Debt-Free Facebook’s Free Cash Flow Surges 38%, Adds to Buybacks

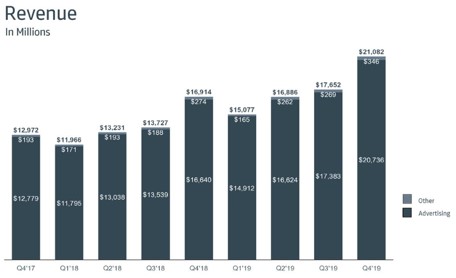

Image Source: Facebook Q4 2019 slides. Revenue growth at Facebook remains solid, if not impressive.

By Brian Nelson, CFA

On January 29, Facebook (FB) reported better-than-expected fourth-quarter 2019 results. In the quarter ending December 31, total revenue advanced 25%, but total costs and expenses leapt 34%, translating to operating-income expansion of just 13%. This was better than the full-year number, which showed operating income fall 4% as costs ballooned. We don’t think the market liked the full-year numbers which were weighed down by a weak first half of the year. The fourth quarter, itself, was solid, and Facebook continues to plow ahead.

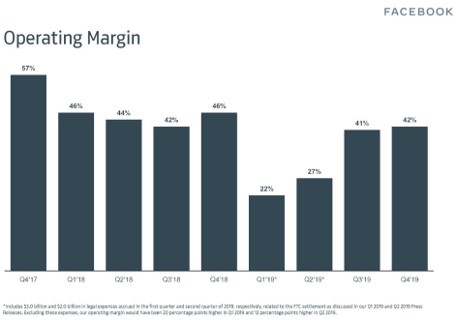

Image Source: Facebook Q4 2019 slides. The company’s operating margin has bounced back significantly.

While we expect the market to overreact (shares are indicated down), nothing was really surprising to us, as we had been expecting cost headwinds and moderating revenue performance. Facebook continues to grapple with data privacy initiatives, social issues including election integrity, and government intrusions into its day-to-day business life, not the least of which is anti-trust considerations.

Headcount reflected the company's recent investments, advancing 26% year-over-year as of the end of December, but Facebook’s operating margin was still a robust 42% in the quarter. Other companies would love to generate this level of profitability--to earn $0.40+ on each $1 of revenue. Importantly, it is clear to us that Facebook has recovered nicely from the headwinds of yesteryear.

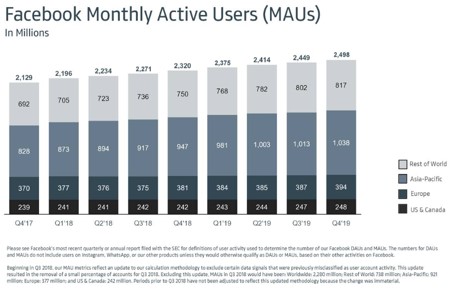

Image Source: Facebook Q4 2019 slides. More and more people are still going on Facebook’s website.

Facebook’s monthly average users came in at a healthy 2.5 billion at the end of 2019, up 8% on a year-over-year basis, a pace that is quite healthy, in our view. Facebook is already a social media powerhouse so we're less concerned about it growing its already-massive user base (or even engagement, for that matter) than we are about its efforts to monetize it, which it continues to do effectively. Long-term, we expect the company’s ‘other’ revenue to be a more important driver than its sliver-of-a-contribution at the moment. Instagram Checkout, augmented/virtual reality, Facebook Dating, etc, offer tremendous incremental opportunities, even if Libra doesn’t pan out.

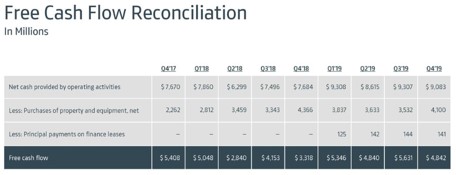

Image Source: Facebook Q4 2019 slides. 2019 was a fantastic year for free cash flow generation.

We liked Facebook’s cash flow numbers. Net cash from operating activities expanded to $36.3 billion in 2019 versus $29.3 billion in 2018, while capital expenditures came in at $15.1 billion in 2019 versus $13.9 billion in 2018. Free cash flow of $21.2 billion was 38%+ better than the $15.4 billion last year. Total cash and cash equivalents and marketable securities expanded to $54.9 billion at the end of 2019 from $41.1 billion at the end of 2018. Its balance sheet remains debt free, and it announced a $10 billion increase to its stock buyback program.

On the conference call, CEO Mark Zuckerberg addressed ongoing opportunities with small business, noting that 140 million small businesses use its services for free, and he emphasized Facebook’s four key priorities: “making progress on the major social issues, building qualitatively new product experiences, continuing to grow our business, and getting out there and communicating more transparently.” In addition to announcing a new Privacy Checkup tool, Zuckerberg also spent some time addressing the social issues of the day. Here’s an excerpt from the conference call regarding the latter:

When it comes to these important social issues, I don't think the private companies should be making so many important decisions by themselves. I don't think that each service should have to individually decide what content or advertising is allowed during elections or what content is harmful overall. There should be a more democratic process for determining these rules and regulations. For these issues, it's not enough for us to just make principal decisions. The decisions also need to be seen as legitimate and reflecting what the community wants. And that's why I've called for clearer regulation for our industry. And until we get clearer rules or establish other mechanisms of governance, I expect that we and our whole industry will continue to face a very high level of scrutiny.

In some ways, the more regulation that is placed on social media participants, the wider Facebook’s economic moat becomes, and the more valuable its business. Increased regulation makes it prohibitively costly for new entrants, making a “Myspace scenario” significantly less likely to disrupt Facebook in the long haul, while any moves to break up the business will likely result in Facebook selling or spinning out portions of its operations at a hefty premium than their embedded value within the overall Facebook umbrella. Though increased regulation sounds like a negative, it remains an indirect and counterintuitive positive for Facebook’s shares.

Concluding Thoughts

The market didn’t like Facebook’s fourth-quarter 2019 report, but we didn’t see anything to be concerned about. Revenue is growing like a weed, the firm’s operating margins have come roaring back, free cash flow is surging, its balance sheet is net-cash-rich with no debt, and the firm is buying back underpriced stock.

We think the market is too focused on the annual reported numbers and less focused on the many opportunities Facebook has ahead of it. While revenue growth will inevitably slow for a huge company as Facebook and cost pressures will remain prevalent, this company is doing well. The firm remains a key holding in the Best Ideas Newsletter portfolio.

Our fair value estimate is unchanged at $234 per share.

Related: TWTR, SNAP, MTCH

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment