CubeSmart Remains Rock-Solid

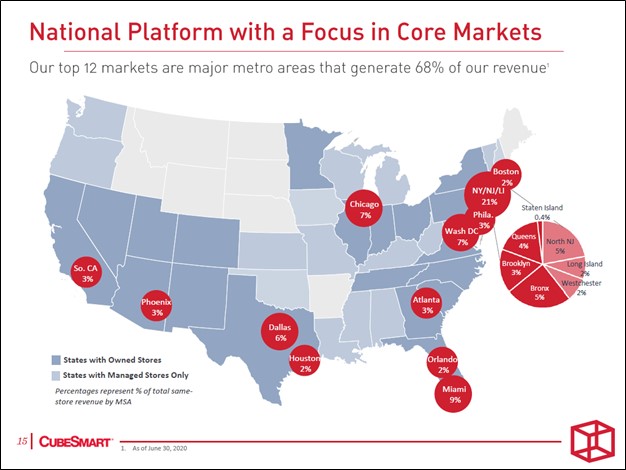

Image Shown: An overview of CubeSmart’s core geographical focus. We continue to like CubeSmart as a holding in our High Yield Dividend Newsletter portfolio. Image Source: CubeSmart – September 2020 IR Presentation

By Callum Turcan

One of our favorite industries as it relates to locating high-quality high-yielding companies with promising dividend growth runways is the self-storage real estate investment trust (‘REIT’) space, particularly companies with operations primarily (if not entirely) in the US. Within this industry, CubeSmart (CUBE) is one of our favorites and remains a holding in our High Yield Dividend Newsletter portfolio. Shares of CUBE yield ~4.0% as of this writing.

The self-storage REIT continued to make good on its dividend obligations during the initial stages of the coronavirus (‘COVID-19’) pandemic, a task made easier through CubeSmart’s ability to generate meaningful free cash flows. Unlike most other REITs, REITs operating in the self-storage space tend to be able to generate substantial free cash flows, and CubeSmart is no exception as we cover in this note.

Quarterly Overview

CubeSmart’s financial and operational performance held up well during the initial stages of the pandemic. When the REIT reported its second quarter 2020 earnings in August, its same-store occupancy rate averaged 93.0% during the period and ended the quarter at 94.0% Its same-store net operating income (‘NOI’) dropped by 4.1% year-over-year in the second quarter due to a combination of revenue declines and rising operating expenses; however, given the headwinds CubeSmart faced due to the pandemic, that performance was quite decent all things considered. By the end of August, CubeSmart’s same-store occupancy rate had improved to 94.3% according to its September 2020 IR presentation.

By the middle of 2020, CubeSmart had resumed rate increases for its existing tenants and had restarted normal delinquency processes, activities that were suspended due to the pandemic. These factors should help significantly improve CubeSmart’s near-term performance going forward.

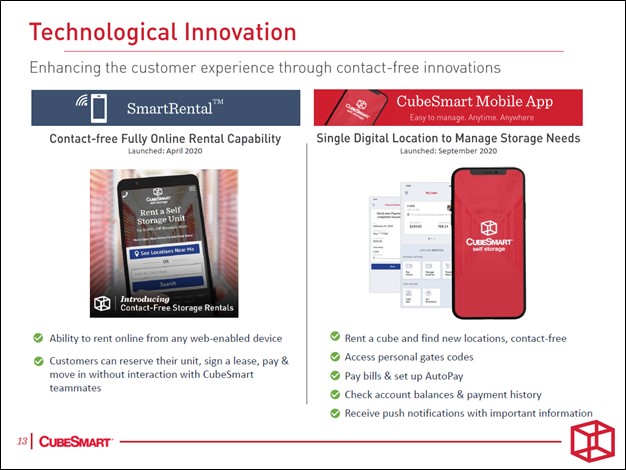

A big part of CubeSmart’s turnaround rests on its ‘SmartRental’ offering which is billed as a “contactless online rental process.” This service was responsible for roughly a quarter of CubeSmart’s rentals during the second quarter according to management commentary provided during the REIT’s latest earnings call. In early September, CubeSmart launched a mobile app that could lead to better tenant retention by meaningfully improving the customer experience (the app allows customers to access their gate code and pay bills online, among other things).

Image Shown: A look at CubeSmart’s digital initiatives. Image Source: CubeSmart – September 2020 IR Presentation

Here is what CubeSmart’s management team had to say regarding recent events during the firm’s latest earnings call (emphasis added, lightly edited):

“As we noted in our press release, we resume[d] more traditional pre-COVID operational processes by the end of June. During the month of July and into early August, rate increase letters were sent to all of our customers including those remaining in our portfolio for whom we had pause the process in mid-March. We anticipate that the rent roll will be fully caught up with rate increases by the end of the quarter.

We continue to innovate at a rapid pace reaping the benefits of investments we have made in our technology stack, revenue management and marketing automation. SmartRental, our online contact free experience, accounted for approximately 25% of our rental volume during the quarter. We remain cautiously optimistic.

Our industry has been and remains very resilient. We are keeping a watchful eye on customer behavior in light of continuing uncertainty around government stimulus, the opening and closing of schools and segments of our economy and the varying impact the pandemic is having in each region of our country.” --- Christopher Marr, President and CEO of CubeSmart

Due to uncertainties created by the ongoing pandemic, CubeSmart did not decide to reinstate guidance for 2020 during the REIT’s second quarter earnings report.

The REIT also provides services to third-party self-storage facilities through its management platform, which added 27 stores to its managed store base in the second quarter, bringing the total up to 719 stores by the end of June 2020 (up 11% versus the same period last year). Please note that this management platform is an effective way for CubeSmart to both generate revenues and locate new properties to acquire. CubeSmart has had a lot of success on this front recently, though this business represents just a small slice of its company-wide revenues.

Payout Coverage

During the first half of 2020, CubeSmart generated $0.81 per share in adjusted funds from operations (‘AFFO’), down from $0.82 per share in the same period last year. Though an imperfect non-GAAP metric, FFO and AFFO per share metrics are a useful tool for gauging the ability for a REIT to keep making good on its dividend obligations in the near term (we will have more to say on this in a moment). As CubeSmart paid out $0.66 per share in dividends during the first half of this year, its dividend payout ratio (dividends per share divided by AFFO per share) came in at a little over 81% during this period. We prefer payout ratios below 80% but appreciate that CubeSmart’s financials have held up relatively well during the pandemic so far. As an aside, CubeSmart’s GAAP revenues grew by 5% year-over-year during the first half of 2020.

As a capital market dependent entity, CubeSmart needs to retain constant access to debt and equity markets to refinance its maturing debt, make good on its dividend obligations, and fund its growth ambitions. During the first half of 2020, CubeSmart generated $189 million in net operating cash flow and spent $49 million on its capital expenditures (defined here as ‘additions and improvements to storage properties’ plus ‘development costs’), allowing for $140 million in free cash flows. The REIT spent $128 million covering its ‘distributions paid to common shareholders’ during this period which were fully covered by CubeSmart’s free cash flows, though we caution that the REIT also spent $73 million on ‘acquisitions of storage properties’ during the first half of this year.

Financial Update

CubeSmart had a little over $3 million in cash and cash equivalents on hand at the end of June (not including $3 million in restricted cash on the books) versus ~$1.95 billion in total debt. Its large net debt load needs to be closely monitored going forward, though we view this burden as manageable. The REIT can use its at-the-market (‘ATM’) equity issuance program to raise funds. Management noted CubeSmart’s debt-to-EBITDA ratio stood at 4.9x at the end of the second quarter of 2020 during the firm’s latest earnings call.

The REIT has a a $0.75 billion revolving credit line due June 2024 that can be tapped for funds. With CubeSmart’s investment grade (Baa2/BBB) credit ratings and strong financial performance of late, it could also likely tap debt markets for funds at (ideally) attractive rates. The interest rate on its revolving credit line is relatively low at LIBOR+1.10% (as of June 30, the effective weighted average interest rate on the revolver was 1.26%). Here we would like to note that LIBOR, or the London Interbank Offered Rate, will soon be going away (regulators in the UK have indicated that they will no longer be able to guarantee the availability of LIBOR beyond the end of 2021) and the Secured Overnight Financing Rate (‘SOFR’) might replace it (more on that here).

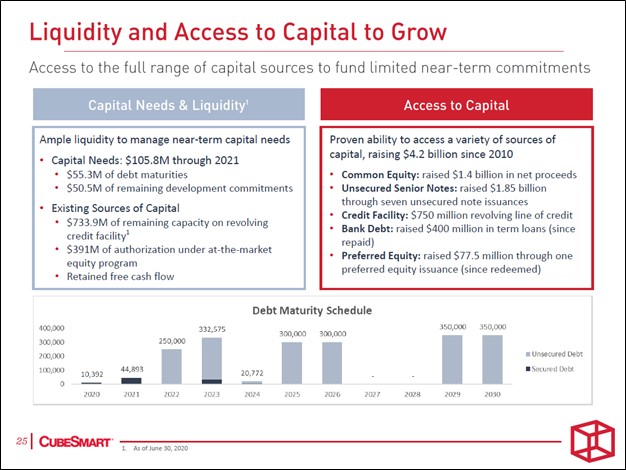

As of the end of June, CubeSmart had over $0.7 billion in remaining borrowing capacity on its revolving credit line. In the upcoming graphic down below, CubeSmart highlights the various ways it could raise funds if needed (free cash flows, equity issuances, tapping its revolving credit line) along with its staggered debt maturity schedule (which we appreciate given that makes refinancing activities an easier task). CubeSmart could also likely issue out debt at attractive rates if it wanted too as noted previously, though that is not necessary at this point given its revolving credit line and sizable free cash flows.

Image Shown: CubeSmart’s debt maturity schedule is staggered, making refinancing activities an easier task. Image Source: CubeSmart – September 2020 IR Presentation

Concluding Thoughts

The equity prices of self-storage REITs initially tanked earlier this year due to fears over COVID-19, though shares of CUBE have now recovered all their lost ground since March as of September. As of this writing, CubeSmart’s stock price is up over 4% year-to-date, not including dividend considerations. We are confident that CubeSmart’s rock-solid financial and operational performance of late indicates that its long-term growth trajectory remains intact, and investors have been steadily warming back up to the name. We expect CubeSmart will be able to continue meeting its dividend obligations going forward, keeping pandemic-related headwinds in mind. On a final note, we continue to like Public Storage (PSA) as a holding in our High Yield Dividend Newsletter portfolio as well.

-----

Related: UHAL, CAR, PSA, R, URI, CUBE, EXR, JCAP, VNQ, PSTG, SPY

----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares of any of the securities mentioned above. CubeSmart (CUBE), Public Storage (PSA), and Vanguard Real Estate ETF (VNQ) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment