JB Hunt Scales Back

Image Source: JB Hunt Transportation Services Inc – First Quarter 2020 Earnings IR Presentation

By Callum Turcan

JB Hunt Transportation Services Inc (JBHT) offers trucking freight and other logistics services to customers in North America, including intermodal services (which is the firm’s largest business segment by revenue). On April 14, the company reported first-quarter 2020 results, which showed its top-line beat consensus expectations while its bottom-line missed consensus expectations. Part of the reason why JB Hunt missed bottom-line expectations was due to incentive pay increases related to the ongoing coronavirus (‘COVID-19’) pandemic and the need to compensate frontline workers for the risks they are taking (and we appreciate all the work frontline workers are doing during these challenging times). Shares of JBHT yield ~1.1% as of this writing.

Quarterly Review

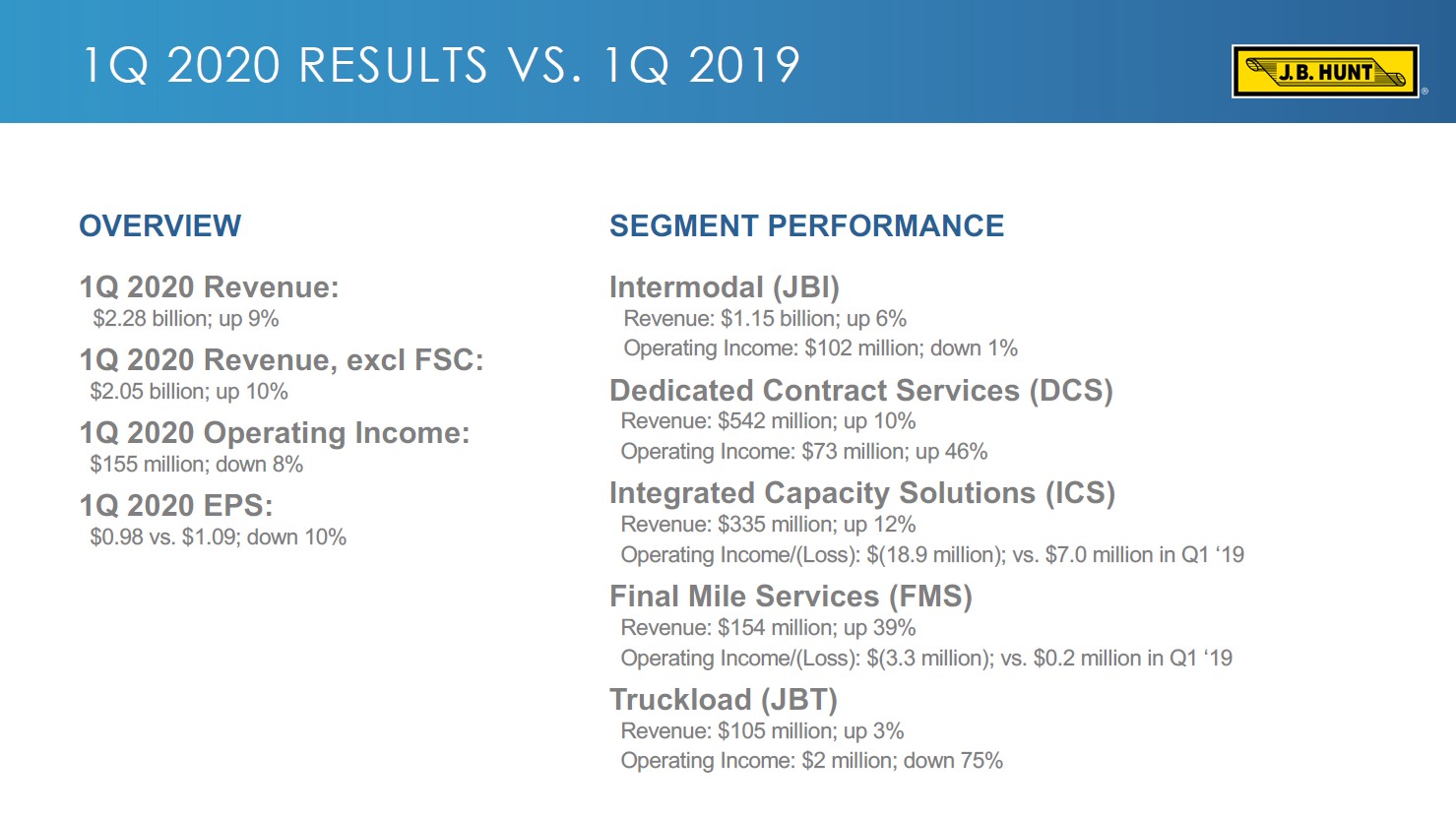

On a year-over-year basis, all of JB Hunt’s business segments reported revenue growth in the first quarter as you can see in the upcoming graphic down below.

Image Shown: JB Hunt reported revenue growth across the board last quarter. Image Source: JB Hunt Transportation Services Inc – First Quarter 2020 Earnings IR Presentation

In the first quarter of 2020, JB Hunt reported a 7% year-over-year increase in load volume which was only marginally offset by a 1% decrease in revenue per load. ‘Transcontinental’ load volumes grew by 11% year-over-year while ‘Eastern network’ volumes grew by 1%, keeping in mind COVID-19 started wreaking havoc on certain regional economies in March.

While JB Hunt’s GAAP revenues grew by 9% year-over-year last quarter, its GAAP operating income fell by 8% due in part to higher wage expenses, increased rail purchase transportation rates, and increased technology investments among other factors. Technology investments are needed to upgrade legacy systems to yield incremental efficiencies and better compensating frontline workers during a pandemic both rewards hardworking employees and helps retain the workforce.

Scaling Back

Due to the pandemic, JB Hunt reduced its capital expenditure expectations for 2020 from $675-$700 million previously down to $575-$600 million currently, with $425-$450 million of that updated capital expenditure budget going towards maintenance activities and the rest allocated towards growth or “success” projects. The intermodal transportation and logistics firm was performing well before the pandemic hit; however, the company is now being cautious, and we appreciate management scaling back cash flow outlays where possible.

JB Hunt exited the first quarter of 2020 with $48 million in cash and cash equivalents on hand versus over $1.3 billion in long-term debt. The firm did not have any short-term debt on the books at the end of this period and carried a current ratio north of 1.5x; however, its large net debt load is concerning. The company did not provide a cash flow statement in its earnings update, which likely won’t be made available until the firm files its 10-Q filing with the SEC.

JB Hunt did note in its earnings press release that it generated $249 million in net operating cash flow and spent $129 million on its ‘net capital expenditures’ during the first quarter of 2020, potentially allowing for meaningful free cash flows. Please note that JB Hunt both pays out a common dividend and has been repurchasing stock of late, which could have consumed a large chunk of those free cash flows. Here’s some key management commentary on how the firm plans to allocate capital going forward, from the quarterly conference call (emphasis added):

“From a capital deployment standpoint, our approach remains the same. We invest in our people and business growth, we will maintain our working capital and leverage positions, return value to shareholders through dividends, and we'll continue an opportunistic approach to share repurchases. This has been our focus and will remain so for the long-term. Although, we certainly recognize the current environment, but believe our framework allows us to make discretionary adjustments to this approach as needed.

In the near-term, we are reprioritizing some of our 2020 spend to essential and critical items. We're evaluating expenditures based on those that must happen, those that can be deferred, and those that are capable of being cancelled, but we have example with plans to expand a terminal facility in our Southwest region during the second quarter to accommodate long-term growth beyond our 2020 needs. However, in light of the current state, we have paused this project until we are in a more predictable environment. Further, our opportunistic buyback approach allows for discretion based on liquidity needs at the time. So, while we have historically planned for excess cash to be used for buybacks, we may have to hold the cash at the interim.

Additionally, while we continue to evaluate the market for M&A opportunities, any potential transaction will still follow our normal evaluation process, which considers liquidity and funding requirements. Today, cost reduction actions have consisted mostly of canceling non-essential travel, pausing hiring activities, and delaying other discretionary spend, which we will continue to do so as needed.”

Given JB Hunt’s hefty net debt load, retaining cash is the right call, in our view. M&A activity appears like a stretch given ongoing market turbulence. While JB Hunt’s unsecured debt is rated at investment grade credit rating (Baa1) by Moody’s Corporation (MCO) as of October 2019, credit market conditions have tightened in response to the pandemic.

With macroeconomic indicators like the Empire State Manufacturing Index crashing to -78.2 in April 2020, JB Hunt would be better served by hunkering down and preparing for the worst to continue. That includes potentially downsizing its fleet, if needed. If JB Hunt had a net cash position, there would likely be plenty of bolt-on (and possibly bigger) acquisition opportunities to pursue, but given its net debt position, fiscal prudence is required.

Furthermore, please note US retail sales plunged by 8.7% in March 2020, with sharp declines realized in electronics and appliances, clothing and accessories, furniture and home accessories, and various other discretionary goods categories. Only non-discretionary goods categories held up well including food and beverage, and health and personal care products. This dynamic, along with the “cocooning” of households in North America (especially Canada and the US), could materially weigh on JB Hunt’s revenues and thus cash flows in the near future. We would prefer that JB Hunt focuses primarily on building up its cash position, especially given its existing dividend obligations.

Concluding Thoughts

JB Hunt’s first-quarter 2020 performance highlights that the economy was doing well, particularly the US economy, until the pandemic hit. Going forward, no one knows for sure how long the crisis will last, but what’s becoming increasingly clear is the chance for a major economic calamity is growing (with a recession in the short- to medium-term becoming increasingly likely, if we aren’t in one already, and major fiscal and monetary stimulus programs being deployed to soften the blow to households and businesses alike). JB Hunt didn’t readily provide guidance going forward, only that the company was ready to adjust its cost structure and fleet size as needed.

Railroad Industry – CNI CSX KSU NSC UNP

Air Freight & Logistics Industry – CHRW EXPD FDX ODFL UPS

Related: AMZN, XPO, FWRD, HUBG, ATSG, AAWW, AIRT, ECHO, USAK, SAIA, WERN, SNDR, KNX, CVTI, BRK.A, BRK.B, JBHT, IYT, XTN

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Shares of Berkshire Hathaway Inc Class B (BRK.B) are included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment