HCA’s Latest Results Indicate Healthcare Providers Are Holding Up Better Than Expected

Image Source: HCA Healthcare Inc – Second Quarter of 2020 Earnings Press Release

By Callum Turcan

The ongoing coronavirus (‘COVID-19’) pandemic has had a devastating impact on the financial performance of healthcare providers (operators of hospitals and other medical facilities) due to the decline in the number of elective surgeries performed. Please note elective surgeries tend to be more lucrative for healthcare providers than the other services they provide, generally speaking. Elective surgeries in many US states were indefinitely postponed when the pandemic first hit. In late March, Congress passed the Coronavirus Aid, Relief, and Economic Security Act (‘CARES Act’) which included $100 billion in emergency funding for hospitals and healthcare providers to mitigate the financial blow from the pandemic and enable the US healthcare system to continue functioning as best it can under the weight of the pandemic.

HCA Healthcare

Since May, elective surgeries have started to resume in earnest according to major hospital and surgery center operator HCA Healthcare Inc (HCA) during its second quarter of 2020 earnings update published July 22 (though meaningful headwinds remain, which we will cover later on). Its GAAP revenues tanked by 12% year-over-year last quarter as inpatient and outpatient surgery cases both fell by double-digits year-over-year last quarter, though funds from the CARES Act saw HCA Healthcare’s GAAP net income surge by 31% during this period.

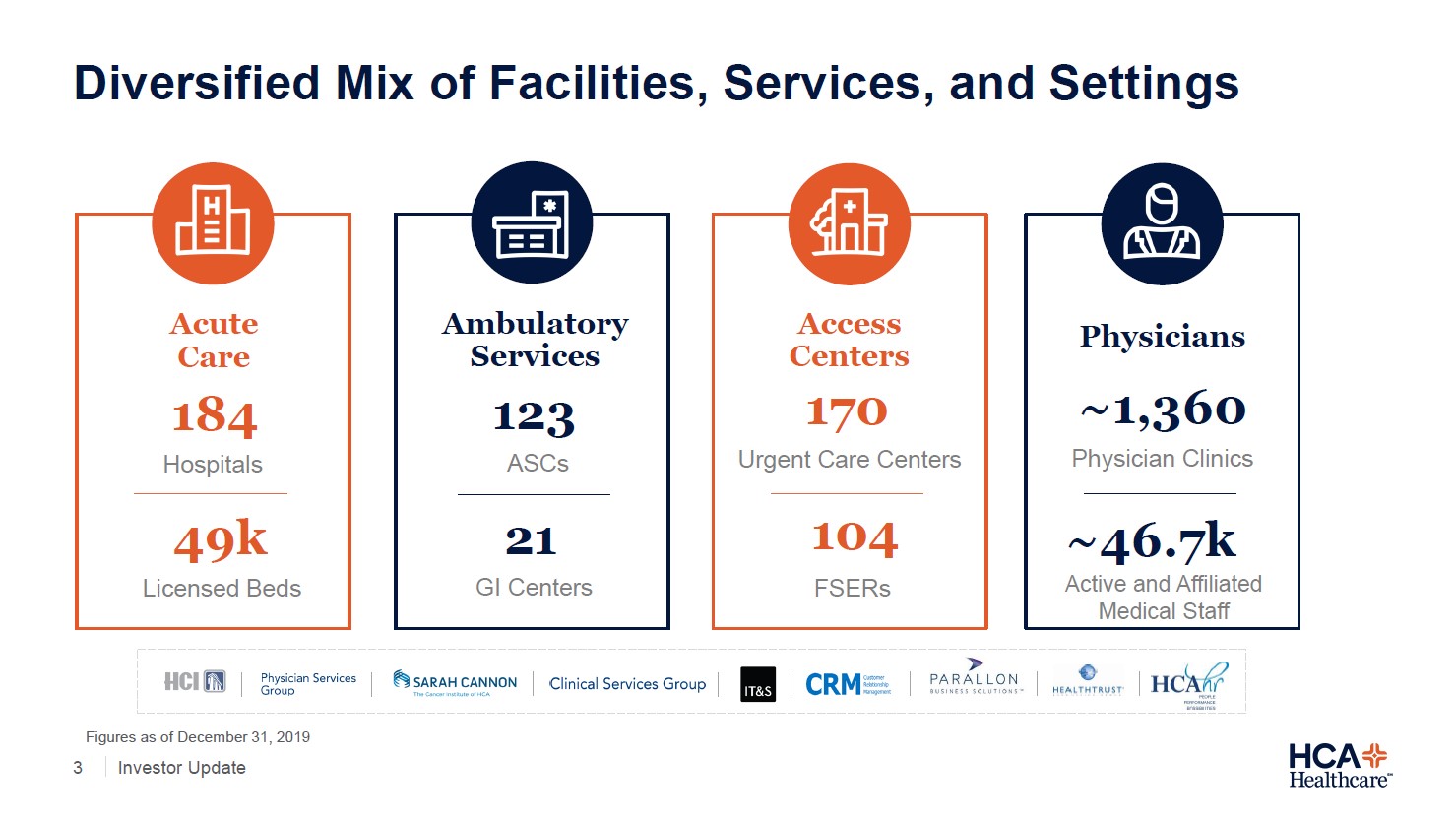

HCA Healthcare is one of the largest for-profit operators of hospitals in the US with 186 hospitals and 122 freestanding outpatient surgery centers as of the second quarter of 2020. Please note six of its hospitals were in the UK at the end of 2019. In the upcoming graphic down below, HCA Healthcare provides an overview of its asset base as of the end of 2019.

Image Shown: A snapshot of HCA Healthcare’s operations at the end of 2019. Image Source: HCA Healthcare - March 2020 IR Presentation

The company’s second quarter performance beat both consensus top- and bottom-line estimates. In our view, shares of HCA jumped up by ~12% during normal trading hours on July 22 due to its improving outlook, not its historical financial performance, though its relatively strong performance during the early stages of the pandemic lends support to its future expected free cash flows. Here is what HCA Healthcare had to say regarding elective surgeries in its latest earnings press release:

Patient volumes across most service lines were significantly impacted in April due to state and local policies implemented to contain the spread of COVID-19 and preserve personal protective equipment. Patient volumes gradually improved in May and June as states began to re-open and allow for non-emergent procedures.

HCA Healthcare recorded $822 million in government stimulus income due to the CARES Act last quarter ($590 million net of tax considerations). With that in mind, HCA Healthcare would have still been profitable even without those direct funds on a GAAP basis last quarter considering it generated $1.1 billion in GAAP net income. In particular, HCA Healthcare did a solid job reducing its operating expenses across the board to better cope with the pandemic. Here is what management had to say regarding HCA Healthcare and the CARES Act during the company’s latest quarterly conference call:

“As of June 30th, we had received approximately $1.4 billion of CARES Act stimulus funding. This included about $920 million from the general distribution and about $450 million from certain targeted distributions for rural and safety net hospitals, as well as hotspot funding. We have not recognized any of the targeted distributions in our P&L as of June 30th, as we are still performing the required analysis and attestation process. The evaluation period and guidance related to the relief fund continue to evolve and as a result, we’ve recognized $822 million of the $920 million in general distribution funds received in the quarter. Subsequent to June 30th, we’ve received approximately $300 million in additional targeted distribution funds.”

During the first half of 2020, HCA Healthcare generated $8.5 billion in free cash flow, up sharply from $1.2 billion in the same period a year-ago, though please note that this is due in large part to very favorable working capital movements. Here is what management had to say on the issue during the firm’s latest earnings call:

“Cash flow from operations was $8.72 billion for the quarter, which includes the following components. We received approximately $4.4 billion in advanced Medicare payments during the quarter. These amounts are scheduled to be repaid over an eight-month period, beginning in August of 2020. Cash flow from operations was also fairly impacted by the approximate $1.4 billion of CARES Act funding received during the quarter, I mentioned earlier, as well as the deferral of estimated income tax payments to the third quarter of approximately $200 million and payroll tax deferrals, that will be paid in late 2021 and 2022 of approximately $200 million.”

HCA Healthcare spent a bit under $0.2 billion covering its dividend obligations and a little over $0.4 billion buying back its common stock during the first half of 2020. HCA Healthcare generated ~$3.0 billion in annual free cash flows from 2017 to 2019 on average. However, in April 2020, HCA Healthcare suspended its dividend and share buyback programs when it reported its first quarter 2020 earnings.

Potential Risks

HCA Healthcare exited June 20202 with $4.6 billion in cash and cash equivalents on hand versus $0.2 billion in short-term debt and $30.8 billion in long-term debt, good for a net debt position of ~$26.3 billion. That is a big improvement from its net debt load of $33.1 billion at the end of 2019, though a lot more work needs to be done before HCA Healthcare’s balance sheet gets under control. Management noted HCA Healthcare had $7.7 billion in borrowing capacity under its credit facilities and that its net debt to EBITDA ratio stood at 2.7x as of the end of June 2020 during its latest earnings call.

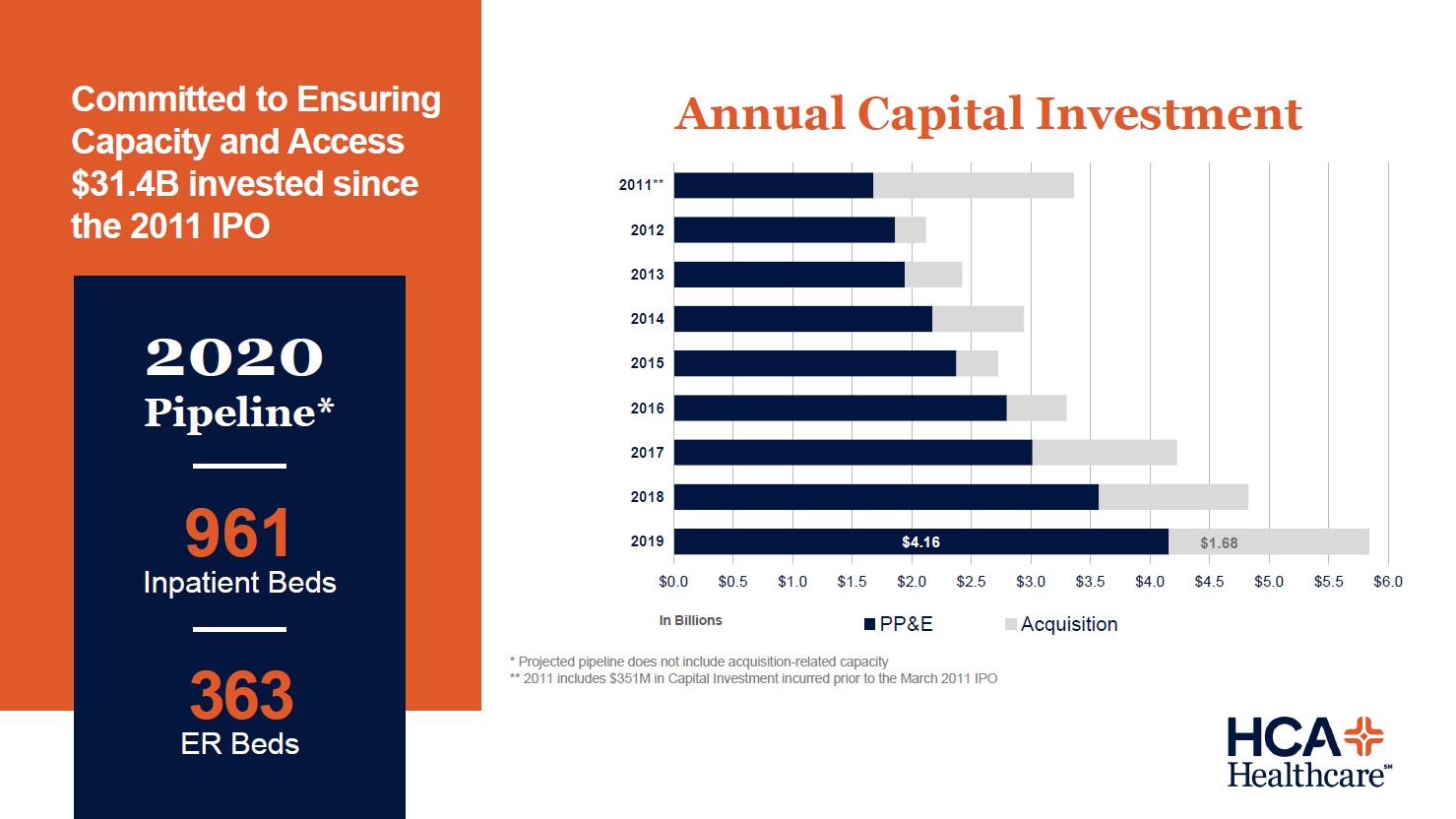

The company’s gargantuan debt load is a product of its growth strategy (as you can see in the upcoming graphic down below) and past share repurchases. HCA Healthcare trimmed its capital investment expectations for 2020. Now the firm expects to spend around $2.8 billion - $3.0 billion on capital investments this year, down from $4.2 billion previously, which should go a long way in shoring up its near-term free cash flow generating abilities in the face of the pandemic.

Image Shown: HCA Healthcare has been steadily growing its asset base over the past decade through a combination of internal expansions and acquisitions. Its annual capital expenditures have steadily grown from 2011 to 2019. Image Source: HCA Healthcare - March 2020 IR Presentation

In the event HCA Healthcare resumes its payout, we caution its large net debt load would weigh very negatively on its dividend coverage strength. As of June 2020, Moody’s Corporation (MCO) rated HCA Healthcare’s corporate family credit rating at Ba1 in “junk” territory. Given that HCA Healthcare’s stock price has largely recovered from its March 2020 lows, it appears investors are becoming increasingly confident in the firm’s ability to manage its balance sheet going forward, though the market may be getting ahead of itself here.

As you can see in the upcoming graphic down below, HCA Healthcare is a major healthcare provider in several states where the COVID-19 pandemic is currently raging including California, Texas and Florida. This situation needs to be closely monitored going forward given the stress the pandemic will continue to place on HCA Healthcare’s operations and financial performance. HCA Healthcare noted in its latest earnings call that the firm “is taking care of more than 33,000 COVID-19 inpatients including over 5,000 patients who are currently in-house.”

Image Shown: HCA Healthcare operates in several markets that are currently witnessing surging COVID-19 infections. Image Source: HCA Healthcare - March 2020 IR Presentation

Additional Government Funds

There is a growing sense (I, II, III) that another stimulus package (really an emergency spending and relief package) will pass Congress and get signed into law by President Trump over the coming weeks. Elevated levels of unemployment, the slowdown (or sometimes reversal) of quarantine easing efforts in various states, severe financial stress at many small- and medium-sized enterprises, and the end of enhanced federal unemployment benefits at the end of July have created a great impetus to approve more spending by key lawmakers and officials in Washington DC.

Should another round of healthcare funding be included in a future COVID-19-related bill that gets signed into law, that could materially change the outlook for operators of hospitals, surgery centers, and other healthcare facilities in the US. Whether that will be the case remains to be seen, but HCA Healthcare would likely be a major beneficiary of additional healthcare funds from the federal government if another emergency spending package is approved.

Concluding Thoughts

HCA Healthcare’s financial and operational performance held up better than expected during the early part of the pandemic. Investors aggressively bid up shares of HCA on July 22, though we caution the company’s large net debt load and the surge in infections in some US regions represent major hurdles that cannot easily be dealt with. Other healthcare providers such as Tenet Healthcare Corporation (THC), which operates 65 hospitals and 500 other healthcare facilities, surged on July 22 due to HCA Healthcare’s strong earnings report and improving outlook. We will continue monitoring this space going forward, and sincerely hope everyone, their loved ones, and their family members stay safe out there.

-----

Medical Devices Industry – EW ISRG MDT VAR WAT ZBH

Health Care Services Industry – DVA EHC HCA UNH UHS

Pharmaceuticals (Big) Industry – ABT ABBV AMGN AZN BMY LLY GSK MRK NVS NVO PFE SNY

Pharmaceuticals (Biotech/Generic) Industry – ALXN AGN BHC BIIB BMRN GILD MYL REGN TEVA VRTX ZTS

Household Products Industry – CHD CLX CL ENR HELE JNJ KMB PG

Related: THC, SPY, XLV, STT, MNK, ENDP, CAH, MCK, ABC, WMT, RAD, CVS, IBB

Related (vaccine/treatment): MRNA, INO, NVAX, BNTX, APDN, VXRT, TNXP, EBS, PFE, JNJ, DVAX, IMV, IBIO, REGN, SNY, GSK, ABBV, TAK, HTBX, SNGX, PDSB, SRNE

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. The Health Care Select Sector SPDR ETF (XLV) and Johnson & Johnson (JNJ) are both included in Valuentum’s simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Vanguard Consumer Staples ETF (VDC) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios include a SPDR S&P 500 ETF Trust (SPY) put option holding with a $295 per share strike price that expire on August 21, 2020. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment