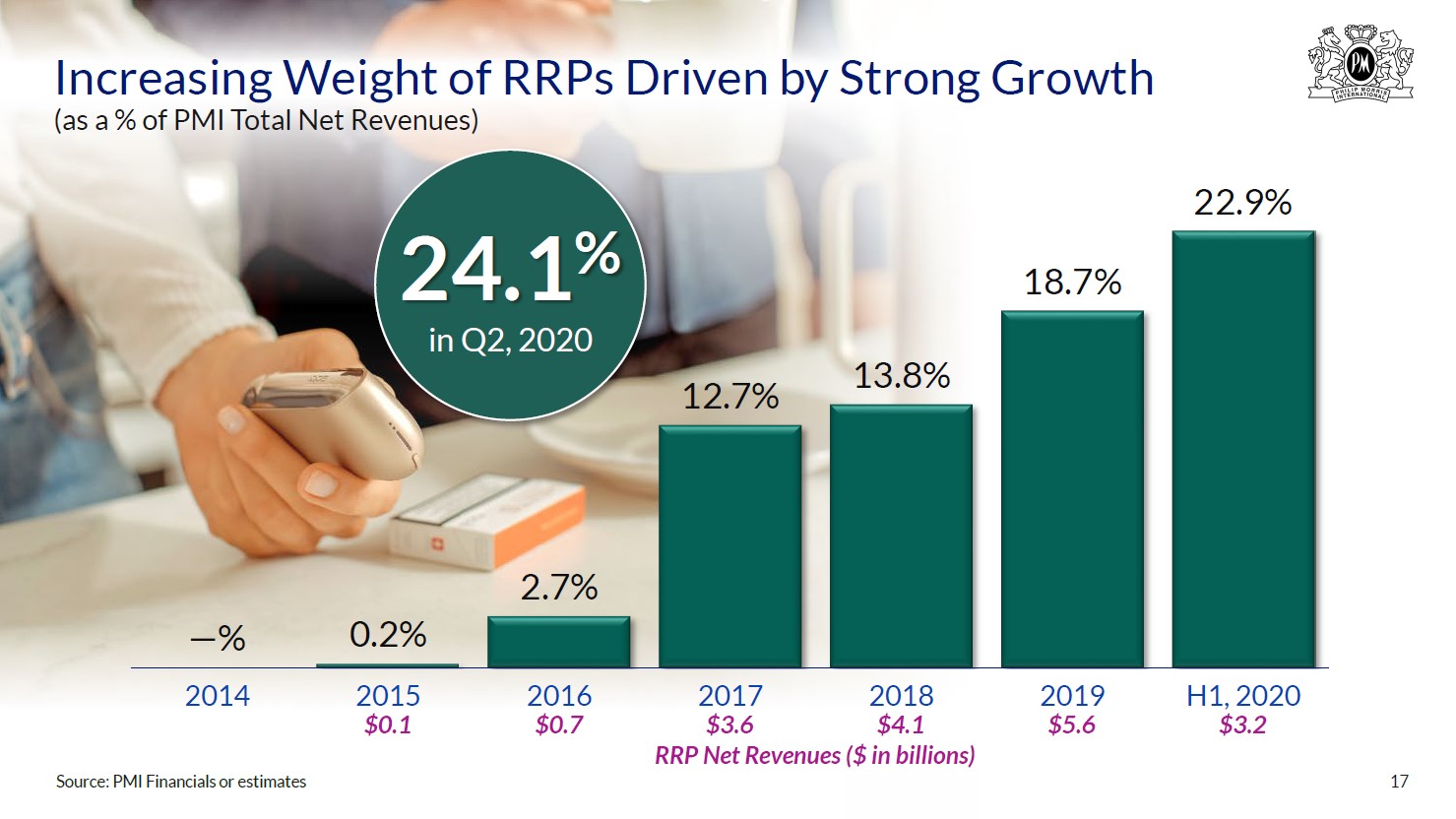

HTUs accounted for over 10% of Philip Morris International’s total shipment volumes during the first half of 2020. Additionally, please note reduced risk products (‘RRPs’) represented almost a quarter of the firm’s net revenues during the second quarter of 2020. As this segment becomes a larger part of its company-wide operations, the firm could offset declining volumes of traditional cigarette shipments with shipments of HTU-related products. Here is some key management commentary from the company’s latest earnings call (emphasis added):

[Philip Morris International] delivered a robust performance in the first half of the year despite the unprecedented circumstances of the pandemic. Most importantly, the continued momentum of IQOS was excellent with an estimated 15.4 million users at the end of the second quarter. Our commercial model pivoted rapidly to digital and remote engagements, while preserving high rates of IQOS' user acquisition and brand retention. With volumes of heated tobacco units growing 24% in Q2 2020 compared to the prior year, RRPs made up almost one quarter of our net revenues.

In addition, after two very difficult months in the quarter due to the pandemic, our combustible business is now improving. Industry volumes started to recover in June and the beginning of July, reflecting the gradual easing of confinement in many countries. The improvement was particularly driven by the EU, our largest region in term of net revenue and adjusted operating income. The main enduring headwinds linked to COVID-related restrictions are the absence of recovery in duty-free; and in Indonesia, where this is compounded by pricing dynamics. Economic uncertainty remains and we all hope for no major resurgence of the pandemic…

…the recovery of industry volume in June, notably in the higher-margin EU region, benefited our net revenues and margin. Second, IQOS user acquisition grew substantially in the same month with markets such as Russia back to pre-COVID rate and overall IQOS acquisition for the quarter only 35% below pre-pandemic levels…

…We expect a gradual underlying improvement in the combustible business coupled with continued robust growth for IQOS. The pandemic continues to present an uncertain operating environment with a potential for tightened restriction in localized areas. While not included in our guidance assumption, there also remain a non-negligible risk of a resurgence in the virus and the return of national lockdowns. The full economic fallout of the various restriction is also unclear.”

Please note that Philip Morris International’s guidance does not factor in the very real risk that a resurgence of COVID-19 infections in various regions could see quarantine efforts put back into place. That being said, we remain optimistic that one of a number of “shots on goal” will see a viable and safe COVID-19 vaccine or effective cure gets discovered relatively soon (more information on that topic here).

Before covering Philip Morris International’s key financial updates, please take a look at the upcoming graphic down below. The company highlights the growing importance of its RRP business, which includes its IQOS offerings, with the segment’s revenues growing from an immaterial part of its business back in 2014-2016 to a very material part of its business by the start of 2020. Philip Morris International’s financial outlook is supported by its ability to innovate in one of the oldest industries in the world (the tobacco industry), which underpins our confidence in its future cash flow generation potential.

Image Shown: Philip Morris International’s RRP operations are steadily becoming a significant part of its overall business. Image Source: Philip Morris International – Second Quarter of 2020 IR Earnings Presentation

Financial Update

As of this writing, Philip Morris International has not yet published its 10-Q SEC filing covering the second quarter of 2020. However, in its 8-K SEC filing covering that period, the firm noted it had $29.6 billion in total debt at the end of June 2020 (including $2.6 billion in short-term debt) versus $4.2 billion in cash and cash equivalents. Its net debt to adjusted EBITDA ratio was ~2.0x at the end of this period (keeping in mind the company’s adjusted EBITDA generation will likely improve going forward assuming the global economy continues to reopen and rebound).

Philip Morris International forecasts that it will generate at least $9.0 billion in net operating cash flow this year, and additionally, management expects the company will invest ~$0.7 billion towards capital expenditures in 2020. In 2019, Philip Morris International spent $7.2 billion covering its dividend obligations and generated $9.2 billion in free cash flow ($10.1 billion in net operating cash flow less $0.9 billion in capital expenditures). The firm did not repurchase a significant amount on share repurchases during this period, and historically, Philip Morris International has not bought back a significant amount of its stock or issued out a significant amount of stock.

It appears Philip Morris International expects it will continue being very free cash flow positive this year, in part due to its low capital expenditure requirements (the company does not need to make major capital investments to generate meaningful revenues). The company forecasts its capital expenditures will fall moderately in 2020 versus 2019 levels. Given its high quality cash flow profile and ongoing access to capital markets, highlighted by Philip Morris International’s ability to issue $0.75 billion in 1.125% Notes due 2023, $0.75 billion in 1.500% Notes due 2025, and $0.75 billion in 2.100% Notes due 2030 at the start of May 2020, we see the company’s net debt load as manageable.

As of February 6, 2020, Philip Morris International had high quality investment grade credit ratings (A2/A/A). On top of the significant amount of cash and cash equivalents Philip Morris International had on hand at the end of June 2020 ($4.2 billion), the firm’s liquidity position is further supported by $8.0 billion in total borrowing capacity under several revolving credit lines.

When Philip Morris International publishes its 10-Q SEC filing covering the second quarter of 2020, we will have more to say on its cash flow performance and financial position overall. On a final note, please note the stable nature of Philip Morris International’s market share in the global tobacco industry (excluding the US and China) in the upcoming graphic down below, which supports its ability to push through price increases.

Image Shown: We appreciate Philip Morris International’s ability to maintain its market share in the global tobacco industry, excluding markets in the US and China. Image Source: Philip Morris International – Second Quarter of 2020 IR Earnings Presentation

Concluding Thoughts

We continue to like Philip Morris International as a holding in our High Yield Dividend Newsletter portfolio and view its forward-looking dividend coverage as solid due to its impressive cash flow profile. While we would prefer the company chip away at its net debt load using its internally generated free cash flows to do so, that burden appears manageable as things stand today. Philip Morris International is well-positioned to ride out the storm, and we appreciate management’s cost cutting program.

-----

Tobacco Industry – BTI MO PM SWM VGR

Related smoking: IMBBY, JAPAY, GLLA, VAPE

Marijuana stocks: ACB, ACNNF, APHA, CGC, CRON, HEXO, STZ, TLRY

Related ETFs: MJ, YOLO, ACT, THCX, SOIL, CNBS, TOKE, POTX

----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Philip Morris International Inc (PM) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Both the simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios include a SPDR S&P 500 ETF Trust (SPY) put option holding with a $295 per share strike price that expire on August 21, 2020. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment