Biofuel Producer Renewable Energy Group Is Worth a Look

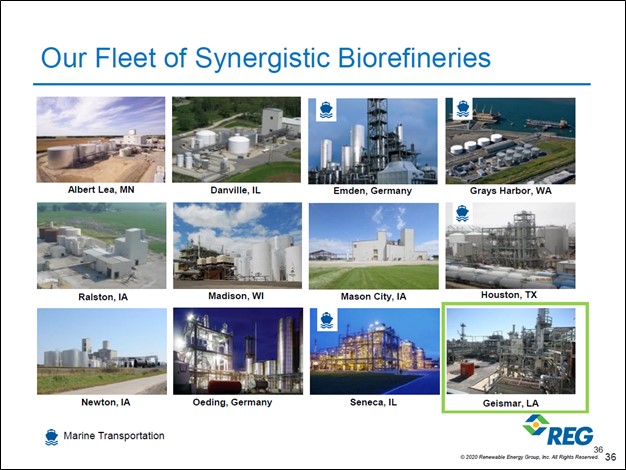

Image Shown: A geographical overview of Renewable Energy Group’s operational “biorefineries” in the US and Germany. Image Source: Renewable Energy Group Inc – October 2020 IR Presentation

Executive Summary: Renewable Energy Group is an intriguing biofuel maker with operational “biorefineries” located across the US and in Europe (specifically Germany). The company’s operations are supported by an extensive distribution network that is primarily built upon supply agreements with third parties, though Renewable Energy Group opened its own branded fuel location in 2019 for the first time.

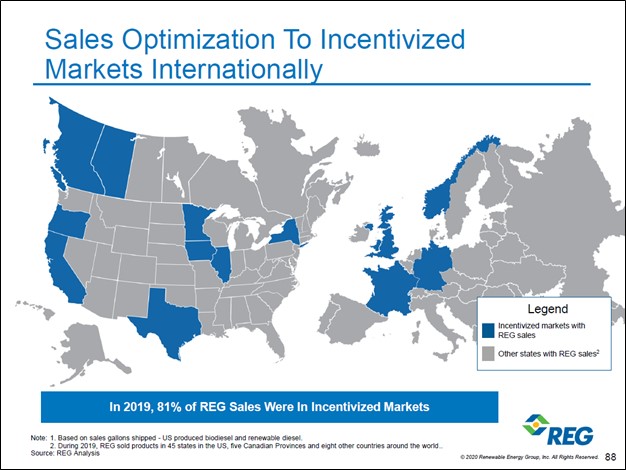

Shares of REGI have been on an upward tear of late, likely due to growing investor optimism towards green energy firms, in our view, as the new Biden administration in the US has made it clear that it would push for greater federal incentives to stimulate investment in domestic renewable energy industries. In Europe, the EU has imposed mandates and created incentives to stimulate investment in the biofuel space and non-EU members states, like Norway and the UK, have also implemented aggressive policies to support the biofuel industry.

During the first nine months of 2020, Renewable Energy Group’s financial performance posted a tremendous turnaround as the company focused on higher-margin products. The company’s balance sheet is pristine, though we caution that historically, Renewable Energy Group has leaned on equity issuances to fund its growth ambitions though more recently, the firm has started to focus on reducing its outstanding diluted share count (or at the very least, limiting its shareholder dilution).

We are impressed with Renewable Energy Group’s recent financial performance and are intrigued by its long-term outlook. However, we caution that the firm is highly exposed to exogenous forces. Government incentives, or lack thereof, from national government bodies (and to a lesser extent, from certain US state governments) will have an outsized impact on the trajectory of Renewable Energy Group’s growth story going forward. Investors are clearly optimistic, as shares of REGI have more than tripled over the past year. Please note Renewable Energy Group does not pay out a common dividend at this time.

By Callum Turcan

The biofuel producer Renewable Energy Group Inc (REGI) operates roughly a dozen “biorefineries” across the US and Europe. Shares of REGI have more than tripled during the past year as of this writing due primarily to expectations that the new Biden administration will provide the US biofuel industry with significant federal support, in our view, which comes on top of expectations that Europe will continue to aggressively support the industry going forward. In this article, we dig into the biofuel industry’s regulatory landscape, incentive structure, and Renewable Energy Group’s outlook.

Regulatory and Unit Economics Overview

Well over a decade ago, then-President Bush signed the Energy Policy Act of 2005 into law which created the Renewable Fuel Standard that mandated transportation fuels (such as gasoline and diesel) had to include a greater amount of biofuel. This mandate was expanded two years later when then-President Bush signed the Energy Independence and Security Act of 2007 into law. Every year since this mandate was enacted, an increasing amount of biofuel was required by law to be blended with traditional fossil fuel-based transportation fuels. The annual increases are slated to run through 2022, and by then the Renewable Fuel Standard mandate dictates the US needs to blend 36 billion gallons of biofuel per year with traditional transportation fuels. For reference, this is referred to as the Renewable Volume Obligation (‘RVO’) which is set by the US Environment Protection Agency (‘EPA’).

The Renewable Fuel Standard mandate is monitored through the Renewable Identification Numbers (‘RINs’) system. RINs are created when a domestic gallon of renewable fuel (such as biodiesel) is produced. Renewable fuels can be produced through “conventional” means (such as using corn or grain sorghum as a feedstock) or “advanced” means (using cellulosic and other feedstocks); please note there are several different classifications for biofuels. The Renewable Fuel Standard mandates that a certain amount of each type of biofuel (the four core groups are cellulosic biofuel, biomass-based diesel, advanced biofuel, and renewable fuel) needs to be produced each year domestically.

RINs can be sold to traditional refiners, refining operations that use fossil fuel to produce transportation fuels, to allow those refiners to comply with the Renewable Fuel Standard mandate. When a gallon of fossil fuel-based transportation fuel is produced domestically or imported, that creates a regulatory liability which needs to be offset either through the refiner producing a commensurate amount of its own biofuels domestically or by acquiring RINs from third parties. Generally speaking, most traditional refiners do not produce enough biofuels internally to comply with the Renewable Fuel Standard mandate.

Effectively, RINs increase the value of biofuels, which in theory, is supposed to stimulate domestic production of biofuels by enhancing the economics of biorefineries. There are other US government incentives to be aware of including state incentives, though one of the biggest is the biodiesel tax credit (‘BTC’). While the BTC expired at the end of 2017, it was extended until 2022 when the Further Consolidated Appropriations Act was signed into law in December 2019 by then-President Trump. Additionally, the biofuel industry received further federal support when the massive omnibus spending package for fiscal 2021 was signed into law by then-President Trump in December 2020, as that package extended key tax credits and other provisions that are beneficial to the industry.

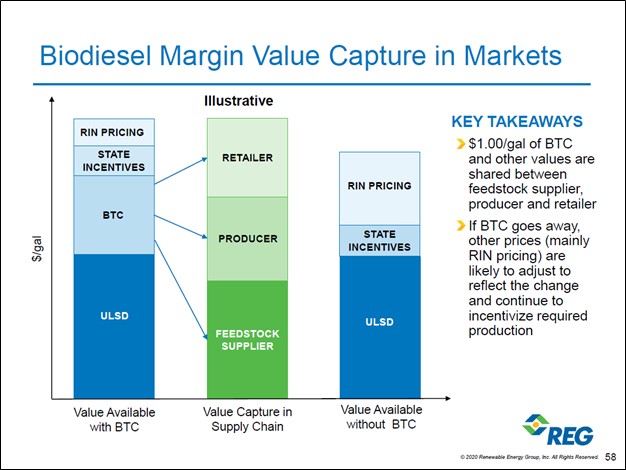

In the upcoming graphic down below, Renewable Energy Group provides a breakdown of the unit economics of biofuel production in the US. There is the value generated from selling a product that is broadly equivalent to ultra-low sulfur diesel (‘ULSD’), where Renewable Energy Group would pocket the difference between its feedstock expenses and other operating costs versus the price received for the final product when sold (similar to “crack spreads” in the traditional refining industry). Also, there is the value generated from the creation of RINs through the domestic production of biofuels along with various state incentives, and then there is the BTC (along with any other tax credits).

Image Shown: Renewable Energy Group provides an illustrative overview of how the unit economics of biofuel production plays out in the US. A combination of market oriented dynamics and government subsidies underpin the economics of the industry. Image Source: Renewable Energy Group – October 2020 IR Presentation

According to Renewable Energy Group, should the BTC expire, market dynamics would push up the value of RINs to stimulate enough biofuel production to comply with the RVO for the relevant year, though we will stress that the BTC does play a leading role in supporting the firm’s unit economics and the industry at-large. Here, we will caution that waivers from the EPA to certain domestic refineries can have an outsized impact on the price of RINs, though in our view, it is unlikely the Biden administration would prioritize these waivers.

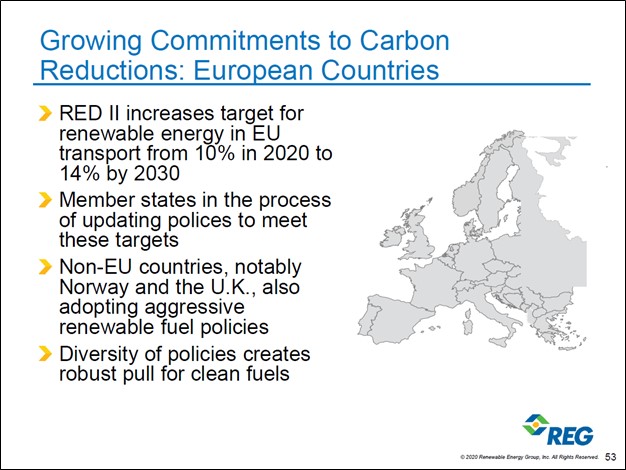

Government intervention, particularly on a federal level, plays a huge role in the economics of the biofuel industry in the US, Europe and elsewhere. Various national government policies in EU member countries and in non-EU European countries (such as Norway and the UK) are quite supportive of the biofuel industry. The upcoming graphic down below highlights why Renewable Energy Group views the regulatory landscape in Europe favorably. For reference, RED II stands for Renewable Energy Directive II and that directive requires EU member states to mandate that fuel suppliers, at a minimum, supply 14% of the energy consumed by transportation and rail activities with renewable energy by 2030 (up from 10% in 2020).

Image Shown: Renewable Energy Group views the regulatory landscape in Europe as one that is quite favorable towards the biofuel industry. Image Source: Renewable Energy Group – October 2020 IR Presentation

Looking at Renewable Energy Group

Pivoting now to Renewable Energy Group, the company operates roughly a dozen biorefineries across the US and Germany. The firm supports its operations through an expansive distribution network (largely through agreements with third-parties). Here, we would like to note that about 10% of the firm’s annual revenues came from the sale of petroleum products there were purchased from third parties in 2019.

Renewable Energy Group is in the process of expanding its biofuel plant in Geismar, Louisiana. The goal is to add 250 million gallons of annual biofuel production capacity to the facility, which currently has 90 million gallons of annual biofuel production capacity. Constructing activities are expected to run through 2023 and this development is expected to cost $825 million to complete.

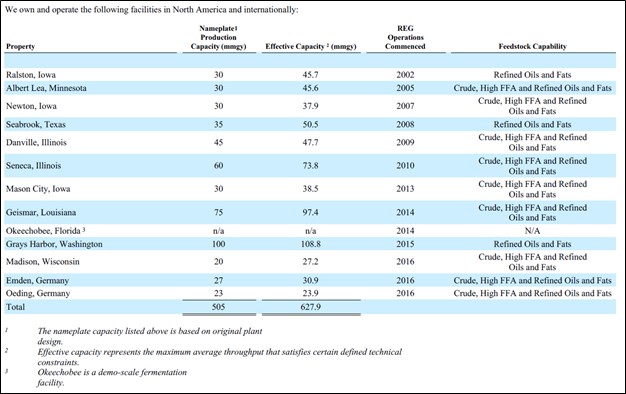

Image Shown: An overview of Renewable Energy Group’s operational biorefineries. Image Source: Renewable Energy Group – October 2020 IR Presentation

Other than its big expansion project in Louisiana, Renewable Energy Group has pursued relatively modest-sized projects elsewhere. For instance, the firm spent roughly $9 million adding a little over 2 million gallons of storage capacity by expanding the tank farm at its biorefinery in Emden, Germany. This endeavor reduced freight rates (via larger parcel sizes and economies of scale), reduced downtime related to shipping delays, and reduced third-party handling costs. Combined, these dynamics are expected to save the company roughly $5 million on an annual basis going forward.

Another project involves upgrading its biorefinery in Seneca, Illinois, through a roughly $34 million development. This endeavor aims to save almost $16 million per year by increasing the facility’s brown grease processing capacity that, in turn, will upgrade the bio-residual oil quality and thus allow certain products to be sold into the heating oil market. Effectively, this development aims to make Renewable Energy Group’s biorefinery in Seneca, one of its largest (in terms of production capacity), more efficient.

Financial Performance Stages Impressive Turnaround

In the third quarter of 2020, Renewable Energy Group produced 137 million gallons of fuel and generated $576 million in GAAP revenues after selling 176 million gallons of fuel. Though the company’s GAAP revenues fell 1% year-over-year in the third quarter of 2020, Renewable Energy Group produced a positive GAAP operating income of $27 million during this period (versus a GAAP operating loss of $12 million in the same quarter in 2019). Additionally, Renewable Energy Group’s GAAP net income swung to a profit of $26 million in the third quarter of 2020 (versus a net loss of $14 million in the third quarter of 2019) as the company focused on higher margin products.

Renewable Energy Group reported that it sold 6% fewer gallons of fuel in the third quarter of last year on a year-over-year basis as it sold fewer “lower margin petroleum diesel volumes and third party biodiesel volumes” and more “self-produced biodiesel,” which had a favorable impact on its profitability levels. The company has been steadily seeking to become a more integrated operation and opened its first fueling station back in July 2019, which is located in Seneca near its existing biorefinery. Renewable Energy Group acquired Keck Energy in 2018 to support its distribution growth ambitions. Shifting towards higher margin products, boosting its own biofuel production capabilities and growing its distribution network underpins Renewable Energy Group’s cash flow growth trajectory.

During the first nine months of 2020, Renewable Energy Group’s GAAP gross profit came in at $210 million (versus negative $15 million in the same period in 2019) and it reported $103 million in GAAP operating income (versus negative $104 million in the same period in 2019). The turnaround in its financial performance is impressive. We caution the company has leaned on equity issuances in the past to fund its growth ambitions (which is particularly relevant as the firm’s capital expenditure expectations going forward have increased materially due to its planned biorefinery expansion in Louisiana).Renewable Energy Group’s weighted-average outstanding diluted share count was up 13% year-over-year during the first nine months of 2020.

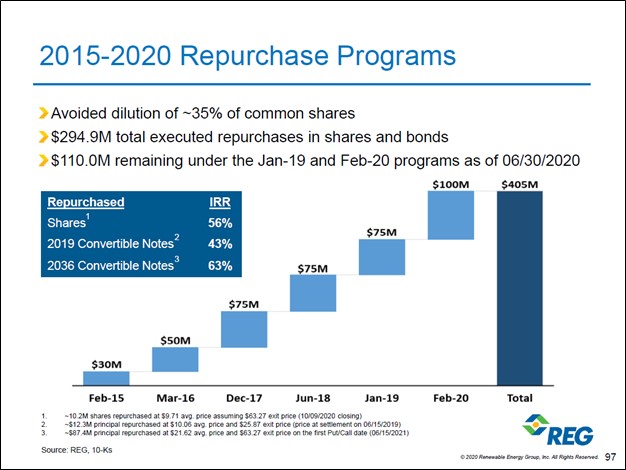

Though favorable working capital movements have been key, Renewable Energy Group generated $0.5 billion in free cash flow during the first nine months of 2020. Please note that more recently, Renewable Energy Group has been steadily buying back its convertible bonds while also pursuing share repurchases. For reference, the company does not pay out a common dividend at this time. Management had this to say during Renewable Energy Group’s third quarter of 2020 earnings call on the issue (moderately edited, emphasis added):

“Now let's turn to the balance sheet… and discuss our capital allocation strategy. The balance sheet remains strong. We have $286 million in marketable securities, with $100 million of those classified as long-term. Our multi-quarter debt reduction program has resulted as planned in a low leverage ratio and a net cash position as we consider the necessary financing to the deployment Geismar expansion.

…our strong liquidity and capital position, which provides us with many options as we finalize our financing strategy. On that subject, we have a combination of opportunities and operational needs that compete for capital. Obviously, renewable diesel is attractive and the planned Geismar expansion is at the top of the list.

Sharing convertible bond repurchases have also been a high return option opportunistically over the years.Finally, our biodiesel fleet optimization opportunities are attractive and delivering returns.

As a reminder, our target for growth and capital projects is a 20% internal rate of return for the project and an overall 15% return on invested capital for the company. In the third quarter, our capital expenditure investment was $16 million. We also use[d] $18 million to repurchase convertible bonds early in the quarter. And we now have $91 million of repurchase authorization remaining following that repurchase.” --- Chad Stone, Senior Vice President, Commercial Performance and CFO of Renewable Energy Group (CFO since 2009)

In the coming years, Renewable Energy Group may one day be able to significantly pare down its outstanding share count via large share buyback programs funded through its organically generated free cash flows. The upcoming graphic down below highlights the company’s share buyback and convertible bond repurchase programs from 2015 through 2020, though please note this graphic does not include all of its financing activities conducted last year. Stock-based compensation expenses remain material but manageable (the firm’s stock-based compensation benefits totaled $5 million during the first nine months of 2020, up modestly year-over-year).

Image Shown: Renewable Energy Group has been steadily buying back its convertible notes and shares over the past several years to limit the dilution of its shareholder base. Image Source: Renewable Energy Group – October 2020 IR Presentation

The company exited September 2020 with almost $0.4 billion in cash-like assets on hand (inclusive of short- and long-term marketable securities) versus less than $0.1 billion in total debt (inclusive of short-term debt). While Renewable Energy Group also has modest operating lease liabilities on the books, those totaled less than $0.05 billion at the end of this period (inclusive of short- and long-term operating lease liabilities). We're big fans of the company’s pristine balance sheet. Renewable Energy Group’s financial position is quite strong--and given that there is a very real chance the US federal government will step up investment and incentives towards the biofuel industry going forward--the company’s outlook is quite promising.

We caution, however, that should government incentives come to an end and/or additional government incentives do not materialize, that would have an outsized impact on Renewable Energy Group’s financial performance. During the first nine months of 2020, ‘biomass-based diesel government incentives’ represented ~15% of the company’s GAAP revenues. Renewable Energy Group’s outlook is heavily influenced by exogenous forces and the direction political winds are blowing.

Image Shown: Renewable Energy Group focuses on selling biofuel products in markets with favorable incentive structures. Image Source: Renewable Energy Group – October 2020 IR Presentation

Closed Plant

In August 2019, Renewable Energy Group closed its biorefinery in New Boston, Texas. The press release announcing the closure noted the firm’s decision was made “due to challenging business conditions and continued federal policy uncertainty, most notably the long-lapsed federal biodiesel tax credit.” For reference, the facility had 15 million gallons of annual biofuel production capacity.

Renewable Energy Group currently has 11 biorefineries in the US (though its facility in Okeechobee, Florida is only for demo-scale fermentation purposes) and two in Germany. It is possible that the New Boston facility in Texas may reopen in the future should key domestic federal incentives towards the biofuel industry get extended for a prolonged period (to provide certainty to the industry). However, please note that there are no plans to reopen that facility that have been made publicly available. The company still has an operational biorefinery in Seabrook, Texas, and it is not clear if Renewable Energy Group retained ownership of the facility in New Boston.

As one can see in the upcoming graphic down below, Renewable Energy Group has been steadily growing its production capacity during the past two decades. Its biorefinery in Grays Harbor, Washington (state) is currently its largest, though that will change once the expansion of its Geismar facility is complete.

Image Shown: An overview of when Renewable Energy Group’s biorefineries opened and the nameplate capacity of each facility. Image Source: Renewable Energy Group – 2019 Annual Report

Partnership

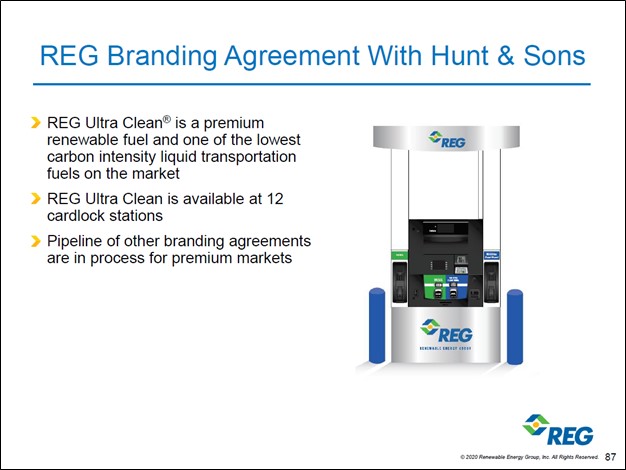

Renewable Energy Group announced a supply agreement with Hunt & Sons in July 2020 that involves Renewable Energy Group supplying its REG Ultra Clean biofuel (for transportation needs) to 12 of Hunt & Sons’ fuel locations in Northern California. Deals like these are how Renewable Energy Group can scale its production capabilities as the firm needs to know it will be able to find buyers for its output. The company is in the process of securing additional supply deals.

Image Shown: Renewable Energy Group continues to secure supply agreements with transportation fuel distributors and retailers which in turn supports its ability to grow its biofuel production levels going forward. Image Source: Renewable Energy Group – October 2020 IR Presentation

Here is what Renewable Energy Group’s management had to say regarding the company’s growth strategy during the firm’s third quarter of 2020 earnings call (moderately edited, emphasis added):

“One area of focus here is expansion of renewable diesel production, which will balance our product portfolio and enable us to accelerate our downstream strategy. Last month, we announced that we have a major expansion planned at Geismar, Louisiana.

…we intend to add 250 million gallons per year capacity to our existing facility there increasing renewable diesel production capacity to 340 million gallons per year. The project is on track to be completed in late 2023 with projected costs of around $825 million. Geismar was selected solely for the advantages that it offers us, including economies of scale, ready access to hydrogen, advantage logistics, and a strong community of support, including an excellent workforce.

As we pursue this growth, we will also continue to closely watch our economics at all locations and we're committed to making strategic decisions to optimize our portfolio, maximizing margin and impact, and shifting resources as opportunities arise.

A second important focus for growth is our downstream strategy. Our aim is to generate near-term margin enhancement for the fuels we sell. Our partnership with [Hunt & Sons] continues to progress as [planned] to increase sales of REG Ultra Clean in California and it gives us a strong foothold in the largest renewable fuels market in the country. All 12 locations are up and running and the initial customer reception has been quite positive.” --- Cynthia “CJ” Warner, President and CEO of Renewable Energy Group since early-2019

Renewable Energy Group’s two main growth avenues involve expanding its biofuel production capabilities, particularly for higher-margin products, and securing new distribution deals via long-term supply agreements. In our view, this is a sound growth strategy, and the company has performed well so far. Smaller growth projects and optimization endeavors are also on the table.

Concluding Thoughts

We are intrigued by Renewable Energy Group’s impressive growth outlook and its strong financial performance of late, though we caution that the firm’s trajectory remains heavily dependent on government incentives. Simply put, should the Biden administration sharply increase incentives from the federal government to support the development of the domestic biofuel industry, that would go a long way in supporting and enhancing Renewable Energy Group’s long-term cash flow growth outlook. However, should these government incentives disappear or underwhelm (versus current investor expectations), the company’s outlook would not look nearly as promising.

In our view, there is a good chance the Biden administration will step up federal incentives towards the biofuel industry. Combined with the favorable incentives and regulatory structures benefiting the biofuel industry in various European nations, Renewable Energy Group's long-term free cash flow growth outlook looks promising. Though the company’s capital expenditures in the medium-term will likely grow materially so the firm can complete its major expansion project in Louisiana, Renewable Energy Group’s strong financial position and recent debt reduction efforts should enable the firm to cover those increased outlays.

Members looking to read more about the green energy landscape are encouraged to check out this article here.

-----

Related: AMRC, CLNE, GEVO, JUHL, PLUG, BE, FCEL, BLDP, ICLN, ACES, CNRG, REGI

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment