Nvidia’s Shares Could Run Higher Even More!

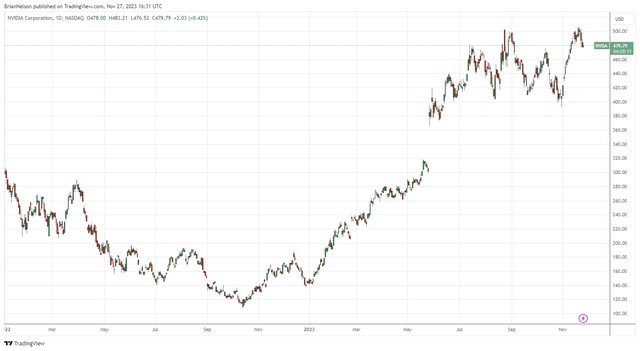

Image: Nvidia has been a market darling, and the firm's equity looks to have further upside potential on the basis of our valuation.

By Brian Nelson, CFA

On November 21, market darling Nvidia Corp. (NVDA) reported excellent fiscal third quarter results for the period ending October 29 that showcased the power behind the revolution in artificial intelligence. The company’s revenue hit a record, advancing more than three-fold on a year-over-year basis thanks to strength in its Data Center business. Its non-GAAP earnings were up six-fold from the year-ago period, and the firm continues to haul in tremendous free cash flow. We’ve raised our fair value estimate of Nvidia to $606 per share, and we think the company’s shares could continue to run higher.

Here’s what CEO Jensen Huang had to say in the press release:

Our strong growth reflects the broad industry platform transition from general-purpose to accelerated computing and generative AI…Large language model startups, consumer internet companies and global cloud service providers were the first movers, and the next waves are starting to build. Nations and regional CSPs are investing in AI clouds to serve local demand, enterprise software companies are adding AI copilots and assistants to their platforms, and enterprises are creating custom AI to automate the world’s largest industries…NVIDIA GPUs, CPUs, networking, AI foundry services and NVIDIA AI Enterprise software are all growth engines in full throttle. The era of generative AI is taking off.”

The company’s outlook for the fourth quarter of its fiscal year calls for revenue of $20 billion (+/- 2%), while non-GAAP margins are targeted in the range of 75.5% (+/- 50 basis points). Nvidia continues to generate strong levels of profitability as sales continue to ramp. Nvidia holds a robust net cash position on its balance sheet, with the firm ending the quarter with $18.3 billion in cash and ~$1.2 billion and ~$8.5 billion in short- and long-term debt, respectively. Through the first nine months of its fiscal year, free cash flow totaled ~$15.8 billion, up from ~$2.1 billion in the year-ago period. Nvidia is a net-cash-rich, free-cash-flow generating secular growth powerhouse--the kind of business we like in the current market environment.

Please select the image below to download its 16-page stock report.

----------

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, RSP, QQQ, and SCHG. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and range.

0 Comments Posted Leave a comment