Buffett’s Berkshire, Corporate Buybacks on Pace for Record; Lithium, Steel Prices on the Move

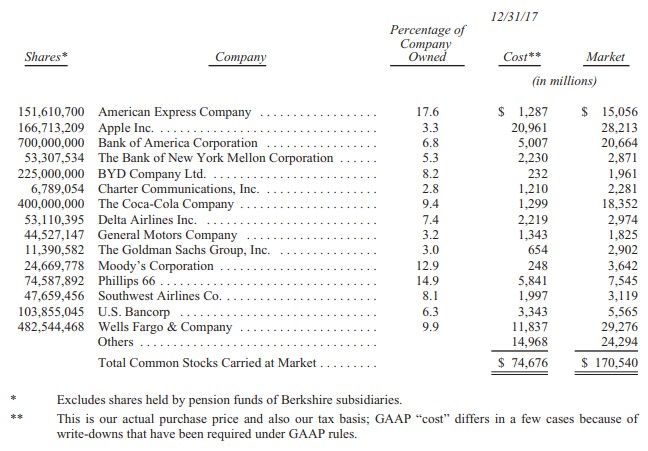

Image Source: Berkshire Hathaway, Shareholder Letter (2017). “Fifteen common stock investments at year end that had the largest market value.”

“The less the prudence with which others conduct their affairs, the greater the prudence with which we must conduct our own.” – Warren Buffett, Shareholder Letter (2017)

By Kris Rosemann and Brian Nelson, CFA

Simulated Best Ideas Newsletter portfolio holding Berkshire Hathaway's (BRK.A, BRK.B) fourth-quarter results didn’t disappoint, and commentary from the Oracle of Omaha, Warren Buffett, was at its finest in the company’s Shareholder Letter. The letter was chock full of insights, from an emphasis on normalized earnings power, to buying stocks at a “sensible purchase price,” to warning about the dangers of “purchasing frenzy” with respect to M&A, to the hazards of debt (“aversion to leverage”) and beyond. Grandpa Warren was at his old self, too: “Charlie and I view the marketable stocks that Berkshire owns as interests in businesses, not as ticker symbols...” Every letter is a treasure to read.

However, it was hard not to pick up on the Oracle’s cautious tone, despite his ever-optimism with respect to equities: “In America, equity investors have the wind at their back.” He noted last year was quite challenging in finding bargains, and frankly, we agree. Pickings have been slim on the Valuentum Buying Index, too. As we hover around all-time highs, stocks are not cheap by most measures, and at such lofty prices, portfolio managers have become more concerned about risk management than uncovering bargains. Buffett’s wisdom shines through in his words: “The less the prudence with which others conduct their affairs, the greater the prudence with which we must conduct our own.” A reference to owning Treasury Bills (TLT, TBT)—"we liked having Treasury Bills--loads of Treasury Bills”—during the Financial Crisis of 2008-2009 may offer further insight into Grandpa Warren’s current line of thinking.

He even left us with a poem this year about the importance of patience, Kipling’s If:

“If you can keep your head when all about you are losing theirs . . .

If you can wait and not be tired by waiting . . .

If you can think – and not make thoughts your aim . . .

If you can trust yourself when all men doubt you...

Yours is the Earth and everything that’s in it.”

How wonderful.

In other news, share buybacks are expected to continue at the recent robust rate throughout 2018 as Goldman Sachs (GS) estimates that a record $650 billion of the estimated $2.5 trillion in corporate cash spending will be allocated to repurchases. Through the first seven weeks of 2018, ~$171 billion in shares have been repurchased by companies, a record level that is more-than-twice the 10-year average for the period of $77 billion. Such a high level of corporate buying activity has the potential to continue smoothing volatility in the US equity market as many corporate buyback programs are relatively less price sensitive compared to average investors.

That said, we can’t help but feel many corporates are overpaying for their own stock. S&P 500 companies are trading at 15-16 times forecasted calendar 2019 numbers, not terribly expensive but not at all cheap either, considering the risks of rising rates and the elevated debt levels, which are helping to fuel the very buyback activity that is supporting market prices. The issuance of new debt and the reinvestment of the proceeds into overpriced equities destroys economic value, regardless of what happens to accounting earnings per share. Unfortunately, we think many management teams may be chasing earnings per share and managing share-price volatility than focusing on return on invested capital.

President Trump’s reported desire to impose highest possible tariffs on steel (SLX) and aluminum imports will benefit US producers as the President is said to prefer a 24% tariff, the highest of three options presented by the Commerce Department, on all steel imports. Tariffs up to 10% on all aluminum imports are reported to be his desired level on all aluminum imports, which would be higher than the recommendations received, but the evaluation process is ongoing and far from a certain conclusion. Nevertheless, Trump’s reported desires reflect recommendations from Commerce Secretary Wilbur Ross who recently recommended global tariffs of at least 24% on steel imports and 7.7% tariffs on aluminum imports.

Steel and iron ore prices (PICK) also got a boost after China’s (FXI, MCHI) top steel-production region announced plans to continue its winter production controls that are aimed at reducing pollution. Tangshan, which accounts for ~12% of China’s steel output, will extend the production limits that are scheduled to expire in mid-March when the winter heating season ends for an additional 244 days through November 14 according to a proposal from the local government.

Lithium producers (LIT) have been impacted by a new outlook for pricing pressure in the coming years from Morgan Stanley (MS), which expects lithium prices to fall 45% by 2021 as robust capacity increases could materially outpace demand growth in the forecast period. According the Morgan Stanley, new projects and planned capacity growth from large Chilean producers could add as much as ~500k metric tons per year to global supply by 2025, which would require battery-powered electric cars making up ~31% of global vehicle sales in 2025 to soak up the increased production capacity. Such vehicles currently account for less than 2% of the global auto sales market. This wasn’t good news for Albermarle (ALB) or FMC Corp (FMC), two indirect plays on the lithium market.

As we wrap up this note, always remember: “Performance comes, performance goes. Fees never falter,” which just happened to be another nice quote from the Oracle in the 2017 edition of his famous annual letter. It is because of the hefty fees of mutual funds and even index funds (see here) that we do all the work we do on stocks. Some more wisdom from the Oracle: “As an investor’s investment horizon lengthens, however, a diversified portfolio of U.S. equities becomes progressively less risky than bonds, assuming that the stocks are purchased at a sensible multiple of earnings relative to then-prevailing interest rates.” Thank you for reading.

Metals & Mining - Aluminum: AA, ACH, ATI, CENX, KALU

Metals & Mining - Steel: AKS, GGB, MT, NUE, PKX, STLD, X

Related: AXP, AAPL, BAC, BK, BYDDY, CHTR, KO, DAL, GM, GS, MCO, PSX, LUV, USB, WFC, KHC

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann and Brian Nelson do not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.