Berkshire Hathaway Recovering Lost Ground

Image Shown: Shares of Berkshire Hathaway Inc Class B started to recover some of their lost ground in early-July, and the company’s second quarter earnings report has kept the momentum going in the right direction.

By Callum Turcan

On August 8, Berkshire Hathaway Inc (BRK.A) (BRK.B) reported second quarter 2020 earnings that beat consensus top- and bottom-line estimates. Due to the impressive recovery in US equity markets (SPY) since bottoming in late-March, Berkshire Hathaway’s investment portfolio put up tremendous performance last quarter, though its first quarter performance was harrowing. We include Berkshire Hathaway Class B (ticker BRK.B) as a holding in our Best Ideas Newsletter portfolio.

Earnings Overview

Unrealized gains on investments offset a large impairment charge relating to Berkshire Hathaway’s acquisition of aerospace parts supplier Precision Castparts that was completed in early-2016 (the deal was valued at $37.2 billion when including Precision Castparts’ net debt). The ongoing coronavirus (‘COVID-19’) pandemic has devasted the airline industry (JETS), and Berkshire Hathaway had little choice but to reduce the headcount at Precision Castparts by ~10,000 during the first half of 2020 (equal to roughly 30% of the subsidiary’s total workforce at the end of 2019). Management noted that “the duration and severity of the pandemic and the long-term effects on commercial air travel and aerospace industries remains unclear.” On a GAAP basis, Berkshire Hathaway reported $26.3 billion in net income in the second quarter of 2020.

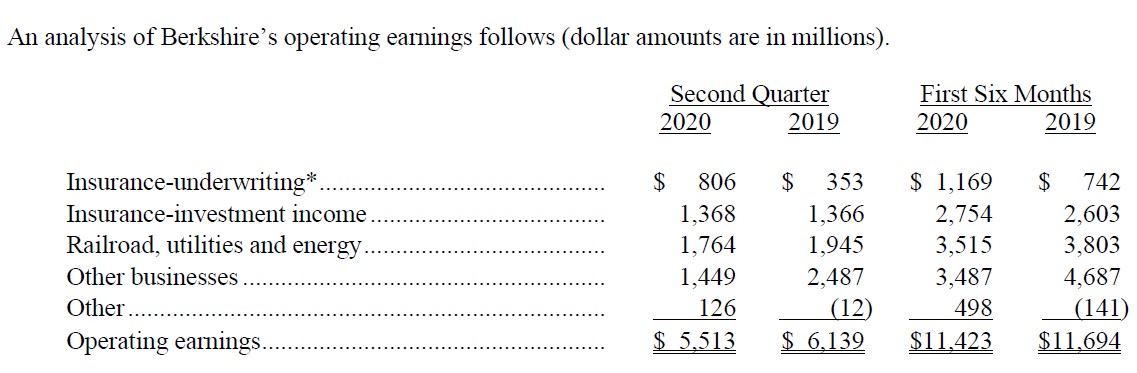

Berkshire Hathaway’s operating earnings (which management provides in order to highlight the conglomerate’s financial performance when excluding swings in its investment portfolio) fell by 10% year-over-year last quarter, namely due to a drop off in income at its ‘other businesses’ segment. We appreciate the stability of Berkshire Hathaway’s insurance and ‘railroad, utilities, and energy’ operations last quarter, which performed fairly well all things considered. On the other hand, revenue at its Berkshire Hathaway Automotive unit (a subsidiary with over 80 auto dealerships) was down sharply year-over-year last quarter which played a big role in reducing Berkshire Hathaway’s ‘retail group’ earnings.

Image Shown: Overall, Berkshire Hathaway’s financials held up quite well last quarter in the face of the pandemic, though some units were hit quite hard. Image Source: Berkshire Hathaway – Second Quarter of 2020 Earnings Press Release

Please note that Geico, one of Berkshire Hathaway’s insurance subsidiaries, initiated a $2.5 billion “give-back” program in early-April. Here is what the firm had to say about the program as it relates to its past and near-term financial performance at its insurance operations (from its earnings press release):

One unusual item to note occurred during the second quarter: On April 8, 2020, GEICO initiated a $2.5 billion “give-back” to policyholders with respect to policies renewed and newly issued policies during the six month period beginning on April 8, 2020. For accounting purposes, the “give-back” will be spread over the twelve month period beginning on April 8, 2020. The effect was to increase GEICO’s underwriting profits during the second quarter that will lead to less favorable results – even perhaps underwriting losses – in the third and fourth quarters.

The pandemic has aggressively cut down on driving in the US and elsewhere. For instance, the work-from-home (‘WFH’) trend means commuting into work is not part of the regular routine for many households (at least for the time being). Less driving (generally speaking) means less accidents and reduces the need for expansive auto insurance policies. Berkshire Hathaway responded by rewarding its policyholders, with an eye towards long-term customer retention.

Financial Strength Remains

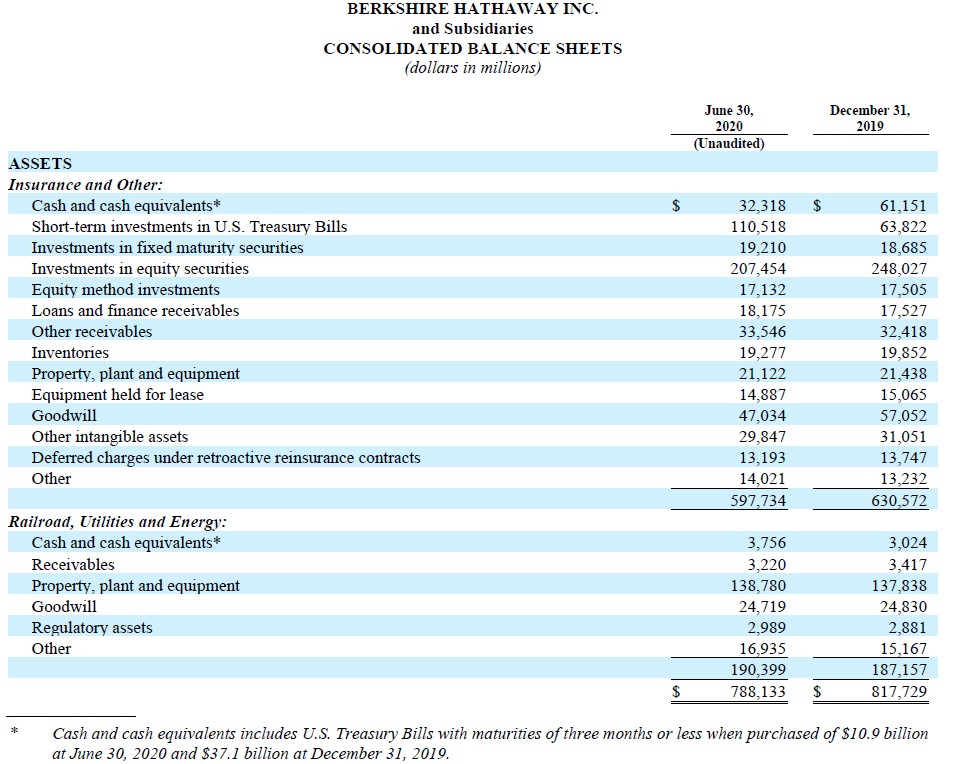

Berkshire Hathaway exited June 30 with $373.3 billion in cash, cash equivalents, short-term investments in US Treasury Bills, investments in fixed maturity securities, and investments in equity securities combined. Additionally, the firm had $17.1 billion in equity method investments on the books as you can see in the upcoming graphic down below. The $142.8 billion in cash, cash equivalents, and short-term investments in US Treasury Bills combined Berkshire Hathaway had as its ‘Insurance and Other’ segment is particularly noteworthy, as that is the kind of “dry powder” the firm can use to make large acquisitions and strategic investments.

Image Shown: Berkshire Hathaway continues to have ample financial firepower that could be used to make large acquisitions and strategic investments. Image Source: Berkshire Hathaway – 10-Q SEC filing covering the second quarter of 2020

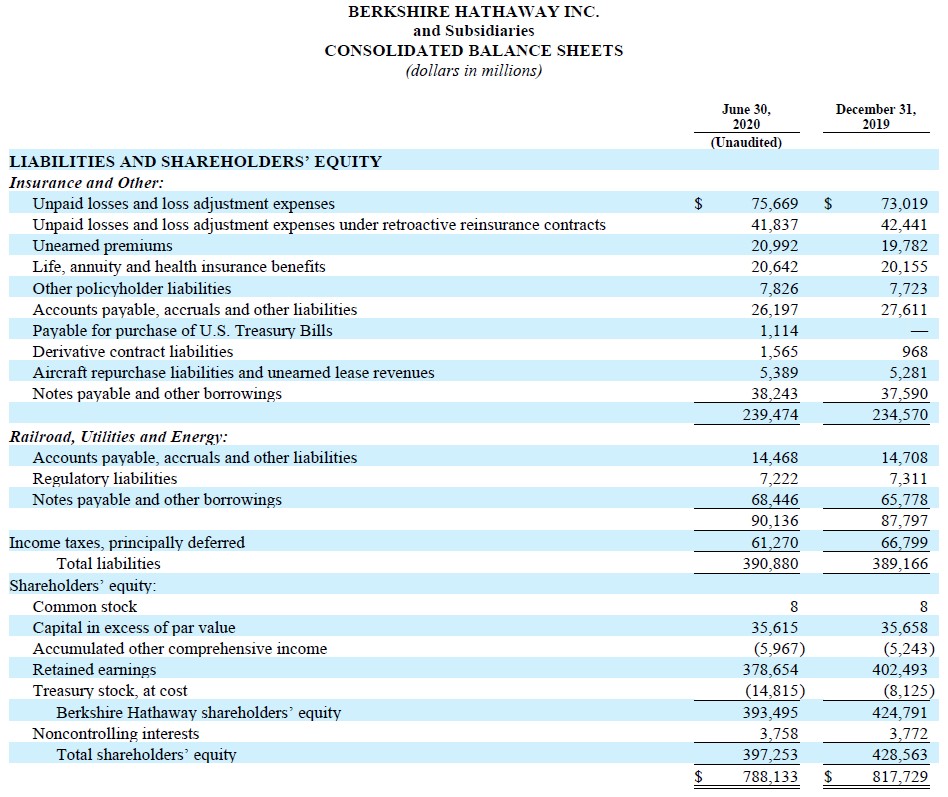

Please note Berkshire Hathaway also carries a significant amount of liabilities on the books, largely from its insurance operations, but the firm also has a meaningful amount of debt on the books as well, namely from its industrial-related operations. Berkshire Hathaway’s total debt (inclusive of short-term debt) stood at $106.7 billion at the end of June 2020. Those liabilities are highlighted in the upcoming graphic down below.

Image Shown: Berkshire Hathaway has a significant amount of liabilities, largely due to its insurance operations though its industrial-related total debt load is meaningful as well. Image Source: Berkshire Hathaway – 10-Q SEC filing covering the second quarter of 2020

During the first half of 2020, Berkshire Hathaway generated $17.5 billion in net operating cash flow and spent $6.2 billion on capital expenditures, allowing for $11.3 billion in free cash flows. The company spent $6.7 billion repurchasing its stock during this period, including $5.1 billion during the second quarter of 2020. We strongly appreciate Berkshire Hathaway’s ability to generate meaningful free cash flows in any macroeconomic environment.

Concluding Thoughts

Over the past few weeks, shares of Berkshire Hathaway have recovered a lot of their lost ground on the back of the firm’s relatively strong second quarter performance (keeping the pandemic in mind) and due to Berkshire Hathaway showing signs it is ready to put its massive cash hoard to use. At the beginning of the third quarter, the firm announced it was acquiring natural gas pipeline and storage assets from Dominion Energy Inc (D) along with an equity stake in a liquified natural gas (‘LNG’) export terminal in Maryland which we covered in this article here. That deal is worth $9.7 billion by enterprise value, meaning Berkshire Hathaway still has plenty of financial firepower to pursue other acquisitions and strategic investments.

-----

Oil & Gas Pipeline Industry – ENB ET EPD KMI MMP

Utilities (Large) Industry - AEP, D, DUK, ED, EIK, ETR, EXC, FE, NEE, NGG, OKE, PCG, PPL, SO, XEL

Utilities (Mid/Small) Industry - AEE, ALE, BIP, CNP, CMS, DTE, ES, LNT, MGEE, NFG, NI, PEG, PNW, SCG, SJI, SR, SRE, WEC

Data Sheet on Stocks in the Insurance Industry

Related: AMLP, AMZA, JETS, SPY, XLU

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Berkshire Hathaway Inc (BRK.A) (BRK.B) Class B shares are included in Valuentum’s simulated Best Ideas Newsletter portfolio. Kinder Morgan Inc (KMI) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Enterprise Products Partners L.P. (EPD), Magellan Midstream Partners L.P. (MMP), and Utilities Select Sector SPDR (XLU) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios include a SPDR S&P 500 ETF Trust (SPY) put option holding with a $295 per share strike price that expire on August 21, 2020. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment