Dividend Growth Idea Dick’s Sporting Goods Is Firing on All-Cylinders; Raises Guidance (Again) While Generating Gobs of Free Cash Flow

Image Source: Valuentum

By Callum Turcan

On November 23, Dick’s Sporting Goods Inc (DKS) reported third quarter earnings for fiscal 2021 (period ended October 30, 2021) that beat both consensus top- and bottom-line estimates. The sporting goods retailer once again raised its full-year guidance for fiscal 2021 in conjunction with its latest earnings report. Dick’s Sporting Goods also raised its guidance when reporting its fiscal second quarter earnings back in August 2021 and its fiscal first quarter earnings back in May 2021, highlighting management’s growing confidence in the company’s near term performance.

Though shares of DKS sold off following its latest earnings update, likely due to concerns over inflationary pressures and supply chain hurdles, Dick’s Sporting Goods’ outlook remains rock-solid. We continue to like the firm as an idea in the Dividend Growth Newsletter portfolio.

The company announced a 21% sequential increase in its regular quarterly dividend when reporting its fiscal second quarter earnings alongside a $5.50 per share special dividend that was paid out in September 2021. Dick’s Sporting Goods has a history of paying out special dividends (it announced a special dividend of $2.00 per share in December 2012 that was paid out that same month). Shares of DKS yield ~1.5% as of this writing.

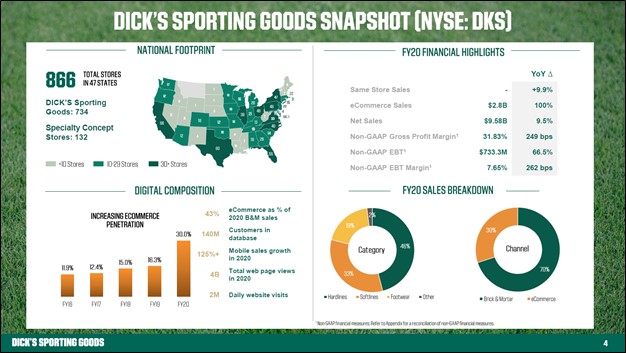

Image Shown: An overview of Dick’s Sporting Goods Inc’s operational presence and recent financial performance. Image Source: Dick’s Sporting Goods Inc – Third Quarter of Fiscal 2021 IR Earnings Presentation

Earnings Update

During the third quarter of fiscal 2021, Dick’s Sporting Goods’ GAAP revenues grew 14% year-over-year, hitting ~$2.75 billion. Its same-store sales grew 12.2% year-over-year in the fiscal third quarter as customers returned to its physical stores in the wake of widespread coronavirus (‘COVID-19’) vaccine distribution efforts. New store concepts such as its ‘Dick’s House of Sport’ stores and adding in-store ‘Soccer Shops’ played a role in this strong performance. The company’s e-commerce sales were up just 1% year-over-year last fiscal quarter, and up 97% over levels seen during the same period in fiscal 2019.

Dick’s Sporting Goods has also done a stellar job boosting its profitability. Its GAAP gross margins rose by over 350 basis points year-over-year and its GAAP operating margin grew by almost 510 basis points year-over-year, enabling its GAAP operating incomes to grow by 71% year-over-year last fiscal quarter, coming in north of $0.4 billion. According to management commentary provided during the firm’s latest earnings call, reduced promotional activity and a favorable sales mix helped its performance on this front, alongside growing economies of scale.

In the fiscal third quarter, the retailer posted $2.78 in GAAP diluted EPS, up 51% year-over-year. On a non-GAAP basis, management noted the retailer reported $3.19 in diluted EPS in the fiscal third quarter, up 59% year-over-year. Strong sales growth and meaningful margin improvements are a powerful combination, made all the more impressive when considering the sizable headwinds the US retail space has faced of late (with an eye towards labor shortages, inflationary concerns, and supply chain hurdles).

Dick’s Sporting Goods generated $0.8 billion in free cash flow during the first three quarters of fiscal 2021 while spending $0.6 billion covering its dividend obligations (keeping its special dividend payment in mind) and an additional $0.4 billion buying back its stock. The firm exited the fiscal third quarter with a net cash position of $0.9 billion with no short-term debt on the books, though it does have sizable operating lease liabilities to be aware of. Stellar free cash flow generating abilities and a pristine balance sheet are immense sources of strength during turbulent times such as these.

Guidance Update

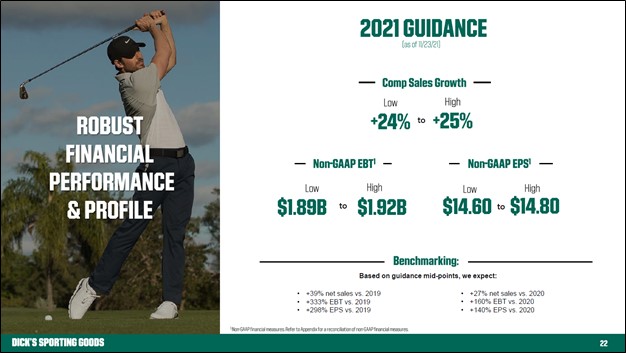

In light of its strong performance last fiscal quarter, Dick’s Sporting Goods is now guiding to generate $14.60-$14.80 in non-GAAP diluted EPS (versus $12.45-$12.95 previously) in fiscal 2021, up 140% on an annual basis at the midpoint of guidance. Additionally, the company forecasts that its comparable store sales will grow by 24%-25% this fiscal year (up from 18%-20% previously) and that its sales growth will reach 27% at the midpoint of guidance (versus 21% previously) on an annual basis.

Dick’s Sporting Goods also favorably adjusted other aspects of its fiscal 2021 guidance (including its GAAP net income and GAAP EPS guidance), and we appreciate the firm’s confidence in its near term outlook. This latest guidance boost may still prove to be a tad conservative given the strength of the US consumer.

Image Shown: An overview of Dick’s Sporting Goods’ guidance for fiscal 2021, which was recently increased once again. Image Source: Dick’s Sporting Goods – Third Quarter of Fiscal 2021 IR Earnings Presentation

As of October 30, 2021, the retailer had $2.5 billion in inventory on hand, up from $2.3 billion as of October 31, 2020. This should enable Dick’s Sporting Goods to meet robust consumer demand during the current holiday shopping season. Management noted in the company’s recent earnings presentation that Dick’s Sporting Goods has a 7% market share in the $120 billion total addressable market the firm is catering to (as of fiscal 2019, before the pandemic struck). During the retailer’s latest earnings call, management noted that the firm is well-positioned to continue growing its market share (emphasis added):

“During a time when consumers are making lasting lifestyle changes with an increased focus on health and fitness, and greater participation in outdoor activities, we believe that DICK'S Sporting Goods has become synonymous with sport in the United States. Nearly our entire category portfolio has re-baselined meaningfully higher versus pre-COVID sales levels. We've capitalized on strong consumer demand and have gained considerable market share in key categories, driven by enhanced product access, service and omni-channel capabilities.

Looking ahead, we're well-positioned to continue gaining share, and we remain optimistic about the long-term demand trends in our most important categories, like Athletic Apparel, Footwear, Team Sports and Golf. We also remain very optimistic about longer-term EBT margin driven by a number of permanent changes versus pre-COVID levels. These changes include a highly differentiated product assortment that is less susceptible to broader promotional pressures, more granular management of promotions and significantly higher profitability of our e-commerce channel.” --- Lauren Hobart, President and CEO of Dick’s Sporting Goods

The company’s e-commerce business, customer loyalty programs (which according to recent management commentary have been effective at encouraging existing customers to be “more active” in their spending habits), new store concepts and revamped in-store layouts are supporting the retailer’s efforts to grow its market share. Dick’s Sporting Goods has identified multiple ways to grow its business going forward. Improvements to the profitability of its e-commerce busienss would go a long way in bolstering its company-wide financial performance.

Supply Chain and Inventory Concerns

During Dick’s Sporting Goods latest earnings call, management mentioned how the retailer was handling its supply chain and inventory concerns (emphasis added):

“Before concluding, I want to spend a moment on the supply chain. Amidst a very dynamic environment our team has done an excellent job working with our vendor partners and with our vertical brand manufacturers to ensure a robust flow of product to meet strong demand.

We ordered aggressively to get ahead of the disruption, and our quarter ending inventory levels increased 7.3% compared to the end of the same period last year. While there will continue to be inventory challenges across the marketplace, our fourth quarter is off to a strong start, and we feel that we are well-positioned within our industry this holiday season. In closing, we have exciting growth opportunities ahead of us.” --- President and CEO of Dick’s Sporting Goods

The company is doing its best on this front, and its outlook indicates that Dick’s Sporting Goods’ growth trajectory remains intact and has ample inventory on hand to meet demand.

Concluding Thoughts

Though shares of DKS sold off initially after its latest earnings update, we liked what we saw. The retailer boosted its guidance once again, continues to generate gobs of free cash flow, has a plan to grow its market share in an attractive market, and exited the fiscal third quarter with a pristine balance sheet. Management remains committed to rewarding shareholders. Our fair value estimate for Dick’s Sporting Goods is $148 per share, and we continue to like the company as an idea in the Dividend Growth Newsletter portfolio.

Dick's Sporting Goods' 16-page Stock Report (pdf) >>

Dick's Sporting Goods' Dividend Report (pdf) >>

-----

Discretionary Spending Industry - ATVI, BBY, CBRL, CMG, DIS, DG, DLTR, DPZ, EL, F, GM, HAS, HD, LOW, MCD, NFLX, NKE, SBUX, TSLA, YUM, DKS, TJX, ROST, WHR, KMX, AZO, RL, ULTA, LEG, GPC, VFC, CTAS, WSM

Tickerized for DKS, HIBB, BGFV, ASO, NKE, YETI, LULU, FL, UA, UAA, AOUT, NLS, SWBI, VSTO, POWW, ADDYY, SKX, DECK, CROX, ELY, GOLF, MSGN, MSGS, AEO, GPS, PLCE, BKE, JWN, URBN, MVP

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Chipotle Mexican Grill Inc (CMG), Dollar General Corporation (DG), Domino’s Pizza Inc (DPZ) and The Walt Disney Company (DIS) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Dick’s Sporting Goods Inc (DKS) and Home Depot Inc (HD) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment