Meta Platforms (Facebook), One of the Most Underpriced Stocks on the Market

Image Shown: Meta Platforms Inc – Third Quarter of 2021 IR Earnings Presentation

By Callum Turcan

In late October 2021, the company now known as Meta Platforms Inc (FB) announced its name change from Facebook to highlight its focus on the “metaverse,” a digital universe that Meta Platforms is investing heavily in. The metaverse is supposed to be a digital world where video gaming, social media, community and family gatherings, TV and movie watching, card game and board game playing, major entertainment events and related venues, and various other activities come together in an immersive experience that ultimately could generate a lot of revenue for Meta Platforms.

In 2014, then-Facebook announced it was acquiring Oculus VR, a maker of virtual reality (‘VR’) headsets that are essential to enabling the metaverse as it is currently envisioned, through a cash-and-stock deal worth ~$2 billion. As things stand today, the goal is to enable users to engage in the metaverse by putting on a modern VR headset as the computing power and overall capabilities of these offerings have improved considerably in recent years, seen through the launch of the Oculus 2 in September 2020.

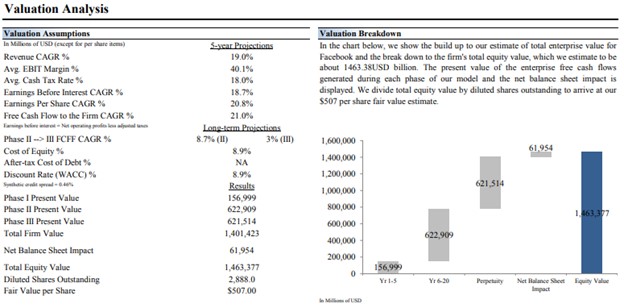

We are keeping a close eye on Meta Platforms’ efforts in this area, though please note these are still early days. As part of its pivot, Meta Platforms originally intended to change its ticker symbol to MVRS at the beginning of December 2021, though that ticker change now won’t take place until early 2022. We are huge fans of Meta Platforms and include shares of FB as an idea in the Best Ideas Newsletter portfolio. Our fair value estimate for Meta Platforms sits at $507 per share, well above where its shares are trading at as of this writing.

Image Shown: A look at the key valuation assumptions used in our discounted free cash flow model to arrive at our $507 per share fair value estimate for Meta Platforms.

New Corporate Structure, Strong Underlying Performance

As part of this pivot, Meta Platforms announced two new core reporting business segments when reporting its third-quarter 2021 earnings results. The first is its Family of Apps (‘FoA’) segment, which includes its popular social media and messaging apps Facebook, Instagram, Messenger, WhatsApp along with other services. Its second segment is Facebook Reality Labs (‘FRL’) which includes its augmented reality (‘AR’) and VR operations along with the related software, hardware (such as its aforementioned Oculus VR headsets), and content. Starting in the fourth quarter of 2021, Facebook will break down its performance by these two segments.

Here, we would like to stress something that many in the financial media appear to have skipped over, and that is the immense underlying profitiability of its non-AR/VR operations. Within the company’s third-quarter 2021 earnings press release, the firm noted that “we expect our investment in Facebook Reality Labs to reduce our overall operating profit in 2021 by approximately $10 billion.”

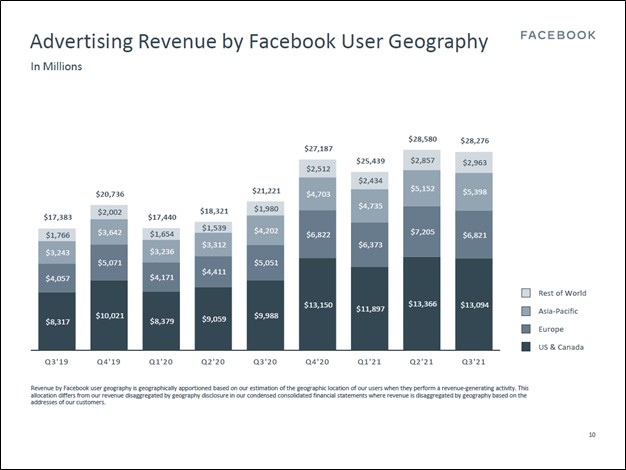

For reference, Meta Platforms’ digital advertising business represented ~98% of its revenues during the first nine months of 2021 (I, II, III). During the first nine months of 2021, Meta Platforms posted $83.3 billion in GAAP revenues (up 46% year-over-year) and $34.2 billion in GAAP operating income (up 72% year-over-year). We bring these figures up to highlight that its FRL investments (specifically the forecasted ~$10 billion hit to Meta Platform’s operating income its FRL investments are expected to create in 2021) are effectively going towards operations that have yet to generate meaningful revenues, meaning the company’s underlying financial performance is much stronger than it first appears (which is already stellar to begin with).

Stellar Financials and Share Buybacks

During the first three quarters of 2021, Meta Platforms generated $39.6 billion in net operating cash flow and spent $13.2 billion on its capital expenditures, allowing for $26.4 billion in free cash flow. For all of 2021, Meta Platforms expects to invest ~$19 billion towards its capital expenditures (versus previous guidance calling for ~$19-$21 billion in capital investments), though that figure is set to rise to ~$29-$34 billion in 2022 as the firm boosts its investments in “data centers, servers, network infrastructure, and office facilities.” In the near term, its increased capital expenditures will weigh on its free cash flow generating abilities, though Meta Platforms has the financial capacity to make these investments in its future while still churning out “gobs” of free cash flows.

Meta Platforms exited September 2021 with $58.1 billion in cash, cash equivalents, and marketable securities on hand (excluding its $6.8 billion in non-current equity investments line-item which is largely represented by strategic assets) with no debt on the books. The company has ample financial capacity to buy back large chunks of its stock, which Meta Platforms is currently doing.

During the first three quarters of 2021, Meta Platforms spent $24.5 billion buying back its Class A common stock. Meta Platforms has a dual class share structure, with its Class B common stock having “super voting” capabilities (one Class B share is entitled to ten votes while one Class A share is entitled to one vote) and CEO Mark Zuckerberg owns a large chunk of those Class B shares.

At the end of September 2021, the firm had $8.0 billion in remaining share authorization capacity, which Meta Platforms announced it had recently increased by $50.0 billion during its third quarter of 2021 earnings update. We are incredibly supportive of Meta Platforms’ stock buyback strategy given that shares of FB are trading at a steep discount to their intrinsic value estimate as of this writing and have been for some time.

With shares of Meta Platforms contending with a series of negative headlines about its suite of social media apps (such as the WSJ’s recent Facebook Files segment) and potential regulatory concerns (which, in our view, are overblown), Meta Platforms is making the right call by taking advantage of this disconnect by repurchasing its stock. Its outstanding diluted share count fell over 1% year-over-year during the third quarter of 2021.

Concluding Thoughts

These are still early days for the metaverse, though we are intrigued by the opportunities. We are keeping a close eye on these efforts. In the meantime, we want to stress that Meta Platforms’ core business is more lucrative than it first appears (when looking at just its digital advertising operations), and that is something that should not be ignored.

We appreciate that Meta Platforms is returning cash to shareholders via sizable stock repurchases, especially at these arguably “cheap” levels, and we continue to like the company in the Best Ideas Newsletter portfolio. The company is an incredible free cash flow generator, its outlook is supported by secular growth tailwinds (as digital advertising continues to proliferate worldwide), its balance sheet is pristine, and Meta Platforms’ core business is a lot more profitable than first glances suggest. In our view, there is a lot to like about Meta Platforms and its immense capital appreciation upside.

Downloads

Meta Platforms 16-page Stock Report (pdf) >>>

-----

Technology Giants Industry - FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI, SIMO

Tickerized for holdings in SOCL.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO), and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Meta Platforms Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Meta Platforms, Oracle Corporation, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

1 Comments Posted Leave a comment