Alphabet Surges Higher

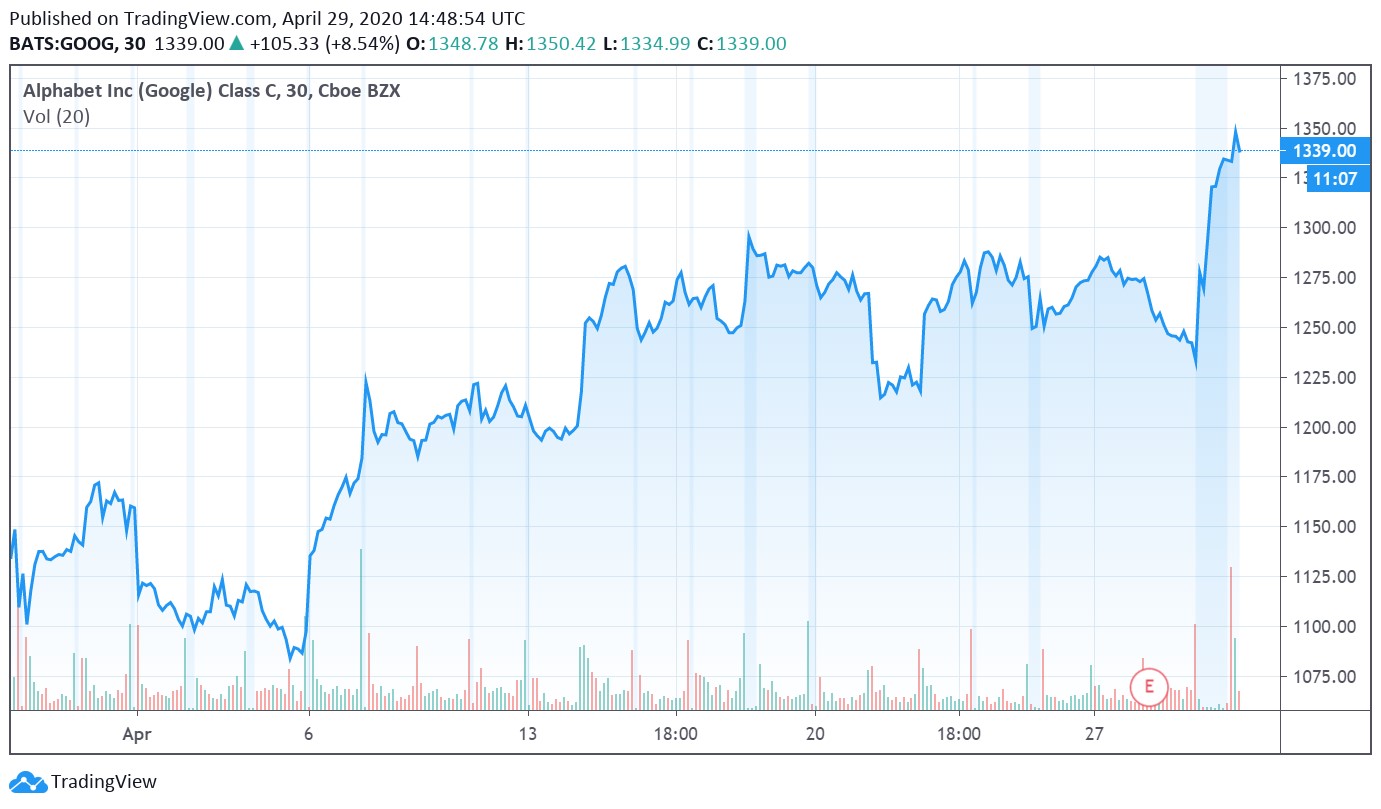

Image Shown: Shares of Alphabet Inc surged higher on April 29 after reporting a stellar earnings report, and we continue to like Alphabet Class C shares as a top-weighted holding in our Best Ideas Newsletter portfolio.

By Callum Turcan

After the market close on April 28, Alphabet Inc (GOOG) (GOOGL) reported first-quarter earnings for 2020 that beat top-line consensus estimates and missed bottom-line consensus estimates, with sales supported by the strength of its digital advertising business and its growing Google Cloud business. Alphabet’s advertising revenue (comprised of revenue from its Google Search, YouTube, and Google Network Members' properties operations) was up 10% year-over-year to $33.8 billion while Google Cloud reported 52% revenue growth year-over-year, reaching $2.8 billion last quarter. All-in-all, Alphabet’s GAAP revenues climbed higher by 13% year-over-year in the first quarter, hitting $41.2 billion. Shares of Alphabet moved significantly higher on April 29 as the firm’s outlook was better than expected, aided by management communicating that Alphabet was prepared to utilize its fortress-like balance sheet to repurchase stock at a meaningful discount to their intrinsic value (we’ll cover that later on in this article).

Quarterly Overview

The negative blow the ongoing coronavirus (‘COVID-19’) had on digital advertising spending in the first quarter was less than feared though still meaningful given that Alphabet’s growth rate slowed materially in March according to management’s commentary. While the second and third quarters will likely be brutal given sharp pullbacks in digital advertising budgets, the company is confident digital advertising spending will bounce back once the storm begins to clear. Here’s what Alphabet’s CEO, Sundar Picahi, had to say during the firm’s latest conference call:

“Turning to our business, let me touch on our performance this quarter. Q1 was in many ways the tale of 2 quarters. For our advertising business, the first 2 months of the quarter were strong. In March, we experienced a significant and sudden slowdown in ad revenues. The timing of the slowdown correlated to the locations and sectors impacted by the virus and related shutdown orders…

Overall, recovery in ad spend will depend on a return to economic activity. There are 2 key aspects of our business that give us confidence about the future. First, as we saw after 2008, one of the strongest features of Search is that it can be adjusted quickly, so it’s relatively easier to turn off and then back on, and marketers see it as highly cost effective and ROI based.”

Management seemed to indicate that the decline in Alphabet’s digital advertising business could be quickly reversed as the economy reopens, which speaks favorably towards its medium-term trajectory, relatively speaking, as investors were expecting a much worse outlook.

Alphabet’s Google Cloud segment continued to show promise (which offers cloud computing services in a lucrative but highly competitive market), and while a small part of its company-wide revenues, Google Cloud offers Alphabet one of its best way to diversify into a non-digital advertising business (a process that will take time). When it comes to YouTube’s non-advertising revenues, management noted that the video sharing and streaming service continued to experience subscriber growth last quarter. Alphabet’s ‘Google other’ revenues climbed higher by almost 23% year-over-year in the first quarter, hitting $4.4 billion, and those sales include YouTube subscription revenues. Digital advertising remains Alphabet’s core business, but we appreciate the firm expanding into other realms.

Rising traffic acquisition costs (‘TAC’) and operating expenses weighed on Alphabet’s operating income, keeping in mind that as a percent of advertising revenues, TAC costs shifted lower according to management. The operating income from Alphabet’s Google segment only climbed marginally higher year-over-year (up almost 1%) as it reached $9.3 billion last quarter. However, please note Alphabet’s ‘Other Bets’ operating loss widened by 29%, reaching $1.1 billion last quarter (while that segment’s revenues actually declined year-over-year as these are long-term bets with no meaningful near-term commercial opportunities) which also weighed on Alphabet’s GAAP operating income. However, the lack of a major European Commission fine still saw Alphabet’s GAAP operating income rise by 21% year-over-year to reach $8.0 billion in the first quarter.

Pressures from TAC and operating losses from its Other Bets segment need to be monitored going forward, though Alphabet remained a juggernaut in the first quarter and that spoke favorably towards its outlook as the firm gets ready to ride out the storm. A growing headcount also weighed on the firm’s operating margins. Here’s what Alphabet’s CFO Ruth Porat had to say during the firm’s latest quarterly conference call:

“Regarding our key expense lines, on a consolidated basis, total cost of revenues including TAC, was $19 billion, up 19% year-on-year. Other cost of revenues on a consolidated basis was $11.5 billion, up 26% year-over-year primarily driven by Google-related expenses. The biggest factors here again this quarter were costs associated with our data centers and other operations, including depreciation, and then content acquisition costs, primarily for YouTube’s advertising supported content followed by content costs for YouTube TV and our paid YouTube music and premium subscription services.

Operating expenses were $14.2 billion with headcount growth being the largest driver of year-on-year growth for R&D and sales and marketing expenses. For G&A, the biggest driver of expense growth was attributable to a reserve for estimated credit deterioration as a result of COVID-19…

Total Traffic Acquisition Costs were $7.5 billion or 22% of total advertising revenue and up 9% year-over-year. Total TAC as a percentage of total advertising revenues was down slightly year-over-year, reflecting once again of favorable revenue mix shift from network to Google properties.”

Cash Flow and Balance Sheet Update

Alphabet continued to generate an enormous amount of free cash flow in the first quarter, though that will likely become a tougher task during the remainder of the year given the sharp slowdown in digital advertising spend of late. Last quarter, it generated a tad less than $11.5 billion in net operating cash flow and spent $6.0 billion on capital expenditures, allowing for ~$5.55 billion in free cash flow. The company does not pay out a common dividend at this time and spent $8.5 billion repurchasing its stock in the first quarter.

Some of its share repurchases were clearly funded by Alphabet’s pristine balance sheet, which remained pristine after the fact. As of the end of March 2020, Alphabet’s total cash, cash equivalents, and marketable securities line-item stood at $117.2 billion (down $2.4 billion from the end of 2019) while its long-term debt load stood at a just $5.0 billion (up $0.5 billion from the end of 2019). Additionally, the firm carried $12.4 billion in non-marketable securities on the books at the end of March 2020. The digital advertising giant’s GAAP diluted EPS climbed higher by 4% year-over-year in the first quarter, reaching $9.87, as its outstanding diluted share count fell by over 1% due to its ongoing share buyback program.

Management indicated during the firm’s latest quarterly conference call that Alphabet’s share repurchasing program would continue as planned, aided by the strength of the firm’s fortress-like balance sheet and high quality cash flow profile. Here’s what Alphabet’s CFO had to say during the firm’s latest quarterly conference call in response to an analyst question (emphasis added):

“…[W]e believe a share purchase program for us appropriately sized is responsible [in] the current environment based on our capital allocation framework and our cash balance. So in the beginning of the year, I indicated that we expected to repurchase shares at a pace at least consistent with the fourth quarter on the remaining authorization and that remains our view for the second quarter.”

Alphabet intends on utilizing its pristine balance sheet to continue buying back its stock, which we can appreciate given our fair value estimate for shares of GOOG stands at $1,440 per share, well above where GOOG is trading at as of this writing. The company’s strong balance sheet allows for the firm to take advantage of the recent decline in its share price to buy back stock at prices that represent a significant discount to their fair value estimate or intrinsic value. In many instances, we prefer that companies hoard cash during harrowing times such as these, but Alphabet and a select few other large tech companies are in a completely different position than most publicly traded firms out there. At the top end of our fair value estimate range, shares of GOOG carry a fair value estimate of $1,800 per share.

Key Considerations Going Forward

Looking ahead, the second quarter won’t look as rosy as the first with Alphabet’s major clients aggressively scaling back their digital advertising budgets. While that spending will likely return once the pandemic starts to subside, we caution that Alphabet’s near-term performance will be lumpy.

With that being said, for the first time in a while, Alphabet is now focused on controlling costs to better position itself to ride out the storm. That includes slowing down its hiring rate (Alphabet’s headcount rose by 19% year-over-year last quarter, reaching over 123,000 employees) and cutting marketing spend, among other things (such as potentially paring back its investment in data centers, keeping in mind Alphabet wants to make Google Cloud a bigger part of its revenue mix).

Management is not just sitting around; the company is making the decisions required to ride out a storm like COVID-19. During the firm’s latest quarterly conference call, management noted that significant changes to Alphabet’s spending and investing plans would begin to appear by the third quarter (if not sooner).

Alphabet still intends on making the necessary long-term investments to keep the company competitive, but in “non-essential areas” the firm is showing a willingness to scale back which we appreciate. We’ll see how or if Alphabet rationalizes some of its ‘Other Bets’ spending levels given the lack of revenues those segments are generating.

Concluding Thoughts

We continue to like Alphabet, particularly Alphabet Class C shares (ticker GOOG), as a top-weighted holding in our Best Ideas Newsletter portfolio. Digital advertising spending will recover as the economy restarts as it is much easier to start, stop, and restart digital advertising investments compared to other forms of advertising. Furthermore, Alphabet is well-positioned to ride out the storm and emerge on the other side of the COVID-19 pandemic with a reduced outstanding share count and a stronger cloud computing segment. Cloud computing is a hypercompetitive and lucrative space, one that requires a lot of investment to stay ahead of the curve.

Alphabet continued to make material investments in its Google Cloud operations last quarter, which included aggressively increasing its headcount in the segment’s engineering and sales departments. Those investments have panned out nicely so far and management remains committed to making Google Cloud a core part of Alphabet’s operations. Over the long-term, the company’s autonomous driving unit Waymo offers the company a way to further diversify its business, which we appreciate.

-----

Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM

Internet Content & Services Industry – GOOG GOOGL BIDU FB JD TECHY TWTR

Internet Content and Catalog Retail Industry – BABA AMZN BKNG EBAY EXPE GRPN IAC OSTK QRTEA STMP

Related: AAPL, SOCL

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Oracle Corporation (ORCL) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares and Facebook Inc (FB) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment