Our Thoughts on Chevron Buying Noble Energy

Image Shown: An overview of Chevron Corporation’s all-stock acquisition of Noble Energy Inc that was announced in July 2020. Image Source: Chevron Corporation – July 2020 Noble Energy Acquisition Presentation

By Callum Turcan

On July 20, Chevron Corporation (CVX) announced it was acquiring Noble Energy Inc (NBL) through a $5.0 billion all-stock transaction, or $13.0 billion when factoring in net debt and the book value of non-controlling interests. Shareholders of Noble Energy will receive approximately 0.12 share of Chevron for each share of Noble Energy. At the time the deal was announced, shareholders of NBL were receiving a ~12% premium based on the ten-day average closing stock prices. Chevron intends to issue ~58 million shares to cover the deal, keeping in mind the firm had approximately 1.85 billion shares outstanding on a weighted-average diluted basis as of the second quarter of 2020. The deal is expected to close during the fourth quarter of this year and is forecasted to generate $0.3 billion in annualized run-rate cost synergies one year after closing.

Eye Towards East Mediterranean

In our view, this deal was entirely about Chevron gaining access to Noble Energy’s Mediterranean assets, which are primarily upstream operations supported by third-party midstream assets. For reference, upstream operations focus on discovering and extracting raw energy resources (oil, natural gas, natural gas liquids) from the ground, ideally in an economical manner though low prices of late have made that a tricky task. Midstream operations, in the oil & gas industry, include energy infrastructure assets such as pipelines and storage facilities among other things.

Noble Energy owns a significant working interest in the offshore Tamar and Leviathan natural gas fields in Israel. With the Leviathan field now operational (came online near the end of 2019), Noble Energy’s net production in the region is quite sizable even for a firm as large as Chevron, and its output should steadily ramp up in the region in the medium-term as production from the Leviathan field ramps up. For reference, production from the Tamar field came online back in 2013. Supplies from these two offshore natural gas fields are meeting regional demand, which we will cover later on in this article. Combined, both fields contain tens of trillions of cubic feet of potentially recoverable natural gas resources.

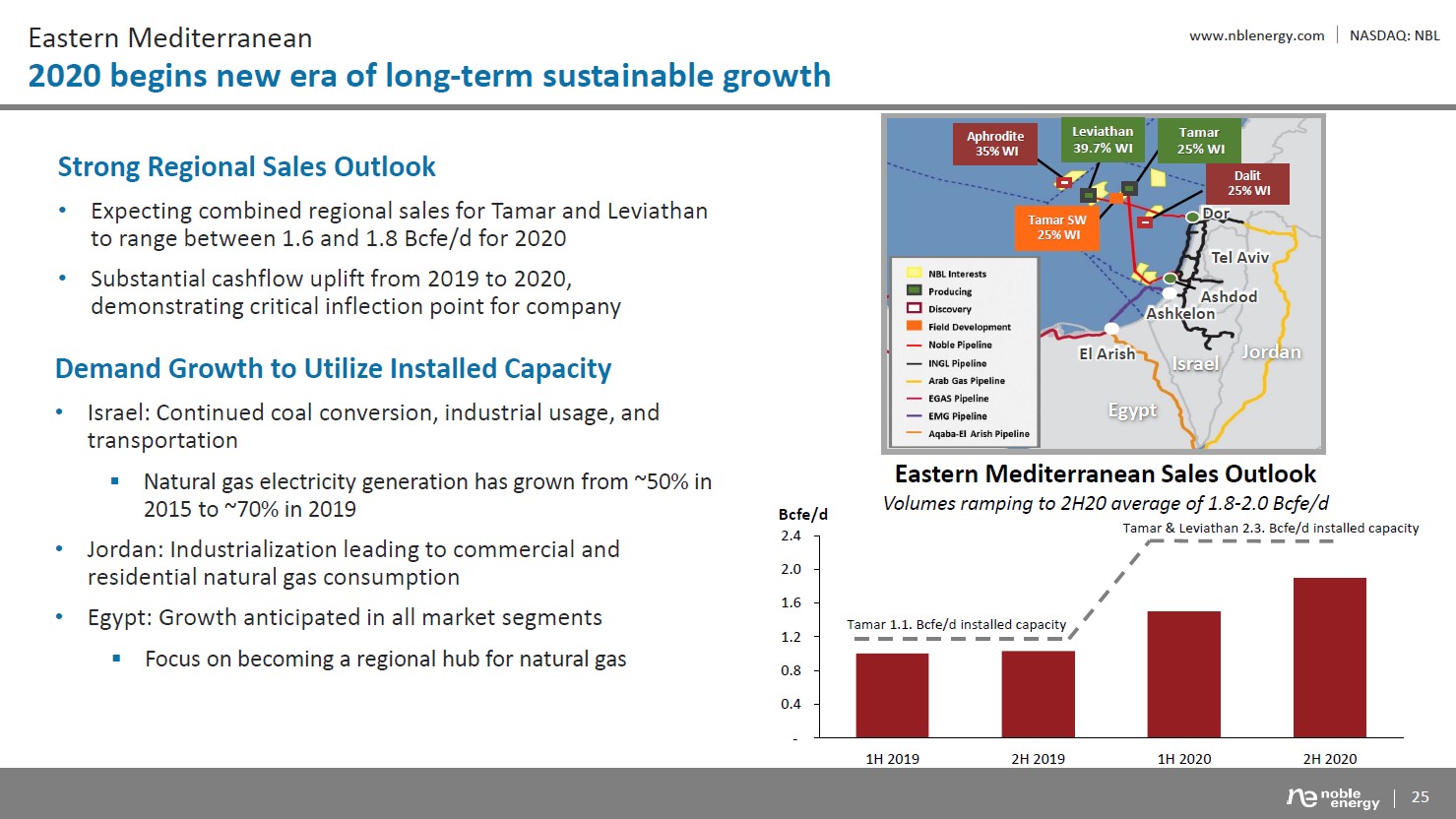

There remains an enormous amount of room for upside in this region that could be unlocked by expanding the output capacity at producing fields and by developing other offshore gas fields in the area (like the Aphrodite and Dalit discoveries, which are not producing fields as things stand today). In the upcoming graphic down below, Noble Energy highlights its asset base and near-term goals in the area.

Image Shown: An overview of Noble Energy’s Mediterranean operations and its near-term production outlook in the East Mediterranean region. Image Source: Noble Energy – March 2020 Investor Handout

Please note that there are serious geopolitical considerations, especially for resources in Cypriot waters (such as the Aphrodite discovery), as Turkey and Cyprus are at odds over resource development in this region (due to a longstanding territorial dispute). Additionally, Turkey and Greece are at odds over offshore resource development in the region as well (relating to the dispute between Cyprus and Turkey, with Cyprus and Greece being close allies). In response to Turkey very recently sending over a seismic research vessel into contested waters supported by warships, France is beefing up its military presence in the Eastern Mediterranean region to help out Greece, which scrambled its own navy to rebuff Turkey’s incursion into its and Cyprus’ territory according to the WSJ (France explicitly called out Turkey and intends on supporting Greece’s sovereignty).

The Tamar and Leviathan fields are home to vast amounts of low cost natural gas supplies and the financial performance of these assets are well suited to ride out the storm. Israel, Jordan, and Egypt are the three main markets Noble Energy and its partners have focused on as it relates to finding end natural gas demand, and that will likely stay the same when Chevron takes over. Please note Noble Energy owns a ~40% working interest in the Leviathan field and a 25% working interest in the Tamar field, as Israeli regulations forced the company to sell down its stake in these assets to reduce potential anti-competitive threats to the Israeli economy (that process was completed a couple of years ago). Israel’s Energy Minister Yuval Steinitz has recently signaled that he supports Chevron taking over Noble Energy’s local assets.

Natural gas produced from the offshore Tamar and Leviathan fields are sold under long-term contracts and delivered by pipelines, including the Arab Gas Pipeline and the EMG Pipeline, which deliver natural gas supplies to customers in Egypt and Jordan. Customers in Israel receive natural gas supplies through the Israel Natural Gas Lines (‘INGL’) Network. For reference, a network of subsea pipelines connects the offshore production facilities with onshore transmission and distribution pipeline networks. Please note Noble Energy acquired an equity stake in the Eastern Mediterranean Gas Company S.A.E that owns the EMG Pipeline back in November 2019 to support its growth efforts in the region.

Natural gas sales to Egypt and Jordan from the two producing offshore fields have already begun, though we would like to stress that should geopolitical tensions flare up between Israel and its neighbors, it is possible things well beyond Noble Energy’s (and soon Chevron’s) control will prevent those sales from occurring. However, everything has been moving in the right direction (more or less) as it relates to regional economic ties and the development of these offshore natural gas resources over the past few years.

On August 13, Israel and the United Arab Emirates announced the initiation of formal diplomatic relations between the two countries, marking a historic turning point in Israeli-Gulf Arab state relations. Going forward, it appears there could be greater geopolitical risk to Chevron’s future assets in the area from tensions between Turkey and Greece/Cyprus (the aforementioned offshore resource development disputes) than from other geopolitical dynamics in the region (particularly the state of relations between Gulf Arab states and Israel given recent events). Israel currently has formal diplomatic relations with Jordan and Egypt as well.

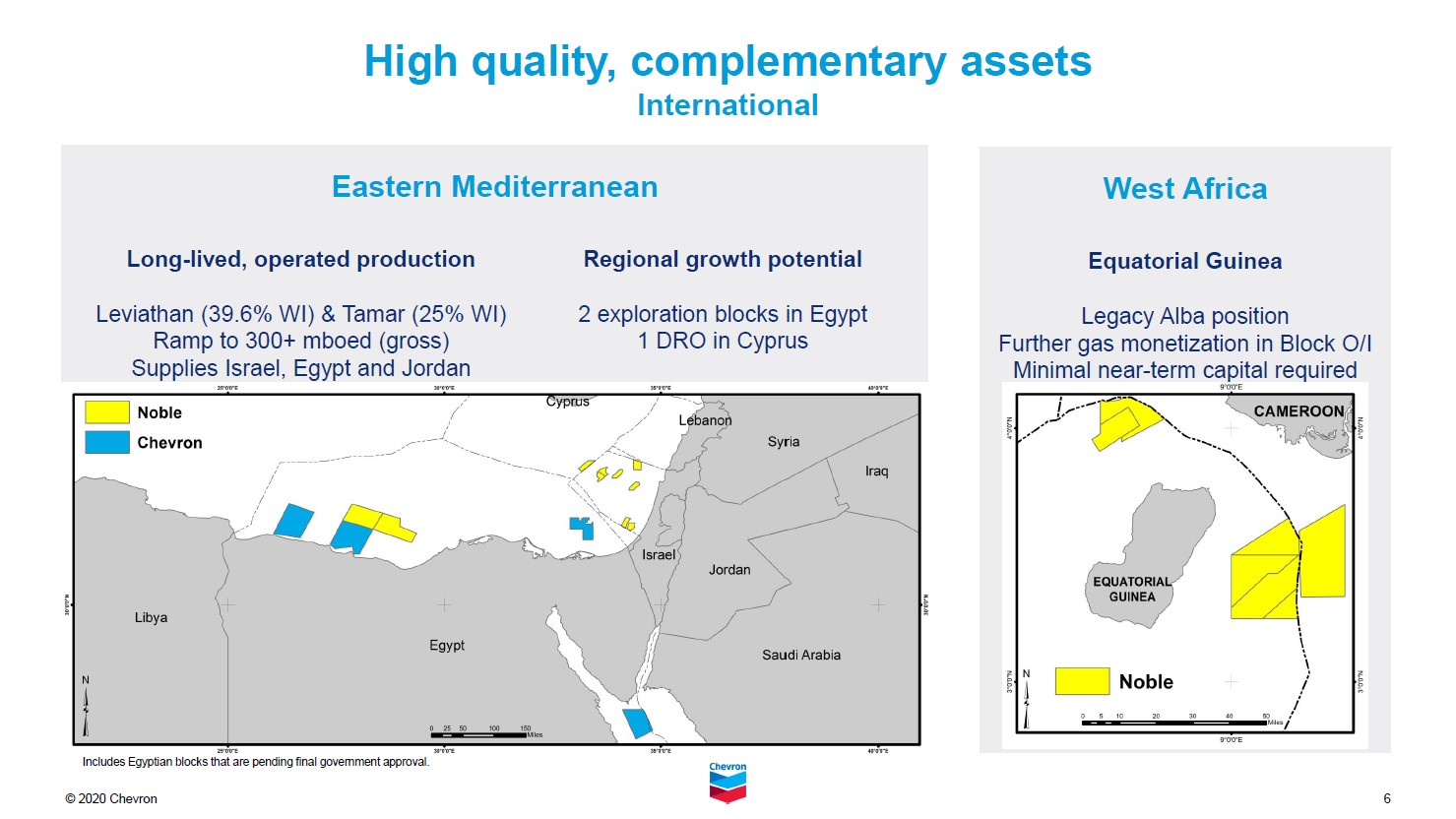

As you can see in the upcoming graphic down below, Chevron and Noble Energy both have offshore exploration blocks in Egypt. When the deal closes, Chevron may allocate significantly more resources towards exploring for additional raw energy resources in the East Mediterranean region given its enlarged footprint. Several major energy companies including Italy’s Eni SpA (E), which discovered the massive offshore Zohr natural gas field, have located meaningful raw energy resources off the Egypt’s Mediterranean coast in recent years indicating there is reason to be optimistic as it concerns future exploration endeavors in the region. BP plc (BP) has also struck it big in Egypt’s offshore natural gas space in recent years.

Image Shown: An overview of Noble Energy’s East Mediterranean and West African operations. Image Source: Chevron – July 2020 Noble Energy Acquisition Presentation

As an aside, Chevron is also acquiring Noble Energy’s assets in Equatorial Guinea which includes upstream and some downstream operations (such as an equity stake in a methanol plant). These are not growth assets, but they are meaningful cash flow generators and in the short-term, do not require significant capital investment. It is likely Chevron will retain Noble Energy’s West African operations for the time being, though Chevron’s asset base in the region is centered around Nigeria. There might be room for some synergies here, particularly as it relates to exporting activities. Additionally, Noble Energy owns various other international assets, such as exploration blocks in Colombia and in Cameron (near Equatorial Guinea).

US Asset Overview

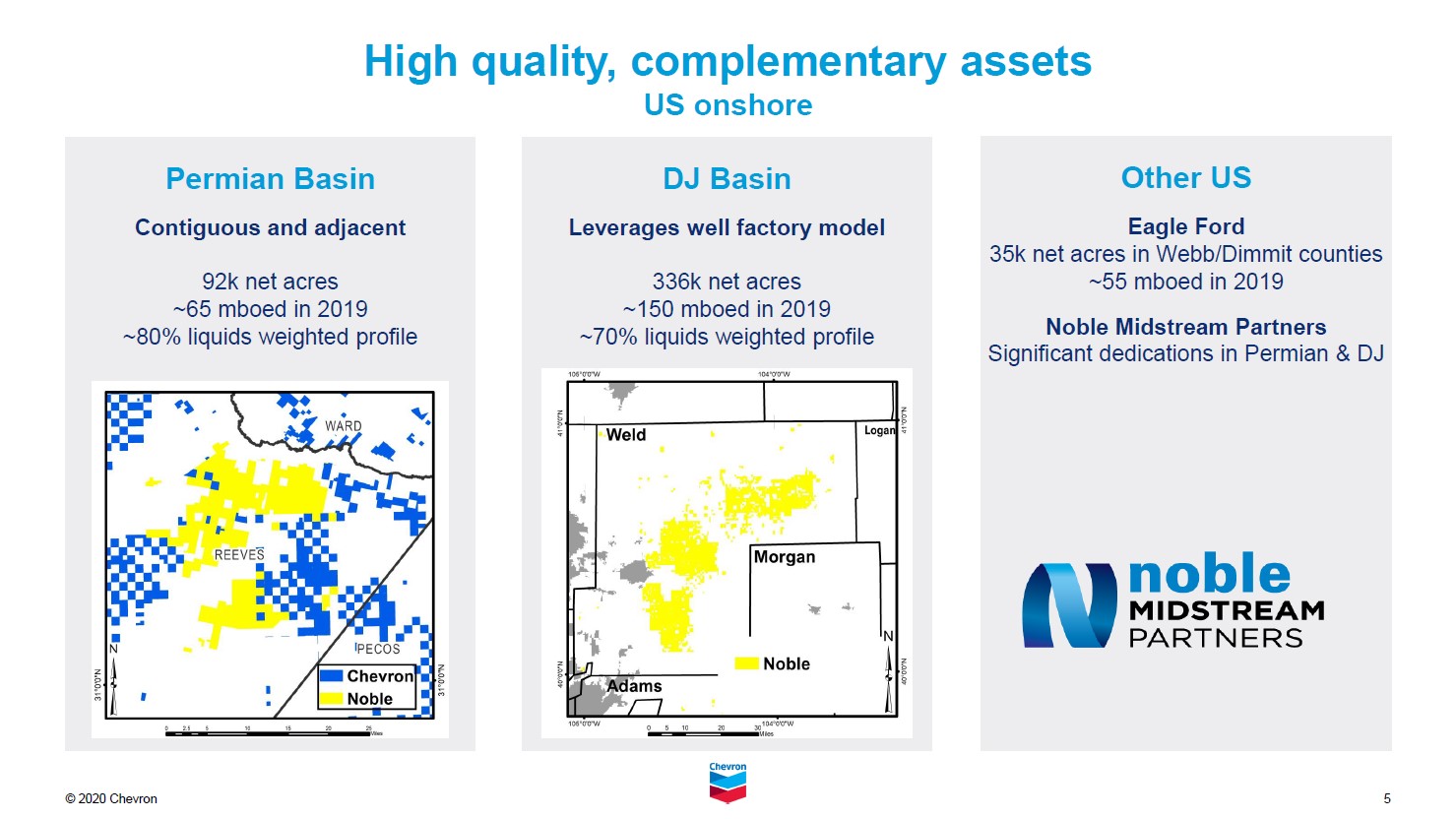

Noble Energy also operates in the Permian Basin which stretches across Southeastern New Mexico and West Texas. In this region, hydraulic fracturing and horizontal drilling techniques (known as “fracking”) are utilized during upstream operations to unlock vast amounts of raw energy resources from shale, sandstone, and other geological formations deep underground. Chevron has been aggressively developing its Permian Basin position over the past few years, though more recently it has reduced development activity in the region due to the ongoing coronavirus (‘COVID-19’) pandemic weighing negatively on raw energy resources pricing.

As you can see in the upcoming graphic down below, Noble Energy’s acreage position in the Permian Basin (in Reeves County, Texas) is located either near or adjacent to Chevron’s existing position. The bolt-on nature of the acreage makes it ideal for Chevron due to the numerous operational synergies (centralized development plans, centralized midstream infrastructure) Chevron will likely want to retain and eventually develop these assets as the Permian Basin represents a core part of its upstream strategy. However, Noble Energy’s position in the Denver-Julesburg Basin (‘DJ Basin’) in Colorado and its position in the Eagle Ford in South Texas does not really fit in with its long-term upstream strategy, and those assets are less likely to get developed (in a meaningful way) in the medium-term.

Image Shown: A look at the domestic onshore upstream assets Chevron will take on by buying Noble Energy. Image Source: Chevron – July 2020 Noble Energy Acquisition Presentation

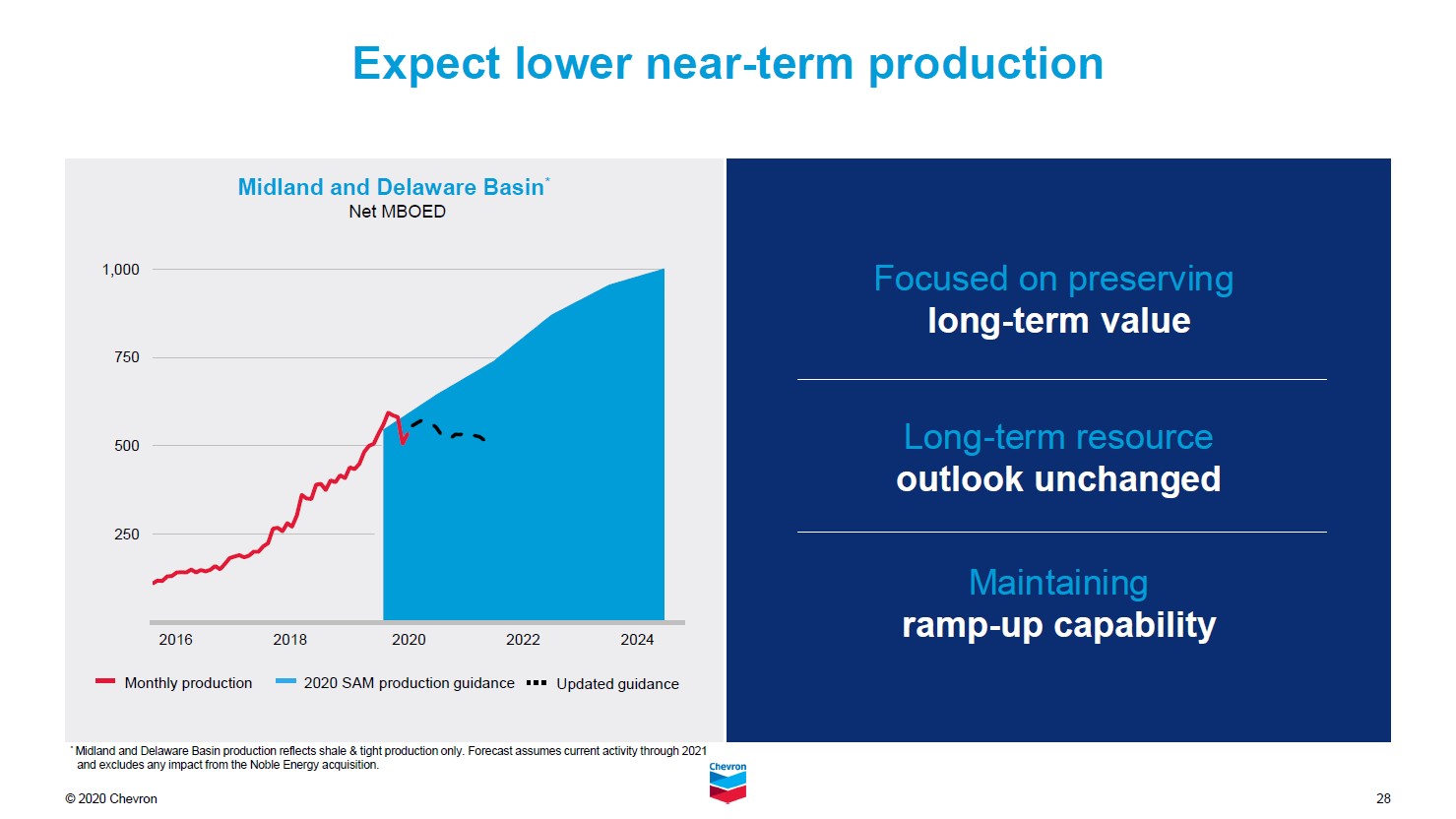

In the upcoming graphic down below, Chevron highlights the significant upstream production growth it has generated in the Permian Basin since 2015-2016, a product of the large capital expenditure budgets Chevron allocated to the region. Due to the pandemic-related downturn in raw energy resources pricing, Chevron is scaling back and that included cutting its 2020 capital expenditure budget significantly (bringing it down to as low as $14.0 billion as of May 2020, though that target may change going forward given that it has changed at least twice so far this year). Due to the steep production decline rates seen at fracked wells (~50-80% in the first year alone), Chevron’s upstream Permian Basin output is expected to move lower in the medium-term as less drilled but uncompleted (‘DUC’) well locations are turned online.

Image Shown: Though Chevron is reducing its upstream development activity in the Permian Basin in the medium-term, the region remains a key part of its long-term upstream strategy. Image Source: Chevron – July 2020 Investor Presentation

As it relates to the other onshore assets in the US Chevron is acquiring from Noble Energy, we would not be surprised to sell those operations get sold off in the next few years. Regulatory hurdles have been steadily growing in Colorado for years, and the Eagle Ford is considered a “mature” unconventional upstream play, meaning many of the best well locations have likely already been developed.

Chevron also acquired Noble Energy’s stake in its midstream spinoff, Noble Midstream Partners LP (NBLX). This midstream spinoff operates in the DJ Basin and the Permian Basin within the US. As of November 2019, Noble Energy owned 63% of Noble Midstream Partners’ outstanding equity, and through a transaction completed last year, Noble Midstream Partners eliminated its incentive distribution rights (‘IDRs’). What Chevron intends to do with its stake in Noble Midstream is far from clear. Chevron will also own Noble Midstream Partners’ general partner and will be in complete operational control of the company.

There is a small chance Chevron could rollup Noble Midstream Partners by acquiring the remaining outstanding equity once the deal closes, though that is far from likely given the cash requirements of doing so (and the net debt Chevron would take on, though please note Chevron will likely consolidate its financials with Noble Midstream Partners when the deal closes given the controlling stake it will have in the company). Many analysts see Chevron possibly attempting to sell off that stake (and remove the net debt recourse to the midstream spinoff from its balance sheet), though attempts to do similar transactions at Chevron’s peers have not been successful. For reference, Noble Midstream Partners had $1.6 billion in net debt at the end of June 2020.

Divesting Chevron’s stake in Noble Midstream Partners (at a decent price) would be no easy task. As Occidental Petroleum Corporation (OXY) found out with its interest in Western Midstream Partners LP (WES) (another midstream spinoff) acquired through its purchase of Anadarko Petroleum last year, there are not many buyers out there. Occidental Petroleum has accepted it will need to slowly sell off its stake in Western Midstream, likely at subdued prices given the weak technical performance of shares of WES since late-2019. Chevron may simply choose to hold onto its equity stake in Noble Midstream Partners for now, along with the general partnership.

Concluding Thoughts

Shareholders of Noble Energy are not receiving a large premium from this deal, though there are not many buyers in the oil & gas industry right now and that is likely to remain the case for some time. Given Noble Energy’s existing net debt load, Chevron opted to use equity to buy into the Eastern Mediterranean region to limit the amount of leverage taken on by pursuing this deal. For Chevron, the cost savings combined with the potential exploration and production upside (particularly in the Mediterranean) makes this a favorable deal from its perspective, though for Noble Energy, the deal offers little relief to long-term shareholders given the precipitous drop in Noble Energy’s stock price since the start of 2020.

-----

Oil & Gas (Majors Industry) – BP CVX COP XOM RDS.A RDS.B TOT

Independent Oil & Gas Industry – APA COG CLR DVN EOG MRO OXY PXD

Industrial Minerals - ARLP, CCJ, CNX, HCR, NRP

Refining Industry – HES HFC MPC PSX VLO

Oil & Gas Pipeline Industry – ENB ET EPD KMI MMP

Energy Equipment & Services (Large) Industry – BKR HAL NBR NOV SLB FTI SI

Related: NBL, NBLX, EUSO, BNO, UNG, ARMCO, XLE, XOP, VDE, AMLP, AMZA, HYG, JNK, LQD, WLL, KRE, KBE, PBR, EQNR, FM, GULF, EWW, NORW, EWC, SPY, KSA, ERUS, UAE, EWZ, CVE, OIH, CRAK, MCO, SPGI, WES

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Kinder Morgan Inc (KMI) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Enterprise Products Partners L.P. (EPD) and Magellan Midstream Partners L.P. (MMP) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Both the simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios include a SPDR S&P 500 ETF Trust (SPY) put option holding with a $295 per share strike price that expire on August 21, 2020. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment