Alphabet Continues to Move Higher, Supported By Its Promising Long-Term Growth Runway

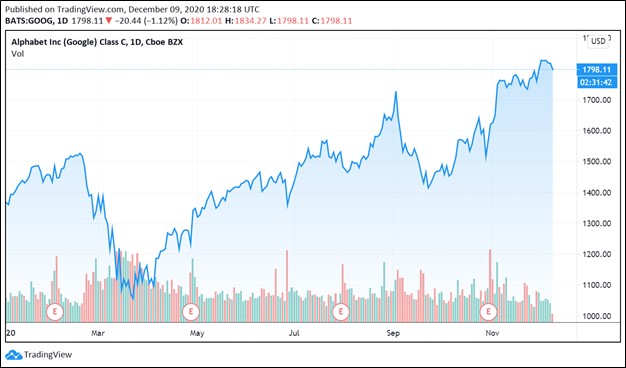

Image Shown: Alphabet Inc Class C shares have surged higher year-to-date as of this writing. We see room for additional capital appreciation upside.

By Callum Turcan

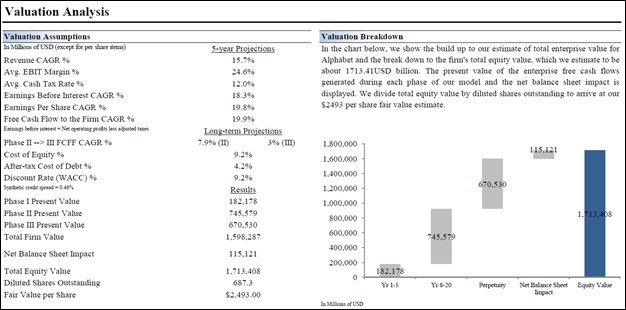

Alphabet Inc (GOOG) (GOOGL) is one of our favorite companies, and we include Alphabet Class C shares as a top weighting in the Best Ideas Newsletter portfolio. Shares of GOOG have staged an impressive recovery since March 2020, when the coronavirus (‘COVID-19’) pandemic sent equity markets spiraling lower, and we still see room for significant capital appreciation upside. Under our “base” case scenario, Alphabet Class C shares have a fair value estimate of $2,493 per share, well above where GOOG is trading at as of this writing. The summary valuation assumptions used in our discounted free cash flow model to derive that fair value estimate for Alphabet can be viewed in the upcoming graphic down below (we also provide detailed models for companies under coverage for members of higher-priced membership plans). Note that the top end of our fair value estimate range for Alphabet Class C shares sits at $3,116 per share, should the firm significantly outperform the key valuation assumptions laid out below.

Image Shown: Alphabet Class C shares have a fair value estimate of $2,493 per share under our “base” case scenario.

Impressive Growth Runway

The digital advertising giant has been firing on all cylinders of late, keeping headwinds from the COVID-19 pandemic in mind. Alphabet’s ‘Google advertising’ revenues were up 10% year-over-year in the third quarter of 2020. GroupM, a division of WPP Plc (WPP) which is the largest advertising company in the world by revenue, forecasts that digital advertising spend in the US will represent more than half of the total advertising spend in the US in 2020 when excluding political ads, a first. In 2021, GroupM forecasts digital advertising will continue to take market share in the US, indicating that Alphabet’s total addressable market (‘TAM’) will continue to get bigger and bigger, which in turn underpins our growth forecasts at it concerns the company’s future revenues and ultimately future free cash flows.

Alphabet has also been pushing deeper into the cloud-computing space via its ‘Google Cloud’ segment. That segment’s revenues were up 45% year-over-year in the third quarter of 2020, though Google Cloud accounted for less than 10% of Alphabet’s company-wide revenues during this period. During Alphabet’s third quarter of 2020 conference call, management stressed that investing in Google Cloud remains a top priority for the firm and that the company was happy with the segment’s recent performance. Here are some key comments from management regarding the firm’s cloud-computing operations that were made during Alphabet’s third quarter of 2020 earnings call (emphasis added, lightly edited):

“Next, cloud, three trends are driving the continued momentum of cloud business. First, as the shift to digital accelerates, Google Cloud continues to provide a foundation for data processing and analytics. One of the fastest growing segments of the market. BigQuery, which provides real time and predictive analytics is winning retailers like Best Buy (BBY), helping them create better experiences for shoppers. Customers value [our] differentiated AI ML based industry specific solutions. This is leading to significant events with brands like Unilever (UL), Anvil, and Reckitt Benckiser (RBGLY).

Additionally, we are working with government agencies like the U.S. Navy to modernize maintenance operations for vessels and facilities. We are also partnering with the defense innovation unit part of the U.S. Department of Defense to help military doctors with cancer detection research. And recently, we signed an enterprise agreement with the U.S. Department of Energy to help scale research efforts and innovate across national labs and field sites.

Second, customers are increasingly moving to the cloud to drive efficiencies and lower IT costs. A strength in multi cloud is an advantage here. This is helping us when large data center and IT transformation deals like Nokia (NOK), which recently announced its migrating and modernizing approximately 30 data centers across 12 countries onto Google Cloud.

And third, the future of work is creating a more collaborative world. Customers are looking to support hybrid work environments, we're seeing significant growth in demand. Earlier this month, we announced Google Workspace which brings together all of our communication and collaboration apps and ensures they work better together. This is helping organizations like the State of West Virginia and shipping company Ocean Network Express improve collaboration productivity for their employees. Google Workspace continues to grow. For example, Google Meet saw peak in Q3 of 235 million daily meeting participants, and more than 7.5 billion daily video call minutes.” --- Sundar Pichai, CEO of Alphabet

Cloud-computing, big data analytics, and AI together represent an enormous growth opportunity for Alphabet, though the company is still a relatively small player in this space. Additionally, the company could also generate upside in the workspace collaboration realm, and the recent launch of Google Workspace could assist the firm in these efforts by bringing multiple existing offerings under one umbrella.

Data from Synergy Research Group cited by Statista indicates Google Cloud had a high single-digit percent market share of the global cloud infrastructure services market by revenue as of the second quarter of 2020. However, Google Cloud has been moving in the right direction recently and Alphabet is well-positioned to remain a relevant player in this space with room to take additional market share. As the world continues to shift towards cloud-computing to meet their IT needs, Alphabet’s TAM will continue to grow at a nice clip going forward.

Another opportunity Alphabet could potentially capitalize on is the emergence of self-driving taxis and/or self-driving-powered logistics networks (if such activities are allowed by the relevant regulatory authorities) given its Waymo unit. Waymo is thought to be one of the leaders in self-driving technology, though it will be a while until commercial-level activities can begin on this front. Waymo has been working on several pilot projects recently, including a partnership with United Parcel Service Inc (UPS) that involves testing out self-driving logistics operations in Arizona and self-driving taxi pilot projects in California and Arizona.

However, Alphabet’s Waymo upside remains a big known unknown, and should the firm move to commercial-level operations, that could provide further upside to our fair value estimate. One thing we really appreciate about Alphabet is that it is not relying solely on its dominant position in digital advertising to grow. Having several growth levers to pull supports our optimistic view toward Alphabet’s long-term growth runway.

Concluding Thoughts

Our favorite companies are firms with pristine balance sheets (Alphabet had ~$118.7 billion in net cash, inclusive of short-term debt and not including long-term ‘non-marketable investments,’ at the end of September 2020), high-quality cash flow profiles (Alphabet generated over $25.6 billion in free cash flow during the first nine months of 2020), and impressive long-term growth runways (ideally) supported by secular growth tailwinds (allowing for multiple “winners” in the space). We continue to be big fans of Alphabet as the firm checks all three boxes, and we continue to see room for significant capital appreciation upside going forward.

Alphabet’s 16-Page Stock Report (pdf) >>

-----

Also tickerized for key digital ad players Facebook (FB) and Amazon (AMZN), which together with Google, control about two thirds of the digital ad market in the US, according to eMarketer.

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Facebook Inc (FB), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment