DermTech Revolutionizing the Cancer Detection Market

Image Source: DermTech Inc – Corporate IR Presentation for the first quarter of 2021

Executive Summary: DermTech is an innovator in the skin cancer and skin cancer risk detection market. The company's DermTech Melanoma Test offering that is built on its Pigmented Lesion Assay (‘PLA’) test is cheaper, more effective, and more patient friendly than traditional skin cancer detection offerings. The total addressable market (‘TAM’) for the company’s currently approved PLA test--and PLAplus test if that offering receives regulatory approval--is estimated to stand at ~$2.5 billion (or more) in the US alone. In our view, there is room for DermTech to take a sizable chunk of that market, especially as the firm scales up its sales force. DermTech is one for the radar of capital appreciation seeking investors.

By Callum Turcan

We want to draw your attention to DermTech Inc (DMTK), a US-based innovator in the skin cancer and skin cancer risk detection market. Shares of DermTech are on a sharp upward trajectory of late as its operational performance started to rebound during the second half of 2020, after the firm had to contend with significant headwinds during the first half of 2020 due to the coronavirus (‘COVID-19’) pandemic.

Major Innovation in Skin Cancer Detection Space

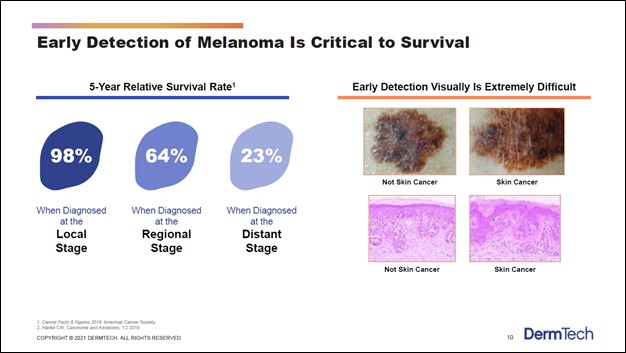

DermTech’s current commercialized product is its DermTech Melanoma Test offering which is a non-invasive way to test for melanoma (a type of skin cancer). Traditionally, testing for melanoma involves removing skin near the suspect mole and sending that skin sample off to a lab for testing. Under conventional methods, biopsy and histology (the study of microscopic anatomy of biological tissues) is used to assess whether the patient may have melanoma, though DermTech sees this process falling short of what patients really need. There is a chance that conventional detection processes will not detect melanoma, particularly during early stages of the disease, which can have an enormous impact on patient survival rates. Catching and treating melanoma early on is critical, as one can see in the upcoming graphic down below.

Image Shown: Detecting melanoma as early as possible is critical when it comes to treating the disease. Patient survival rates are much higher when melanoma is detected early at the ‘local stage’ as compared to when the disease is detected later, such as at ‘distant stage’ when the disease is much more difficult to treat. Image Source: DermTech – Corporate IR Presentation for the first quarter of 2021

The DermTech Melanoma Test involves using an adhesive product to remove skin cells from the area around the suspect mole in a more patient friendly way. Once completed, the adhesive product and skin sample are sent off to DermTech’s laboratories which conduct a Pigmented Lesion Assay (‘PLA’) test on that skin sample that seeks to detect the expression of two genes associated with melanoma, LINC and PRAME (more on this process here). DermTech’s commercial laboratory is in San Diego, California, in the city’s La Jolla neighborhood. Please note that DermTech has numerous patents protecting its PLA testing process, adhesive skin collection product, and similar offerings.

Image Shown: An overview of the operational capabilities of DermTech’s commercial laboratory in California. Image Source: DermTech – Corporate IR Presentation for the first quarter of 2021

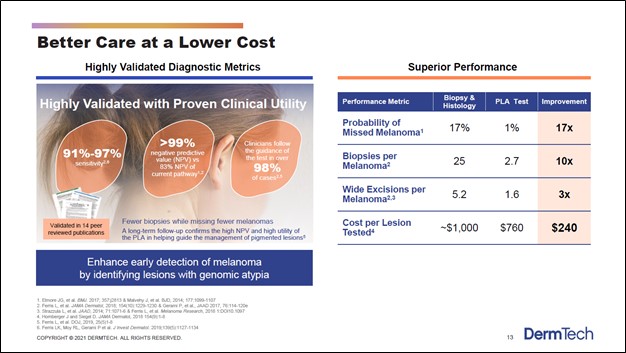

According to the TRUST study conducted by DermTech, its PLA test has significantly better melanoma detection rates (i.e., reduced probability of missing a melanoma diagnosis) than traditional detection tests. Top-line results from the TRUST study were announced by the company in December 2020. We expect that the favorable results from the study to prove to be a crucial marketing point for the DermTech Melanoma Test going forward. DermTech highlights why its PLA offering is superior to its traditional competition in the upcoming graphic down below.

Image Shown: DermTech sees its PLA test having significantly better melanoma detection rates than its traditional competition, which is crucial when it comes to treating the disease. Identifying melanoma early on goes a long way in improving patient survival rates. Furthermore, DermTech’s offering is cheaper than the traditional competition and more patient friendly, which indicates that its PLA test could have room to take significant market share in the US and elsewhere. Image Source: DermTech – Corporate IR Presentation for the first quarter of 2021

What really sticks out is the better melanoma detection rates. As we noted earlier, detecting melanoma early on is essential to treating the disease, as survival rates for patients where the disease is detected (and treated early on) is significantly higher than when that is not the case and the disease is detected much later. DermTech’s PLA offering is also cheaper than the competition, indicating patients will not need to pay up to benefit from DermTech’s medical advancements but can save money instead. Finally, the patient friendly nature of the PLA test could see a greater number of individuals with suspect moles take such a diagnostic test (meaning some individuals in the US may have opted not to take the more invasive and more expensive traditional melanoma detection test but would be willing to take DermTech’s PLA test).

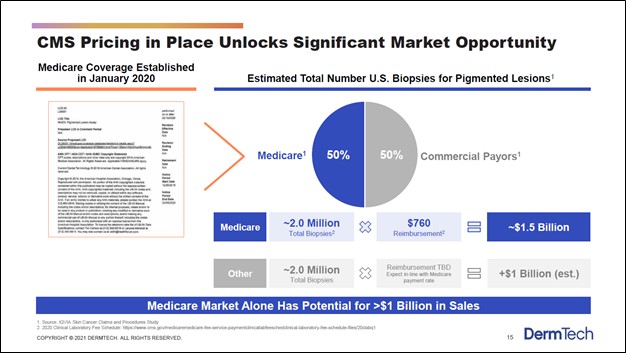

Preventative and detection-related health care measures are becoming increasingly popular with both patients and the health care industry at-large, especially in the US. It is likely that DermTech will find plenty of support from the health care industry for its offerings. Back in January 2020, DermTech noted it had secured an agreement to have its PLA test covered by Medicare Advantage insurance plans. On February 10, DermTech announced it had reached an agreement with Blue Cross Blue Shield of Texas that will make its PLA test available to the health insurer’s 6 million members in the state of Texas. DermTech’s upside from both Medicare and private health insurance holders is substantial as it concerns its PLA test and other offerings.

Massive Market Opportunity

According to DermTech, the total addressable market (‘TAM’) regarding biopsies for pigmented lesions in the US is worth approximately $2.5 billion (or more) as one can see in the upcoming graphic down below. As the company’s PLA test is now covered by Medicare, DermTech views its growth trajectory quite favorably given that the Medicare market alone is a $1.0+ billion opportunity.

Image Shown: DermTech’s PLA test is catering to a sizable market opportunity. Image Source: DermTech – Corporate IR Presentation for the first quarter of 2021

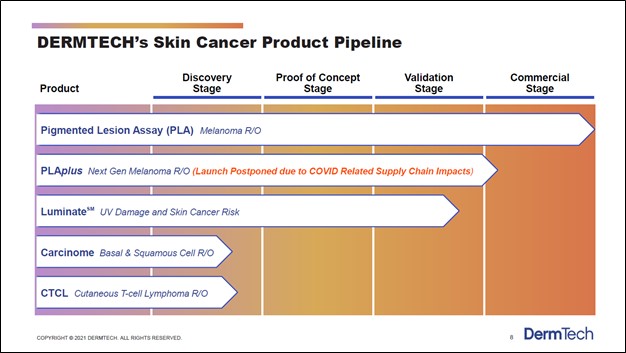

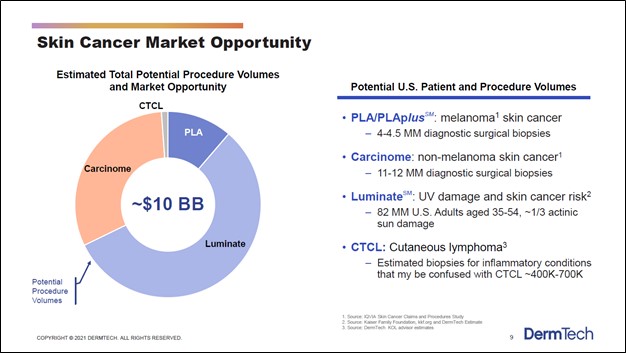

DermTech has other products in the works including its PLAplus offering, which according to commentary given during its third quarter of 2020 earnings call, is expected to launch quite soon (after getting delayed by the COVID-19 pandemic). Management noted that “this second generation test identifies mutations in the TERT promoter, along with the other genes, and improves the sensitivity of our PLA test” which is promising news. Furthermore, DermTech is working on other cancer and cancer risk detection products as one can see in the upcoming graphic down below. However, we will stress that DermTech’s PLA and PLAplus offerings represent the bedrock of its business model, as those are the only products that have either been commercialized or will likely soon be commercialized (assuming everything goes as planned regarding its potential PLAplus product).

Image Shown: DermTech has a pipeline of various cancer and cancer risk detection products. Image Source: DermTech – Corporate IR Presentation for the first quarter of 2021

One of the company’s potential products, Luminate (which aims to detect UV damage and skin cancer risk), is nearing the commercialization stage, though DermTech’s other potential products are still in the early stages of development. Management noted that DermTech was “very excited about the preliminary data that we've seen for Luminate” during its third quarter of 2020 earnings call. In total, DermTech sees its product portfolio (potential and current) targeting a ~$10 billion TAM in the skin cancer and skin cancer risk detection space in the US.

Image Shown: The domestic skin cancer and skin cancer risk detection market is estimated by DermTech to be worth roughly $10 billion. Image Source: DermTech – Corporate IR Presentation for the first quarter of 2021

Financial Overview

At the end of September 2020, DermTech had $52 million in cash, cash equivalents, and short-term marketable securities on hand with no debt on the books. Please note that DermTech pursued a secondary offering in January 2021 that was estimated to generate $117 million in net cash proceeds for the firm (assuming ~4.2 million new shares were issued out), or $135 million if the underwriters were to exercise their option to purchase all of the additional shares allowed through the secondary offering (assuming ~4.9 million new shares were issued out). We appreciate DermTech’s pristine balance sheet and will stress that given its strong stock price performance of late, it could tap equity markets again at very attractive rates to fund its growth trajectory (should it need to).

DermTech roughly tripled its GAAP revenues on a year-over-year basis during the first nine months of 2020, and please note this performance occurred in the face of major headwinds created by the COVID-19 pandemic. The company is aggressively scaling up its salesforce to build awareness for its PLA test offering. Management noted during DermTech’s third quarter of 2020 earnings call that the goal was for the company to have 40 to 50 sales representatives by the end of last year. While the pandemic has created headwinds for DermTech’s business, particularly its expansion plans, management communicated that the firm was getting back on track by the third quarter of last year, noting this in the related earnings call (emphasis added, lightly edited):

“We continue to make progress with increasing awareness of the PLA in the Medicare population. Note that approximately half the surgical biopsies performed for melanoma each year are in the Medicare population. However, Medicare represented only about 16% of our billable sample volumes in Q3 of 2020 compared to approximately 11% in the same period of the prior year. We are now actively working to increase clinician and patient education awareness that our PLA is covered by Medicare. So, this patient population is currently less likely to seek dermatologic care during the pandemic.

Our current overall target market includes approximately 13,000 dermatology clinicians. We [will scale] our sales force to reach our current overall target market and prioritize approximately 5,000 clinicians or our initial target market to account for a high concentration of the total annual surgical procedures to diagnose melanoma. During the first nine months of 2020 we penetrated approximately 30% our initial target market and 8% of our current overall target market with approximately 1,400 unique ordering clinicians.

We had approximately 950 unique ordering clinicians in Q3 of 2020 compared to approximately 620 in Q2 and 900 in Q1 of 2020, highlighting our COVID recovery, while we're working to both increase the number of unique ordering conditions, and to increase the average number of tests ordered by each clinician each month.” --- Kevin Sun, CFO of DermTech

With an operational rebound underway, DermTech aims to scale the business so it can one day be profitable. The company’s GAAP operating loss stood at $26 million during the first nine months of 2020, more than double year-ago levels, and DermTech also generated negative free cash flows of $24 million during the first nine months of 2020. In our view, DermTech posseses the financial strength to continue covering its cash flow outspend over the coming years as it grows the business, especially considering its PLA test should experience strong revenue growth in the near-term (and beyond).

Telehealth

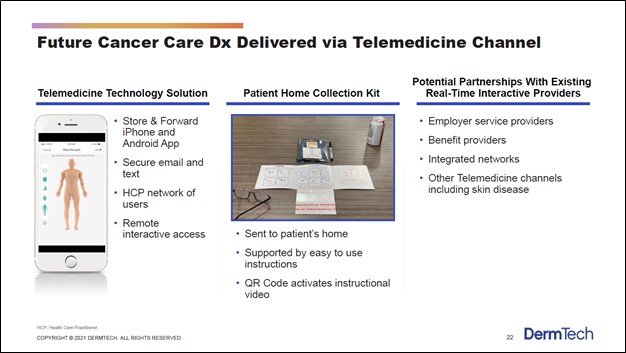

DermTech highlighted its telemedicine efforts as offering the company a way to improve the patient experience and create new growth avenues. However, we caution that there are significant regulatory and other hurdles that makes implementing telemedicine operations no easy task. Management had this to say during the firm’s third quarter of 2020 earnings call:

“…[W]e have identified a unique telemedicine strategy that will capitalize on our digital consumer education campaign and offer patients visiting our Find a Doctor page, an immediate telemedicine option. One technology development solution we completed in the third quarter is a downloadable iPhone and Android HIPAA compliant software application that allows for submission of high quality images and lesion information to a portal for review by a clinician.

We will initiate beta testing of this application before the year end. We're also evaluating web-based software application to provide the same function without the need to download a phone application. In the first half of 2021, we will look to pilot a complete solution.” --- John Dobak, President and CEO of DermTech

Though DermTech has made some process on its digital initiatives, these are still early days and additional investments will be required to build up a comprehensive digital operation. In our view, there is room for significant upside if DermTech is able to encourage a greater portion of the populace to test out suspect moles by offering a cheaper, non-invasive test compared to its more expensive and invasive traditional competition. However, we will caution that it appears patients need to have the collection process monitored so the skin sample (collected via the adhesive product) can be handled and processed properly according to recent management commentary. Additionally, sample volumes “receive[d] via this method [are] very low right now” and DermTech aims to further improve and streamline the process going forward.

Over the long haul, it appears that DermTech is working towards getting regulatory approval to allow its patients to potentially collect the skin sample themselves (likely without supervision) after DermTech sends a patient home collection kit to the appropriate location. After completing the sample collection process, the patient could then send the sample off to the firm’s commercial laboratory in California or to another health care entity that would ultimately deliver the sample to the laboratory. The upcoming graphic down below highlights some of DermTech’s long-term goals in the telemedicine space.

Image Shown: We are intrigued by DermTech’s telemedicine ambitions. Image Source: DermTech – Corporate IR Presentation for the first quarter of 2021

Concluding Thoughts

DermTech is revolutionizing the skin cancer and skin cancer risk detection space, and there is a large market opportunity in the US alone. Internationally, DermTech likely has substantial upside, though it appears the company’s main goal is building up scale domestically first. DermTech is a way off from being profitable though it appears to be at the beginning of a major growth spurt as its first commercialized product is starting to gain some real traction. What underpins DermTech’s promising growth outlook is the meaningful improvements its PLA test offers over the traditional competition. Capital appreciation seeking investors should keep an eye on DermTech.

-----

Health Care Bellwethers Industry - JNJ, WBA, CVS, ISRG, MDT, ZBH, BAX, BDX, BSX, MTD, SYK, BIIB, GILD, ABT, ABBV, LLY, AMGN, BMY, MRK, PFE, VRTX, ZTS, REGN, UNH

Tickerized for DMTK, MYGN, CSTL, SSKN, VRSEF, HRC

Other: EXAS

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Johnson & Johnson (JNJ) and the Health Care Select Sector SDPR Fund (XLV) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Vertex Pharmaceuticals Inc (VRTX) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. UnitedHealth Group Inc (UNH) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. The Vanguard Consumer Staples ETF (VDC) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment