Berkshire Hathaway Prepares Itself for COVID-19

Image Source: Berkshire Hathaway Inc – 2019 Annual Report

By Callum Turcan

Berkshire Hathaway Inc (BRK.A) (BRK.B) reported first quarter 2020 earnings on May 2, which due to significant unrealized losses in its investment portfolio (a product of the market swoon in the early months of 2020) the firm swung to a large loss on a GAAP basis. As Berkshire Hathaway’s leadership team has often noted, the 2018 accounting rule change that forces companies to recognize unrealized gains and losses in the income statement can make GAAP net income and GAAP diluted EPS figures near meaningless without digging deeper into the firm’s financials.

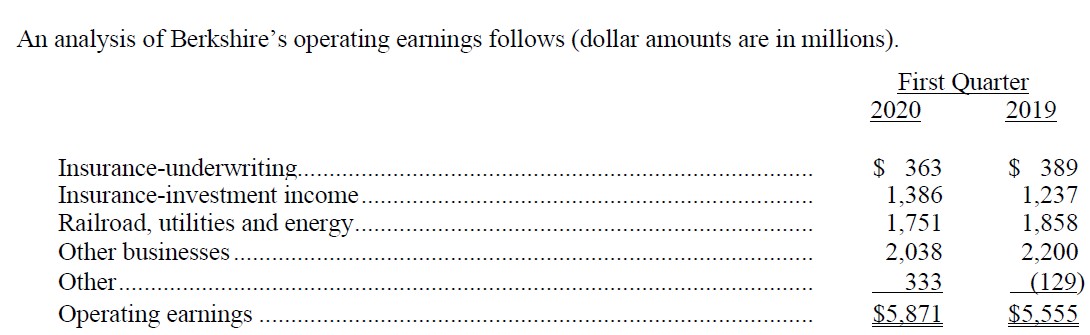

For convenience and to better showcase its actual performance, Berkshire Hathaway also includes its ‘operating earnings’ within its earnings press release which reached $5.9 billion last quarter (up almost 6% year-over-year). We continue to like Berkshire Hathaway Class B shares (ticker: BRK.B) as a top-weighted holding in our Best Ideas Newsletter portfolio, keeping material short-term headwinds in mind, and our fair value estimate for BRK.B sits at $229 per share (well above where shares of BRK.B are trading at as of this writing). In our view, Berkshire Hathaway possesses the financial and operational strength to emerge on the other side of the ongoing coronavirus (‘COVID-19’) pandemic with its financials intact.

Image Shown: While Berkshire Hathaway’s operating earnings rose year-over-year in the first quarter of 2020, we caution that exogenous headwinds will likely depress its financial performance going forward as the firm waits out the pandemic. Image Source: Berkshire Hathaway – First Quarter of 2020 Earnings Press Release

Overview

The company’s operating earnings rose year-over-year due to ongoing strength at its insurance-investment income, and its ‘other’ business segment flipping from a $0.1 billion loss to a $0.3 billion profit last quarter which combined offset modest weakness at its insurance-underwriting, railroad, utilities and energy, and ‘other businesses’ segments last quarter. Additionally, Berkshire’s Class A and Class B outstanding share count both moved lower year-over-year in the first quarter as the company continues to slowly repurchase its stock.

Given the slowdown in March caused by the ongoing coronavirus (‘COVID-19’) pandemic, Berkshire Hathaway’s underlying business showed signs of weakness given that its industrial and other segments reported weaker operating earnings than in the prior year. More importantly, in the upcoming second quarter, that weakness is likely to continue and become a much bigger drag on Berkshire Hathaway’s underlying results given how most of the US economy and other major global economies are effectively locked down due to stay-at-home orders to contain the pandemic.

Some of this slowdown was reflected in Berkshire Hathaway’s first quarter earnings report as its ‘industrial product’ revenues within its ‘manufacturing’ segment dropped by 4% year-over-year, in large part due to a decline in sales at its Precision Castparts Corp (‘PPC’) subsidiary. PPC caters to the aerospace, industrial gas turbine, and defense industries. The Boeing Company (BA) suspended production of its 737 Max airplane which hurt PPC’s financial performance as that negatively impacted the LEAP program (otherwise known as the Leading Edge Aviation Propulsion program that involves building efficient jet engines). The program is run by CFM International which is a joint-venture between General Electric Company (GE) and the French company Safran SA (SAFRY). However, please note Berkshire Hathaway reported that “PPC experienced lower sales across all of its major markets” which indicates the decline in sales was about much more than just ongoing problems at the embattled 737 Max airplane.

Another subsidiary within Berkshire Hathaway’s manufacturing segment, IMC International Metalworking Companies (‘IMC’), reported a 5% year-over-year decline in its revenues which was attributed to the slowdown in Asian economic activity due to COVID-19 and unfavorable foreign currency movements. Please note that this decline was partially offset by the sales uplift IMC received from its acquisitions. IMC manufactures metalworking products and is comprised of over a dozen companies operating under the IMC Group umbrella. Berkshire Hathaway also noted that the slowdown in other countries (outside of Asia) negatively impacted IMC’s financial performance, though that slowdown started in March and has yet to be reflected for a full quarter of reported results.

For these reasons and others, members should expect the second quarter to be a rough one for Berkshire Hathaway’s underlying businesses, save for a select few such as its auto insurance business, which might actually benefit from a reduction in transportation activity in the near-term as that reduces the chance of accidents (Geico is offering some relief to its auto and motorcycle insurance customers due to COVID-19). Here’s a key excerpt from Berkshire Hathaway’s 10-Q filing covering the first quarter of 2020 (emphasis added):

Prior to the middle of March, many of our operating businesses were experiencing comparative revenue and earnings increases over 2019. As efforts to contain the spread of the COVID-19 pandemic accelerated in the second half of March and continued through April, most of our businesses were negatively affected, with the effects to date ranging from relatively minor to severe. Several of our businesses deemed essential have continued to operate, including our railroad, utilities and energy, insurance and certain of our manufacturing, distribution and service businesses. However, revenues of these businesses have slowed considerably in April. Other businesses, including several of our retailing businesses and certain manufacturing and service businesses are being severely impacted due to closures of facilities where crowds can gather, such as retail stores, restaurants, and entertainment venues.

In response to the effects of the pandemic, we have implemented various business continuity plans to protect our employees and customers. Such plans include a variety of actions, such as temporarily closing certain retail stores, manufacturing facilities and service centers of businesses that were not subject to government mandated closure. In addition, many of our businesses have implemented practices to protect employees while at work. Such practices have included work-from-home, staggered or reduced work schedules, increased cleaning and sanitation of work spaces, providing employee health screening, eliminating non-essential travel and face-to-face meetings and providing general health reminders intended to help lower the risk of spreading COVID-19.

Berkshire Hathaway is doing what it can to ride out the storm and possess the financial strength to do so. As plenty of its businesses are deemed “essential” that should allow for Berkshire Hathaway to continue generating meaningful (albeit subdued) cash flows going forward.

Furthermore, please note that after the severe acute respiratory syndrome (‘SARS’) outbreak in 2002-2003, which resulted in some insurance firms taking a bath due to hefty payouts that weren’t expected, insurance companies made sure to exclude pandemic coverage from their general policies (pandemic coverage had to be purchased as a separate policy) according to the WSJ. Additionally, several members of the Republican leadership team are pushing for the next COVID-19 bill to include legal liability protections for businesses as it relates to the pandemic (to protect businesses from lawsuits relating to events that are considered outside of their control).

Financial Update

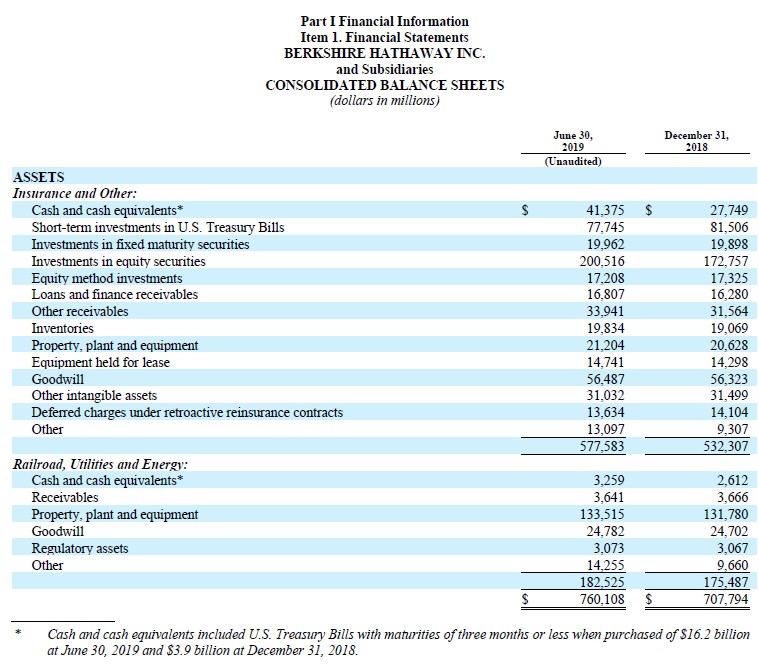

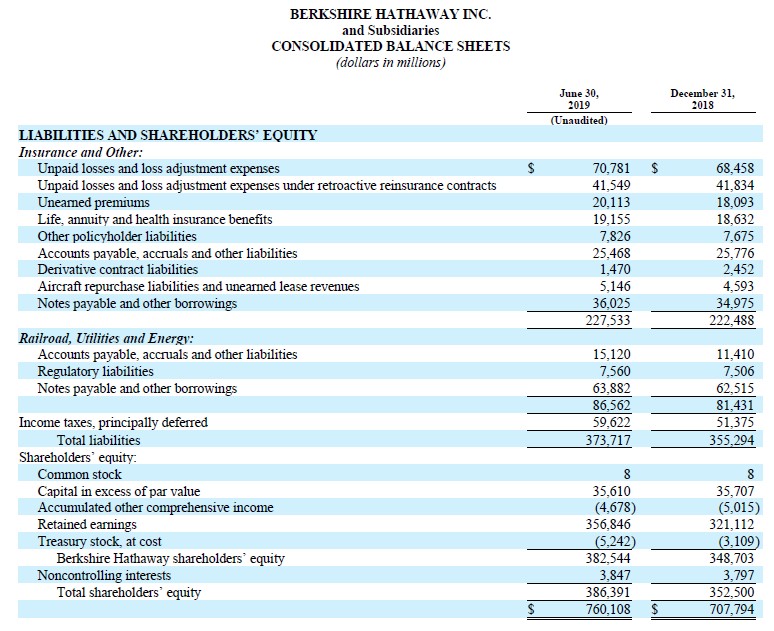

At the end of March 2020, Berkshire Hathaway was sitting on $137.3 billion in cash and cash equivalents, and short-term investments in U.S. Treasuries across its various businesses along with $17.9 billion in fixed maturity securities, $180.8 billion in investments in equity securities (which was down sharply from year-end 2019 levels due to the selloff in equities during the first quarter of this year), and $17.5 billion in equity method investments. Berkshire Hathaway exited March 2020 with $104.2 billion in total debt (inclusive of short-term debt) along with material liabilities stemming from its insurance businesses with ‘unpaid losses and loss adjustment expenses’, ‘unpaid losses and loss adjustment expenses under retroactive reinsurance contracts’, ‘unearned premiums’, ‘life, annuity and health insurance benefits’, and ‘other policyholder liabilities’ totaling $168.3 billion at the end of this period.

Images Shown: A look at Berkshire Hathaway’s balance sheet and large cash-like position. Images Source: Berkshire Hathaway – 10-Q filing covering the first quarter of 2020

Most importantly, Berkshire Hathaway has continued to hold a lot of cash on the books as the firm is waiting for an opportunity to arise to make a large deal at a good price in the eyes of management. Berkshire Hathaway generated $3.8 billion in free cash flow during the first quarter of 2020 while spending $1.7 billion repurchasing its stock. The firm does not have a common dividend policy at this time and is unlikely to change its stance on the issue as things stand today.

Pivoting to Berkshire Hathaway’s investment portfolio, the firm has now exited its equity positions in American Airlines Group Inc (AAL), Delta Air Lines Inc (DAL), United Airlines Holdings Inc (UAL), and Southwest Airlines Co (LUV), and furthermore, Berkshire Hathaway’s CEO Warren Buffett admitted it was a mistake to own those names in the first place (we covered why we thought those investments were a mistake in this article here). While Berkshire Hathaway owned a material equity stake in each company relative to the size of the four aforementioned airliners, those stakes represented just a sliver of Berkshire Hathaway’s intrinsic value and its current market capitalization, and we appreciate Mr. Buffett admitting when he’s wrong as that better allows the company to move forward on a stronger footing.

We continue to be optimistic on the upward trajectory of US equities (read more about that here) due to unprecedented US monetary and fiscal stimulus creating the “Fed/Treasury put” and went fully invested in our newsletter portfolios back on April 29 (link here).

Concluding Thoughts

We continue to like Berkshire Hathaway as a top-weighted holding in our Best Ideas Newsletter portfolio and view the firm as well-positioned to ride out the storm. Should equities, particularly US equities, continue melting up that should offer room for Berkshire Hathaway to report material unrealized gains from its investment portfolio. Members looking to read more about Berkshire Hathaway should check out our analysis of the firm’s 2019 earnings (link here).

-----

Data Sheet on Stocks in the Insurance Industry

Tickerized for companies in the SPDR S&P Insurance ETF (KIE)

Related: AAL, BA, BRK.A, BRK.B, DAL, GE, LUV, SAFRY, UAL

----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Berkshire Hathaway Inc (BRK.A) (BRK.B) Class B shares are included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment