Our Thoughts on Rackspace and Zoom Video Communications

Image Source: Rackspace Technology Inc – Second Quarter of 2020 IR Earnings Presentation

The appeal of the SaaS space is that these types of companies are asset-light and are light on capital expenditures, potentially allowing for meaningful free cash flows if scale is achieved. Secular growth tailwinds underpin their free cash flow growth trajectories, and the pandemic has accelerated changes that were already underway long before COVID-19 came into the picture. We appreciate that Rackspace is beginning to pay down its net debt load, though more work needs to be done on that front. Zoom Video Communications posted truly impressive results; however, we caution that there are many competitors in the live online video chat arena and staying on top is no easy task.

By Callum Turcan

The ongoing coronavirus (‘COVID-19’) pandemic has fundamentally disrupted daily activities for households all over the globe, which has changed the way individuals work and communicate with each other. Now many are working from home, doing schoolwork and attending virtual classes from home, and seeking to stay connected with friends and family while at home. Software-as-a-Service (‘SaaS’) companies that provide solutions to the problems created by COVID-19 are well-positioned to ride out the storm, aided by their asset-light and highly scalable business models. Let's talk about two companies that are heavily tied to the work-from-home trend.

Rackspace Technology

In early August, Rackspace Technology Inc (RXT), an end-to-end multicloud solutions expert that delivers "innovative capabilities of the cloud to help customers build new revenue streams, increase efficiency and create incredible experiences," went public. The firm intends to use the proceeds to pay down debt. If the underwriters fully exercise their over-allotment option, Rackspace will raise $0.8 billion in gross proceeds (or $0.7 billion in gross proceeds if those options are not exercised). The company issued a tender in August to repurchase up to $0.6 billion of its $1.1 billion outstanding 8.625% Senior Notes due 2024, and by late August, over $0.5 billion of those senior notes have been tendered and not validly withdrawn.

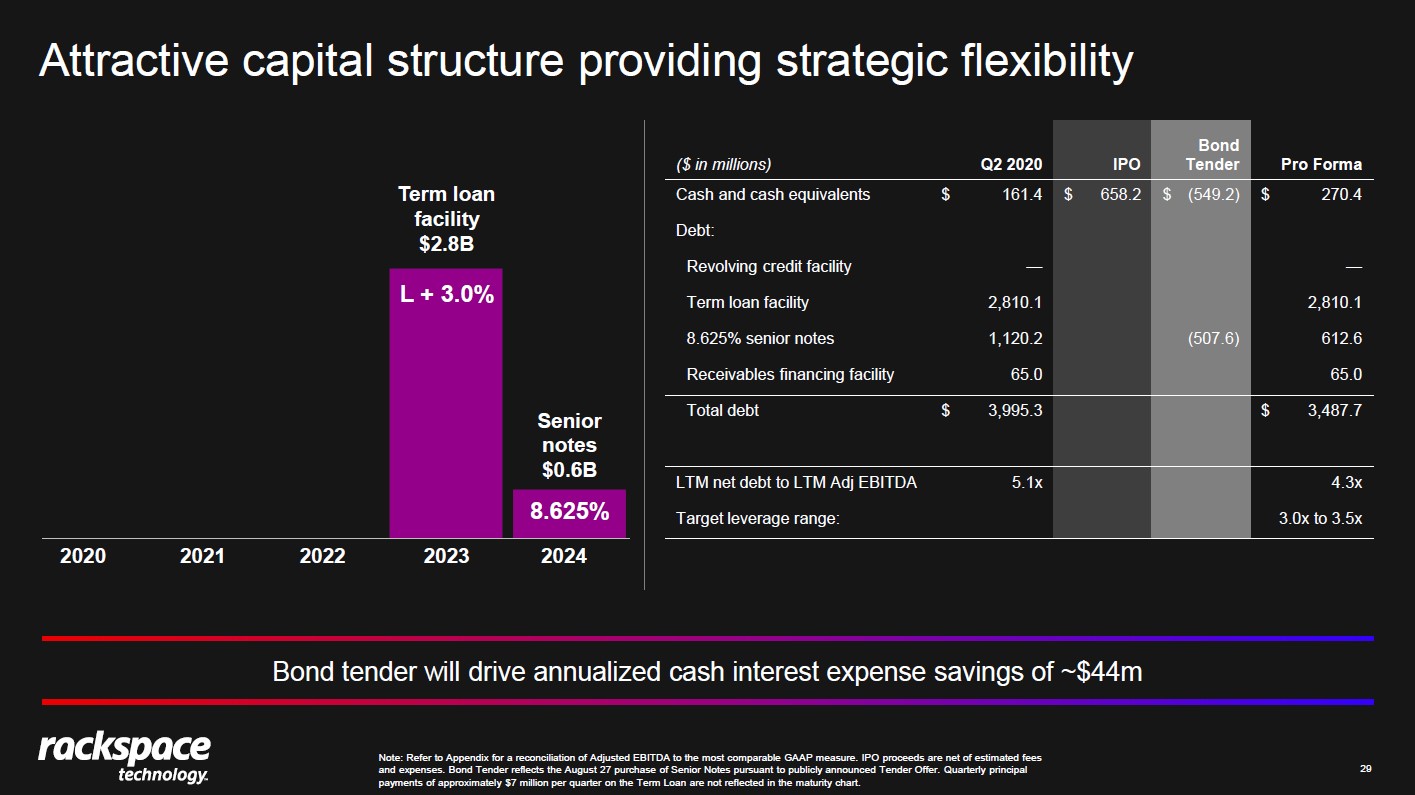

As of June 30, Rackspace had $161 million in cash and cash equivalents versus $72 million in short-term debt (inclusive of current ‘financing obligations’) and approximately $4.0 billion in long-term debt (inclusive of long-term ‘financing obligations’ and non-current finance lease obligations). Please note that this picture changed materially after Rackspace went public, and that the cash infusion will help get its balance sheet under control. Additionally, Rackspace did not have any borrowings drawn on its $375 million revolving credit line at the end of last quarter, which matures in August 2025, as you can see in the upcoming graphic down below.

Image Shown: Rackspace has a significant amount of net debt on the books, though its IPO proceeds will help pare down that burden. Image Source: Rackspace – Second Quarter of 2020 IR Earnings Presentation

Here is what management had to say regarding Rackspace’s financial position during the firm’s latest earnings call:

“…[W]e currently have no meaningful debt maturities before 2023 after raising $658 million in proceeds from IPO, our leverage stands at 4.3 times against our trailing adjusted EBITDA. Our intention longer-term is to reduce our leverage to a target range of 3 to 3.5 times, but I also offer that the highly recurring nature of our revenues allows for leverage to be applied in this model.

Additionally, we have available liquidity of over $601 million as of quarter end. Last point I’ll make here is we believe there is ample opportunity to lower our funding cost over time given the highly recurring nature of our cash flows and our improved leverage profile. As you can see here, through our deleveraging with the recent bond tender, we have already saved nearly $44 million in annual interest expense. We’ll be sure to update you as we announced progress further on this front.” --- Dustin Semach, CFO of Rackspace

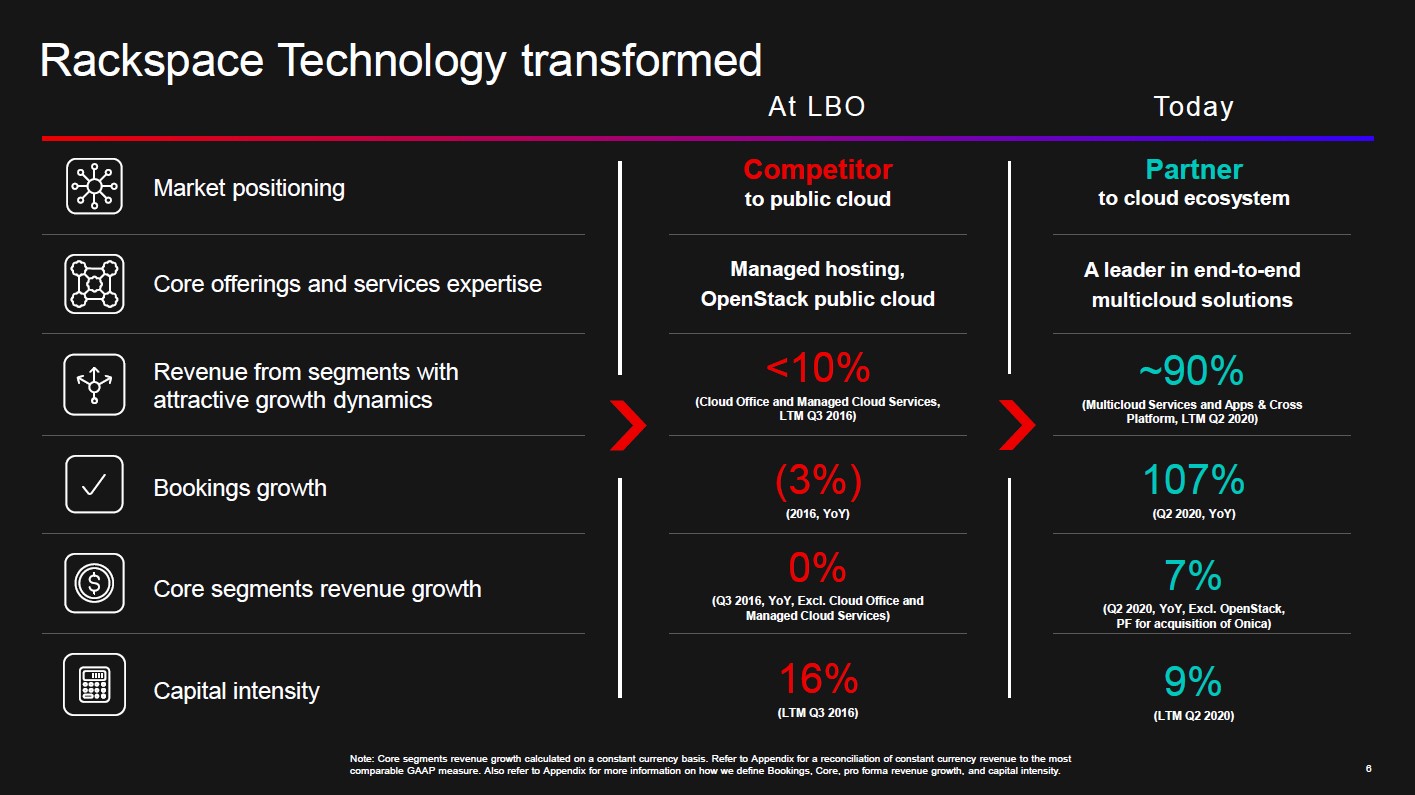

Back in 2016, Rackspace was taken private by funds affiliated with Apollo Global Management Inc (APO). In the upcoming graphic down below, Rackspace provides a snapshot of how the firm’s operations have changed since then.

Image Shown: Rackspace’s business model was revamped over the past several years, though we will stress here that the company had a net cash balance at the time the acquisition was announced back in 2016, which is clearly no longer the case given Rackspace’s hefty debt load as of 2020. Image Source: Rackspace – Second Quarter of 2020 IR Earnings Presentation

Rackspace has close alliances with the cloud computing units of Amazon Inc (AMZN), Alphabet Inc (GOOG) (GOOGL) and Microsoft Corporation (MSFT) as Rackspace helps its clients migrate their IT functions to the cloud while minimizing disruptions and downtime. According to its corporate website, Rackspace offers SaaS hosting options including hybrid cloud solutions, along with a slate of services that allows its clients to “develop, migrate, create, test and back up your apps.”

On August 31, Rackspace reported second quarter 2020 earnings that saw its GAAP revenues climb higher by 9% on the back of the strength seen at its ‘Multicloud Services’ unit. The company’s GAAP operating income climbed by 13% year-over-year last quarter while its quarterly bookings came in at $288 million, up 107% on a year-over-year basis and a record for the firm. Shares of RXT seesawed between gains and losses during normal trading hours on September 1.

During the first six months of 2020, Rackspace generated $112 million in net operating cash flow and spent $114 million on its capital expenditures. As the company scales, it should soon be able to generate meaningful free cash flows. Here is what management had to say during Rackspace’s latest earnings call (emphasis added):

“Turning to profitability, our adjusted EBITDA for the second quarter totaled $188 million, which represents a strong margin of approximately 29%, which is up year-over-year and year-to-date. This increased profitability was driven by revenue growth and the continued benefit of our transformation programs. We also continued to decrease our capital intensity, which was down 80 basis points to 9% for the last 12 months. The continued shift to our capital-light offerings brought capital expenditures as a percentage of revenues down, which positions us well to drive significant free cash flow growth.” --- Kevin Jones, CEO of Rackspace

Where Rackspace showed weakness was at its quarterly net retention rate as that came in below 100% for the second quarter, hitting 98% (flat year-over-year). The firm’s ‘core quarterly net revenue retention rate’ improved modestly last quarter (hitting 99%) versus the same period last year.

Having a net retention rate north of 100% means the firm is effectively generating more revenue from its existing customer base (through upgrades, price increases, and greater usage of services), while a rate south of 100% means that revenue losses from its existing customer base (churn, downgrades, reduced usage of services) are offsetting gains seen at portions of its existing customer base. Rackspace is near parity, but a net revenue retention rate north of 100% is strongly preferred when it comes to seeking out top-quality SaaS companies. Management noted that Rackspace was laser focused on improving its net revenue retention rate during the firm’s latest earnings call.

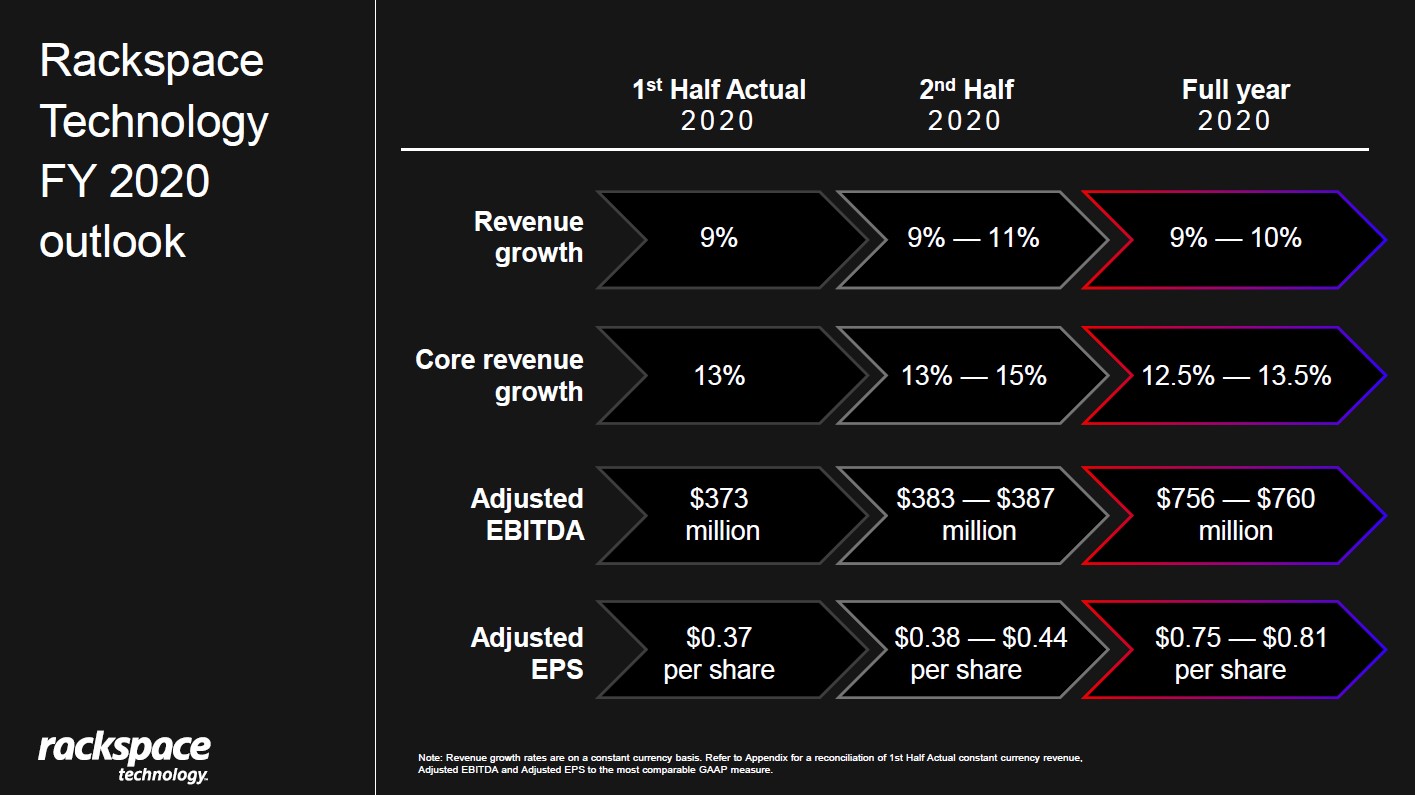

For the full-year, Rackspace forecasts it will generate 12.5%-13.5% in core revenue growth on a constant-currency basis (non-GAAP) while generating $756 million - $760 million in adjusted non-GAAP EBITDA. Rackspace’s guidance is depicted in the upcoming graphic down below.

Image Shown: An overview of Rackspace’s full-year and half-year guidance for 2020. Image Source: Rackspace – Second Quarter of 2020 IR Earnings Presentation

Back in November 2019, Rackspace announced it was acquiring Onica Holdings which provides cloud migration assistance to firms seeking to transition to Amazon Web Services (the cloud computing unit of Amazon), a deal that closed a month later. Those financial terms were not disclosed at the time of the acquisition, the firm noted the total cash consideration net of cash acquired was ~$0.3 billion in its latest 10-Q SEC filing.

Rackspace’s position in the cloud migration market appears solid though the firm needs to do a better job retaining customers and upselling those clients. We are keeping our eyes on the firm and the industry at-large, but we caution that Rackspace’s net debt load combined with its lackluster net revenue retention rate need to be dealt with before we could become interested in the firm.

Zoom Video Communications

Also on August 31, the live online video chat company Zoom Video Communications Inc (ZM) reported earnings for the second quarter of fiscal 2021 (period ended July 31, 2020). Investors were incredibly impressed with the company’s performance and shares of ZM skyrocketed higher initially after the report was published (up ~39% during normal trading hours on September 1 as of midday). The firm’s GAAP revenues more than quadrupled year-over-year while its GAAP operating incomed surged from $2 million to $188 million in the fiscal second quarter, highlighting the immense scalability of many digital businesses, particularly SaaS firms.

On July 31, Zoom Video Communications had $1.5 billion in cash, cash equivalents, and marketable securities on hand combined with no debt on the books. The firm generated a little over $0.6 billion in free cash flow during the first half of fiscal 2021, up from less than $0.1 billion in the same period last fiscal year. Zoom Video Communications’ stock price has surged upwards and that performance has perplexed some, though we want to stress here that investors bid up shares of ZM due to the sharp improvements in the firm’s long-term free cash flow growth trajectory. Additionally, having a net cash position further supports its valuation, though in this case only to a modest degree.

Zoom Video Communications noted the number of its customers that generated the firm over $100,000 in sales over the past twelve months (as of the end of its last fiscal quarter) grew by 112% year-over-year last fiscal quarter. Additionally, the firm noted its customer base with more than ten employees rose by 458% year-over-year during this period, hitting 370,200 customers.

What is interesting about these metrics is that the growth in Zoom Video Communications’ customer base is supported by small- and medium-sized businesses (‘SMBs’) along with larger enterprises. There were some concerns regarding whether the company’s explosive growth rate in usage would translate into a commensurate growth in its paying client base, and that appears to have been the case here (more or less). Zoom Video Communications increased its full-year guidance for fiscal 2021 during its latest earnings report and management had this to say during the firm’s latest earnings call (emphasis added):

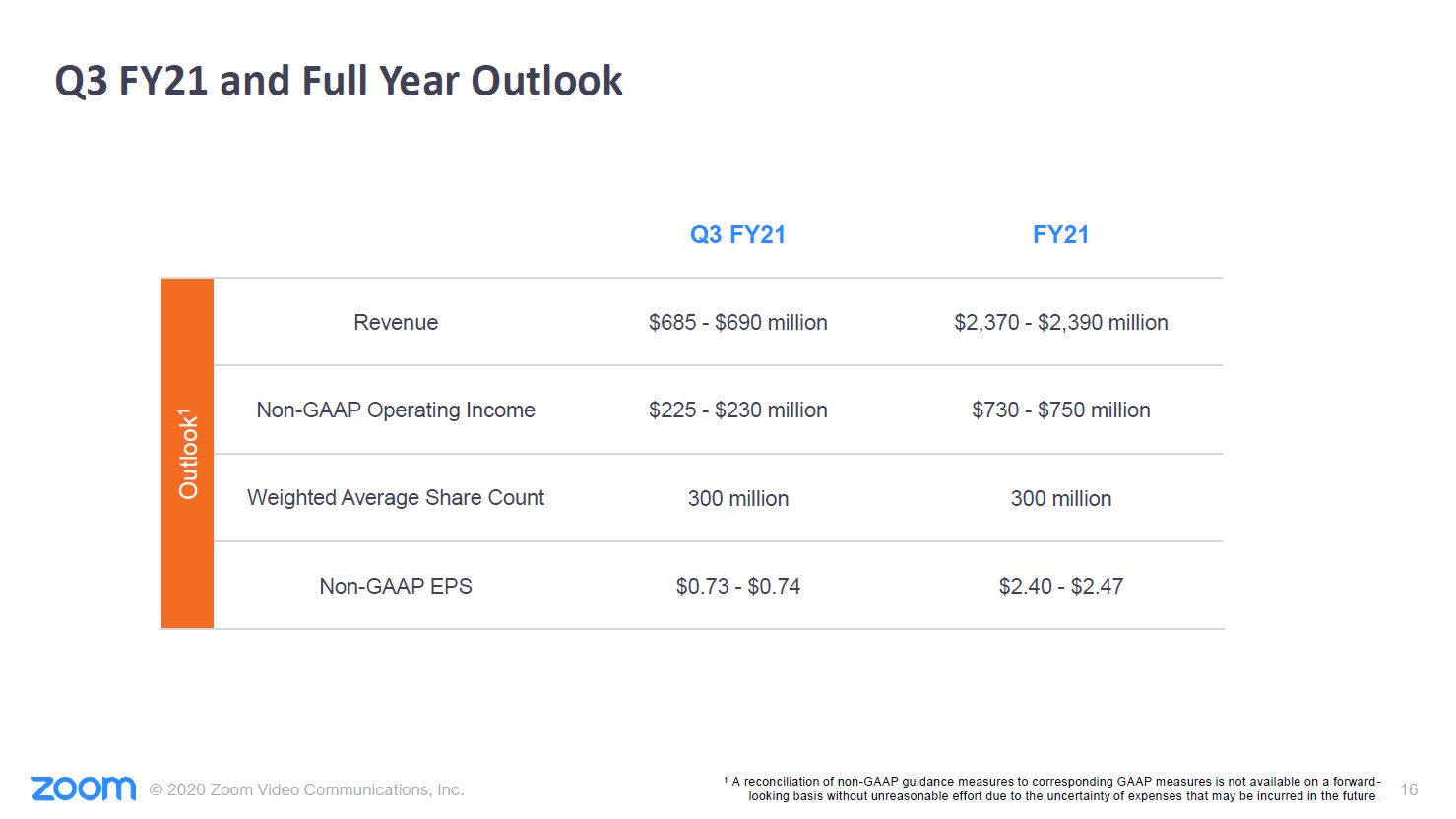

“Now turning to guidance, we are pleased to raise our outlook for FY'21 for both revenue and non-GAAP profitability. Although we remain optimistic on Zoom's outlook, please note that the impact and extent of the COVID-19 prices and its associated economic concerns remain largely unknown. Our higher outlook for FY'21 is based on our view of the current business environment…

For the full-year of FY'21, we expect revenue to be in the range of $2.37 billion to $2.39 billion, which will be approximately 281% to 284% year-over-year growth. This implies that Q3 and Q4 revenue will be only modestly higher than Q2, indicating a decline in quarter-over-quarter growth. For the full-year of FY'21, non-GAAP operating income is expected to be in the range of $730 million to $750 million. We expect to deliver non-GAAP earnings per share of $2.40 to $2.47 for the full-year FY'21 based on approximately 300 million shares outstanding.” --- Kelly Steckelberg, CFO of Zoom Video Communications

Zoom Video Communications’ outlook for fiscal 2021 is provided in the upcoming graphic down below.

Image Shown: We appreciate Zoom Video Communications’ recent guidance boost. Image Source: Zoom Video Communications – Second Quarter of Fiscal 2021 IR Earnings Presentation

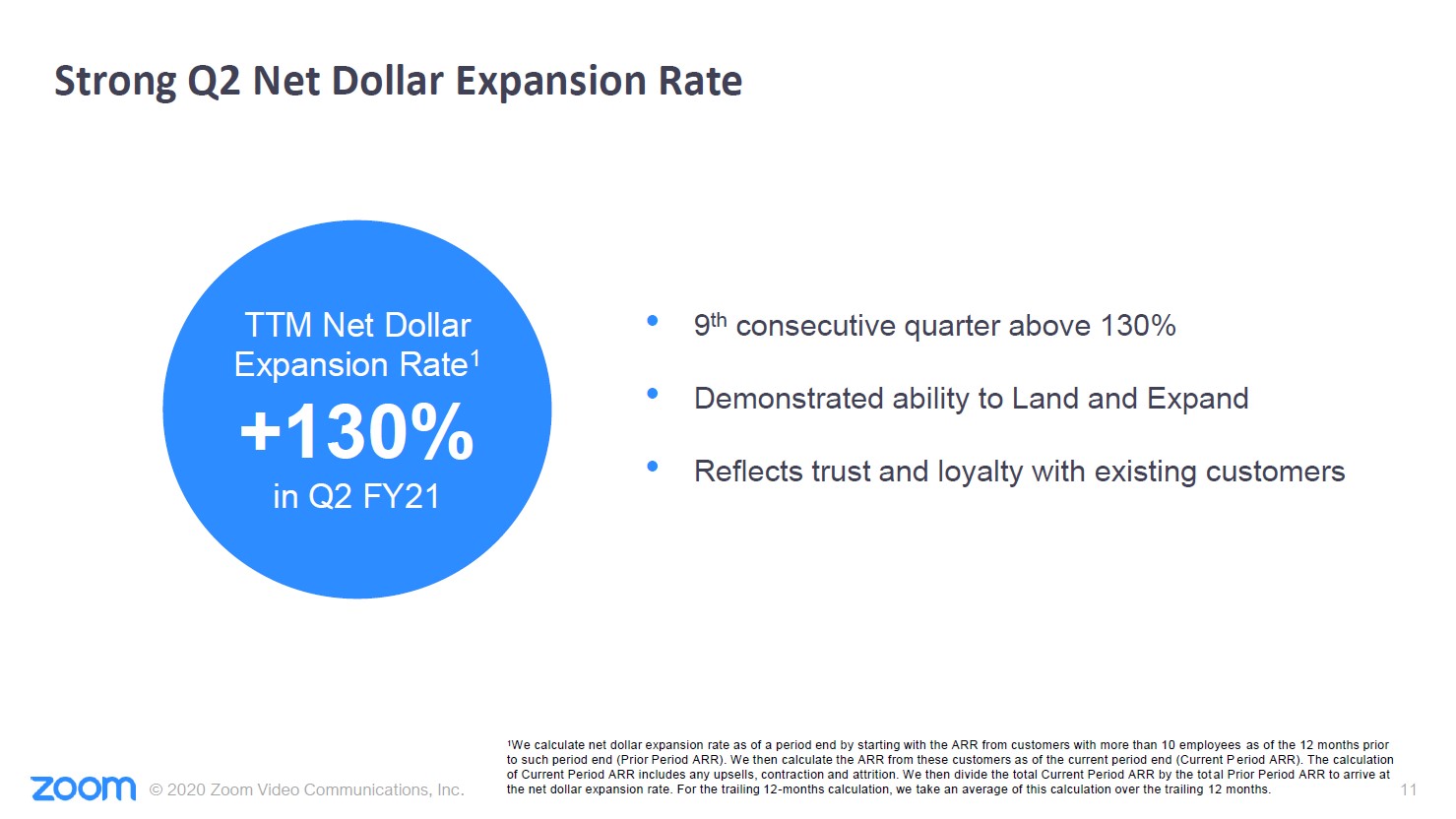

In the upcoming graphic down below, Zoom Video Communications highlighted that its ‘net dollar expansion rate’ came in at 130% last fiscal quarter, which is similar to the net revenue retention rate except that the company only is looking at clients with over ten employees. We can appreciate that Zoom Video Communications is generating significantly more revenue from its existing clients, especially considering its stellar ability to win over new customers of late.

Image Shown: Zoom Video Communications is generating more revenue from its existing clients, particularly those who have more than ten employees. Image Source: Zoom Video Communications – Second Quarter of Fiscal 2021 IR Earnings Presentation

We are not interested in adding Zoom Video Communications to our newsletter portfolios at this time, though we applaud the firm for its strong operational and financial performance of late. Shares of ZM appear to have already priced in the significant improvements in Zoom Video Communications’ long-term free cash flow growth trajectory as of this writing and have gone hyperbolic.

Concluding Thoughts

The appeal of the SaaS space is that these types of companies are asset-light and are light on capital expenditures, potentially allowing for meaningful free cash flows if scale is achieved. Secular growth tailwinds underpin their free cash flow growth trajectories, and the pandemic has accelerated changes that were already underway long before COVID-19 came into the picture. We appreciate that Rackspace is beginning to pay down its net debt load, though more work needs to be done on that front. Zoom Video Communications posted truly impressive results; however, we caution that there are many competitors in the live online video chat arena and staying on top is no easy task.

----

Broad Line Semiconductor Industry – AMD AVGO FSLR INTC TXN

Computer Hardware Industry – AAPL BB HPQ IBM TDC

Communications Equipment Industry – CSCO JNPR KN NOK SMCI

Internet Content & Services Industry – GOOG GOOGL BIDU FB JD TCEHY TWTR

Internet Content and Catalog Retail Industry – BABA AMZN BKNG EBAY EXPE GRPN IAC OSTK QRTEA STMP

Integrated Circuits Industry – ADI MCHP MRVL NVDA SWKS TSM XLNX

Semiconductor Equipment Industry – AMAT CREE IPGP KLAC LRCX MKSI SNPS TER

Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM

Related: APO, DOCU, WDAY, DDOG, NET, AVLR, CRWD, ZM, RXT, SKYY, WFH, CRM, COUP, TWLO, OKTA

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO), Intel Corporation (INTC), and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Alphabet Inc (GOOG) Class C shares and Facebook Inc (FB) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment