Best Idea Alphabet Flying Higher

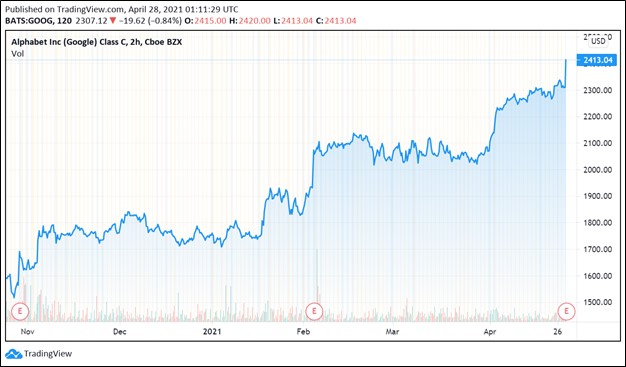

Image Shown: Shares of Alphabet Inc Class C stock are on a nice upward climb of late as investors continue to warm up to the company’s fortress-like balance sheet, stellar free cash flow generating abilities, and promising growth outlook. We continue to like Alphabet Inc Class C shares (ticker GOOG) as a top-weighted idea in the Best Ideas Newsletter portfolio.

By Callum Turcan

We are huge fans of Alphabet Inc (GOOG) (GOOGL), and the digital advertising giant delivered again April 27 when it reported a stellar first quarter 2021 earnings report that saw the firm fly by both consensus top- and bottom-line estimates. Shares of Alphabet Class C (ticker: GOOG) are included as a top-weighted idea in the Best Ideas Newsletter portfolio. As of this writing, even after the post-earnings bounce, shares of GOOG are trading well below our fair value estimate of $2,792 (the top end of our fair value estimate range sits at $3,490) indicating there is room for substantial capital appreciation upside going forward.

Earnings Update

Alphabet reported stellar revenue growth across all of its core business operating segments last quarter. Google advertising revenue (includes Google Search, YouTube, and Google Network operations) was up 32% year-over-year, highlighting the strong underlying demand for its core offerings. The firm’s Google other revenues (which includes revenues from its Google Play marketplace, YouTube subscriptions, and Google Nest sales among other things) was up 46% year-over-year and Google Cloud revenue was up 46% year-over-year. We view ongoing momentum at its Google Cloud segment as an incredibly promising sign of Alphabet’s long-term growth potential. Company-wide, Alphabet posted 34% year-over-year GAAP revenue growth in the first quarter of this year.

Please note that Alphabet’s Google Services division, which includes its Google advertising sales and other Google-related revenues, generates virtually all of Alphabet’s operating income. In the first quarter of 2021, Google Services generated $19.5 billion in operating income while Google Cloud and Other Bets both ran at an operating loss that combined totaled $2.1 billion. Additionally, Alphabet incurred $1.0 billion in unallocated corporate-level costs. Company-wide, Alphabet reported $16.4 billion in GAAP operating income last quarter, more than double year-ago levels. However, Alphabet’s performance is even more impressive when looking at its core businesses, indicating the company is more profitable than first appearances suggest.

With that in mind, we are supportive of Alphabet investing heavily in its future growth opportunities. For instance, its Waymo self-driving business could one day become a full-fledged self-driving taxi service, offering Alphabet whole new ways to grow its revenues over the long haul. Right now, Waymo is in the pilot phase, testing out self-driving taxi services in select US markets.

Pivoting to Alphabet’s Google Cloud business, the company needs to make enormous investments in its workforce, R&D efforts, and data center operations to grow its market share and remain relevant in a hyper-competitive space. Historically, Alphabet’s cloud computing business has been left in the dust by its rivals, including Amazon Inc (AMZN) and Microsoft Corp (MSFT), though Alphabet has more recently started to gain some real traction in this area.

Given how lucrative Amazon Web Services (‘AWS’) is for Amazon and Azure is for Microsoft (their respective cloud computing businesses), it is reasonable, in our view, to believe Google Cloud will scale to profitability over the coming years. Last quarter, Google Cloud generated $4.0 billion in revenues though it posted an operating loss of $1.0 billion. However, its operating loss shrank significantly versus year-ago levels.

At the end of March 2021, Alphabet had a net cash position of ~$121.2 billion with no short-term debt on the books. This figure does not include $25.3 billion in non-current non-marketable investments the company had on hand at the end of last quarter. Alphabet generated $13.3 billion in free cash flow last quarter, up from $5.4 billion in the same quarter last year, while spending $11.4 billion buying back its stock in the first quarter of 2021.

The company noted in its earnings press release that Alphabet’s board had authorized an additional $50.0 billion in share buyback authority of its Class C common stock on April 23. We view share buybacks as a good use of capital given shares of GOOG are trading well below their intrinsic value, in our view, and considering its pristine financial position.

Concluding Thoughts

Over time, Alphabet’s Google Cloud segment should scale to profitability which in turn (if realized) would provide a nice uplift to its operating income and free cash flow generating abilities. Farther out, the potential upside its Waymo segment could generate remains entirely incremental to our intrinsic value for Alphabet.

The company’s bread-and-butter, digital advertising continues to allow Alphabet to churn out gobs of free cash flow in the here and now. Alphabet has also started rationalizing chunks of its Other Bets segment which will help improve its cost structure along the margins. This process involved shutting down its Loon venture (built around the idea of providing high-speed internet to remote locations around the world via balloons) as it became clear there was no clear way to build up Loon into a viable business.

We continue to be enormous fans of Alphabet and like the company as a top-weighted idea in the Best Ideas Newsletter portfolio. Shares of GOOG and GOOGL both moved higher during after-hours trading on April 27 in the wake of Alphabet’s solid earnings update. In our view, investors continue to warm up to Alphabet’s fortress-like balance sheet, stellar free cash flow generating abilities, and promising growth outlook.

-----

Technology Giants Industry - FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI

Related: SPY, QQQ

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO), and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Facebook Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment