Bank of America Retains Earnings Power and Healthy Balance Sheet

Growing pressure from Fed officials on banks to cut dividends, and any extremely-adverse scenario, as outlined by JPMorgan in its latest annual note, coming to fruition may suggest that no banking dividend may be completely safe in this environment. That said, assuming the US economy is able to avoid a prolonged depression-type scenario, Bank of America has the earnings power and balance sheet to withstand most probable scenarios and come out the other side continuing to nip at JPMorgan’s heels for best in class US mega-bank. We are maintaining our recently reduced $28 fair value estimate of Bank of America.

By Matthew Warren

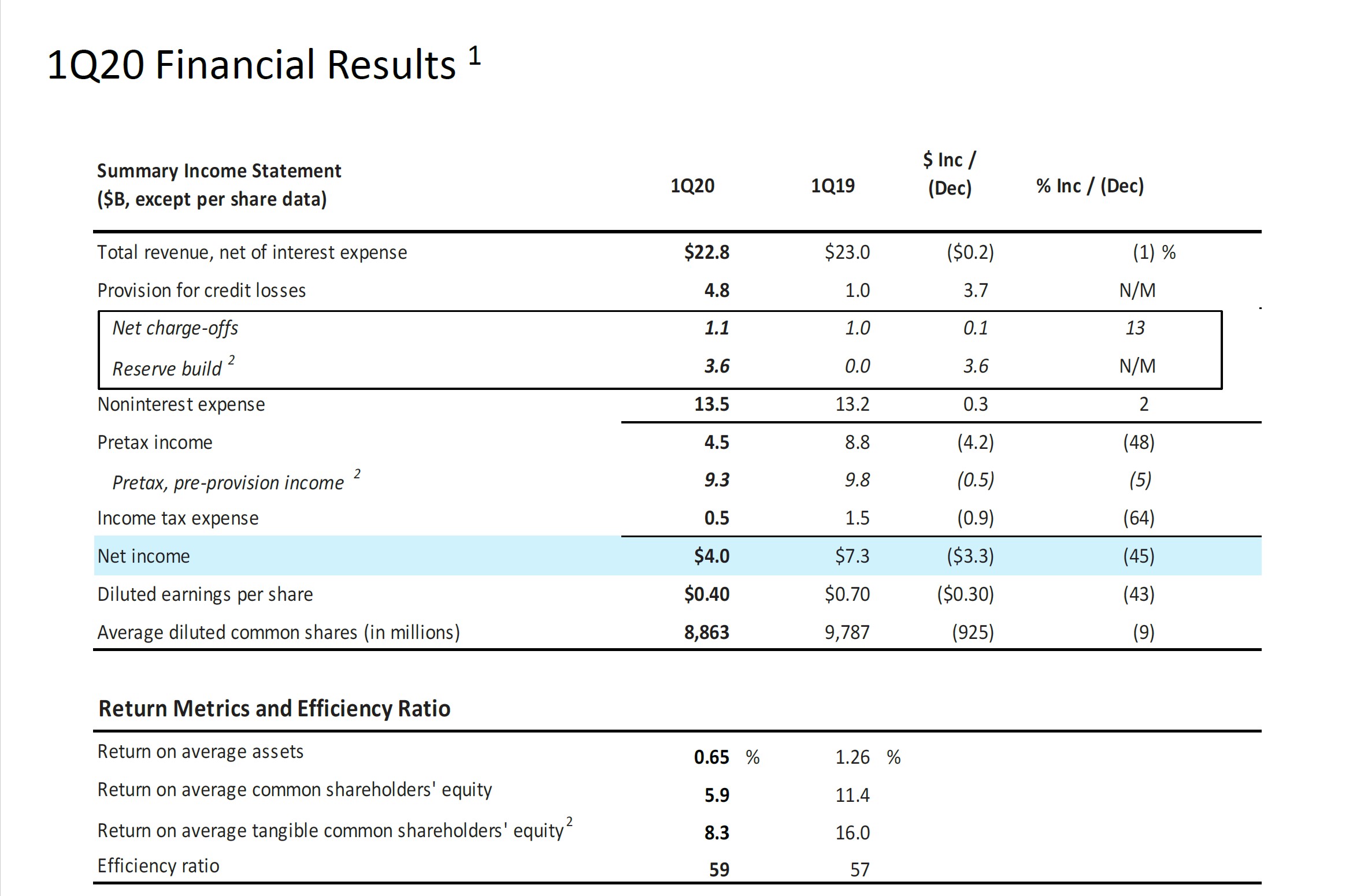

Bank of America (BAC) posted ugly first-quarter results April 15. Though revenue of $22.77 billion exceeded the analyst consensus estimate by $190 million, bottom-line results of $0.40 per share missed consensus by $0.14. This was largely the result of a huge reserve build of $3.6 billion, in anticipation of large losses straight ahead resulting from a free-falling economy and rapidly escalating unemployment.

As you can see in the graphic down below, revenue pressure from lower rates was only moderate and pre-tax, pre-provision income was only down 5% compared to the same period last year. But the $3.6 billion reserve build meant that net income was down 45%. The efficiency ratio backed up to 59% from 57% last year as expenses grew while revenue went slightly backwards. Return on tangible common equity dropped to 8.3% from 16% in last year’s quarter.

Image Source: Bank of America 1Q2020 Earnings Presentation

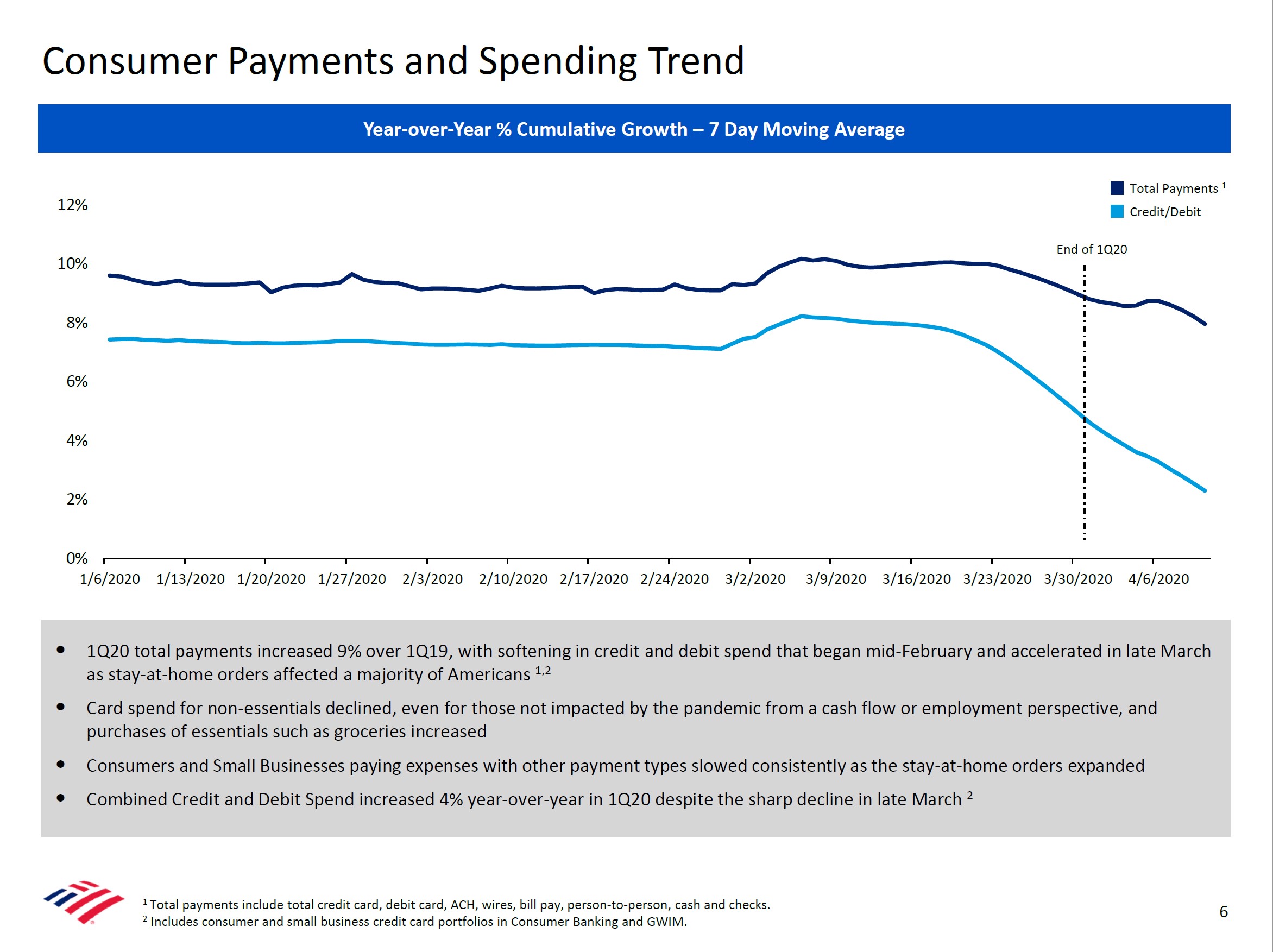

When asked whether the bank would expect further reserve builds next quarter, management simply stated that it would depend on how the economic outlook progressed through the quarter. The executive suite also said that it is out-earning the dividend and that it expects to continue paying it. Both reserve builds and dividend health will of course depend on just how bad the economy gets while the globe tries to fight off the coronavirus. As one can see in the below graphic, total payments and credit/debit growth both decelerated markedly in March and into April.

Image Source: Bank of America 1Q2020 Earnings Presentation

Concluding Thoughts

Growing pressure from Fed officials on banks to cut dividends, and any extremely-adverse scenario, as outlined by JPMorgan (JPM) in its latest annual note, coming to fruition may suggest that no banking dividend may be completely safe in this environment. That said, assuming the US economy is able to avoid a prolonged depression-type scenario, Bank of America has the earnings power and balance sheet to withstand most probable scenarios and come out the other side continuing to nip at JPMorgan’s heels for best in class US mega-bank. We are maintaining our recently reduced $28 fair value estimate of Bank of America.

---

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Matthew Warren does not own any of the securities mentioned. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment