Fed Cuts 100 Basis Points, Launches More QE

“Now, stocks and other assets are being sold, some indiscriminately. It is truly becoming a stock pickers market as opposed to a quant-led and index-led market. It takes a different kind of bravery to buy on massive down days and one must have conviction in their research that the company will not go away if massive downside scenarios do in fact emerge.” – Matthew Warren. In this piece, we cover our assessment of what the global markets might be facing in a bull-case, base-case, and bear-case scenario. Our base case is a substantial recession in the US and a financial crisis of some unknown magnitude.

By Matthew Warren

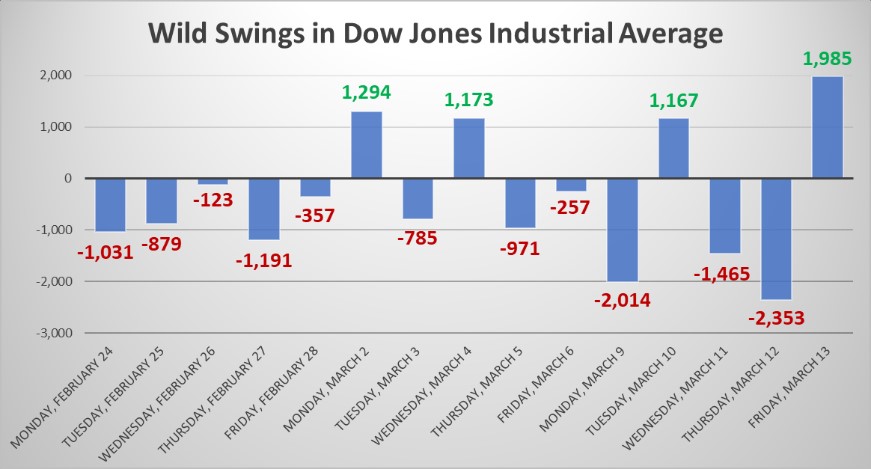

The tremendous (mostly downside) volatility in all asset markets globally during the past few weeks reflects a widening out of potential future scenarios about how the global economy will play out over the next few years and decades. The VIX (CBOE Volatility Index) is back towards record high levels, something that might have been expected in part as a result of the tremendous growth in price-agnostic trading (indexing/quant) during the past decade or so.

What is clear is the coronavirus, now COVID-19, is a “black swan” event that is knocking down a fairly low growth (roughly 2% GDP growth) US economy (with the help of massive tax cuts and an easy Fed) and even higher flying (extended valuations) equity markets. Many companies, properties, investors, and some households are over-leveraged, causing a state of fragility underlying the calm at the surface.

With that said, what are the clear impacts from the coronavirus outbreak? For starters, the oil and gas industry (XOP) will be under enormous pressure from lower commodity prices (USO), especially considering what happened with the fallout from the fight between Saudi Arabia (KSA) and Russia (RSX). The market is over-supplied, and demand is taking a substantial hit from lower demand due to the virus -- less travel especially. Many equity holders have already taken massive hits, and some will be wiped out completely. Similarly, there will be many bad loans turning up in this sector.

The travel and leisure-oriented industries, which is a very wide range of industries (everything from cruise lines, to airlines, to hotels, to movie theaters, to restaurants, to small businesses such as catering operations and dog kennels), will take a huge hit from the “cocooning’ that is taking place as social distancing takes hold broadly across the country and the world. Business leaders are increasingly taking the lead in cutting back all unnecessary travel and even encouraging as many employees as possible to work from home. Have no doubt that lawyers and insurance companies (KIE) are advocating for a cautious approach to risk of blame for employees getting infected and worse.

There will be unexpected knock-on effects. On the one hand, warehouse stores, grocers, and pharmacies are running out of stock of things like certain types of shelf-stable foods, water, and toilet paper, which creates a certain amount of panic amongst the populace. On the other hand, these same businesses will lose sales for treats from the cancelled kids’ soccer match and/or food and supplies for larger social gatherings. Netflix (NFLX) and Zoom (ZM) will benefit from cocooning and virtual meetings, respectively, but these types of positives are like a grain of sand at the beach.

This shock to the system will shake out the over-leveraged players, the weak business models, and the poor operators. Some companies will change managers, many companies if not most will turnover their shareholder base during this period of rapid share turnover, and many (especially private leveraged) companies will be forced to restructure to get away from heavy debt loads.

Asset markets have gone quite a bit haywire. We have gone from lofty ever-rising levels with easy liquidity to choppy largely downside trade with less liquidity and wider bid-offer spreads. The lowest-quality assets have gapped lower, denting confidence and even putting some asset managers in the doghouse with their clients. Even the highest-quality assets like US Treasuries have seen much less orderly trading, calling into question the base rate for the cost of capital. The TINA (there is no alternative) mindset could be called into question as CDS spreads on US sovereign debt have started climbing.

The one-way higher markets based on those who were buying every dip to avoid FOMO (fear of missing out) and the associated career risk have fallen away. Now, stocks and other assets are being sold, some indiscriminately. It is truly becoming a stock pickers market as opposed to a quant-led and index-led market. It takes a different kind of bravery to buy on massive down days and one must have conviction in their research that the company will not go away if massive downside scenarios do in fact emerge.

Scenarios

So, what scenarios are most likely to emerge? Let’s simplify a multitude of Monte-Carlo like simulations into three more likely scenarios, in our opinion.

Bull Case:

Let us start with the most benign or bullish scenario. In the best case that we could picture, social distancing is put in place across the US and the world in relatively short order. Business leaders, civic leaders, and local politicians seem to be taking the lead on this front in the United States, while federal governments are taking a much stronger stance in places like China (FXI, MCHI, KWEB) and Italy (EWI). The key assumptions are that social (and testing) is put in place around the world and that the virus can then run its course in as orderly fashion as what is now possible given the community spread that is already taking place around the world.

The other key assumption is that the virus will die down in something like 6 or 8 weeks as opposed to 6 or 8 months. The shorter timeframe is needed to restart the economy without facing a very substantial recession and financial crisis. If the above two lynchpins were to take place, then the asset markets will have a chance to rebound in somewhat short order, though new highs may still remain out of reach for some time. In fact, we would postulate along with others that the markets might find much relief as the second derivative of new infections bends lower in the bulk of key geographies around the world.

Base Case:

Our base case is a substantial recession in the US and a financial crisis of some unknown magnitude. While this might sound draconian, we would simply point out that depression-like conditions are already taking place in oil & gas and many travel and leisure-oriented industries. Some businesses are reporting that revenues are running down 70% year over year as consumers increasingly stay at home. We would also point out that the financial markets have already expressed the initial stages of a financial crisis. “2,350-2,750 on the S&P? Could the Coronavirus Catalyze a Financial Crisis? (March 5).” Bank stocks have sold off dramatically around the world. European bank bonds are also selling off substantially. Italian and Spanish sovereign spreads are widening in alarming fashion, harkening back to the recent and episodic Euro Sovereign Debt Crisis.

High yield bond spreads have blown out, suggesting real risk of refinancing for this $1+ trillion market. The Federal Reserve has cut rates by 100 basis points, to the range of 0%-0.25%. The Fed is also taking emergency actions to try and settle down trading in the US Treasuries markets, and more action was implemented March 15, including a new $700 billion quantitative easing (QE) program. Markets have deteriorated more quickly than they did in the run-up to the Global Financial Crisis (GFC). That episode was slow motion churning as compared to how badly asset markets have acted in the past month.

We expect substantial counter measures from both the monetary and fiscal authorities in countries around the world as they try to fend off the budding financial crisis and bend the current and/or upcoming recession to a lower magnitude and duration. Regarding the coronavirus, this scenario assumes that the infection curve mounts for months rather than weeks (in part due to failures in social distancing and testing and in part due to the nature of fighting a pandemic in a free western country). According to some experts, the virus might go away and reemerge again in the fall, complicating the situation further. Stocks could easily go down 25-50% from the top in this scenario. Bigger bargains might emerge in the strongest companies before we hit bottom. Weak companies and weak balance sheets should be avoided at all costs as permanent capital impairment is a clear and present danger for these types of companies

Bear Case

The bear case remains a tail risk, though one that has grown, away from the zero bound where many market participants assume (or simply wish) it remains. It is possible that a global financial crisis and sizable recession could morph into a deflationary depression. Easy money and bailouts have increased the amount of risk-taking in the system in recent decades. Asset prices, including real assets like the global real estate asset class, have been inflated by the easy money. The past few decades have been a story of disinflationary and even deflationary impulses arising from globalization, labor arbitrage, and the adoption of technology.

Japan (EWJ) has been teetering on deflation for decades since its bubble burst and zombie banks have dominated the landscape. Europe has looked much the same since the GFC. Overcapacity in the banking industry remains. Negative rates pressure banks, insurers, pension funds, and savers more broadly. Countries such as Italy simply have too much debt relative to its growth potential. Sovereign debt spreads were pressured lower by dramatic ECB action, but even the hint by new ECB head Lagarde that this policy might come into question has the Italian stock market off significantly.

Aside from the fragilities in Japan and Europe, China is sitting on a massive debt and real estate bubble that could unwind in disorderly fashion due to this “black swan” event. Supply chains were already being called into question due to the tariffs and trade war that had been emerging in the past year. Anti-globalization forces are on the rise around the world. If China were to bust, deflationary pressures would spread around the globe, starting with the materials markets (IYM). Trade wars and tariffs could mount in such a scenario. The Japanese and European Banks are fragile and very susceptible to deflationary forces.

While American banks are in a much healthier position than when entering the GFC, they are susceptible to pressure from real estate deflation. They are also susceptible to revenue pressure from lower rates and slower economic activity. Credit costs will amount according to the scenario that becomes reality. Loan and deposit growth could slow or go backwards. Efficiency ratios could easily go backwards if revenue pressures are strong enough. The basic truth that these are leveraged lending institutions with somewhat opaque balance sheets remains in place. All that said, we think America is in a much stronger starting position than the other three core geographies mentioned above.

Concluding Thoughts

The race against the virus is critical and governments around the world need to cooperate to do everything possible to mitigate and get past this pandemic outbreak. The better this race goes, the better the economic and asset performance will turn out. The other key is that the fiscal and monetary authorities around the world need to cooperate and get in front of financial plumbing problems as quick as possible, so that failures don’t cascade through the system. Government, civic, and business leaders need to cooperate and set differences aside, to get our arms around this global problem. We are all in this together, and let’s fight with everything -- we must get to the other side in the best scenario possible.

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

-----

Exchanges - Financial: CBOE, CME, ICE, NDAQ, VIRT

Gaming & Hotels: HLT, LVS, MAR, MGM, WYNN, CHDN

Leisure: AOBC, CCL, CLCT, FUN, HAS, IGT, MAT, RCL, SIX, WWE

Metals & Mining - Aluminum: AA, ACH, ATI, CENX, KALU

Metals & Mining - Diversified: BHP, FCX, NEM, RIO, SCCO, VALE, WPM

Metals & Mining - Steel: AKS, GGB, MT, NUE, PKX, STLD, X

Related: XLF, KBE, KRE, XLE, BNO

Related Volatility ETFs: VXX, UVXY, TVIX, SVXY, VIXY, ZIV, VXXB, VIXM, VXZ, VIIX, XVZ, XXV

Related Treasury ETFs: TLT, TBT, IEF, SHY, IEI, EDV, TMV, TMF, VGLT, SHV, BIL, VGSH

Other Related: VGK, FEZ, HEDJ, EZU, IEV, IEUR, EPV, EURL, SPEU, DBEU, EEA, HEZU

0 Comments Posted Leave a comment