PayPal Posts a Tremendous Quarterly Report, Reinstates Guidance

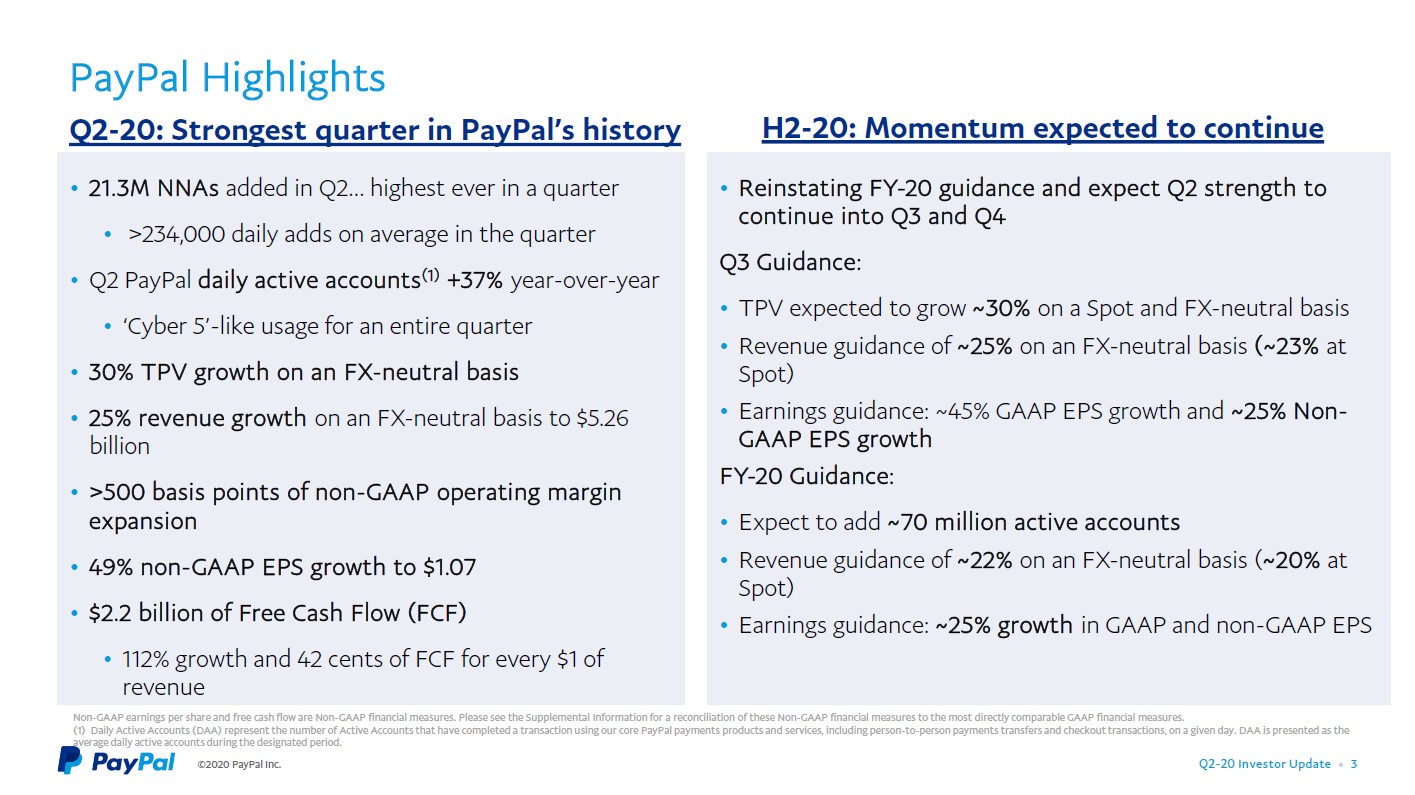

Image Shown: PayPal Holdings Inc put up tremendous performance during the first half of 2020 as consumers are increasingly shopping online. In the second quarter of 2020, PayPal continued to grow at a decent clip even in the face of the ongoing pandemic. Image Source: PayPal Holdings Inc – Second Quarter of 2020 IR Earnings Presentation

By Callum Turcan

After the market close July 29, PayPal Holdings Inc (PYPL) reported second quarter 2020 earnings that beat consensus top- and bottom-line estimates. Shares of PYPL moved sharply higher after the report was published, and we continue to like PayPal as a holding in the Best Ideas Newsletter portfolio. Our fair value estimate sits at $200 per share of PYPL, comfortably above where PayPal is trading at as of this writing. There is room for meaningful capital appreciation upside as the top end of our fair value estimate range sits at $240 per share of PayPal.

Even in the face of the ongoing coronavirus (‘COVID-19’) pandemic PayPal continued to grow, and we appreciate the resilience of its business model. The firm’s cash flow profile is of high quality, supporting its ability to generate meaningful free cash flows in any economic environment. Additionally, having a pristine balance sheet provides PayPal with ample financial flexibility to ride out the storm.

Overview

PayPal’s GAAP net revenues grew by 22% year-over-year last quarter as its total payment volumes (‘TPVs’) grew by 29% year-over-year, and please note those growth rates are even higher on a constant-currency basis. Rising peer-to-peer (‘P2P’) transactions helped make this possible as PayPal’s P2P TPVs were up 38% year-over-year (that includes transactions conducted through PayPal’s very popular Venmo mobile app). Overall, P2P transactions represented ~29% of PayPal’s TPVs last quarter. Here is what management had to say during PayPal’s latest earnings call:

“In the first half of 2020, the penetration of e-commerce as a percentage of retail sales outpaced prior external forecast by an astonishing 3 to 5 years. In this environment, the demand for our products and services has dramatically increased and unleashed multiple opportunities. We are focused on several key initiatives to fully leverage this unique moment in time.

First and foremost is our push to accelerate in-store contactless payments. Both consumers and merchants are rapidly moving towards digital payments across their online and off-line experiences. This is an existential issue for merchants who realized that reopening their retail stores depends on touchless forms of payments to keep both their employees and customers safe and healthy. There are numerous market research studies highlighting that consumers no longer want to handle cash or other forms of payments that require any physical touch at checkout.

We are significantly investing to accelerate our presence in all forms of omnichannel commerce, from point-of-sale in-store to buy online and pick up in store, order ahead, pay at table and home delivery.”

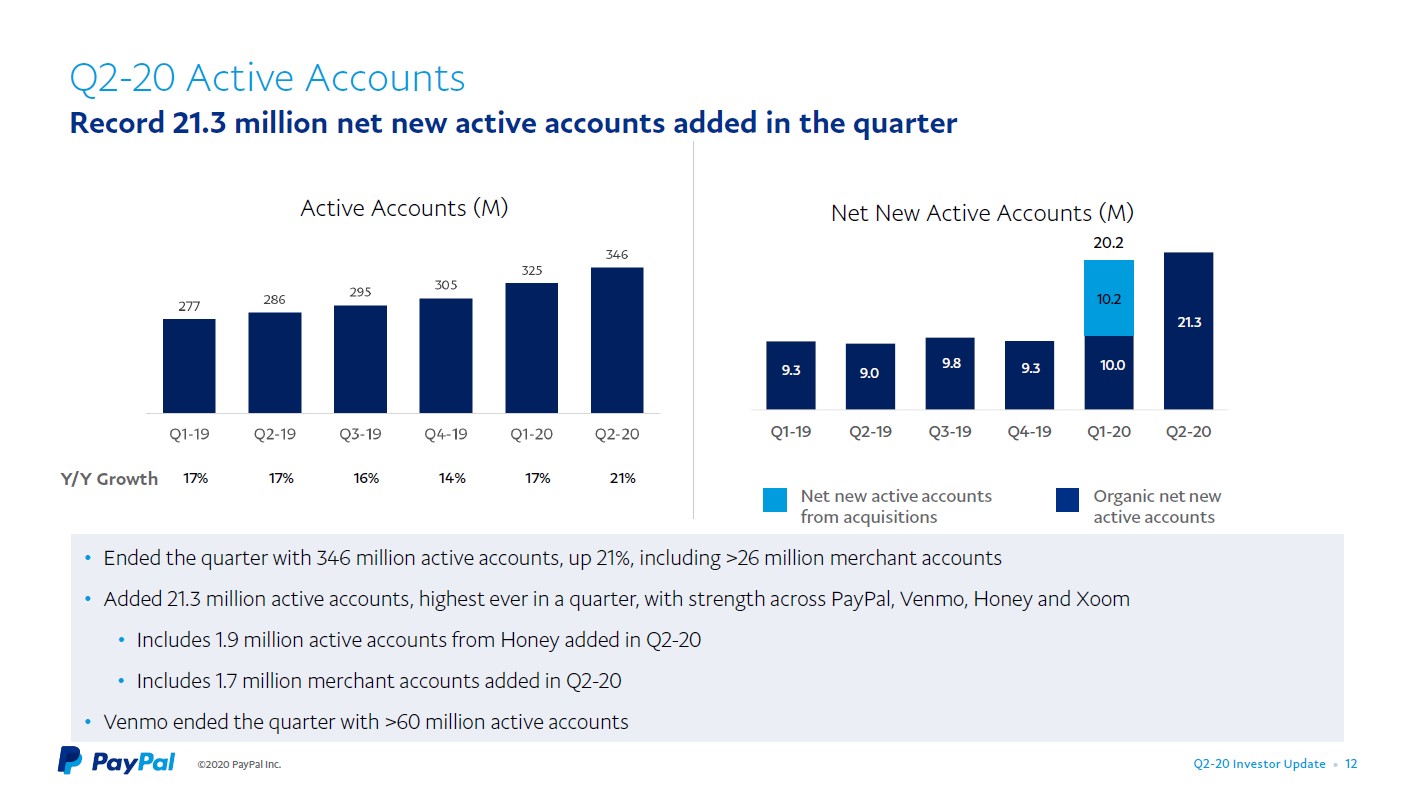

As you can see in the upcoming graphic down below, PayPal reported that it added 21.3 million net active organic accounts to its user base in the second quarter, its biggest on record. In January 2020, PayPal closed its ~$4.0 billion all-cash acquisition of Honey Science Corporation, which resulted in the inorganic net new active accounts added in the first quarter as shown below. Beyond consumers, PayPal added 1.7 million merchant accounts last quarter to its user base.

Image Shown: PayPal’s user base continued to grow at a nice clip last quarter, which supports the growth outlook for its TPVs going forward. That in turn supports PayPal’s promising cash flow growth trajectory. Image Source: PayPal – Second Quarter of 2020 IR Earnings Presentation

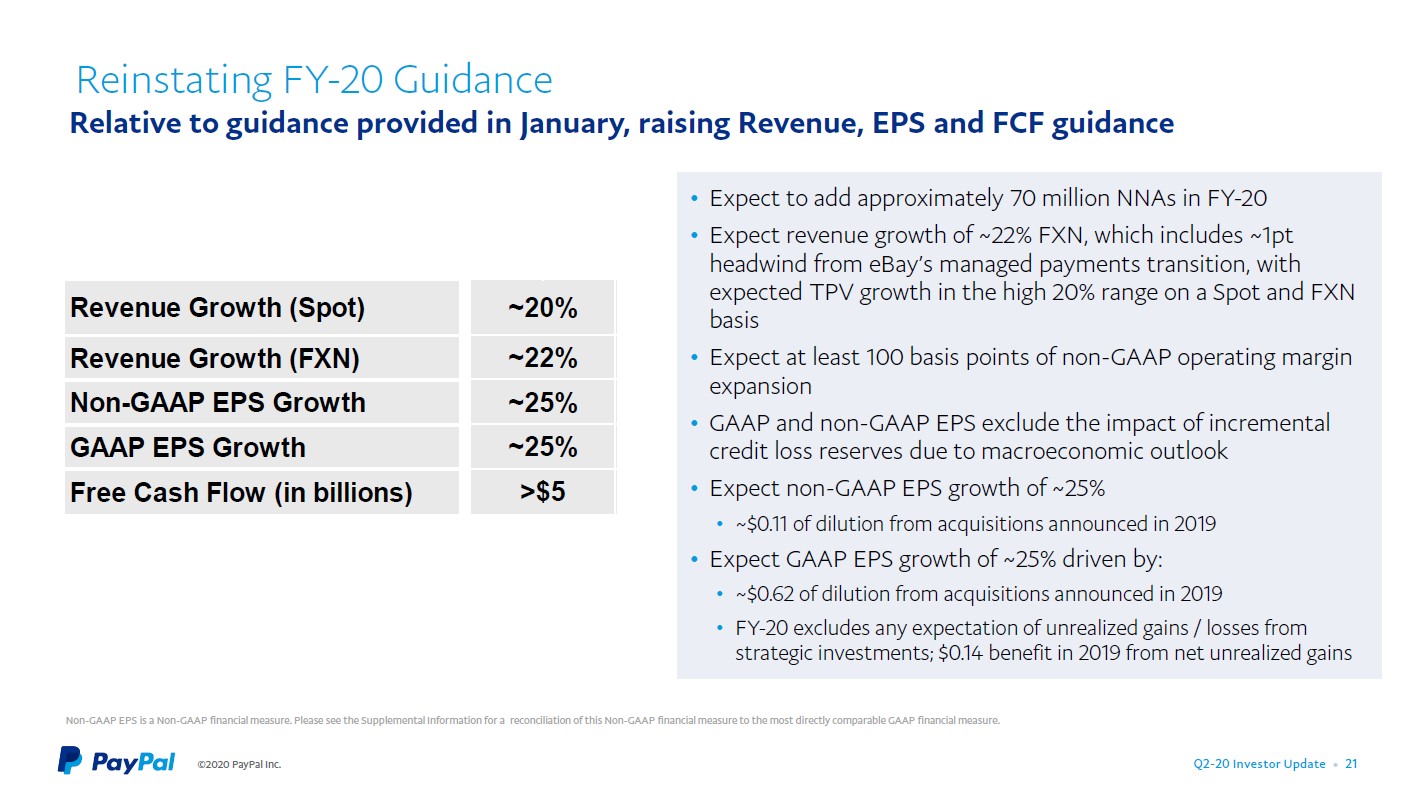

The company reinstated its full-year guidance for 2020 during its second quarter update after withdrawing that guidance back in May 2020. Please note that compared to the full-year guidance for 2020 that PayPal put out in January 2020, its updated guidance calls for stronger revenue growth, EPS, and free cash flow than expected back then. Surging e-commerce demand and a growing user base are key here.

Image Shown: PayPal reinstated its full-year guidance for 2020 during its second quarter earnings report. Management forecasts the company will post strong revenue growth this year. Image Source: PayPal – Second Quarter of 2020 IR Earnings Presentation

In the second quarter, PayPal’s GAAP operating income grew by 35% year-over-year due to economies of scale and controlled operating expenses (total operating expenses rose by a little under 20% last quarter, below GAAP revenue growth of 22%). PayPal also recorded a large net unrealized gain in the second quarter, namely from its stake in Mercadolibre Inc (MELI). Last year, PayPal made a $0.75 billion investment in Mercadolibre’s equity. Due to that large net unrealized gain and its growing GAAP operating income, PayPal’s GAAP net income almost doubled year-over-year in the second quarter of 2020.

Financial Strength

PayPal exited June 2020 with $13.0 billion in cash, cash equivalents, and short-term investments on the books versus $8.9 billion in long-term debt (and no short-term debt). Furthermore, please note PayPal had $3.2 billion in long-term investments on hand at the end of this period. Long-term investments are defined as strategic investments and available-for-sale debt securities (US government and agency securities, foreign government and agency securities, and corporate debt securities). When including long-term investments as cash-like assets, PayPal had a net cash position of $7.3 billion at the end of June 2020. We strongly appreciate PayPal’s pristine balance sheet, which the firm retained after acquiring Honey.

During the first half of 2020, PayPal generated $3.5 billion in free cash flow, assisted by its low capital expenditure requirements (the firm needs to make only modest capital investments to maintain its revenue generating abilities). The firm spent $1.0 billion buying back its stock during this period, which we view as a solid use of its capital given that shares of PYPL had been trading well below their fair value estimate during the first half of this year. PayPal’s high quality cash flow profile is a key reason why we like the firm.

Concluding Thoughts

We continue to like PayPal as a holding in the Best Ideas Newsletter portfolio and view the firm as very well-positioned to ride out the pandemic with its financials and growth story intact. The strong technical performance shares of PYPL have been putting up of late indicates that investors are steadily pricing in its promising growth outlook, bidding shares of PayPal up in the process.

-----

Financial Tech Services Industry – MA MELI PYPL VRSK V

Banks & Money Centers Industry – AXP BAC BBT BK C DFS FITB GS HSBC JPM KEY MS NTRS PNC RF STI TCF USB WFC

Related: DAL, IYG, IPAY, IYF, XLF

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Visa Inc (V) and PayPal Holdings Inc (PYPL) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Both the simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios include a SPDR S&P 500 ETF Trust (SPY) put option holding with a $295 per share strike price that expire on August 21, 2020. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment