Dividend Growth Stocks Soar!

publication date: Dec 7, 2021

|

author/source: Brian Nelson, CFA

Dear members:

---

We're watching one of the strongest stock market rallies we've seen in some time during the trading session December 7. At the time of this writing, the Dow Jones Industrial Average is up over 500 points, the S&P is up nearly 100, while the NASDAQ is up a tremendous 440+. We continue to like what we see.

---

Almost every idea in the Best Ideas Newsletter portfolio is up today, led by Chipotle (CMG) +5.9%, PayPal (PYPL) +3.3%, Domino's (DPZ) +3.1%, Apple (AAPL) +2.9% and Alphabet (GOOG) +2.9%.

---

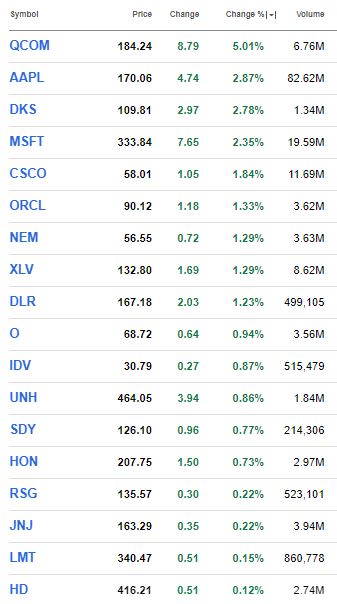

We're loving the moves by Valuentum-style stocks today, and we're even more excited to report that every idea in the Dividend Growth Newsletter portfolio is advancing today, as shown below. We know you're getting tired of hearing it, but we continue to like stocks for the long haul!

---

Bull market on!

---

Image: Every stock in the Dividend Growth Newsletter portfolio is in the green today, with a little less than an hour left in the trading session! Image Source: Seeking Alpha.

----------

Image Source: Value Trap

----------

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment