Dollar General Posts Another Stellar Earnings Report

Image Shown: Best Ideas Newsletter portfolio holding Dollar General Corporation has seen its stock price climb significantly higher year-to-date, as of this writing on August 27.

By Callum Turcan

On August 27, Dollar General Corporation (DG) reported second quarter fiscal 2020 earnings (period ended July 31, 2020) that beat both consensus top- and bottom-line estimates. The retailer’s same-store sales increased by 18.8% year-over-year aided by a series of initiatives that we have covered in the past including DG Pickup (Dollar General had stepped up its digital investments in recent years, with DG Pickup offering customers a way to order via mobile device and pickup those goods in-store), DG Fresh (Dollar General is adding more consumer staples offerings to its stores, namely refrigerated and frozen foods), and by placing a greater emphasis on selling non-consumable products (which carry higher gross margins). Longer term, Dollar General wants to add more fresh produce to its stores.

Additionally, greater consumer staples demand in the US due to households stockpiling goods and changing spending habits in the face of the ongoing coronavirus (‘COVID-19’) pandemic played a role in growing Dollar General’s same-store sales as well.

Financial Update

In the fiscal second quarter, Dollar General reported $8.7 billion in GAAP net sales (up 24% year-over-year) and $2.8 billion in GAAP gross profit (up 31% year-over-year). Rising non-consumable product sales, a reduction in price markdowns, and higher initial prices for its products helped drive Dollar General’s GAAP gross margin higher by over 165 basis points year-over-year. Combined with strong revenue growth, Dollar General’s gross profit surged upwards last fiscal quarter.

The firm did a solid job controlling operating expenses (SG&A expenses were up 13% year-over-year, though this line-item declined as a percentage of net sales due to economies of scale) which allowed Dollar General to post over $1.0 billion in GAAP operating income (up 80% year-over-year) in the fiscal second quarter. Its GAAP operating margin rose by over 370 basis points for the aforementioned reasons (economies of scale, controlled operating expense growth, rising gross margins). Last fiscal quarter, Dollar General’s GAAP diluted EPS came in at $3.12, up 89% year-over-year (assisted by the firm’s weighted average diluted share count falling by almost 3% year-over-year).

Due to Dollar General’s stellar performance, the company recently increased its share repurchase authorization by $2.0 billion. Combined with the ~$0.5 billion in remaining buyback authority at the end of its last fiscal quarter, Dollar General has roughly $2.5 billion in total share repurchasing authority (before taking potential share repurchases conducted during the current fiscal quarter into account).

Pivoting to Dollar General’s cash flow performance, the company generated $2.9 billion in net operating cash flow during the first half of fiscal 2020 while spending $0.4 billion on capital expenditures. This allowed for $2.5 billion in free cash flows which handedly covered $0.7 billion in share repurchases and $0.2 billion in dividend payments during this period.

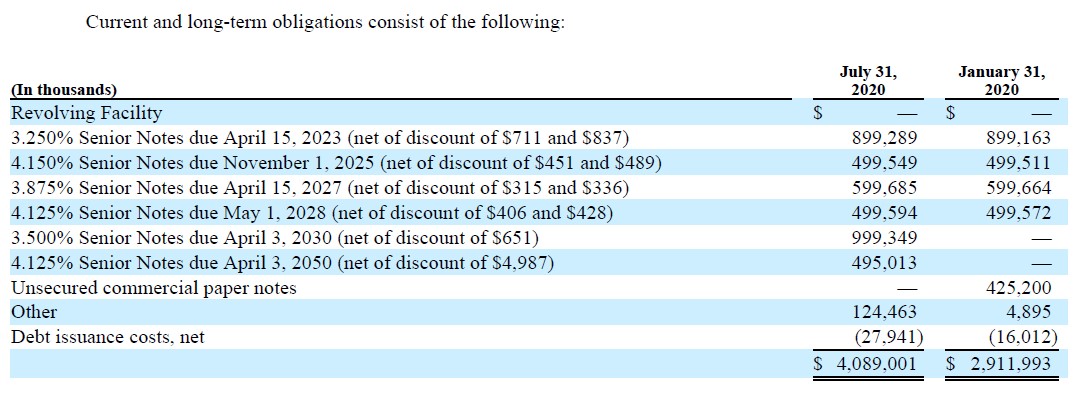

Dollar General had $3.0 billion in cash and cash equivalents on hand versus $4.1 billion in long-term obligations as of July 31, 2020. In the upcoming graphic down below, Dollar General provides an overview of its long-term obligations (which are primarily debt-like liabilities). On a related note, please keep in mind Dollar General has significant operating lease liabilities as well (both short- and long-term).

Image Shown: An overview of Dollar General’s long-term debt-like liabilities at the end of its fiscal second quarter. Image Source: Dollar General – 10-Q SEC filing covering the second quarter of fiscal 2020

Though Dollar General has a net debt load, we view that burden as very manageable given its sizable cash position, strong free cash flows, and staggered maturity schedule as you can see in the graphic right up above. Management noted the retailer would step up its real estate investments this fiscal year, which involved boosting Dollar General’s capital expenditure expectations. Given Dollar General’s high quality business model and impressive same-store sales growth of late, we appreciate management extending the firm’s growth runway.

Dollar General now expects to complete 2,780 real estate projects this fiscal year, up from 2,580 previously. Those 2,780 real estate projects include 1,000 new store openings, 1,670 mature store remodels, and 110 store relocations. Now Dollar General is guiding for $1.0 billion - $1.1 billion in capital expenditures for fiscal 2020, up $0.1 billion at the midpoint from its previous guidance. Given that Dollar General has seen its net operating cash flows swell upwards of late, we see this capital expenditure budget increase as a reasonable maneuver. Management also expects Dollar General will spend $2.5 billion repurchasing its stock this fiscal year.

Management Commentary

Given uncertainties relating to the ongoing pandemic, management did not provide full-year guidance for fiscal 2020. During Dollar General’s latest earnings call, management did have this to say (emphasis added):

“Let me now provide some additional context as it relates to our full year outlook. Given the unusual situation, I will elaborate on our comp sales trends thus far in August. Since the end of Q2 and through August 25, we have continued to experience elevated same-store sales, which have increased by approximately 15% during this timeframe. That said, we remain cautious in our sales outlook and recognize the significant uncertainty that still exists concerning the duration of the positive operating environment.

In particular, we can’t speculate as to whether there will be additional government stimulus or if so, to what degree our business would benefit. Ultimately, we expect to see our comp sales trends moderate as we move through the back half, but believe we are very well-positioned to deliver positive sales growth for the balance of the year even if broader economic conditions deteriorate.

With regards to our strategic initiatives, we continue to anticipate they will improve operating margin over time, particularly as benefits to gross margin continue to scale and outpace the associated expense with both NCI [non-consumable initiative] and DG Fresh expected to be accretive to operating margin in 2020. However, our investment in these initiatives will pressure SG&A rates in the back half, particularly as we further accelerate their rollouts.

Finally, we expect to make additional investments in the second half as a result of COVID-19, including up to $50 million in employee appreciation bonuses… as well as investments in additional safety measures.” --- John Garratt, CFO of Dollar General

Though Dollar General expects to experience some expense pressures during the second half of fiscal 2020, the firm’s near- and long-term outlook remains very promising. In the near-term, the retailer’s sales have continued to hold up well during the early weeks of the fiscal third quarter. Its margins are expanding and the strategic initiatives driving that expansion are expected to continue yielding positive results over time.

Dollar General’s long-term outlook is supported by expectations for future margin expansion, a growing store count, and by expanding into new states. This past March, Dollar General opened its first store in Wyoming and this past April, Dollar General opened its first store in Washington state. As of the end of July 2020, Dollar General operated in 46 US states.

Concluding Thoughts

We continue to like shares of Dollar General at a modest weighting in our Best Ideas Newsletter portfolio. The retailer’s focus on cities/towns with a population of 20,000 or less in the US insulates the firm from the types of competitive pressures e-commerce giants like Amazon Inc (AMZN) have posed for retailers focused on large, heavily-populated metropolitan areas. Shares of DG yield ~0.7% as of this writing and Dollar General’s dividend policy offers modest incremental upside to its capital appreciation potential.

On a final note, we would like to congratulate Kathy Reardon, Dollar General’s “chief people officer” since March 2019, who was recently promoted to executive vice president effective August 27. We wish Kathy Reardon the best.

-----

Dollar Store and Department Store Industries – KSS M JWN BIG DG DLTR PSMT

Household Products Industry – CHD CLX CL ENR HELE JNJ KMB PG

Specialty Retailers Industry – AAN BBBY BBY GME HD LOW LL ODP SHW TSCO WSM

Food Retailing Industry – CASY COST CVS KR SYY TGT WBA WMT

Related: XRT, RTH, FIVE, ULTA, ROST, TJX, OLLI

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Dollar General Corporation (DG) and Johnson & Johnson (JNJ) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Johnson & Johnson is also included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Vanguard Consumer Staples ETF (VDC) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment