US Steel Helped By Steel Import Tariffs

Image Source: US Steel

By Callum Turcan

United States Steel Corporation (X) is a major integrated steel producer with production facilities in the Untied States and Slovakia, which joined the European Union in 2004. The company primarily produces flat-rolled and tubular steel products, along with an ‘Other Businesses’ segment that is made up its railroad and real estate assets. Aided by the imposition of additional tariffs on American steel imports (particularly the 25% tariff placed on imports from the EU, Canada and Mexico) and ongoing economic growth (both globally and in the US), US Steel posted significantly stronger financial performance in 2018 than it has in recent past. The company’s yield as of this writing is not as enticing at 1.1% as US Steel is investing heavily in its asset revitalization program to bolster its existing production facilities and reduce ongoing operating costs.

Upgrading Existing Assets to Enhance Profitability

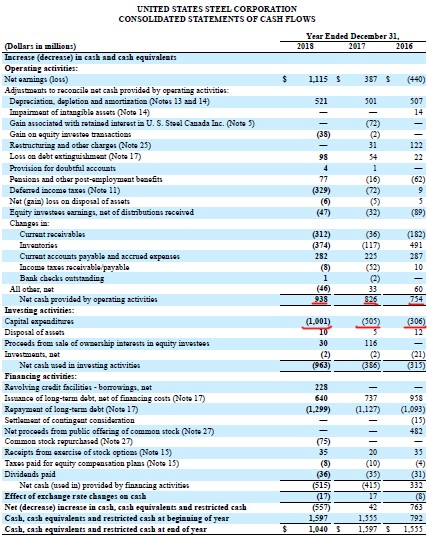

In 2017, US Steel embarked on a $2.0 billion revitalization program seeking incremental efficiencies at its flat-rolled steel division. $1.5 billion of that program consists of capital expenditures (the rest being operating expenses incurred specifically to support this strategy), which is largely why US Steel’s total capital expenditures have sharply increased since then. From 2016 to 2017, US Steel’s capital expenditures shot up from $0.3 billion to $0.5 billion and climbed further still in 2018 to over $1.0 billion. While US Steel’s net operating cash flow jumped by 24% over this period north of $0.9 billion, it’s clear major capital expenditure increases are outpacing cash flow gains.

Image Shown: US Steel has posted significant net operating cash flow growth since 2016, which has been outpaced by rising capital expenditures as management embarks on a major corporate revamp. Image Source: US Steel – 2018 Annual Report

Management expects US Steel will spend $1.2 billion on capital expenditures this year, $0.3 billion of which is expected to go towards its revitalization program (similar to 2018 levels). Longer-term, US Steel will likely need to scale back its capital expenditures in order to better live within its net operating cash flow generation.

Cash Flow and Capital Allocation Commentary

In 2016 and 2017, US Steel generated $448 million and $321 million in free cash flow, respectively, when defining free cash flow as net operating cash flow less capital expenditures. That was more than enough to cover $31 million in dividend payments in 2016 and $35 million in dividend payments in 2017. However, as US Steel was free cash flow negative in 2018 and will potentially be free cash flow negative this year in light of continued capital expenditure increases, $36 million in dividend payments in 2018 were covered by cash on hand.

US Steel approved a $300 million share buyback program that was announced at the beginning of November 2018. That month, the company spent $75 million repurchasing almost 2.8 million shared at an average price of $27.17 per share. As of this writing, US Steel is trading below $19 per share, highlighting the many risks involved in share repurchasing strategies. Like US Steel’s 2018 dividend payments, share buybacks were funded with cash on hand.

At the end of 2018, US Steel was sitting on $1.0 billion in cash versus $2.4 billion in short & long-term debt, good for a net debt position of $1.4 billion. Note US Steel’s total debt load slipped by a tad over $0.3 billion from the end of 2017 to the end of 2018 as management has been steadily chipping away at US Steel’s liabilities over the past few years. That being said, the reduction in its cash balance from the end of 2017 to the end of 2018 saw US Steel’s net debt load increase during this period by roughly $0.2 billion. Here is a key excerpt from US Steel’s fourth quarter 2018 conference call:

“The strong financial performances for our business in 2018 allowed us to make significant progress on our balance sheet and capital structure. Let me go through some of the highlights. In the year, we retired $322 million of debt and extended our maturity profile. Our next senior note maturity is not until 2025. This further de-risks our execution on the asset revitalization program, and gives us a good runway to continue to execute strategy.

In the quarter, we began executing on our previously announced stock repurchase program. In Q4, we repurchased $75 million worth of stock. In January, we repurchased an additional $25 million. Since the announcement of the program on November 1st, we've repurchased just over 2% of shares outstanding. We continue to believe stock repurchases are an attractive value opportunity and remain committed to our balanced capital allocation framework.”

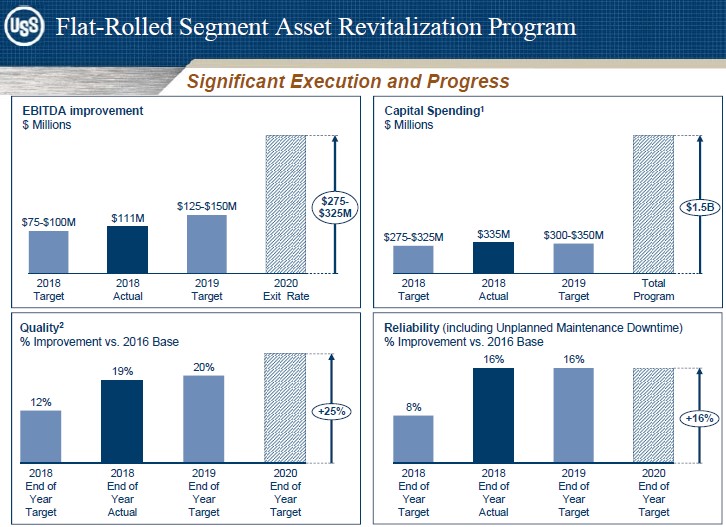

The company set benchmarks and performance goals in order to gauge the effectiveness of its corporate revamp. One of its most important goals is achieving a $275 – 325 million improvement in its annual EBITDA from 2016 levels by the end of 2020. In 2018, US Steel had been able to realize $111 million in incremental EBITDA generation through this program (as determined by the company), well above guidance. US Steel is targeting $125 – 150 million in incremental EBITDA generation this year versus 2016 levels.

US Steel appears ready to continue repurchasing stock as market conditions allow, however, we would be more supportive of management allocating the company’s cash to retiring debt and further reducing its annual interest expenses. The company’s interest expense has fallen from $230 million in 2016 to $168 million in 2018, while its interest income has jumped from $5 million to $23 million during this period.

Measuring the Efficacy of this Corporate Revamp

The company set benchmarks and performance goals in order to gauge the effectiveness of its corporate revamp. One of its most important goals is achieving a $275 – 325 million improvement in its annual EBITDA from 2016 levels by the end of 2020. In 2018, US Steel had been able to realize $111 million in incremental EBITDA generation through this program (as determined by the company), well above guidance. US Steel is targeting $125 – 150 million in incremental EBITDA generation this year versus 2016 levels.

Image Shown: These metrics are how management is gauging the effectiveness of US Steel’s ongoing asset revitalization program. Image Source: US Steel – Fourth quarter 2018 IR presentation

US Steel has grown its adjusted EBITDA generation from $0.5 billion in 2016 to $1.8 billion in 2018, highlighting the effectiveness of this program and the favorable impact of domestic tariffs on steel imports. The company has also realized major improvements in its operational uptime and the quality of its products through its asset revitalization program. Fundamentally, this is a holistic strategy with incremental improvements targeted across the board. Here is a key excerpt from US Steel’s 2018 10-K highlighting the nature of the revamp;

“In 2017, we launched our asset revitalization program, a multi-year, comprehensive $2 billion investment in our most critical assets within our Flat-rolled segment. The program is composed of many projects designed to continuously improve safety, quality, delivery and cost performance…

Importantly, while this is a large program, most projects are not complex, making projects easier to execute. Due to the smaller nature of many of the projects, we do not have to complete the entire program in order to start seeing benefits, as evident in our 2018 performance. Also, by breaking the program down into a series of smaller projects, we have greater flexibility to adjust the scope and pace of project implementation based on changes in business conditions.”

This flexibility is essential as it allows US Steel to scale back in the event of an economic slowdown or a recession, while still enabling the company to make much needed upgraded to its asset base. Steel prices, especially when tariffs are involved, can be quite volatile and that volatility has an outsized impact on US Steel’s financial performance. Should economic conditions deteriorate, capital expenditure reductions are one of the few levers US Steel can pull in the short-term to adjust to market conditions. The excerpt below concisely sums up our thoughts on the steel industry, which is a very tough space to operate in:

“Firms in the steel industry face strong international competition, especially from China, which can often produce steel at rock-bottom prices thanks to lower-cost operations and structural advantages. Steel producers operate at the whim of the prices of volatile raw materials used in production, namely iron ore, coal, natural gas and scrap. Products are sold on the spot market, while other shipments can often be sold under agreements that do not allow for recovery of changes in input costs. Labor unions and the threat of structural overcapacity add more uncertainty. We think the industry structure is very poor.”

That being said we think it’s key to keep in mind that:

“Though it acknowledges the cyclical nature of its business, US Steel is projecting slight growth in steel consumption in 2019, along with a decline in import volumes. As a result, it anticipates solid levels of buying activity in the near term…

US Steel is focused on the right things. Through the firm's approach called 'The Carnegie Way,' it is working to strengthen its balance sheet, with an intense focus on cash flow. The plan also calls for a series of initiatives to 'get leaner faster, right-size, and improve performance across its core business processes' (commercial, supply chain, manufacturing).”

Concluding Thoughts

The imposition of additional tariffs on US steel imports under President Trump’s administration, namely the 25% tariff slapped on steel imports from the EU, Mexico and Canada, has greatly behooved US Steel’s financial performance. Going forward, those tariffs may not always be in place which is why management is making prudent capital allocation decisions as it relates to revamping US Steel’s flat-rolled business. Longer term, US Steel will eventually have to scale back capital expenditures in order to live within net operating cash flow generation and ultimately enable more cash to flow back to investors via dividend increases. For now, we aren’t buyers, but appreciate all the work management has done to turn things around at US Steel.

Metals & Mining - Steel: AKS, GGB, MT, NUE, PKX, STLD, X

Related: SLV, AGQ, PSLV, SIL, USLV, SIVR, ZSL, SLVO, SILJ, SLVP, DSLV, DBS, USV, SHNY

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.