Nvidia Bets Big on Data Centers

Image Source: Nvidia Corporation – 2020 Annual Meeting of Stockholders Presentation

By Callum Turcan

On August 19, Nvidia Corporation (NVDA) reported second quarter fiscal 2021 earnings (period ended July 26, 2020) that beat consensus top-line estimates (on a GAAP basis) and consensus bottom-line estimates (on a non-GAAP basis, as its GAAP earnings were slightly lower than consensus estimates). Nvidia has several things going for it including a pristine balance sheet (meaning a net cash position), a data center business that is growing at a brisk pace (which we will cover in this note), a high quality cash flow profile (relatively low capital expenditure requirements to generate meaningful revenues), and its outlook is supported by secular growth tailwinds, particularly as it relates to demand from cloud computing providers. Shares of NVDA yield a negligible ~0.1% as of this writing.

Operations Overview

Please note Nvidia closed its acquisition of Mellanox Technologies in April 2020, which was a deal worth ~$6.9 billion by enterprise value at the time it was announced last calendar year. Mellanox “is a leading supplier of end-to-end Ethernet and InfiniBand smart interconnect solutions and services for servers and storage” and primarily caters to data centers, a space Nvidia has had plenty of success with recently. In the fiscal second quarter, Nvidia’s ‘data center’ revenue was up 54% on a sequential basis and 167% versus the same period last fiscal year. For reference, in the fiscal first quarter (period ended April 26, 2020), Nvidia’s data center revenue was up 18% sequentially and 80% on a year-over-year basis. Please note that was before the Mellanox deal closed.

The ongoing coronavirus (‘COVID-19’) pandemic has seen demand for video streaming services and cloud-oriented offerings surge as households stay home and many employees shift towards working remotely. School activities, in some regions, are now being conducted online and at home as part of broader quarantine efforts. These dynamics are driving up data demand and ultimately the need for more data centers and additional servers at existing data centers. Nvidia was well-positioned to capitalize on this trend before the Mellanox deal, and now that the acquisition has closed, Nvidia’s long-term outlook has significantly improved.

Nvidia’s ‘gaming’ revenue grew by 24% on a sequential basis and 26% on a year-over-year basis in the fiscal second quarter as certain households turned to video games to keep themselves entertained while others purchased equipment to do school work at home. Please note that last fiscal quarter, Nvidia’s data center segment generated $1.75 billion in revenue while its gaming segment generated $1.65 billion in revenue, which combined represented most of its sales during the period (about 88% of its GAAP revenues, which came in just below $3.9 billion). Though Nvidia is often though of as a company that designs graphic cards for higher end laptops and desktops, going forward, data centers are going to play a big role in its financial performance.

Financial Overview

During the first half of fiscal 2021, Nvidia generated $6.9 billion in GAAP revenues (up 45% year-over-year), $4.3 billion in GAAP gross profit (up 51% year-over-year), $1.6 billion in GAAP operating income (up 75% year-over-year), and $1.5 billion in GAAP net income (up 63% year-over-year). We strongly appreciate Nvidia’s expanding gross and operating margins, a product of its growing data center sales and declining ‘automotive’ sales according to management, further supported by its increasing economies of scale (particularly as it relates to its operating margin). Nvidia’s automotive unit is facing headwinds from declining global auto sales due to COVID-19 and the related slowdown in economic activity.

To fund the purchase of Mellanox, Nvidia tapped debt markets and utilized cash on hand. At the end of the fiscal second quarter, Nvidia had $11.0 billion in cash, cash equivalents, and marketable securities on hand, up ~$0.1 billion from the end of fiscal 2020 (period ended January 26, 2020). That was stacked up against $7.0 billion in long-term debt and no short-term debt on the books at the end of this period (Nvidia’s total debt load grew by ~$5.0 versus year-end fiscal 2020 levels). Nvidia suspended its share repurchases after announcing the Mellanox deal to cover the acquisition cost while maintaining its pristine balance sheet, which we appreciate.

Even after the Mellanox deal closed, Nvidia maintained its net cash position. We are strong believers that companies with net cash positions are far better positioned to ride out the storm caused by COVID-19 and are more likely to offer investors meaningful capital appreciation upside. Nvidia’s management team runs a tight ship as it relates to capital allocation strategies, and that has served the company well so far.

Nvidia generated $2.5 billion in net operating cash flow during the first half of 2021 and spent just $0.4 billion on its capital expenditures, allowing for $2.1 billion in free cash flow. The firm spent $0.2 billion during this period covering its dividend obligations and did not repurchase a meaningful amount of its common stock. As Nvidia’s capital allocation policy prioritizes growth at the company over dividends, its dividend obligations are quite modest. For dividend investors, Nvidia’s yield is lackluster to say the least, though we are optimistic its payout will grow significantly over time (albeit off a low base). Nvidia’s outstanding diluted share count on a weighted-average basis grew by a little under 2% year-over-year in the fiscal second quarter due primarily to material stock-based compensation expenses.

Outlook

During Nvidia’s latest earnings call, the firm’s CFO Colette Kress had this to say about Nvidia’s near-term outlook:

“With that, let me turn to the outlook for the third quarter of fiscal 2021. We expect revenue to be $4.4 billion, plus or minus 2%. With that, we expect gaming to be up just over 25% sequentially, with data center to be up in the low to mid-single digits sequentially. We expect both [professional visualization] and [automotive] to be at similar levels out in Q2.”

Though Nvidia expects revenue at its ‘profession visualization’ and automotive segments will be broadly flat sequentially during the firm’s current fiscal quarter, please note those segments represented just $0.3 billion in sales combined last fiscal quarter. Considering management is targeting meaningful growth at both Nvidia’s data center and gaming segments this fiscal quarter, we are optimistic on Nvidia’s near-term growth outlook. Longer term, Nvidia’s growth trajectory is underpinned by secular growth tailwinds as greater cloud adoption drives demand for data centers higher. Here is what Nvidia’s CFO had to say about the firm’s data center operations during its latest earnings call (emphasis added):

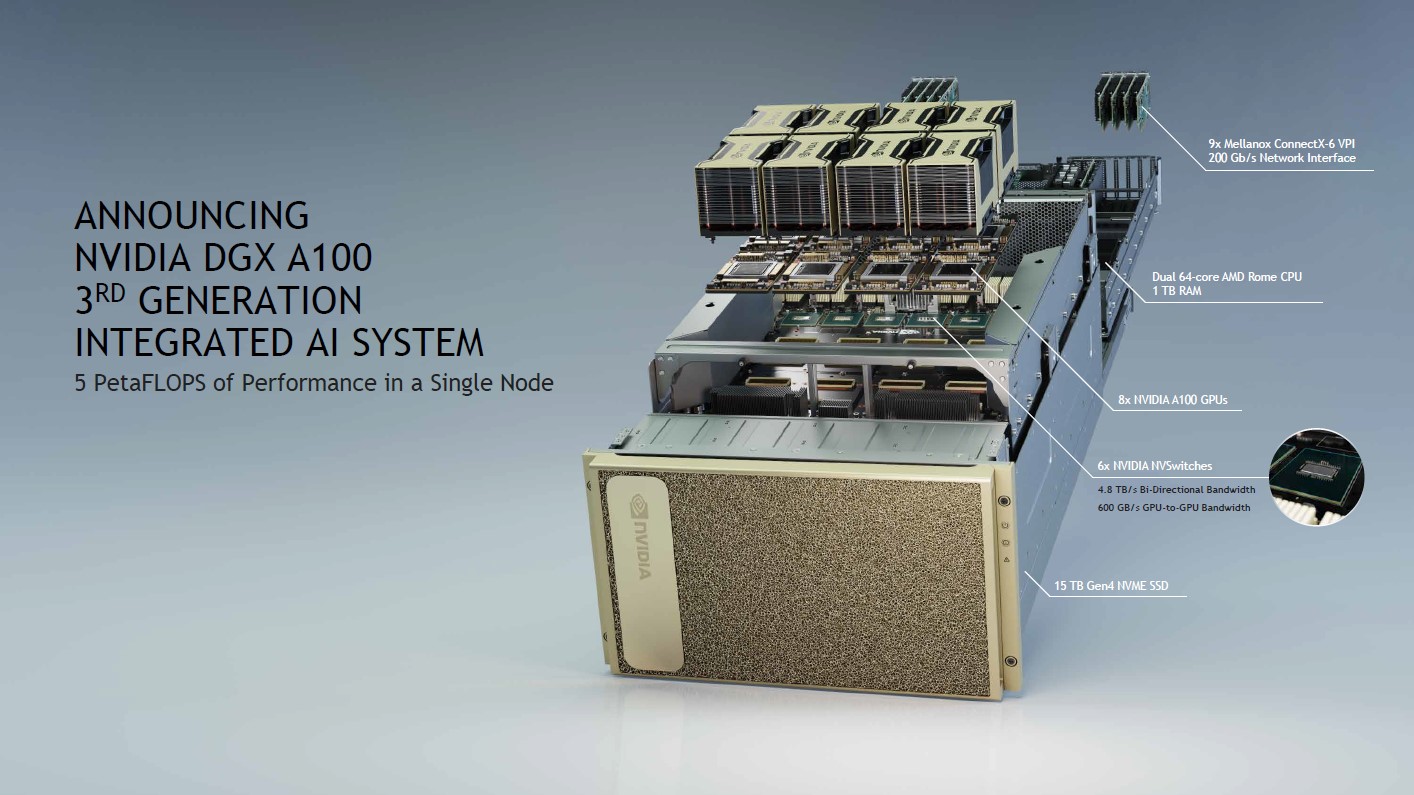

“Moving to data center, data center is a diverse, consist of cloud service providers, public cloud providers, supercomputing centers, enterprises, telecom and industrial edge. Q2 revenue was a record $1.75 billion, up 167% year-on-year and up 54% sequentially. In Q2, we incorporated a full quarter of contribution from the Mellanox acquisition, which closed on April 27, the first day of our quarter. Mellanox contributed approximately 14% of company revenue and just over 30% of data center revenue. Both compute and networking within data center set a record with accelerating year-on-year growth. The biggest news in data center this quarter was the launch of our Ampere architecture. We are very proud of the team’s execution in launching and ramping this technological marvel especially amid the pandemic…

The first Ampere GPU, A100, has been widely adopted by all major server vendors and cloud service providers. Google Cloud (GOOG) (GOOGL) platform was the first cloud customer to bring it to market making it the fastest GPU to come to the cloud in our history. And just this morning, Microsoft (MSFT) Azure announced the availability of massively scalable AI clusters, which are based on the A100 and interconnected with 200-gigabyte-per-second Mellanox InfiniBand networking.

A100 is also getting incorporated into offerings from AWS (AMZN), Alibaba (BABA) Cloud, Baidu (BIDU) Cloud and Tencent (TCEHY) Cloud. And we announced that the A100 is going to market with more than 50 servers from leading vendors around the world, including Cisco (CSCO), Dell (DELL), Hewlett-Packard Enterprise (HPE) and Lenovo (LNVGY). Adoption of the A100 into leading server makers offerings is faster than any prior launch, with 30 systems expected this summer and over 40 more by the end of the year.”

We are intrigued by Nvidia’s push into artificial intelligence (‘AI’), and those interested can read more about Nvidia Jarvis, “a fully accelerated application framework for building multimodal conversational AI services that use an end-to-end deep learning pipeline,” by clicking this link here. During Nvidia’s conference call its CFO noted that the firm’s “A100 [offering] delivers NVIDIA’s greatest generational leap ever, boosting AI performance by 20x over its predecessor. It is also our first universal accelerator unifying AI training and inference and powering workloads, such as data analytics, scientific computing, genomics, edge video analytics, 5G services and graphics.” Nvidia’s success in this space helps differentiate its offerings from its competitors.

Concluding Thoughts

Nvidia’s stock price had more than doubled year-to-date as of the market close on August 20, and as of this writing, NVDA is trading well above the top end of our fair value estimate range. Investors clearly like its pristine balance sheet, high quality cash flow profile, and promising growth outlook. We like the company but see shares of NVDA as generously valued as of this writing, even when assuming strong mid-cycle growth rates.

Should shares of NVDA pull back meaningfully, we would take a closer look at the firm. Some companies are worth paying up for as we noted in our August 20 article that highlighted recent newsletter portfolio changes (members are strongly encouraged to check out that note by clicking this link here), though we caution that Nvidia faces significant competition from well-funded peers.

----

Broad Line Semiconductor Industry – AMD AVGO FSLR INTC TXN

Computer Hardware Industry – AAPL BB HPQ IBM TDC

Communications Equipment Industry – CSCO JNPR KN NOK SMCI

Internet Content & Services Industry – GOOG GOOGL BIDU FB JD TCEHY TWTR

Internet Content and Catalog Retail Industry – BABA AMZN BKNG EBAY EXPE GRPN IAC OSTK QRTEA STMP

Integrated Circuits Industry – ADI MCHP MRVL NVDA SWKS TSM XLNX

Semiconductor Equipment Industry – AMAT CREE IPGP KLAC LRCX MKSI SNPS TER

Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM

Related: DELL, HPE, LNVGY, SCWX, SPY

Other: VLUE, SMH, FTXL, SOXX, TDIV, DEEP, JHMT

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO), Intel Corporation (INTC), and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Alphabet Inc (GOOG) Class C shares and Facebook Inc (FB) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment