Goldman Posts a Blowout Quarter

While we still do not like the private ($17 billion) and public equity ($3 billion) positions on Goldman’s balance sheet, we acknowledge that the firm is working them lower through sales and that the bank is aiming to increase managed funds instead. This move is overdue and will help reduce the risk profile of the firm. Though the quarter showed the massive revenue potential of Goldman when markets are at fairly high levels and with extreme volatility, it is difficult to value these earnings streams, given the notoriously volatile nature of the key segments of investment banking and markets (trading).

By Matthew Warren

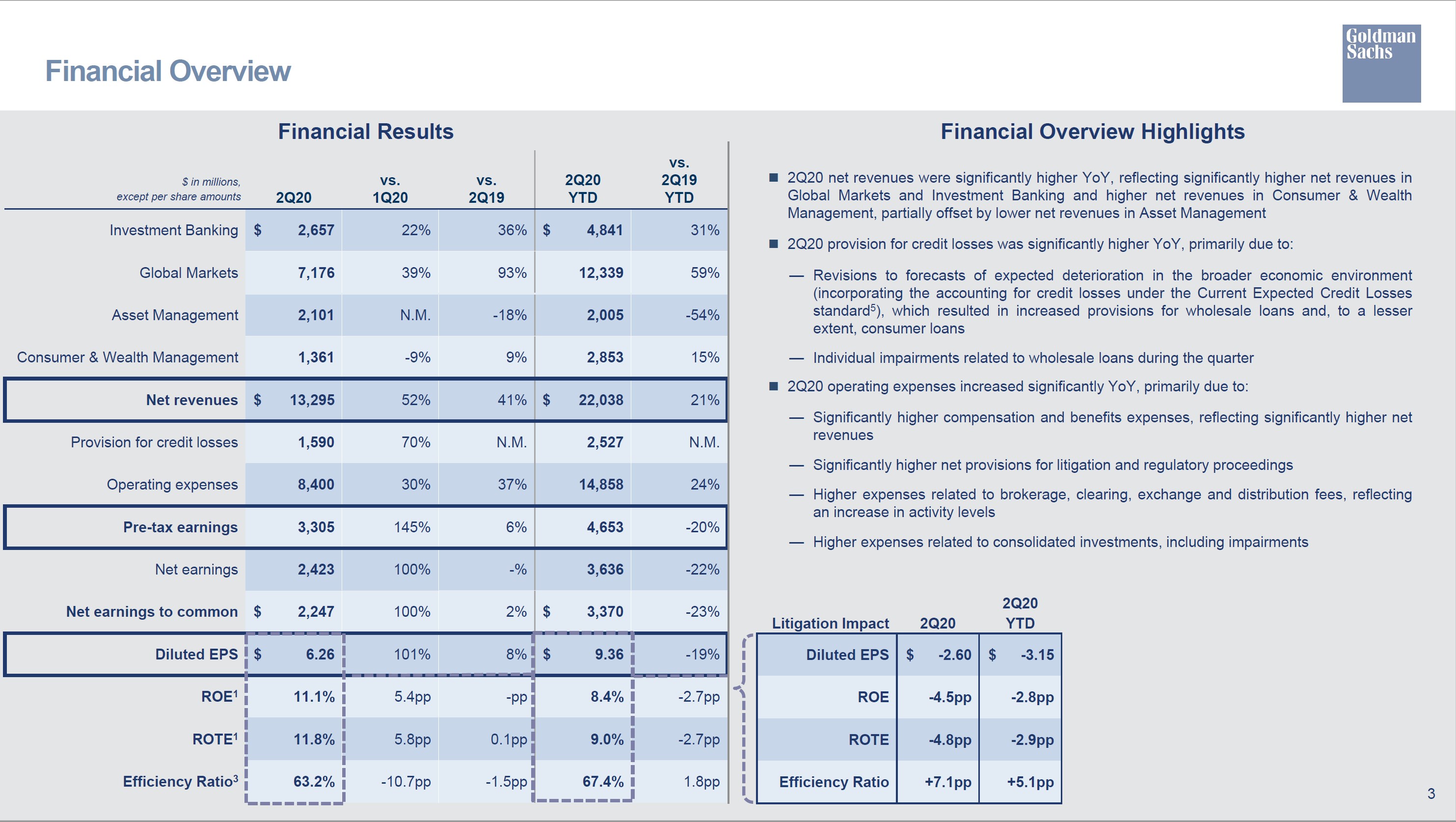

Goldman Sachs (GS) posted blowout second-quarter results July 15 thanks to its notoriously volatile Markets and Investment Banking segments, surging past analyst consensus estimates for both the top and bottom-line figures. Bottom line results would have been better, but for significant credit loss provisioning and litigation expenses. As you can see in the upcoming graphic down below, net revenues were up 41% compared to last year while net earnings to common was up only 2% due to the above-mentioned drags on the bottom line.

Image Shown: Goldman Sachs Results Breakdown by Segment. Image Source: Goldman Sachs 2Q2020 Earnings Presentation

While investment banking revenue was up 36% (equity underwriting up 122% and debt underwriting up 93%) year over year, bottom line earnings in the segment were down 93% as this segment was battered by credit losses and litigation charges. Clearly though, Goldman benefitted from the massive industry tailwind of equity, convert, and bond offerings as clients shored up their balance sheets in the face of the ongoing Covid-19 Pandemic.

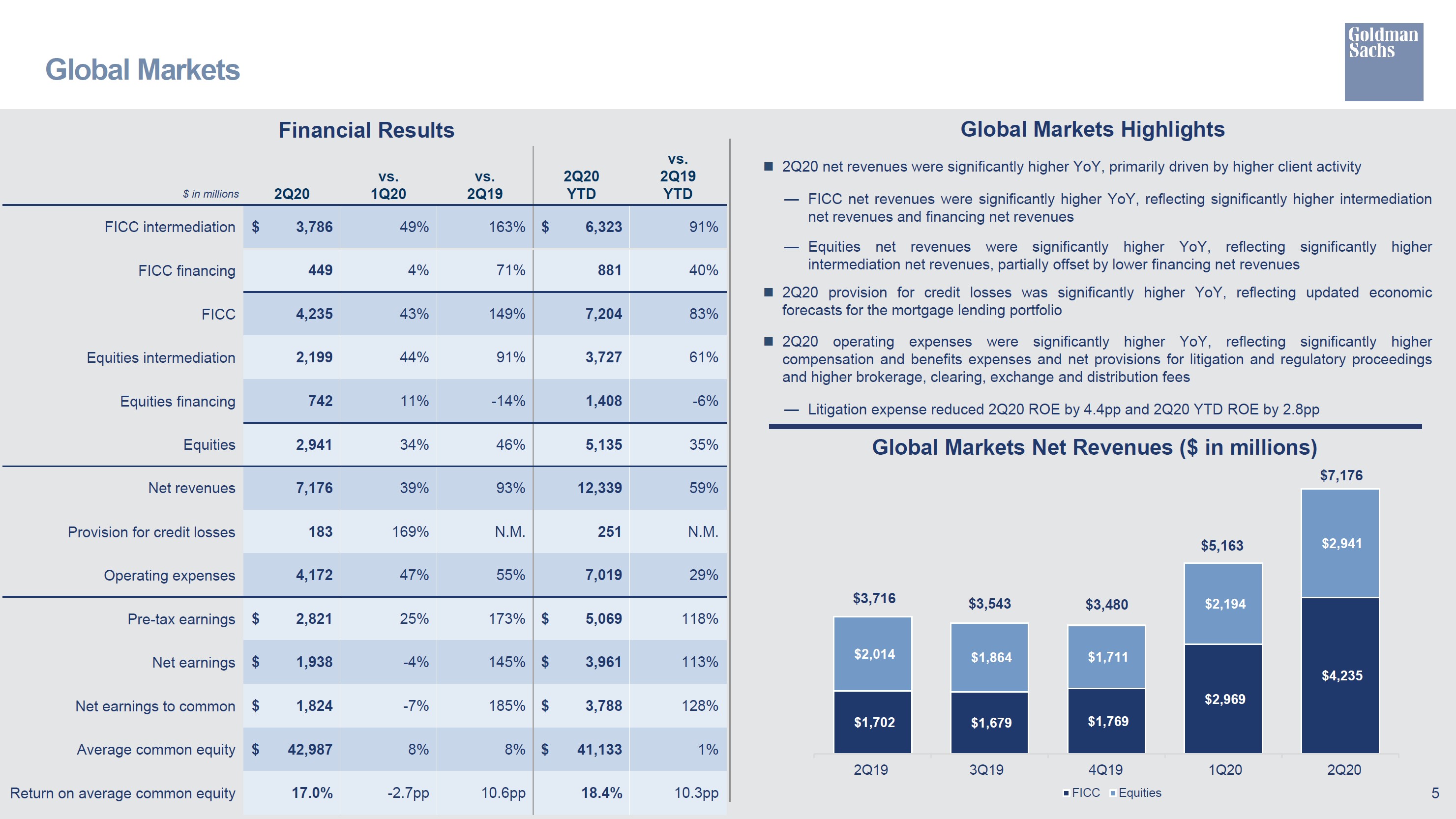

The real star of the show in the quarter was Goldman’s Global Markets Segment, with net revenues up 93% and net earnings to common up 185%. Frantic client trading, volatile markets, and wide bid-ask spreads all contributed to phenomenal trading revenue in the quarter, as you can see in the upcoming graphic down below. FICC (fixed income, currencies, and commodities) trading was the absolute standout performer, with revenue up 149% versus last year, as clients raised liquidity and termed out the debt on their balance sheets.

Image Shown: Global Markets Segment Results Broken Down into Subsegments. Image Source: Goldman Sachs 2Q2020 Earnings Presentation.

As to whether this level of activity can continue, many senior executives across the industry have been blatantly tamping down expectations. Goldman Sachs CEO David Solomon did that in the below quote from the quarterly earnings call, but also struck an optimistic tone at the same time about current levels of trading as compared to prior years:

…in a period where there's enormous change and enormous volatility in markets, we became super busy because our clients are super busy. And the reason you see this pick up in activity is because there was a lot of activity from our clients. I don't necessarily view that as permanent… It's obviously very hard to predict, given the uncertain nature of the environment, how this would continue, I'd say up front, because I know it'll be a question from a number of you that the activity levels that we saw at the end of March and in April, we're really extraordinary. We've not seen the same level of activity over the course of the last five or six weeks, since the beginning of June, but I would say the activity levels over the last five or six weeks when looked at compared to activity levels in 2019, or 2018 still look pretty active. And so we continue to see clients very, very engaged in our markets business.

While we still do not like the private ($17 billion) and public equity ($3 billion) positions on Goldman’s balance sheet, we acknowledge that the firm is working them lower through sales and that the bank is aiming to increase managed funds instead. This move is overdue and will help reduce the risk profile of the firm. Though the quarter showed the massive revenue potential of Goldman when markets are at fairly high levels and with extreme volatility, it is difficult to value these earnings streams, given the notoriously volatile nature of the key segments of investment banking and markets (trading).

---

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Matthew Warren does not own any of the securities mentioned. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment