Incyte, Examining Epacadosat's Recent Data

Image shown: Incyte's stock price performance since the beginning of 2014.

The need for innovative advances in oncology remains unmet in spite of the entrance of next-generation treatments. We will examine the recent data release from Incyte pertaining to its novel treatment Epacadosat. Incyte hopes it will boost response rates which will greatly expand the number of patients that can be effectively treated. Let’s examine the details of the data release.

By Alexander J. Poulos

Incyte Overview

Incyte (INCY) remains an up-and-coming biotech star that has burst onto the scene thanks to the stellar growth of its JAK-1/2 Inhibitor Jakafi. Sales of Jakafi continue to ramp higher, with management guiding towards peak sales of $2 billion per year. Assuming the lofty target is met, sales of Jakafi would place the compound firmly in blockbuster status. We feel confident Jakafi will perform as expected, but to justify Incyte’s current lofty market cap north of $25 billion, the clinical pipeline would need to bring forth additional novel compounds, in our view.

The equity price of Incyte has exploded higher in 2017 as the biotech sector has come back into favor with investors. From our perspective, the meteoric rise has partly been a result of the excitement of the pending approval of Incyte’s compound Olumiant (Baracitinib). Expectations reached a fever pitch when the European version of the US FDA approved the product for sale. Many including ourselves were somewhat surprised when the FDA came out and denied the approval request stating the need for additional data. For those interested in our take at the time, please see, “How the FDA’s Delay of Baricitinib Impacts Eli Lilly and Incyte (May 2017).”

The share price of Incyte predictably sold-off on the disappointment yet remains comfortably above the levels seen in January. We believe the reason for investor optimism remains the promise of Incyte’s new class of oncology product named Epacadostat. Expectations remain elevated as investors continue to watch incoming data of Epacadostat in combination with Keytruda (Pembrolizumab) and Opdivo (Nivolumab).

Epacadostat

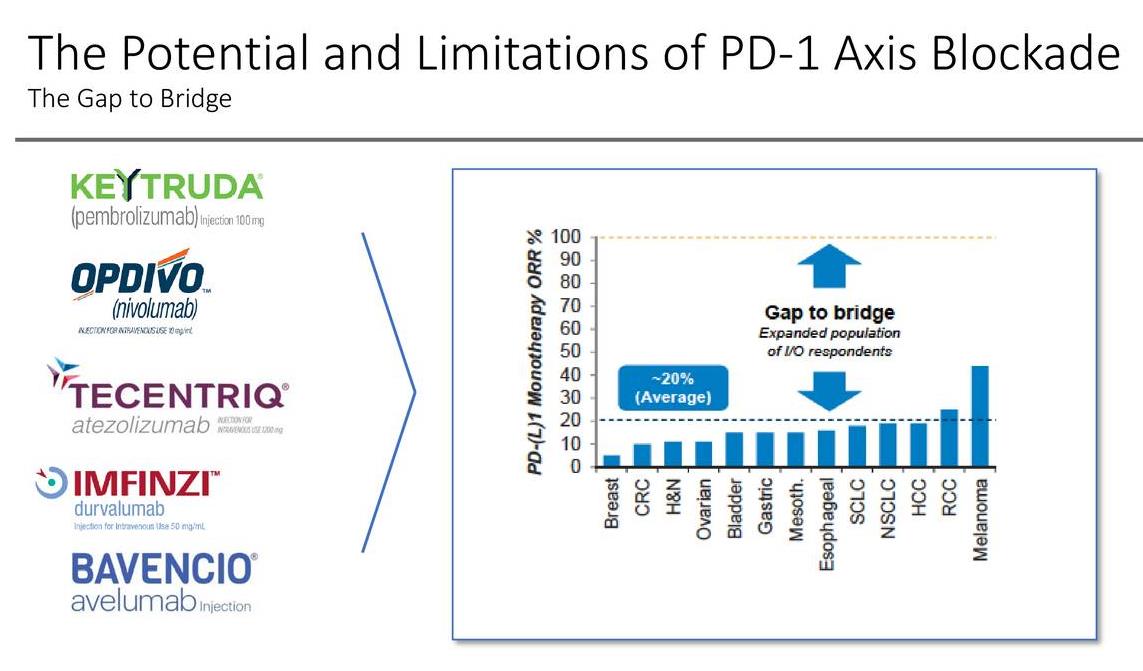

Epacadostat belongs to the novel class of IDO1 inhibitors. The goal is to combine Epacadostat with a PD-1/PD-L1 class to produce a more robust response in patients afflicted with various forms of cancer. As illustrated in the slide below, the ORR (Overall Response Rate) varies based on the disease state treated. Those afflicted with melanoma demonstrated the most robust response rate while those afflicted with breast cancer posted the lowest overall response rate.

Image Source: Incyte

The concept of combination therapy is well founded in oncology. For example, in our recent Bristol-Myers Squibb (BMY) post titled--“Bristol-Myers Squibb Disappoints”--we described the toxicity of Bristol’s in-house combination of Opdivo (Nivolumab) and Yervoy (Ipilimumab) for the Treatment of Refractory or Relapsing Malignant Pleural Mesothelioma. The side-effect profile was not encouraging, yet combination therapy is necessary to produce a more robust ORR.

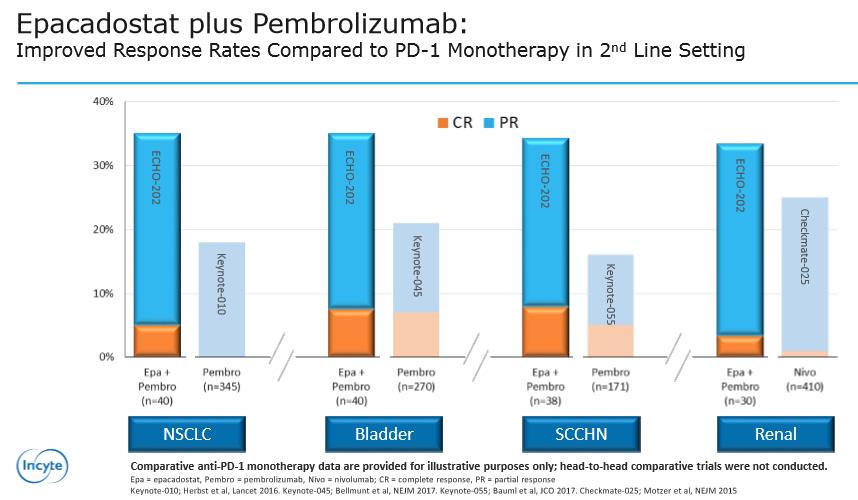

Image Source: Incyte

Incyte released preliminary data from the combination of Epacadostat with Pembrolizumab versus monotherapy. The first three columns for the treatment of NSCLC (Non-Small Cell Lung Cancer), Bladder and SCCHN (squamous cell carcinoma of the head and neck) demonstrate a superior response versus monotherapy with Pembrolizumab. We would like to caution that, while the results are exciting and represent an expansion of the potential treatment paradigm, the results are still early-stage--additional trials will be conducted to confirm and further detail the data presented.

The final column discussing the results tabulated in Renal Carcinoma are of particular interest. Yet again, Keytruda (Pembrolizumab) in combination with Epacadostat has bested the results of the Checkmate-025 trial of Opdivo (Nivolumab) monotherapy. Granted, each trial is independently conducted, and comparison of separate trials are not recommended we feel the results posted will aid in the uptake of Keytruda at the expense of Opdivo. We expect Merck’s (MRK) sales force to highlight the more robust response when detailing oncologists—Keytruda should garner the majority of new scripts written. Opdivo would need to score a “win” versus Keytruda, which seems less and less likely as new data emerges.

Path Forward for Epacadostat

Incyte will press forward with new trials combining Epacadostat with Pembrolizumab for the treatment of NSCLC, Bladder, SCCHN, Renal, and Melanoma. Fortunately for Bristol, Incyte will further trials of Nivolumab in combination with Epacadostat for the treatment of NSCLC and SCCHN. The largest area of unmet need remains in NSCLC, an area that Nivolumab famously posted poor results thta led to a near $20 per-share collapse in the share price of Bristol. With the exception of very brief foray into the $60 range, Bristol has not even attempted to close the downward gap that opened upon the revelation of the failed NSCLC. We are not optimistic at this juncture that Epacadostat/Nivolumab will best the results posted by Epacadostat/Pembrolizumab, though nothing is assured until the final data is tabulated and presented. We feel Merck’s PD-1 remains king of the hill as far as the most capable PD-1 compound that is commercially available.

Conclusion

The biotech field continues to deliver cutting-edge treatments, but the path forward is often treacherous, with multiple disappointments along the way. An investment in the biotech space requires a willingness to endure a great deal of risk; often, if the key product fails in clinical trials, the vast majority of the equity price may evaporate. We remain constructive on the future path of Incyte but we cannot get excited with the current value of the equity. We feel a great deal of optimism pertaining to future revenues from Epacadostat, and to a lesser extent, Oluminat is built into the share price. We will continue to follow the events at Incyte and post a timely update when warranted.