FERC Clarifies MLP Tax Changes

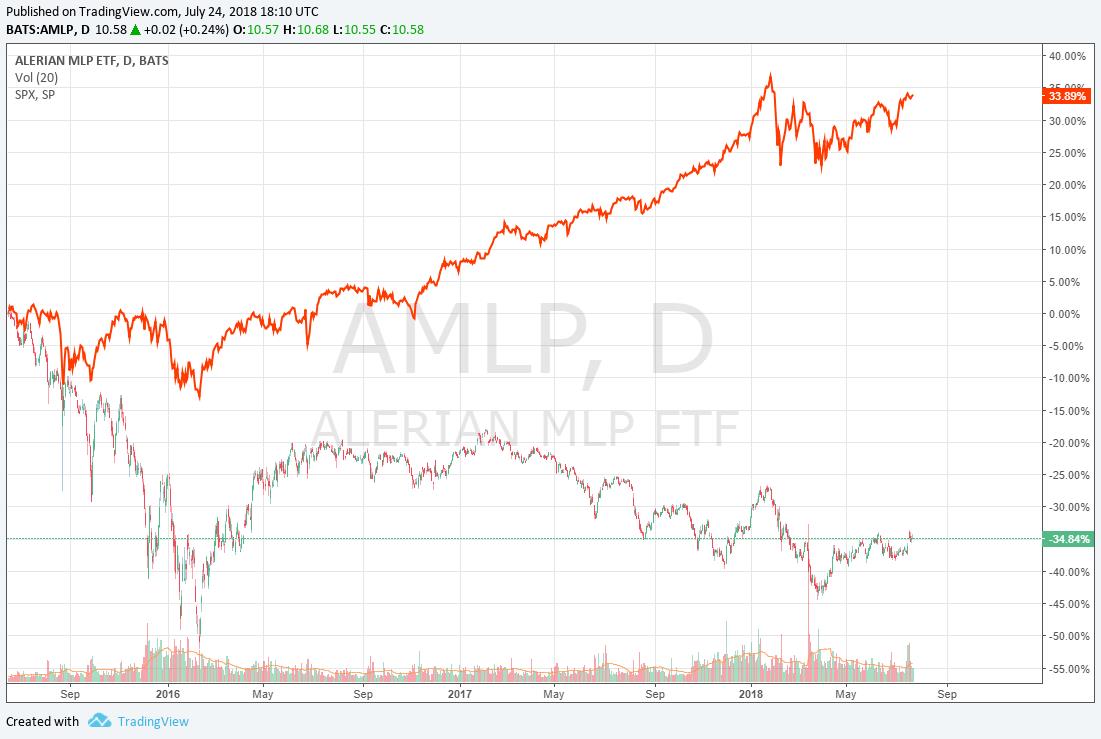

Image shown: The prices of MLPs have collapsed since mid-June 2015 as the stock market has surged.

The status quo for many MLPs looks to be restored, though that doesn’t mean MLPs are out of the woods. We continue to expect many to transition to corporates in coming years, and the idea of consolidation/buyouts may bring new investor capital to the space.

By Brian Nelson, CFA

The transitions away from the master limited partnership (AMLP) model won’t stop, as executive teams seek to find more transparent ways to operate their businesses. Frac sand distributor Hi-Crush Partners (HCLP) is the latest entity considering a transition to a C-corp in a long line of MLP transitions/roll-ups that began with Kinder Morgan’s (KMI) consolidation a number of years ago. We maintain our view that without the market artificially pricing an MLP’s equity on the basis of its yield as opposed to its fundamental enterprise free cash flow, the need for MLPs as a means of low-cost capital raising, have come to an end.

We expect there will be holdouts as there are with anything (and as some executive teams have become married to the business model, for better or worse), but for the most part, our thesis on the view that the MLP model will not survive over the long haul has largely panned out. In some ways, expectations for consolidations and more rollups are fueling buying activity across the group, as investors are hoping for premium pricing within consolidation scenarios. Ironically, it is the idea that the MLP model may not survive that is driving the recent excitement in the group, as speculators seek to embed buyout premiums. TransCanada (TRP), Magellan Midstream (MMP) and Phillips 66 Partners (PSXP) have been participating in the strength.

Offering further support to the group’s latest advance has been the ongoing back-and-forth on the regulatory front, the latest move of probable help to the ailing space. On July 18, the Federal Energy Regulatory Commission (FERC) backtracked on its views that had been expected to be negative to MLP earnings, clarifying “that pass-through entities are eligible for a tax allowance (in cost-of-service rates) if their income or losses are consolidated on the federal income tax return of their corporate parent (source: S&P Global Platts).” It seems as though pressures on the regulatory body may have been behind the back-and-forth in just a couple months, and while the status quo is better than the original change in March, the motivation for creating new MLPs remains subdued.

We’re not changing any of our fair value estimate ranges for MLPs at this time, as we did not move them when the FERC announced its original proposal in March. We’re reiterating our view, however, that the MLP model may not survive over the long haul, as we believe the primary motivation for their creation has been to raise equity on the basis of a “yield-based” valuation, which the market is no longer applying to most units, given the systemic revaluation across the industry and the threat of rising interest rates.

Related: FEI

Pipelines - Oil & Gas: BPL, BWP, DCP, ENB, EPD, ETP, GMLP, HEP, KMI, MMP, NS, PAA, SEP, WES

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment