Earnings Brief: Facebook and Alphabet

Image: Facebook (orange) and Alphabet (blue) have advanced 26% and 20%, respectively, thus far in 2020 versus roughly flat performance of the S&P 500. We continue to like both names as the highest-weighted constituents in the Best Ideas Newsletter portfolio.

By Brian Nelson, CFA

We’re not making any changes to our fair value estimates of Facebook (FB) and Alphabet (GOOG) following their respective third-quarter reports, released October 29. Both Facebook and Alphabet are the highest-weighted positions in the Best Ideas Newsletter portfolio, and they have been for some time now.

Collectively 26% of the newsletter portfolio at the high end of their respective weighting ranges, shares of Facebook and Alphabet have advanced more than 20% this year, while the S&P 500 has been roughly flat. The outperformance of these two outsize-weighted names has been a huge contributor to alpha.

Facebook’s third-quarter report showed a company that thrived during the COVID-19 pandemic. Revenue advanced more than 21% (setting a quarterly record), beating the consensus forecast handily, while earnings per share also registered a fairly large beat (while setting a record high as well).

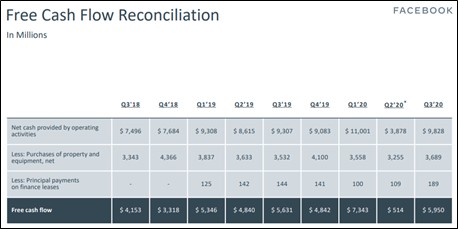

The number of daily active users and monthly active users came in better than expected, and its free cash flow generation wasn’t too shabby, coming in at $5.95 billion versus last year’s mark of $5.6 billion. Facebook ended the third quarter with $55.6 billion in cash equivalents and no debt.

Image Source: Facebook

We think some investors are taking profits in Facebook after a long advance in the name from the March 2020 bottom, perhaps using the view of increased “uncertainty” heading into 2021 as a reason. Facebook is pointing to some potential moderation in digital ad spend in 2021 as a result of a stronger than expected 2020 due to COVID-19 and some headwinds due to platform changes on Apple iOS 14.

Though investors should not take these concerns too lightly, the reality is that Facebook has been facing heightened levels of uncertainty for years, particularly with respect to privacy issues and antitrust considerations, not to mention how both may impact its P&L (expense line items). In many respects, we view any pullback in the equity as a potentially exciting opportunity to consider, with the high end of our fair value estimate range standing at $355 per share (shares are trading at ~$260 at the time of this writing) .

Alphabet put up what can best be described as a “tremendous” third-quarter report. Revenue advanced 14% on a year-over-year basis, beating consensus estimates materially, while earnings per share also came in much higher than what analysts had been expecting. Management attributed the better-than-expected performance to higher “advertising spend in Search and YouTube as well as continued strength in Google Cloud and Play.” Growth rates were solid across the board, supporting the high end of our fair value estimate range for shares, $1,795 (it's trading at ~$1,620 at the moment).

Alphabet pulled in $11.6 billion in free cash flow in the quarter (versus $8.7 billion in the year-ago period). The search giant ended the quarter with $132.6 billion in cash equivalents and just $13.9 billion in long-term debt. As with Facebook, Alphabet is a free cash flow generating powerhouse with a considerable net cash position and material competitive advantages tied to end markets that are experiencing secular tailwinds where many participants can succeed. Facebook and Alphabet remain stalwarts of the Best Ideas Newsletter portfolio, and this won't change anytime soon.

0 Comments Posted Leave a comment