Don't Follow the Social Media Likes: The Divine “Comment(y)”

Image Source: Pilottage

“Personally, it was a miserable experience for me to see things that others couldn’t.” – Nelson on Valuentum’s call preceding Kinder Morgan’s dividend cut.

By Brian Nelson, CFA

-- A foreshadowing, a rare comment remembering Valuentum's successful warning on Seadrill when we made our call on Kinder Morgan, June 2015.

This was one of the more difficult articles for me to write. I don’t know why exactly, but the words just aren’t coming out right. Pardon me.

It sounds trite, almost to the point of blasphemy, to call "The Divine Comedy" a self-help book, but that's how Dante himself saw it. In a letter to his patron, Can Grande della Scala, the poet said that the goal of his trilogy—"Inferno," "Purgatory" and "Paradise"—is "to remove those living in this life from the state of misery and lead them to the state of bliss." …

… On the spiral journey downward into the Inferno, Dante learns that all sin is a function of disordered desire—a distortion of love. The damned either loved evil things or loved good things—such as food and sex—in the wrong way. They dwell forever in the pit because they used their God-given free will—the quality that makes us most human—to choose sin over righteousness. – The Wall Street Journal

The sufferings of a stock research analyst, especially one like me that cares dearly about his work and whether his prognostications come to fruition, in an age of media bloggers and anonymous commenters is real. For one, we don’t pick sides at Valuentum. We don’t have a “home team.” We call things how they are--and that usually means that we’re objective and present both the opportunities and risks of investments as we see them. This sounds great, right? We think so, but it also means we get a lot of flak not only from the “bears,” who think they are right, but also from the “bulls,” who think they are right, too. It’s not easy taking the middle road, nor is it particularly fun playing referee in a world where the players are at each other’s throats. As is often the case, however, the things worth doing are often the most difficult ones, and you and I both know this.

Still, I’m writing this article in part to showcase the story arc highlighting ConocoPhillips’ (COP) dividend cut, but also to remind those readers that may still place meaningful weight on the words of “real” or anonymous commenters, perhaps those driven only by their internal biases, “talking their book,” as it’s commonly referred, or for other self-serving reasons. Now don’t get me wrong. I want readers to share ideas, work together, but there is some nasty stuff out there, and some of it just doesn’t make any sense. Not on our website or from our readers at www.valuentum.com, of course, but on others’ sites. Why do I care? Well, it’s not so much the comments themselves that bother me (everyone should be able to express their opinion), but rather how many people out there “like” such ridiculously “wrong” comments. You’re probably asking: Where am I going with this article? Well, let’s walk through a few definitions.

Groupthink: “Groupthink is a phenomenon developed in groups marked by the consensus of opinion without critical reasoning or evaluation of consequences or alternatives. Groupthink evolves around a common desire to not upset the balance of a group of people. This leads a group of people to stifle and avoid conflict, creativity and individuality, and engage in potentially harmful traits.” Source: Investopedia.

Herd behavior: “Herd instinct is a mentality characterized by a lack of individual decision-making or thoughtfulness, causing people to think and act in the same way as the majority of those around them. In finance, a herd instinct relates to instances in which individuals gravitate to the same or similar investments based almost solely on the fact that many others are investing in those stocks. The fear of regret of missing out on a good investment is often a driving force behind herd instinct.” Source: Investopedia.

Follow the crowd: “Following the crowd into bad outcomes has been a common theme in investing for centuries and is well documented in the popular book, Extraordinary Delusions and the Madness of Crowds, written by Charles MacKay and originally published in 1841. ‘Fear of missing out” caused many Dutch citizens to bid up prices of tulip bulbs in the 1630’s, often exchanging livestock and land of significant value, only to have the bottom fall out of the tulip market.’” Source: Don’t Be a Lemming…” Nexus.

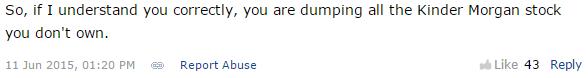

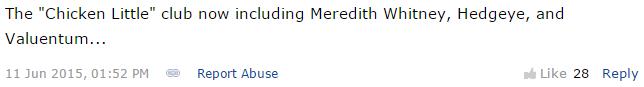

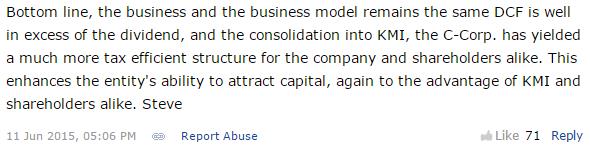

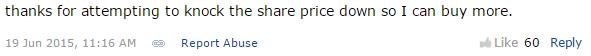

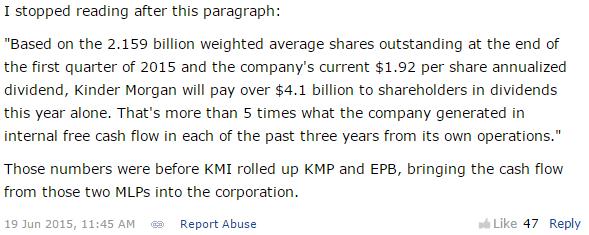

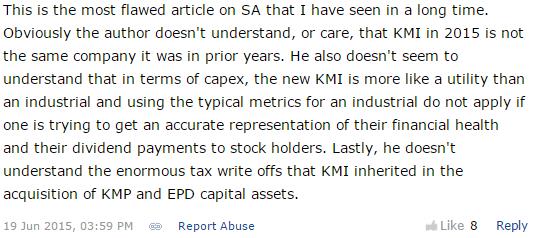

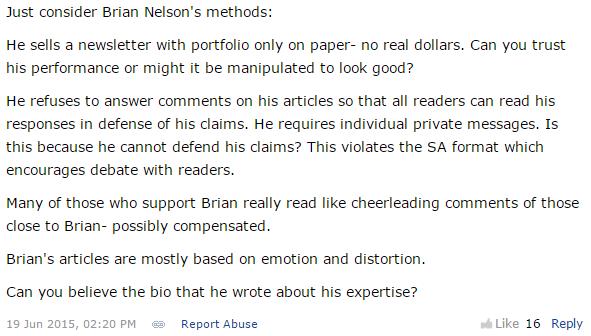

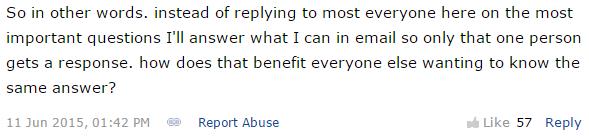

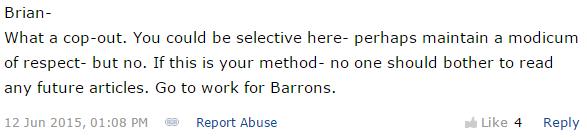

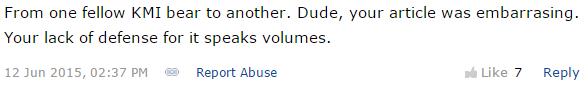

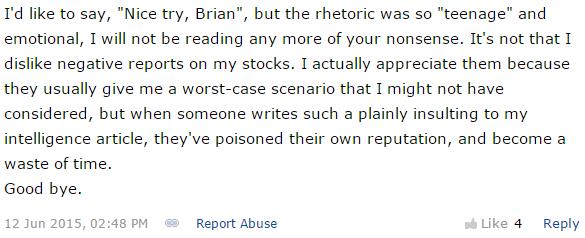

Many are aware of our cutting-edge work on Kinder Morgan (KMI) which not only predicted the collapse in shares from June 2015-January 2016, but also the entity’s dividend cut in December 2015: “Why We’re Dumping Kinder Morgan Right Now (June 2015).” The article link referenced in the previous sentence is the one that we co-syndicated with our partner Seeking Alpha. (We release only about 5%-10% of our work outside our paywall to reach out to new potential clients.) What I’m pointing to in the article referenced is not so much the comments themselves that appear at the bottom, but how many readers actually “liked” such off-base comments (50, 60, 70+). What you are reading below are comments on the June 2015 article(s) before the collapse in Kinder Morgan’s shares and its eventual dividend cut a few months later; again, look at the number of “likes” on these ridiculous comments. Personally, it was a miserable experience for me to see things that others couldn’t. Remember these comments are from June 2015, prior to the collapse and dividend cut.

A fool, I then made the mistake of “commenting” on the message board offering to answer any questions, requesting in return that those that want my opinion to contact me personally via email. I believe this was fair – after all, Valuentum is transparent as any provider out there, providing far more information about ourselves than you’d find by other research providers. It didn’t help. Look at how they treated me in response.

Oh – you have to read the email that follows these comments, too.

-------------------------------------------------------------------

Valuentum:

FWIW, as a paid subscriber and big fan, your response on other websites on the KMI articles 1) frankly sucks, and 2) has shaken my opinion of Valuentum. For better or worse, your lack of author response to reasonable reader comments and alternative views on other websites makes you look less prepared to defend your ideas/conviction and drastically less professional.

I strongly urge you to engage in author discussions on other websites or at least read the comments and respond to the useful comments with follow-up articles. The kind of attention you're getting on other websites is the burning-at-the-stake feeling. Not positive attention without author engagement and defense.

It is odd but the lack of clarity and engagement on other websites has shaken my previously-strong belief in Valuentum. I urge you to see how others interact with their readers of free articles on other websites. It is that sense of community and honest debate that draws me to pay subscriptions and seek new ideas.

Just one guy's opinion who is self-managing a substantial portfolio. I'm not sure how many paid- or non-subscribers have the same or different view. I don't write this lightly; I've considered doing so several times but decided it was your gig.

----------

Anonymous:

We only make ourselves available to members.

Our definition of reasonable does not include insults, belittling or abusive personal attacks, including from those that say our response to random comments on other websites that we do not follow "sucks." The comments on sites other than ours are often completely inappropriate. We've addressed a couple questions on other websites in the past and may not do so again.

Our research and track record speaks for itself. Random and inappropriate comments from anonymous people (robots?) on other websites should not influence your opinion of us...at all. If it has, then the "haters" and "Internet trolls" are winning. We continue to evaluate our relationship with all syndication providers and are under no obligation to continue providing our content through any channel.

We hope that you understand that our value rests in our individual conversation with you not in a conversation on a message board on another website. We think most informed members "get it." We're always available to those that would like to engage in a civil, informative conversation.

----------

Valuentum:

To be clear: I did not say your article sucks. I said your response sucks. I stand by that opinion. Also to be clear, without your prior articles I would not have found your service nor subscribed.

Finally I thought your article was informative. My concern was lack of response and the valid points raised there. No trolls involved. Don't take it personally. Ideas win if well supported.

----------

Anonymous:

We've been in this business a long time, and some points that appear valid to some actually make little reasonable sense, and we have no obligation to respond to such comments on other websites. We put our members first at all times, and for that, we would have hoped that you'd come to the opposite conclusion than you did.

Thanks again for reaching out. If you have any questions about our research, please don't hesitate to ask.

----------

Valuentum:

It is indeed a skill to have experience in a given field and positively share that with others less experienced and wise all while not sounding pompous nor unappreciative of both freeloaders and those that pay subscriptions. If there is any question about my actual opinion, please don't hesitate to ask.

----------

Anonymous:

Though opinions may differ, we think it is reasonable that since we rely on intellectual property to maintain our business that we don't distribute our one-on-one thoughts free of charge.

A request of this nature is equivalent to asking the painter to paint one's house for free, or the butcher to hand out prime steaks for no charge, or to fill up a tank of gas at the owner's expense.

But in this case, it is much more than that.

After the painter paints, the butcher provides, and the gas station accommodates, these institutions are then subject to myriad unpleasantries by the very people they have served and provided for.

Our business model is not easy to figure out, but we hope you can understand we're not what one might describe as Wall Street (in fact, we're far from it), and the token price that we charge for a membership and the personal responses we give means that we sincerely care.

Our best wishes to you and your family,

The Valuentum Team

-------------------------------------------------------------------

Some members may not remember as it has been some time now, but Valuentum also took a lot of flak when it removed ConocoPhillips from the Dividend Growth Newsletter portfolio in May 2013. We had started to warn about the dividend cut that inevitably happened at ConocoPhillips as early as October 2012, “ConocoPhillips’ Free Cash Flow Is Disappointing to Us in Third Quarter,” but as with Kinder Morgan, very few outside our membership were taking us seriously. Here is what we said almost four years ago now:

Though we hold ConocoPhillips in the portfolio of our Dividend Growth Newsletter, we’re taking a hard look at whether we want to keep it, as we’ve been disappointed with some of the cash-flow trends recently (particularly after considering that future performance is largely determined by volatile oil and gas prices).

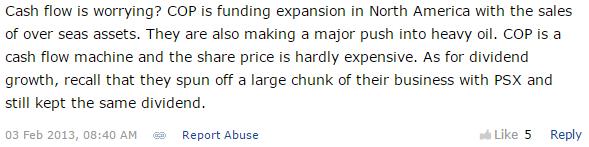

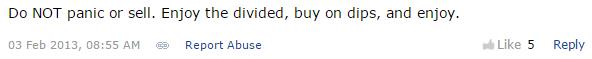

We don’t publish much on other syndication platforms, but we reached out to the Seeking Alpha community in February 2013, too, “Why ConocoPhillips’ Cash Flow Is Starting To Worry Us.” In August 2013, we wrote again on Seeking Alpha, “Why ConocoPhillips’ Dividend Is Not Great…Anymore.” Those that have been following the Dividend Growth Newsletter portfolio know that we removed shares of ConocoPhillips in May 2013 in the following email alert excerpt. ConocoPhillips cut its dividend in January 2016 – again, we wrote the following in May 2013, more than two-and-a-half years in advance:

ConocoPhillips' cash-flow position has become more and more onerous in recent quarters…and the company now posts poor scores for both dividend safety and dividend growth. We think it's a good time for us to head to the exit, as shares are now trading at the high end of our fair value estimate range (further, it registers but a 3 on our Valuentum Buying Index). We plan to sell our full position at $62.81 per share (an excellent gain since our cost basis includes our full position in Phillips 66 (PSX), which has been a huge winner for us).

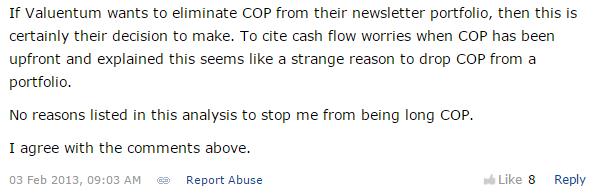

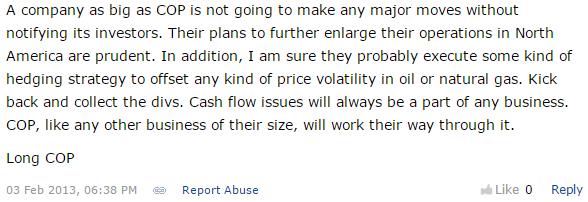

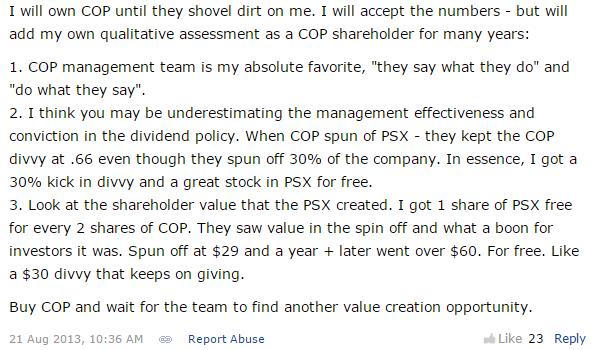

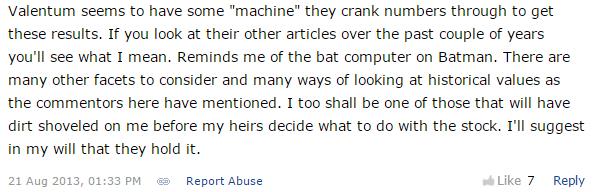

Let’s take a look at some of the comments that “graced” the message boards at Seeking Alpha when we alerted readers there that trouble was on the horizon at ConocoPhillips. These comments are from 2013.

More than 700 years ago, Dante was lost in a dark wood, facing obstacles in the form of vicious beasts as he tried to reach a mountain of light. Many may liken the job of a stock analyst to Dante’s tribulations in the Inferno, at least figuratively, and particularly in light of the mockery faced by the wrath of commenters, who may have fallen victim to the investment “sins” of “groupthink,” “herd behavior,” and “following the crowd.” Nobody said the life of a stock analyst was an easy one though.

Oil & Gas - Major: BP, COP, CVX, PTR, RDS, TOT, XOM

This article originally appeared on our website August 2016.

The comments included in this article, enclosed in text boxes, are sourced from Seeking Alpha and represent the opinions of the commenters on Seeking Alpha's website and in no way represent Valuentum's opinion. Valuentum is a publisher of financial information and nothing on www.valuentum.com or in Valuentum's publications should be viewed as a solicitation to buy or sell any security or as an offer of any personal financial advice.

5 Comments Posted Leave a comment