General Electric Provides Upbeat Outlook for 2021

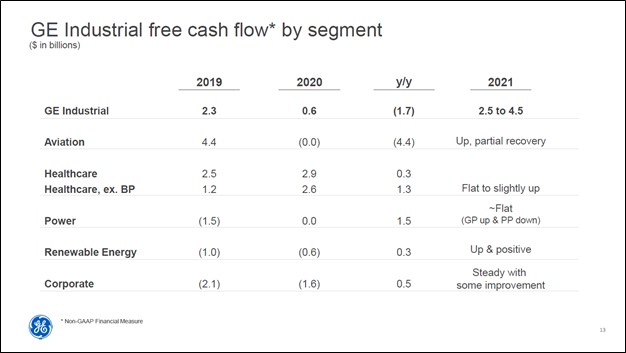

Image Shown: An overview of GE’s cash flow forecasts on a divisional basis for 2021. Image Source: General Electric – Fourth Quarter of 2020 IR Earnings Presentation

By Callum Turcan

The ongoing coronavirus (‘COVID-19’) has weighed negatively on the industrial sector for most of 2020, before the space started to recover during the latter part of the year. On January 26, industrial conglomerate General Electric Company (GE) reported fourth quarter earnings for 2020 that beat consensus top-line estimates but missed consensus bottom-line estimates. The company’s business operating segments are broken down into its various GE Industrial divisions (‘Power,’ ‘Renewable Energy,’ ‘Aviation’ and ‘Healthcare’) and GE Capital.

What really impressed us was that GE Industrial’s free cash flow came in at $4.4 billion in the final quarter of last year which pushed the segment’s full year free cash flow up to a positive $0.6 billion in 2020. Management cited outperformance at GE’s Healthcare division and the ongoing turnaround at its energy portfolio as being key here during GE’s latest earnings call, which offset significant weakness at its Aviation division.

GE divested its ‘BioPharma business’ to Danaher Corporation (DHR) for a total consideration of $21.4 billion through a deal completed in March 2020. Additionally, GE is in the process of selling off its remaining stake in the equity of oil field services firm Baker Hughes Company (BKR) over the next few years after divesting a large chunk of its position in 2019. Here is what management had to say regarding GE’s improving cash flow outlook during the firm’s fourth quarter of 2020 earnings call (emphasis added):

“For the year, industrial free cash flow was $600 million. All businesses, except Aviation, improved cash flows and ended the year stronger than they began. Total Power generated positive free cash flow including Gas Power as we made faster progress on our fixed cost reductions and working capital improvements, despite the negative cash flows at Power portfolio.

Healthcare delivered an impressive free cash flow of $2.9 billion, while overcoming a $1 billion headwind from the foregone cash flows of BioPharma.This was driven by higher earnings primarily from the pandemic-related demand, cost actions and better working capital. Free cash flow at Renewables was negative $600 million, but a $300 million improvement year-over-year despite the impact of the PTC cycle [this likely refers to the production tax credit].

The focus on inventory management is paying off, and we had strong progress from orders and milestone execution. Aviation free cash flow turned positive this quarter and was nearly breakeven for the year, enabled by our significant cash actions.” --- Carolina Happe, Senior Vice President and CFO of General Electric

The company still has a long way to go before it is out of the woods, though its outlook is improving. GE embarked on a major cost cutting program last year to right size the ship at its Aviation division, though this is part of a broader push to shrink GE so the company can focus on profitable opportunities without being burdened by corporate largess. Management guided for GE Industrial to generate low-single-digit organic sales growth (a non-GAAP figure) in 2021 while this segment’s adjusted industrial profit margin (a non-GAAP figure) is expected to expand organically by 250+ basis points this year (on what appears to be an annual basis). These dynamics are expected to culminate into GE Industrial generating $2.5-$4.5 billion in free cash flow in 2021, and the firm also expects GE Capital will generate “better” earnings this year.

GE expects its Aviation division will post flat to positive revenue growth in 2021, though that will depend largely on the trajectory of commercial aircraft production. Additionally, GE forecasts that its Healthcare division will continue to perform well while the turnaround at its energy portfolio is also expected to continue this year. We caution that GE has a sizable net debt load on the books, in part because of its GE Capital segment, and it will be a long time before the company can resume more meaningful dividend payments (which were cut to a token penny per share on a quarterly basis in 2020).

Concluding Thoughts

Our fair value estimate sits at $10 per share for GE, near where shares are trading as of this writing, and the top end of our fair value estimate range sits at $14 per share. We are not interested in GE at this time.

We have been reviewing the financial performance and outlooks for various corporations that recently reported earnings--and from what we have seen so far--regardless of whether the company in question posted strong performance in 2020 or had a harrowing 2020, the outlook given for 2021+ has often been bright, relatively speaking.

The abnormal to downright manic trading activity we have seen of late at various heavily shorted firms and now silver (SLV), largely by retail investors coordinating their efforts on online forums such as Reddit, has created significant risks to financial markets at-large, in our view. We reiterate, however, the outlook for the broader economy remains promising, and the stock market, more broadly, remains fairly valued.

General Electric's 16-page Stock Report (pdf) >>

Related: BKR, DHR, GE

Other: EADSY, BA, SPR, TGI, HWM, SIEGY, SMEGF, SAFRF, AA, ARNC, HXL, ATRO, TDG, CW, KAMN, DCO, LHX, HEI

ETFs: SLV, SLX, JJU, JJUB, CPER, XLI

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment