Microsoft Closes Out Fiscal 2020

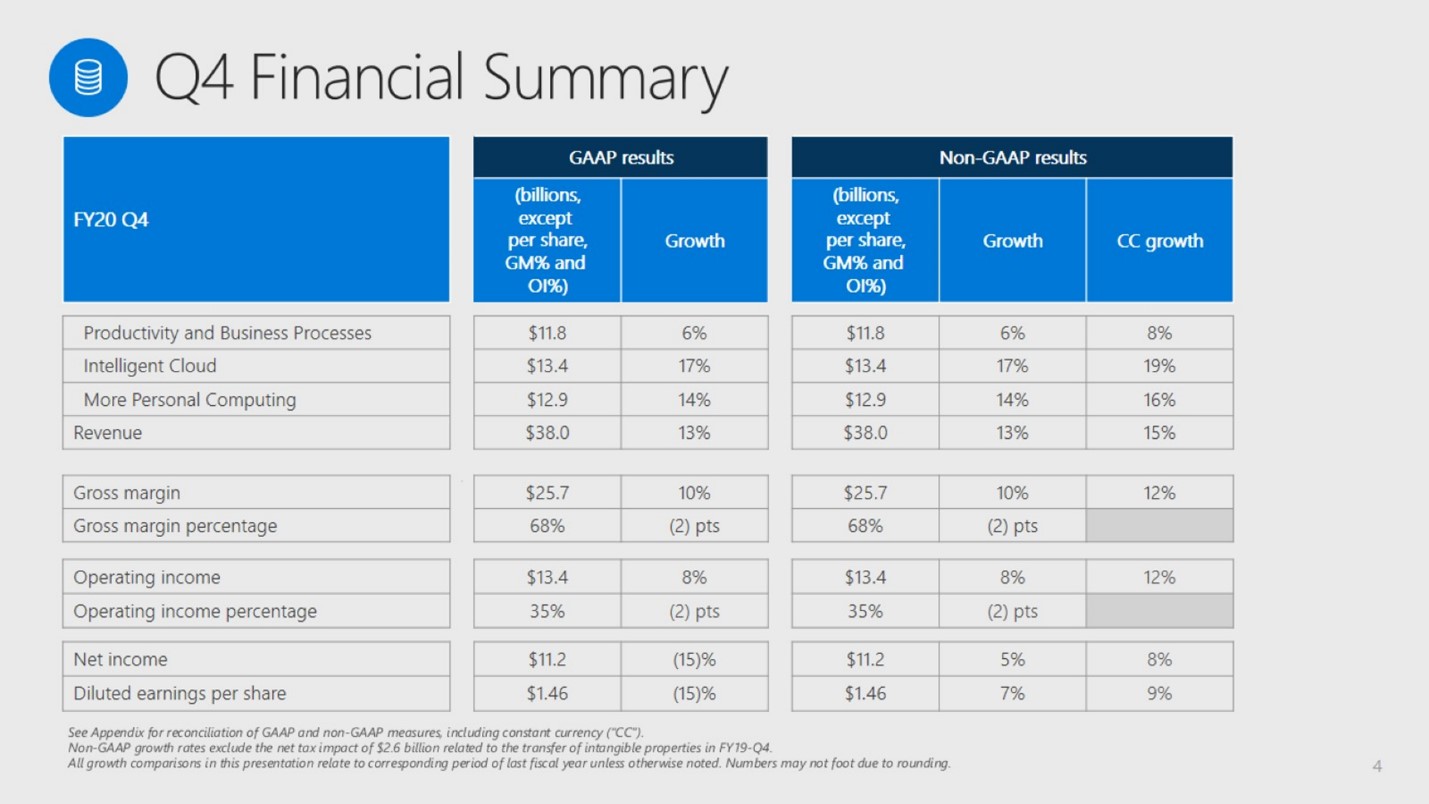

Image Shown: An overview of Microsoft Corporation’s financial performance during the fourth quarter of fiscal 2020. The company reported strong year-over-year revenue growth across its three main business segments. Image Source: Microsoft Corporation – Fourth Quarter Fiscal 2020 Earnings PowerPoint Presentation

By Callum Turcan

On June 12, 2020 (link here), we added Microsoft Corporation (MSFT) back to the Best Ideas Newsletter and the Dividend Growth Newsletter portfolios. We strongly appreciate Microsoft’s net cash position, high quality cash flow profile, and its long-term outlook, which is underpinned by secular growth tailwinds. On July 22, Microsoft posted fourth quarter fiscal 2020 (period ended June 30, 2020) that beat both consensus top- and bottom-line estimates, though its guidance for the current fiscal quarter was lighter than what analysts had expected.

The top end of our fair value estimate range for Microsoft sits at $234 per share, indicating shares of MSFT have room to run further still after climbing ~34% year-to-date as of the end of normal trading hours on July 22 (before taking dividend considerations into account). Additionally, we give Microsoft “EXCELLENT” Dividend Growth and Dividend Safety ratings due to its promising payout growth outlook and stellar Dividend Cushion ratio of 3.9 (which factors in annual double-digit per share dividend increases over the coming fiscal years). Shares of MSFT yield ~1.0% as of this writing.

Earnings Overview

In the fiscal fourth quarter, Microsoft’s GAAP revenues climbed higher by 13% year-over-year assisted by strong growth at its ‘Azure’ (cloud computing), ‘Xbox content and services’ (entertainment), and ‘Dynamics 365’ (enterprise resource planning and customer relationship management) units. Decent revenue growth enabled Microsoft to grow its GAAP operating income by 8% year-over-year last fiscal quarter, which was held down by a $450 million special charge relating to the firm shutting all of its Microsoft Store physical retail locations (a move announced June 26). The company’s margins were also negatively impacted by the firm offering flexible financing operations to some of its customers, an unfavorable sales mix, and major cloud computing investments last fiscal quarter.

Microsoft’s GAAP revenue and GAAP operating income for all of fiscal 2020 was up 14% and 23% year-over-year, respectively, due primarily to strong performance at its cloud computing and productivity offerings. In fiscal 2020, Microsoft generated $45.2 billion in free cash flow while spending $15.1 billion covering its dividend obligations and $23.0 billion repurchasing its common stock. The firm exited fiscal 2020 with a net cash position of $73.2 billion inclusive of $3.7 billion in short-term debt. Microsoft’s pristine balance sheet and top notch cash flow profile lends a tremendous amount of support during these harrowing times.

Cost Structure Rationalizations

The firm has performed relatively well in the face of the ongoing coronavirus (‘COVID-19’) pandemic overall, though some of its segments have been hit harder than others. For example, Microsoft’s ‘search advertising revenues excluding traffic acquisition costs’ were down 17% year-over-year on a constant currency basis last fiscal quarter. Management is making some modest changes to Microsoft’s cost structure to adjust.

Reportedly, Microsoft is trimming some of its workforce across the board and some of the planned reductions are coming from its LinkedIn operations (LinkedIn announced it would eliminate ~960 jobs or roughly 6% of its workforce on July 20). Microsoft announced it would acquire LinkedIn through a transaction valued at $26.2 billion back in June 2016 (the deal closed in the December of that calendar year). Also, Microsoft is reportedly reducing some of its MSN workforce as well by automating certain tasks.

Management Commentary

During prepared remarks, Microsoft’s management team had plenty to say about the firm’s high-flying Dynamics 365 segment (which posted 40% year-over-year revenue growth on a constant-currency basis last fiscal quarter):

Dynamics 365 is helping organizations in every industry digitize their end to end business operations – from sales and customer service to supply chain management – so they can rapidly adapt to changing market conditions. Customer Insights is the fastest-growing Dynamics 365 application ever, helping organizations like Walgreens Boots Alliance (WBA) and Chipotle (CMG) offer more personalized customer experiences. BNY Mellon (BK) chose Dynamics 365 this quarter to help investment managers build stronger relationships with their customers.

More than 4,500 organizations now use Dynamics 365 Commerce, Finance, and Supply Chain Management, making it one of the fastest growing SaaS [Software-as-a-Service] solutions in its category. FedEx (FDX), for example, uses Dynamics 365 to drive more precise logistics and inventory management.

In retail, Dynamics 365 Connected Store now offers in-store traffic analytics and curbside pickup, prioritizing safety as stores reopen. And we continue to invest in solutions to protect merchants as they process more online transactions. New account protection and loss prevention features in Dynamics 365 Fraud Protection help protect online revenue, and we are working with financial services firms, like Capital One (COF), to improve fraud detection and keep customers secure.

Microsoft is not a dusty old tech dinosaur. Microsoft is a cutting-edge, innovation-oriented, free cash flow generating machine. Its cloud computing unit Azure posted 50% year-over-year revenue growth on a constant-currency basis while its cloud-oriented Office 365 Commercial unit posted 22% year-over-year revenue growth on a constant currency basis last fiscal quarter. We appreciate the strong sales growth performance of Microsoft’s leading offerings across the board, especially in the face of a global pandemic. Management noted that Microsoft’s commercial cloud gross margin improved modestly last fiscal quarter, and margin expansion was expected to continue at this unit this fiscal quarter due to an accounting estimate change (the useful life of cloud computing-related server and networking equipment has been extended to four years from three years starting fiscal 2021).

While Microsoft’s year-over-year revenue growth rate largely slowed down last fiscal quarter from fiscal third quarter levels (including at its Dynamics 365, Azure, and Office 365 Commercial units), the company’s growth trajectory more or less stayed intact. Initial after hours trading action on July 22 could be viewed as an indication that investors were not impressed with Microsoft’s performance (as shares of MSFT were down ~2%), though we will stress here that shares of MSFT are up sharply year-to-date, meaning investors had already priced in strong fundamental performance heading into this earnings report.

Concluding Thoughts

We continue to like Microsoft in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Though its guidance for the first quarter of fiscal 2021 came in lighter than expected, we remain very optimistic on Microsoft’s outlook as we view its business model as well-positioned to cater to the needs created by the pandemic (e.g. Microsoft Teams allowing employees and managers to communicate and work together from home). Its strong cash flow profile and pristine balance sheet provide Microsoft with plenty of financial firepower to ride out the storm.

----

Broad Line Semiconductor Industry – AMD AVGO FSLR INTC TXN

Computer Hardware Industry – AAPL BB HPQ IBM TDC

Communications Equipment Industry – CSCO JNPR KN NOK SMCI

Integrated Circuits Industry – ADI MCHP MRVL NVDA SWKS TSM XLNX

Semiconductor Equipment Industry – AMAT CREE IPGP KLAC LRCX MKSI SNPS TER

Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM

Related: SCWX, SPY, TDIV, WBA, BK, CMG, COF, FDX

Other: XLK, IYW, VGT, FTEC, IXN, IETC, IWY, STLG, MGK, QYLD, USXF, NUSI

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO), Intel Corporation (INTC), and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Oracle Corporation is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Both the simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios include a SPDR S&P 500 ETF Trust (SPY) put option holding with a $295 per share strike price that expire on August 21, 2020. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment