Microsoft Boosts Its Dividend and Announces a New Strategic Partnership

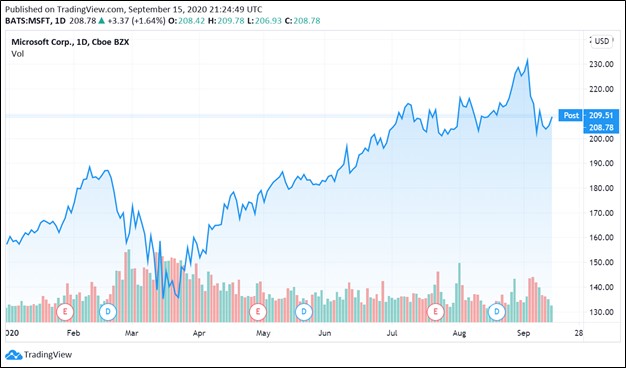

Image Shown: Shares of Microsoft Corporation are up significantly year-to-date as of this writing, and we see room for further capital appreciation upside. Shares of Microsoft are included as a holding in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios.

By Callum Turcan

On September 15, Best Ideas Newsletter and Dividend Growth Newsletter portfolio holding Microsoft Corporation (MSFT) announced a ~10% sequential increase in its quarterly per share dividend, boosting its payout up to $0.56 per share or $2.24 per share on an annualized basis. As of this writing, shares of MSFT now yield ~1.1% on a forward-looking basis. Furthermore, Microsoft noted its 2020 Annual Shareholders Meeting would be held on December 2 and would be conducted through a virtual format.

Strong Dividend Growth Trajectory Intact

Microsoft’s Dividend Cushion ratio sits at 4.2, earning the tech giant an “EXCELLENT” Dividend Safety rating, and please note these proprietary metrics take into account our expectations that Microsoft will push through meaningful per share dividend over the coming fiscal years. To read more regarding Microsoft’s stellar dividend growth trajectory, we encourage our members to check out Microsoft’s Two-Page Dividend Report (link here). Microsoft earns an “EXCELLENT” Dividend Growth rating as well.

The company’s strength comes from its high quality cash flow profile (the firm’s annual free cash flows averaged ~$38.6 billion from fiscal 2018 to fiscal 2020 while its annual dividend obligations averaged ~$13.9 billion during this period) and pristine balance sheet. As of June 30, Microsoft had a net cash position of $73.2 billion, not including its $3.0 billion in non-current equity investments and inclusive of short-term debt, providing the firm with ample financial firepower that allows for Microsoft to push through significant dividend increases while facing meaningful headwinds from the ongoing coronavirus (‘COVID-19’) pandemic.

Other Recent Events

In other recent news, Microsoft signed an agreement with BP plc (BP) that would see the duo collaborate on various “green energy” and other “sustainable” initiatives. This agreement was announced on September 15 and will include Microsoft utilizing its Azure cloud computing offerings and its Internet of Things (‘IoT’) technology alongside BP’s current and future operations.

BP just embarked on a major strategic pivot and now the firm seeks to aggressively grow its renewable energy business over the coming years with an eye towards utility projects (namely commercial-scale wind and solar developments). The oil major reportedly plans to grow its renewable energy business to one that has around 50 gigawatts (‘GWs’) of renewable energy generation capacity by 2030, up from 2.5 GWs at the end of 2019 according to S&P Platts, part of S&P Global Inc (SPGI). BP had a green energy development pipeline with ~20 GW that was largely represented by solar projects at the end of last year, according to S&P Platts, though BP will likely place a greater emphasis on growing its wind power business going forward.

On September 9, BP announced it would acquire half of two offshore wind projects (50% stakes in both the Empire Wind and Beacon Wind developments) in the US from Norway’s Equinor (EQNR) for $1.1 billion, adding to its existing portfolio of onshore wind developments in the US.

Pivoting back to Microsoft, one area of cooperation between Microsoft and BP that was brought up in the press release involved bringing together Microsoft’s “Smart Cities” IoT-oriented technology and BP’s “Clean Cities” initiative to help cities achieve their green energy goals. Another key part of the Microsoft-BP partnership involves BP utilizing greater amounts of Microsoft’s Azure cloud computing services as noted in the press release covering the strategic partnership (emphasis added):

As part of bp’s cloud-first IT approach, the company has extended its agreement to use Microsoft Azure cloud services as a strategic platform. This expands on bp’s existing relationship with Microsoft, which helped accelerate the digitization of bp infrastructure and operations, while Microsoft 365 enabled greater collaboration and remote working productivity during the COVID-19 response.

Utilizing Microsoft Azure cloud enables bp to access a broad and deep portfolio of cloud services, including machine learning with Azure Digital Twins, data analytics, security and more, to gain greater insights, drive significant optimization opportunities and transform business processes.

One final consideration here is that BP will supply Microsoft, particularly Microsoft’s data center operations in the US, Europe, and Latin America, with electricity sourced from renewable energy projects. BP will likely bring new utility assets online to supply Microsoft’s existing and future operations. This is part of Microsoft’s goal of powering all of its operations with renewable energy by 2025. Within the enterprise valuation construct, what the partnership will likely yield for Microsoft is incrementally larger recurring cash flows from its cloud computing business while potentially providing a boost to its IoT-oriented businesses and similar offerings. We are intrigued by the potential upside from this deal.

Concluding Thoughts

Earlier in September we wrote a note covering another one of the Microsoft’s recent wins as it concerns the $10.0 billion Joint Enterprise Defense Infrastructure (‘JEDI’) contract, which we encourage our members to check out (that article can be viewed here). Microsoft continues to be one of our favorite companies. Given that the top end of our fair value estimate range sits at $259 per share of Microsoft, shares of the company have room to climb significantly higher from current levels as of this writing.

-----

Oil & Gas (Majors Industry) – BP CVX COP XOM RDS.A RDS.B TOT

Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM

Related: EQNR, SPGI, SPY, QQQ, SCHG, IVV, VOO, XLK, IYW, VGT, FTEC, IXN

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Microsoft Corporation (MSFT) is included in both Valuentum’s simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Oracle Corporation is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment